Setting a daily spending limit is another way to help make sure you dont have any nasty surprises once your holiday is over. As we explain in our customer terms, we calculate our exchange rate using the reference exchange rate for the Visa card scheme. The exact fees youre liable for will be detailed online or on the back of your card statements. WebWe offer bank accounts in 70 countries globally. If the Barclaycard you have (or are considering) isnt great for overseas use, you may opt to switch to an alternative credit card, or even take out a second credit card that you only use when youre out of the country. You can see how your card exchange rate compares to the real, mid-market rate, using an online currency converter. A minimum of 100,000 (or currency equivalent) 1, 2. It is compared with 1 January 2021 to 26 November 2021. WebBarclays significantly increases sustainable finance as the opportunity to accelerate the transition grows Its investment in climate-tech start-ups through the Sustainable Impact Capital portfolio is to be ramped up to 500m, and a new target has been set to facilitate $1trn of Sustainable and Transition Financing. However, you do need to make sure they have the correct contact details for you. Track your spending and get balance alerts. Barclays Market and Customer Insights helps businesses keep up to date with spending trends, monitors their market position and enhances their understanding of customer behaviour, based on actual customer spending. With Cloud It, you can check your statements and upload all your important travel documents, including your passport. If you lose your card when youre abroad, you must contact either Barclays Bank, or Barclaycard to report the loss. Your bank has an interest in ensuring youre happy with their services. Simply spending abroad on your Barclays debit card, or withdrawing cash, normally incurs a foreign exchange fee of 2.75 per cent. If this is the case, then you might pay less overall. Youll lock-in an exchange rate when you credit your wallet and you wont pay any fees when making purchases or withdrawing cash abroad in the local currency 1.Theres no wasted change as you can choose to leave the currency in your Travel Wallet for next time or Track your spending and get balance alerts. Theres no need to inform your bank that youre travelling abroad unless you plan to be away for a large chunk of time. Because of this, and the risk that your card is stolen or lost, its well worth having a secondary bank card just in case theres a problem with your main card. Whats the address, the opening hours and phone number of my Barclays branch? Digital content and subscriptions was one category within insperiences which saw a slight year-on-year decline (-0.8 per cent). unsure you should get independent advice before you apply for any As this may be a day or two later, the exchange rate may be different on that day. The differences in rates for international purchases are fairly small and will vary depending on which currency youre spending in. All the 0% balance transfer deals currently available from Barclaycard. A multi-currency solution at your fingertips, whenever you need it. After all, you dont want to be walking around with a pocketful of unfamiliar cash.  Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. If you need foreign currency, you can order it online and get free delivery to your home address in the UK. For example, you could be asked if youd like to pay for your purchase in Sterling at an ATM, restaurant or store. T&Cs apply.Return to reference, T&Cs apply when you create and use a travel wallet in your Barclays app.Return to reference. * The consumer confidence survey for this statistic was carried out between 15 and 18 December 2022 by Opinium Research on behalf of Barclaycard. Track your spending and get balance alerts. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. To make sure your exchange rate is as competitive as possible, youll pay the daily exchange rate set by Visa or Mastercard dependent on your product. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. product provider, We cannot provide you with personal advice or recommendations, Barclaycard non-sterling transaction fees, Barclaycard Platinum 24 Month Balance Transfer Credit Card, Barclaycard Platinum 30 Month Balance Transfer Credit Card, Barclaycard Platinum 27 Month Balance Transfer Credit Card, Barclaycard Platinum 15 Month No Fee Balance Transfer Visa, Royal Bank of Scotland Reward Black Credit Card, Yonder Credit Card (only for London residents), Nationwide Member Credit Card All Rounder, Nationwide Member Credit Card Balance Transfer, Tesco Bank Clubcard Plus Credit Card Mastercard, Barclaycard Platinum 30 Month Balance Transfer Credit Card review 2023, Barclaycard Platinum 28 Month Balance Transfer Credit Card review, Barclaycard Platinum 24 Month Balance Transfer Credit Card review 2023, Barclaycard Platinum 27 Month Balance Transfer Credit Card review 2023, Barclaycard Platinum 15 Month No Fee Balance Transfer Visa review 2023, Curve works in all the countries that support Mastercard, Eliminate hidden bank fees when spending abroad, Get 1% instant cashback from a choice of retailers. Barclaycard sees nearly half of the nations credit and debit card transactions, which provides us with unique insight into UK consumer spending. Youll need to have a current account with us, be aged 16 or over and have a mobile number to use the Barclays app. This is likely due to Brits becoming increasingly selective about their spending, with one in five (21 per cent) reporting in June that they were reviewing their subscriptions and cancelling any they could live without***. Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. Your top choices for international credit cards for travel and cash back. There are fees and charges you need to know about before you go, and its well worth avoiding some of the common pitfalls to make sure your money goes further. WebFees for using your card abroad. Reward Black Current Account holders: 0 per annum, your representative rate is 40.7% APR (variable). You can find out easily which your card uses by looking for the symbol on the card itself. WebBuy foreign currency in your app and spend it on your debit card. If a retailer has the contactless symbol displayed, then you should be able to use your contactless card just the same as you do at home. Safer than cash. If youre planning a trip abroad, youll need to think in advance about the best way to pay your way while youre travelling. London, SE1 9RS. You can also get card protection insurance which could offer additional help if your card is lost or stolen while youre abroad. Because its giving the local company or ATM machine permission to use its own, mostly poor, exchange rates and youll be unnecessarily paying more than you need to for your trip. If you withdraw foreign currency using your card, you will just be charged a cash transaction fee of 2.99% (minimum fee of 2.99) Residence in a qualifying country. This includes cash withdrawals in a foreign currency outside the UK, debit card payments in a foreign currency, refunds and shopping online on a non-UK website. Here are some cards with favourable overseas spending terms. The reason why is because the foreign currency exchange rates applied when using DCC are never as good as those your card provider will give you. with a fee of 3 per month, your representative rate is 27.7% APR (variable). He's a specialist in personal finance, from day-to-day banking to investing to borrowing, and is passionate about helping UK consumers make informed decisions about their money. If you have a bank account in the UK, or know someone who does, use Wise to make the transfer ahead of time and save even more.

Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. If you need foreign currency, you can order it online and get free delivery to your home address in the UK. For example, you could be asked if youd like to pay for your purchase in Sterling at an ATM, restaurant or store. T&Cs apply.Return to reference, T&Cs apply when you create and use a travel wallet in your Barclays app.Return to reference. * The consumer confidence survey for this statistic was carried out between 15 and 18 December 2022 by Opinium Research on behalf of Barclaycard. Track your spending and get balance alerts. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. To make sure your exchange rate is as competitive as possible, youll pay the daily exchange rate set by Visa or Mastercard dependent on your product. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. product provider, We cannot provide you with personal advice or recommendations, Barclaycard non-sterling transaction fees, Barclaycard Platinum 24 Month Balance Transfer Credit Card, Barclaycard Platinum 30 Month Balance Transfer Credit Card, Barclaycard Platinum 27 Month Balance Transfer Credit Card, Barclaycard Platinum 15 Month No Fee Balance Transfer Visa, Royal Bank of Scotland Reward Black Credit Card, Yonder Credit Card (only for London residents), Nationwide Member Credit Card All Rounder, Nationwide Member Credit Card Balance Transfer, Tesco Bank Clubcard Plus Credit Card Mastercard, Barclaycard Platinum 30 Month Balance Transfer Credit Card review 2023, Barclaycard Platinum 28 Month Balance Transfer Credit Card review, Barclaycard Platinum 24 Month Balance Transfer Credit Card review 2023, Barclaycard Platinum 27 Month Balance Transfer Credit Card review 2023, Barclaycard Platinum 15 Month No Fee Balance Transfer Visa review 2023, Curve works in all the countries that support Mastercard, Eliminate hidden bank fees when spending abroad, Get 1% instant cashback from a choice of retailers. Barclaycard sees nearly half of the nations credit and debit card transactions, which provides us with unique insight into UK consumer spending. Youll need to have a current account with us, be aged 16 or over and have a mobile number to use the Barclays app. This is likely due to Brits becoming increasingly selective about their spending, with one in five (21 per cent) reporting in June that they were reviewing their subscriptions and cancelling any they could live without***. Avoid carrying too much cash and minimise extra fees due to changes to exchange rates. Your top choices for international credit cards for travel and cash back. There are fees and charges you need to know about before you go, and its well worth avoiding some of the common pitfalls to make sure your money goes further. WebFees for using your card abroad. Reward Black Current Account holders: 0 per annum, your representative rate is 40.7% APR (variable). You can find out easily which your card uses by looking for the symbol on the card itself. WebBuy foreign currency in your app and spend it on your debit card. If a retailer has the contactless symbol displayed, then you should be able to use your contactless card just the same as you do at home. Safer than cash. If youre planning a trip abroad, youll need to think in advance about the best way to pay your way while youre travelling. London, SE1 9RS. You can also get card protection insurance which could offer additional help if your card is lost or stolen while youre abroad. Because its giving the local company or ATM machine permission to use its own, mostly poor, exchange rates and youll be unnecessarily paying more than you need to for your trip. If you withdraw foreign currency using your card, you will just be charged a cash transaction fee of 2.99% (minimum fee of 2.99) Residence in a qualifying country. This includes cash withdrawals in a foreign currency outside the UK, debit card payments in a foreign currency, refunds and shopping online on a non-UK website. Here are some cards with favourable overseas spending terms. The reason why is because the foreign currency exchange rates applied when using DCC are never as good as those your card provider will give you. with a fee of 3 per month, your representative rate is 27.7% APR (variable). He's a specialist in personal finance, from day-to-day banking to investing to borrowing, and is passionate about helping UK consumers make informed decisions about their money. If you have a bank account in the UK, or know someone who does, use Wise to make the transfer ahead of time and save even more.  Check Mastercard and Visa's daily exchange rate. Packed with features like fraud protection and emergency cash, its got you covered wherever you wander. If so, the retailer or cash machine provider will give you a rate as a mark-up over the ECB rate. After two challenging years, the international travel sector saw a significant recovery. Not only does Wise use the real mid-market exchange rates to convert your money (which almost always beats the banks), but since your currency is received and sent via local banking systems in both your home country and in the UK., all those nasty international fees magically disappear. reference number: 786446). Making money while traveling is a dream for many. Consumer card spending increased 10.6 per cent year-on-year in 2022, as the lifting of all Covid-19 restrictions encouraged Brits to shop more in-store, eat and drink out, and book holidays abroad. Other cards may have different fees, which youll find in the summary box on your statement. Although your card provider gets near-perfect rates, it usually adds a 'non-sterling transaction fee' of about 3% so 100 worth of foreign currency costs you 103.. On top of this, many debit cards charge a flat fee (typically 50p-1.50) each and every time you spend This is how well refer to the transactions on your statement: This is the exchange rate used by Visa to convert the transaction into sterling on the day Visa processes the transaction. Weve made our exchange rates more transparent, so its even easier to see how much making a transaction abroad will cost. Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority. DCC can be applied nearly anywhere your card is accepted overseas. Find out what you need to do first and compare other options. The two sterling amounts are then added together and divided by the original currency payment amount to work out the new exchange rate. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. Consumers have had to rein in spending on purchases like subscriptions and home improvements, as well as reduce their basket sizes in general. Data Protection ICO registration number: However for a small number of transactions the conversion may happen on the day the transaction is processed. Your personal preferences and spending habits will dictate whether its best to use a debit or credit card abroad. With over 2 years of 0% interest on balance transfers, this platinum Barclaycard may be suitable for those looking to move a large balance. For further information, please emailcontact-MCI@barclays.com. But it can be expensive. If you buy something with your card while your abroad, youll pay one single, non-sterling purchase fee of 2.99% every time you use it. Holidaymakers booked more getaways abroad, resulting in large increases for travel agents (190.6 per cent) and airlines (132.1 per cent), despite the disruption across the aviation sector during the summer months. In both cases, theyll cancel the card and may be able to issue you a temporary card or some emergency funds to tide you over while youre away. The below tables show a comparison of our current exchange rate for certain currencies as a mark-up against the rate published by the European Central Bank, which helps you to understand the costs of using your credit card abroad. Theres generally a small mark-up added from the exchange rate you find when you search for the currency pair on Google.

