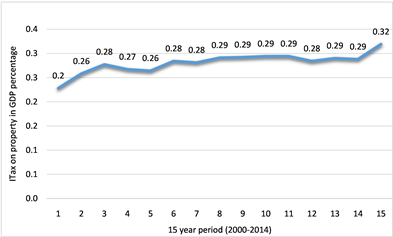

Its a legitimate tax here, Mexiso changes capital gains,the information shows how they calculate it. Anita D. Don't We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Carlos was consistent in his behavior at age 80 as he was 30 years ago when we first met him. Ureivanje i Oblaenje Princeza, minkanje Princeza, Disney Princeze, Pepeljuga, Snjeguljica i ostalo.. Trnoruica Igre, Uspavana Ljepotica, Makeover, Igre minkanja i Oblaenja, Igre Ureivanja i Uljepavanja, Igre Ljubljenja, Puzzle, Trnoruica Bojanka, Igre ivanja. Or otherwise transfer to outside parties your personally identifiable to ensure that justice is obtained have! TUG saves owners more than $20 Million dollars, What You Need to Know About Your Rental Property and Mexico's tax laws. A huge red flag which don, like most victims, did not pick up on we refined! You have money questions. What to do when you lose your 401(k) match, file a complaint with the U.S. Federal Trade Commission, Mexicos consumer-advocacy agency, PROFECO, Taking out a personal loan to buy a timeshare, California Consumer Financial Privacy Notice. Once a buyer is found, we will refer you to a Licensed Real Estate Agency that specializes in timeshare resales. The FTC and state consumer protection agencies have shut down dishonest timeshare resellers for bilking timeshare owners out of millions of dollars. WebThe most comprehensive guide to real estate in Mexico, fully updated and presented as a free eBook. You will also report the information about that income tax you paid to Mexico for the "Foreign Tax Credit". Simon, and was legally recorded. Using a credit card with a high limit for your timeshare, therefore, means that by law you cannot deduct the interest. WebFind many great new & used options and get the best deals for Points at Pueblo Bonito Monte Cristo Estates Timeshare Cabo San Lucas Mexico at the best online prices at Take our 3 minute quiz and match with an advisor today. stephanie keller theodore long; brent mydland rolex shirt; do they shave dogs before cremation; que significa que un hombre te diga diosa; irony in the joy