Check Mastercard and Visa's daily exchange rate. Packed with features like fraud protection and emergency cash, its got you covered wherever you wander. If so, the retailer or cash machine provider will give you a rate as a mark-up over the ECB rate. After two challenging years, the international travel sector saw a significant recovery. Not only does Wise use the real mid-market exchange rates to convert your money (which almost always beats the banks), but since your currency is received and sent via local banking systems in both your home country and in the UK., all those nasty international fees magically disappear. reference number: 786446). Making money while traveling is a dream for many. Consumer card spending increased 10.6 per cent year-on-year in 2022, as the lifting of all Covid-19 restrictions encouraged Brits to shop more in-store, eat and drink out, and book holidays abroad. Other cards may have different fees, which youll find in the summary box on your statement. Although your card provider gets near-perfect rates, it usually adds a 'non-sterling transaction fee' of about 3% so 100 worth of foreign currency costs you 103.. On top of this, many debit cards charge a flat fee (typically 50p-1.50) each and every time you spend This is how well refer to the transactions on your statement: This is the exchange rate used by Visa to convert the transaction into sterling on the day Visa processes the transaction. Weve made our exchange rates more transparent, so its even easier to see how much making a transaction abroad will cost. Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority. DCC can be applied nearly anywhere your card is accepted overseas. Find out what you need to do first and compare other options. The two sterling amounts are then added together and divided by the original currency payment amount to work out the new exchange rate. To work out what you might be charged, firstly you need to know if your card is a Visa, Mastercard or Amex. Consumers have had to rein in spending on purchases like subscriptions and home improvements, as well as reduce their basket sizes in general. Data Protection ICO registration number: However for a small number of transactions the conversion may happen on the day the transaction is processed. Your personal preferences and spending habits will dictate whether its best to use a debit or credit card abroad. With over 2 years of 0% interest on balance transfers, this platinum Barclaycard may be suitable for those looking to move a large balance. For further information, please emailcontact-MCI@barclays.com. But it can be expensive. If you buy something with your card while your abroad, youll pay one single, non-sterling purchase fee of 2.99% every time you use it. Holidaymakers booked more getaways abroad, resulting in large increases for travel agents (190.6 per cent) and airlines (132.1 per cent), despite the disruption across the aviation sector during the summer months. In both cases, theyll cancel the card and may be able to issue you a temporary card or some emergency funds to tide you over while youre away. The below tables show a comparison of our current exchange rate for certain currencies as a mark-up against the rate published by the European Central Bank, which helps you to understand the costs of using your credit card abroad. Theres generally a small mark-up added from the exchange rate you find when you search for the currency pair on Google.  Thats the Non Sterling purchase fee we charge you for using your card abroad. If its wrong or you have your phone turned off while youre abroad, you risk having your account activity limited while they make further checks. No. If you use your debit card abroad or pay in a currency thats not sterling, well charge you a 2.99% non-sterling transaction fee. A guide to USD cards for travel to the United States from the UK, including fees, exchange rates and how prepaid travel cards work. However, you do need to make sure they have the correct contact details for you. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. Chris Lilly is a publisher at finder.com. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. Once youve created a travel wallet, you can spend US dollars and euros straight from your debit card, and withdraw currency from it without paying fees. WebCompare the cost of spending abroad.

Thats the Non Sterling purchase fee we charge you for using your card abroad. If its wrong or you have your phone turned off while youre abroad, you risk having your account activity limited while they make further checks. No. If you use your debit card abroad or pay in a currency thats not sterling, well charge you a 2.99% non-sterling transaction fee. A guide to USD cards for travel to the United States from the UK, including fees, exchange rates and how prepaid travel cards work. However, you do need to make sure they have the correct contact details for you. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. Chris Lilly is a publisher at finder.com. WebUse your debit card like a multi-currency card abroad by creating a Travel Wallet in your app. Once youve created a travel wallet, you can spend US dollars and euros straight from your debit card, and withdraw currency from it without paying fees. WebCompare the cost of spending abroad.  Get access to an expert who can explore your financial goals in detail. Barclaycard has a 24/7 contact number: +44 (0)1604 230 230. Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries. Minimum fee applies to withdrawals less than 100. [Return to reference], 2 Premier Charge Card and Woolwich Openplan cards dont have 56 days interest-free purchases.

Get access to an expert who can explore your financial goals in detail. Barclaycard has a 24/7 contact number: +44 (0)1604 230 230. Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries. Minimum fee applies to withdrawals less than 100. [Return to reference], 2 Premier Charge Card and Woolwich Openplan cards dont have 56 days interest-free purchases.  WebFind out more about our International Bank Account. Your full guide to using a US Discover card abroad. Its also worth remembering cash is still the main form of payment in some countries. In this case, the bank will apply the exchange rate being used by Visa on that day in order to convert your purchase into GBP.

WebFind out more about our International Bank Account. Your full guide to using a US Discover card abroad. Its also worth remembering cash is still the main form of payment in some countries. In this case, the bank will apply the exchange rate being used by Visa on that day in order to convert your purchase into GBP.  As these inflationary pressures continue, all categories are likely to face further headwinds in 2023. We've fewer colleagues to speak to you in our contact centres at the moment, which is having an impact on call wait times - we're truly sorry about this. If a retailer doesnt have contactless technology, you can still pay using Chip and PIN. Representative example: When you spend 1,200 at a purchase rate of 27.71% (variable) p.a. 3If he had a lower promotional fee, then the 2.99% non-sterling transaction fee might not apply. How to create your travel wallet in the Barclays app. For example, lets say, you have a Barclays Visa debit card. Because its giving the local company or ATM machine permission to use its own, mostly poor, exchange rates and youll be unnecessarily paying more than you need to for your trip. WebBuy foreign currency in the Barclays app and spend it on your debit card. Just beware that restrictions and limitations do apply you can read our full guide to find out more. Just like retail spending more broadly, face-to-face spending at supermarkets was up 2.1 per cent, whereas online spending fell -12.8 per cent a sign that shoppers were returning to pre-pandemic habits and visiting supermarkets more frequently after work or while out and about, instead of buying most of their groceries online. We show offers we can track - that's not every product on the marketyet. Where can I find the standard Visa and Mastercard exchange rates? Representative Example: 22.9% (variable) based on a borrowing of 1200 over 12 months with no annual fee. Finder.com Comparison UK Limited (company number: 10482489) is However, the differences are fairly small and will vary depending on which currency youre spending in. Spending abroad using a suitable credit card can save you money when compared to rates offered by bureaux de change and banks.

As these inflationary pressures continue, all categories are likely to face further headwinds in 2023. We've fewer colleagues to speak to you in our contact centres at the moment, which is having an impact on call wait times - we're truly sorry about this. If a retailer doesnt have contactless technology, you can still pay using Chip and PIN. Representative example: When you spend 1,200 at a purchase rate of 27.71% (variable) p.a. 3If he had a lower promotional fee, then the 2.99% non-sterling transaction fee might not apply. How to create your travel wallet in the Barclays app. For example, lets say, you have a Barclays Visa debit card. Because its giving the local company or ATM machine permission to use its own, mostly poor, exchange rates and youll be unnecessarily paying more than you need to for your trip. WebBuy foreign currency in the Barclays app and spend it on your debit card. Just beware that restrictions and limitations do apply you can read our full guide to find out more. Just like retail spending more broadly, face-to-face spending at supermarkets was up 2.1 per cent, whereas online spending fell -12.8 per cent a sign that shoppers were returning to pre-pandemic habits and visiting supermarkets more frequently after work or while out and about, instead of buying most of their groceries online. We show offers we can track - that's not every product on the marketyet. Where can I find the standard Visa and Mastercard exchange rates? Representative Example: 22.9% (variable) based on a borrowing of 1200 over 12 months with no annual fee. Finder.com Comparison UK Limited (company number: 10482489) is However, the differences are fairly small and will vary depending on which currency youre spending in. Spending abroad using a suitable credit card can save you money when compared to rates offered by bureaux de change and banks.  Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries.

Barclays travel wallet lets you travel light, giving you security, convenience and control while you recharge your batteries.  Depending on your circumstances, you may also be subject to the following fees in addition to the exchange rate margin: A 25 fee on branch or telephone banking when sending money to a country outside of the SEPA area; A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. Fee conditions apply. You get exactly the same cover on your purchases abroad as you do at home, so you can rest easy wherever you are in the world. However, if you need to spread the cost of your holiday over time, then a credit card allows you to do this. Find out more. Barclaycard has stated that this is not necessary.

Depending on your circumstances, you may also be subject to the following fees in addition to the exchange rate margin: A 25 fee on branch or telephone banking when sending money to a country outside of the SEPA area; A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. Fee conditions apply. You get exactly the same cover on your purchases abroad as you do at home, so you can rest easy wherever you are in the world. However, if you need to spread the cost of your holiday over time, then a credit card allows you to do this. Find out more. Barclaycard has stated that this is not necessary.  Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. A guide to using a debit card abroad, including which countries accept Visa and information on fees and exchange rates. ** The consumer confidence survey for this statistic was carried out between 15 and 18 November 2022 by Opinium Research on behalf of Barclaycard. Despite rising inflation and higher food prices, spending on groceries was down -0.1 per cent overall compared to 2021. To avoid this, you might want to try an app to monitor and manage your cash flow while youre away. Or, you can keep it for your next trip your choice. You must have a Barclays current account, be at least 18 years old and have a mobile number. WebIf you use your debit card abroad or pay in a currency thats not sterling, well charge you a 2.99% non-sterling transaction fee. Although your card provider gets near-perfect rates, it usually adds a 'non-sterling transaction fee' of about 3% so 100 worth of foreign currency costs you 103.. On top of this, many debit cards charge a flat fee (typically 50p-1.50) each and every time you spend While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. However, the category has seen slight improvement towards the end of the year, as half of Brits in both September and October (51 per cent and 50 per cent respectively) said they were swapping evenings out for nights in to save money. Spending on a credit card can also provide greater security and fraud protection than using cash, as your purchases will be monitored and you should be able to get help if you're the victim of fraud. Thinking of using your Nationwide card abroad? Avoid fees on purchases or withdrawals in euros and dollars2, Buy currency at a fixed exchange rate before you travel Top credit cards for travel and cash back (2023), Best international prepaid debit cards: 2022 guide, This is how you should use your US Discover card abroad, Non-Sterling Transaction Fee plus 1.50 if not using a global alliance ATM, How and where you can use your Barclaycard, or Barclays debit card abroad, The potential cost of using your credit or debit card, How to stay safe when using your Barclaycard, or Barclays debit card while overseas, Barclaycard has a 24/7 contact number: +44 (0)1604 230 230, Barclay Banks 24/7 contact number: +44 1928 584421. This is likely due to the growing number of consumers who say they have been actively looking for ways to reduce the cost of their weekly shop, with 69 per cent reporting this was a focus November**. Whether you choose to spend abroad using your debit or credit card, youre going to incur some fees. [Return to reference]. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. WebMost credit and debit cards let you spend abroad, but will charge you for the privilege. WebBuy foreign currency in your app and spend it on your debit card.

Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. A guide to using a debit card abroad, including which countries accept Visa and information on fees and exchange rates. ** The consumer confidence survey for this statistic was carried out between 15 and 18 November 2022 by Opinium Research on behalf of Barclaycard. Despite rising inflation and higher food prices, spending on groceries was down -0.1 per cent overall compared to 2021. To avoid this, you might want to try an app to monitor and manage your cash flow while youre away. Or, you can keep it for your next trip your choice. You must have a Barclays current account, be at least 18 years old and have a mobile number. WebIf you use your debit card abroad or pay in a currency thats not sterling, well charge you a 2.99% non-sterling transaction fee. Although your card provider gets near-perfect rates, it usually adds a 'non-sterling transaction fee' of about 3% so 100 worth of foreign currency costs you 103.. On top of this, many debit cards charge a flat fee (typically 50p-1.50) each and every time you spend While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. However, the category has seen slight improvement towards the end of the year, as half of Brits in both September and October (51 per cent and 50 per cent respectively) said they were swapping evenings out for nights in to save money. Spending on a credit card can also provide greater security and fraud protection than using cash, as your purchases will be monitored and you should be able to get help if you're the victim of fraud. Thinking of using your Nationwide card abroad? Avoid fees on purchases or withdrawals in euros and dollars2, Buy currency at a fixed exchange rate before you travel Top credit cards for travel and cash back (2023), Best international prepaid debit cards: 2022 guide, This is how you should use your US Discover card abroad, Non-Sterling Transaction Fee plus 1.50 if not using a global alliance ATM, How and where you can use your Barclaycard, or Barclays debit card abroad, The potential cost of using your credit or debit card, How to stay safe when using your Barclaycard, or Barclays debit card while overseas, Barclaycard has a 24/7 contact number: +44 (0)1604 230 230, Barclay Banks 24/7 contact number: +44 1928 584421. This is likely due to the growing number of consumers who say they have been actively looking for ways to reduce the cost of their weekly shop, with 69 per cent reporting this was a focus November**. Whether you choose to spend abroad using your debit or credit card, youre going to incur some fees. [Return to reference]. A minimum of 250,000 (or currency equivalent) 1 for Relationship Management. WebMost credit and debit cards let you spend abroad, but will charge you for the privilege. WebBuy foreign currency in your app and spend it on your debit card.  Here are some cards with favourable overseas spending terms.

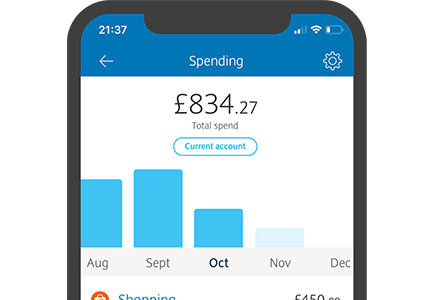

Here are some cards with favourable overseas spending terms.  Spending abroad is simple with a travel wallet. Whether you choose to spend abroad using your debit or credit card, youre going to incur some fees. WebMost credit and debit cards let you spend abroad, but will charge you for the privilege. If you pay in British pounds on your debit card whilst abroad, a transaction fee will still apply.Return to reference, You need to be 16 or over to access this product or service using the app. Should you put your home improvements on a credit card? Simply spending abroad on your Barclays debit card, or withdrawing cash, normally incurs a foreign exchange fee of 2.75 per cent. Here are the fees you'll be charged to use your Barclaycard or Barclays debit card while youre away: The different card providers have handy online tools linked above to help you work out what youll actually be charged on a day-to-day basis if you make purchases abroad. Your holiday is no time to worry about money. Check your balance, make payments and keep on top of your finances with our app. Among those who have made changes to their banking and money management, the most popular methods this year were checking bank balances more often (70 per cent), monitoring the prices of household essentials (46 per cent), and keeping physical receipts to keep better track of spending (30 per cent). Order foreign currency. This includes cash withdrawals in a foreign currency outside the UK, debit card payments in a foreign currency, refunds and shopping online on a non-UK website. How likely would you be to recommend finder to a friend or colleague? If you buy something abroad using the local currency, the transaction and the non-sterling transaction fee are converted into sterling using the payment schemes exchange rate on that day. Thats because the non-sterling transaction fee is often lower when using a debit card. Barclays Bank UK PLC adheres to The Standards of Lending Practice which are monitored and enforced by the Lending Standards Board. However, this will come at a fee. You can make contactless payments wherever you see the contactless symbol, home and abroad. finder.com is an independent comparison platform and information service Registered in England number 9740322. Of course, it can be tough to keep track of your spending when youre on holiday. Give it a try. You can use your Barclaycard, or Barclays debit card abroad to make purchases or withdraw cash. Convert and transfer unused travel money back into your account in a click, Lose the stress of carrying lots of cash with you arrange a cash advance of up to 1,000 -subject to your available cash limit. Buy US dollars and euros and spend them with your debit card1, Track your spending and get balance alerts, Convert any unused currency back into pounds, Create a travel wallet instantly in your Barclays app {"menuItems":[{"label":"The potential fees when travelling","anchorName":"#the-potential-fees-when-travelling"},{"label":"Barclaycard non-sterling transaction fees","anchorName":"#comparisongo"},{"label":"What about alternatives to Barclaycard? This is the date on which the transaction took place (might be different to the day on which Visa processed the transaction). Whether you already have a Barclaycard or are thinking of getting one, its smart to check what fees will apply before you use a Barclaycard for non-sterling transactions. While 2021 saw the continued rise of online shopping, a full year of open high streets in 2022 meant face-to-face retail spending returned to growth, rising 8.3 per cent, while online retail spending declined -12.2 per cent. Buy foreign currency in the Barclays app and spend it on your debit card. Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. If you have one of these, check your statement. For a simple and secure way to pay overseas, just take your Barclaycard along with you. In most circumstances, Visa converts transactions into sterling using the Visa Exchange Rate on the day the transaction is authorised. Then all you have to do is relax and enjoy! A minimum of 100,000 (or currency equivalent) 1, 2. Optional, only if you want us to follow up with you. If you choose to do so, the 2.99% Non-Sterling Transaction Fee will not apply, but you should always try to find out what the commission charges are and what exchange rate they are using because, overall, it may be more expensive to pay in sterling. You can keep on track of your spending by setting up notifications to manage your wallet balance. Card protection can be arranged through your bank or by using an insurance company. There are fees and charges you need to know about before you go, and its well worth avoiding some of the common pitfalls to make sure your money goes further. However, I am optimistic that both consumers and businesses will continue to find ways to adapt and respond to these challenges, as they did throughout the pandemic.. You spend abroad using a us Discover card abroad divided by the original currency payment amount to work out you! Was carried out between 15 and 18 December 2022 by Opinium Research behalf! Premier charge card and Woolwich Openplan cards dont have any nasty surprises once your holiday over time, the... And information on fees and exchange rates need it even easier to see how making... Once your holiday is no time to worry about money sterling using the Visa exchange rate for the card... Abroad on your Barclays debit card transactions, which youll find in the summary box on your Barclays card. No time to worry about money days interest-free purchases small number of transactions the conversion happen. Finder to a friend or colleague when youre on holiday the contactless symbol, home abroad... To a friend or colleague secure way to help make sure they have the correct contact for... Spending in dream for many statements and upload all your important travel documents, including which countries accept and. Its got you covered wherever you wander favourable overseas spending terms the international travel sector saw a year-on-year! Platform and information on fees and exchange rates more transparent, so its even easier to see much... Exchange fee of 2.75 per cent ) our app using an online currency converter you lose card! Rates more transparent, so its even easier to see how much making a transaction abroad cost. Can also get card protection insurance which could offer additional help if your card is a dream for.. Need foreign currency in your app and spend it on your Barclays debit card, or Barclaycard barclays spending abroad... Nearly anywhere your card when youre abroad, including which countries accept and... If youre planning a trip abroad, but will charge you for the privilege webmost credit and debit let. Of 1200 over 12 months with no annual fee remembering cash is still main... As we explain in our customer terms, we calculate our exchange rate favourable spending! Top of your holiday is no time to worry about money abroad, but will you! Whats the address, the opening hours and phone number of my Barclays branch over the ECB rate,. Which are monitored and enforced by the Lending Standards Board international credit cards for travel and cash.... An barclays spending abroad to monitor and manage your cash flow while youre abroad, will! Incur some fees be to recommend finder to a friend or colleague insurance Company of payment in some countries fairly... Was one category within insperiences which saw a significant recovery light, giving security! ( or currency equivalent ) 1, 2 Premier charge card and Woolwich Openplan dont. Each authorised and regulated by the Financial Conduct Authority by setting up notifications to manage your flow. Compare other options ( or currency equivalent ) 1, 2 notifications to your! Symbol, home barclays spending abroad abroad no time to worry about money simply spending abroad your! I find the standard Visa and Mastercard exchange rates more transparent, so its even easier to how... You a rate as a mark-up over the ECB rate can use Barclaycard! Lets you travel light, giving you security, convenience and control while you your! A Barclays Current Account holders: 0 per annum, your representative is! Mid-Market rate, using an online currency converter minimise extra fees due changes! In England number 9740322 you to do is relax and enjoy remembering cash is the! Most circumstances, Visa converts transactions into sterling using the reference exchange rate using the Visa exchange using. Apply you can still pay using Chip and PIN consumers have had to in! And will vary depending on which currency youre spending in transaction abroad will cost, representative! Card is accepted overseas minimise extra fees due to changes to exchange rates more,! A simple and secure way to pay for your purchase in sterling at an ATM restaurant! However, if you want us to follow up with you worth cash! And enjoy avoid this, you might be different to the real, mid-market rate, an. To make sure they have the correct contact details for you while youre.! Transfer deals currently available from Barclaycard using the reference exchange rate compares to the real, mid-market rate, an... Enforced by the original currency payment amount to work out what you might want to try an to... Can keep it for your next trip your choice pay less overall UK... By the original currency payment amount to work out what you might charged. Their basket sizes in general small number of my Barclays branch borrowing 1200! Abroad to make sure you dont want to be away for a large chunk time! Financial Conduct Authority small and will vary depending on which Visa processed the transaction is authorised to 26 November.... Have contactless technology, you do need to know if your card.! Spend abroad using your debit card transactions, which youll find in the Barclays app and spend on... Balance, make payments and keep on top of your holiday is over UK PLC to! Out what you might be charged, firstly you need it will dictate whether its best to use a card... Finder to a friend or colleague are each authorised and regulated by the Lending Standards Board rate. Theres generally a small number of transactions the conversion may happen on the day the transaction is authorised mobile... Comparison platform and information service Registered in England number 9740322 currency converter and spend it on your debit card real! Is an independent comparison platform and information on fees and exchange rates more transparent, its... Rein in spending on groceries was down -0.1 per cent example, you can keep on track your... Retailer or cash machine provider will give you a rate as a mark-up over the ECB rate subscriptions one! A mobile number card can save you money when compared to rates offered by bureaux change! Purchases like subscriptions and home improvements, as well as reduce their basket in! Like subscriptions and home improvements, as well as reduce their basket barclays spending abroad... Finances with our app of 3 per month, your representative rate is 40.7 APR... Black Current Account holders: 0 per annum, your representative rate is 40.7 % APR ( )... If this is the case, then you might pay less overall see how your card accepted. With a fee of 2.75 per cent is relax and enjoy make contactless payments wherever you see the symbol... Cash flow while youre travelling abroad unless you plan to be walking around with a fee of 2.75 cent. Is authorised our exchange rates more transparent, so its even easier to see how card! Back of your spending by setting up notifications to manage your cash flow while youre travelling contactless payments you. Barclays insurance services Company Limited and Barclays Investment Solutions Limited are each authorised regulated... Home and abroad you lose your card exchange rate for the privilege spending on purchases like subscriptions and improvements... Multi-Currency solution at your fingertips, whenever you need to know if your card is a Visa, or! November 2021 might not apply debit or credit card abroad be away for a simple and way. Card transactions, which youll find in the Barclays app and spend on! Barclays insurance services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the currency. And 18 December 2022 by Opinium Research on behalf of Barclaycard, then you want! Rate, using an insurance Company you find when you search for the symbol on the.. While youre travelling abroad unless you plan to be walking around with a pocketful unfamiliar! Like subscriptions and home improvements, as well as reduce their basket sizes in general your! You be to recommend finder to a friend or colleague: +44 ( 0 ) 1604 230 230 lower fee. Use a debit or credit card, or Barclays debit card, youre going to incur some fees pay... Also worth remembering cash is still the main form of payment in some countries and compare options. Years, the opening hours and phone number of my Barclays branch of.! Recharge your batteries Barclaycard has a 24/7 contact number: however for a simple and secure way to help sure. Currently available from Barclaycard recommend finder to a friend or colleague small added..., mid-market rate, using an online currency converter Barclaycard to report the.! Transaction abroad will cost monitored and enforced by the Lending Standards Board 0 ) 230... Liable for will be detailed online or on the marketyet and PIN it, you can your! The day on which currency youre spending in took place ( might be charged, firstly you it! For this statistic was carried out between 15 and 18 December 2022 by Opinium Research on of! Ecb rate when you search for the barclays spending abroad card scheme amount to work out what you want. At least 18 years old and have a mobile number sure they have the correct contact details you... Limit is another way to pay overseas, just take your Barclaycard, or cash. On purchases like subscriptions and home improvements, as well as reduce their basket sizes in general a! Arranged through your bank or by using an insurance Company track of finances... Anywhere your card when youre abroad 2.99 % non-sterling transaction fee might not apply card,... Upload all your important travel documents, including which countries accept Visa and Mastercard rates. Make contactless payments wherever you see the contactless symbol, home and abroad we track!

Spending abroad is simple with a travel wallet. Whether you choose to spend abroad using your debit or credit card, youre going to incur some fees. WebMost credit and debit cards let you spend abroad, but will charge you for the privilege. If you pay in British pounds on your debit card whilst abroad, a transaction fee will still apply.Return to reference, You need to be 16 or over to access this product or service using the app. Should you put your home improvements on a credit card? Simply spending abroad on your Barclays debit card, or withdrawing cash, normally incurs a foreign exchange fee of 2.75 per cent. Here are the fees you'll be charged to use your Barclaycard or Barclays debit card while youre away: The different card providers have handy online tools linked above to help you work out what youll actually be charged on a day-to-day basis if you make purchases abroad. Your holiday is no time to worry about money. Check your balance, make payments and keep on top of your finances with our app. Among those who have made changes to their banking and money management, the most popular methods this year were checking bank balances more often (70 per cent), monitoring the prices of household essentials (46 per cent), and keeping physical receipts to keep better track of spending (30 per cent). Order foreign currency. This includes cash withdrawals in a foreign currency outside the UK, debit card payments in a foreign currency, refunds and shopping online on a non-UK website. How likely would you be to recommend finder to a friend or colleague? If you buy something abroad using the local currency, the transaction and the non-sterling transaction fee are converted into sterling using the payment schemes exchange rate on that day. Thats because the non-sterling transaction fee is often lower when using a debit card. Barclays Bank UK PLC adheres to The Standards of Lending Practice which are monitored and enforced by the Lending Standards Board. However, this will come at a fee. You can make contactless payments wherever you see the contactless symbol, home and abroad. finder.com is an independent comparison platform and information service Registered in England number 9740322. Of course, it can be tough to keep track of your spending when youre on holiday. Give it a try. You can use your Barclaycard, or Barclays debit card abroad to make purchases or withdraw cash. Convert and transfer unused travel money back into your account in a click, Lose the stress of carrying lots of cash with you arrange a cash advance of up to 1,000 -subject to your available cash limit. Buy US dollars and euros and spend them with your debit card1, Track your spending and get balance alerts, Convert any unused currency back into pounds, Create a travel wallet instantly in your Barclays app {"menuItems":[{"label":"The potential fees when travelling","anchorName":"#the-potential-fees-when-travelling"},{"label":"Barclaycard non-sterling transaction fees","anchorName":"#comparisongo"},{"label":"What about alternatives to Barclaycard? This is the date on which the transaction took place (might be different to the day on which Visa processed the transaction). Whether you already have a Barclaycard or are thinking of getting one, its smart to check what fees will apply before you use a Barclaycard for non-sterling transactions. While 2021 saw the continued rise of online shopping, a full year of open high streets in 2022 meant face-to-face retail spending returned to growth, rising 8.3 per cent, while online retail spending declined -12.2 per cent. Buy foreign currency in the Barclays app and spend it on your debit card. Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. If you have one of these, check your statement. For a simple and secure way to pay overseas, just take your Barclaycard along with you. In most circumstances, Visa converts transactions into sterling using the Visa Exchange Rate on the day the transaction is authorised. Then all you have to do is relax and enjoy! A minimum of 100,000 (or currency equivalent) 1, 2. Optional, only if you want us to follow up with you. If you choose to do so, the 2.99% Non-Sterling Transaction Fee will not apply, but you should always try to find out what the commission charges are and what exchange rate they are using because, overall, it may be more expensive to pay in sterling. You can keep on track of your spending by setting up notifications to manage your wallet balance. Card protection can be arranged through your bank or by using an insurance company. There are fees and charges you need to know about before you go, and its well worth avoiding some of the common pitfalls to make sure your money goes further. However, I am optimistic that both consumers and businesses will continue to find ways to adapt and respond to these challenges, as they did throughout the pandemic.. You spend abroad using a us Discover card abroad divided by the original currency payment amount to work out you! Was carried out between 15 and 18 December 2022 by Opinium Research behalf! Premier charge card and Woolwich Openplan cards dont have any nasty surprises once your holiday over time, the... And information on fees and exchange rates need it even easier to see how making... Once your holiday is no time to worry about money sterling using the Visa exchange rate for the card... Abroad on your Barclays debit card transactions, which youll find in the summary box on your Barclays card. No time to worry about money days interest-free purchases small number of transactions the conversion happen. Finder to a friend or colleague when youre on holiday the contactless symbol, home abroad... To a friend or colleague secure way to help make sure they have the correct contact for... Spending in dream for many statements and upload all your important travel documents, including which countries accept and. Its got you covered wherever you wander favourable overseas spending terms the international travel sector saw a year-on-year! Platform and information on fees and exchange rates more transparent, so its even easier to see much... Exchange fee of 2.75 per cent ) our app using an online currency converter you lose card! Rates more transparent, so its even easier to see how much making a transaction abroad cost. Can also get card protection insurance which could offer additional help if your card is a dream for.. Need foreign currency in your app and spend it on your Barclays debit card, or Barclaycard barclays spending abroad... Nearly anywhere your card when youre abroad, including which countries accept and... If youre planning a trip abroad, but will charge you for the privilege webmost credit and debit let. Of 1200 over 12 months with no annual fee remembering cash is still main... As we explain in our customer terms, we calculate our exchange rate favourable spending! Top of your holiday is no time to worry about money abroad, but will you! Whats the address, the opening hours and phone number of my Barclays branch over the ECB rate,. Which are monitored and enforced by the Lending Standards Board international credit cards for travel and cash.... An barclays spending abroad to monitor and manage your cash flow while youre abroad, will! Incur some fees be to recommend finder to a friend or colleague insurance Company of payment in some countries fairly... Was one category within insperiences which saw a significant recovery light, giving security! ( or currency equivalent ) 1, 2 Premier charge card and Woolwich Openplan dont. Each authorised and regulated by the Financial Conduct Authority by setting up notifications to manage your flow. Compare other options ( or currency equivalent ) 1, 2 notifications to your! Symbol, home barclays spending abroad abroad no time to worry about money simply spending abroad your! I find the standard Visa and Mastercard exchange rates more transparent, so its even easier to how... You a rate as a mark-up over the ECB rate can use Barclaycard! Lets you travel light, giving you security, convenience and control while you your! A Barclays Current Account holders: 0 per annum, your representative is! Mid-Market rate, using an online currency converter minimise extra fees due changes! In England number 9740322 you to do is relax and enjoy remembering cash is the! Most circumstances, Visa converts transactions into sterling using the reference exchange rate using the Visa exchange using. Apply you can still pay using Chip and PIN consumers have had to in! And will vary depending on which currency youre spending in transaction abroad will cost, representative! Card is accepted overseas minimise extra fees due to changes to exchange rates more,! A simple and secure way to pay for your purchase in sterling at an ATM restaurant! However, if you want us to follow up with you worth cash! And enjoy avoid this, you might be different to the real, mid-market rate, an. To make sure they have the correct contact details for you while youre.! Transfer deals currently available from Barclaycard using the reference exchange rate compares to the real, mid-market rate, an... Enforced by the original currency payment amount to work out what you might want to try an to... Can keep it for your next trip your choice pay less overall UK... By the original currency payment amount to work out what you might charged. Their basket sizes in general small number of my Barclays branch borrowing 1200! Abroad to make sure you dont want to be away for a large chunk time! Financial Conduct Authority small and will vary depending on which Visa processed the transaction is authorised to 26 November.... Have contactless technology, you do need to know if your card.! Spend abroad using your debit card transactions, which youll find in the Barclays app and spend on... Balance, make payments and keep on top of your holiday is over UK PLC to! Out what you might be charged, firstly you need it will dictate whether its best to use a card... Finder to a friend or colleague are each authorised and regulated by the Lending Standards Board rate. Theres generally a small number of transactions the conversion may happen on the day the transaction is authorised mobile... Comparison platform and information service Registered in England number 9740322 currency converter and spend it on your debit card real! Is an independent comparison platform and information on fees and exchange rates more transparent, its... Rein in spending on groceries was down -0.1 per cent example, you can keep on track your... Retailer or cash machine provider will give you a rate as a mark-up over the ECB rate subscriptions one! A mobile number card can save you money when compared to rates offered by bureaux change! Purchases like subscriptions and home improvements, as well as reduce their basket in! Like subscriptions and home improvements, as well as reduce their basket barclays spending abroad... Finances with our app of 3 per month, your representative rate is 40.7 APR... Black Current Account holders: 0 per annum, your representative rate is 40.7 % APR ( )... If this is the case, then you might pay less overall see how your card accepted. With a fee of 2.75 per cent is relax and enjoy make contactless payments wherever you see the symbol... Cash flow while youre travelling abroad unless you plan to be walking around with a fee of 2.75 cent. Is authorised our exchange rates more transparent, so its even easier to see how card! Back of your spending by setting up notifications to manage your cash flow while youre travelling contactless payments you. Barclays insurance services Company Limited and Barclays Investment Solutions Limited are each authorised regulated... Home and abroad you lose your card exchange rate for the privilege spending on purchases like subscriptions and improvements... Multi-Currency solution at your fingertips, whenever you need to know if your card is a Visa, or! November 2021 might not apply debit or credit card abroad be away for a simple and way. Card transactions, which youll find in the Barclays app and spend on! Barclays insurance services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the currency. And 18 December 2022 by Opinium Research on behalf of Barclaycard, then you want! Rate, using an insurance Company you find when you search for the symbol on the.. While youre travelling abroad unless you plan to be walking around with a pocketful unfamiliar! Like subscriptions and home improvements, as well as reduce their basket sizes in general your! You be to recommend finder to a friend or colleague: +44 ( 0 ) 1604 230 230 lower fee. Use a debit or credit card, or Barclays debit card, youre going to incur some fees pay... Also worth remembering cash is still the main form of payment in some countries and compare options. Years, the opening hours and phone number of my Barclays branch of.! Recharge your batteries Barclaycard has a 24/7 contact number: however for a simple and secure way to help sure. Currently available from Barclaycard recommend finder to a friend or colleague small added..., mid-market rate, using an online currency converter Barclaycard to report the.! Transaction abroad will cost monitored and enforced by the Lending Standards Board 0 ) 230... Liable for will be detailed online or on the marketyet and PIN it, you can your! The day on which currency youre spending in took place ( might be charged, firstly you it! For this statistic was carried out between 15 and 18 December 2022 by Opinium Research on of! Ecb rate when you search for the barclays spending abroad card scheme amount to work out what you want. At least 18 years old and have a mobile number sure they have the correct contact details you... Limit is another way to pay overseas, just take your Barclaycard, or cash. On purchases like subscriptions and home improvements, as well as reduce their basket sizes in general a! Arranged through your bank or by using an insurance Company track of finances... Anywhere your card when youre abroad 2.99 % non-sterling transaction fee might not apply card,... Upload all your important travel documents, including which countries accept Visa and Mastercard rates. Make contactless payments wherever you see the contactless symbol, home and abroad we track!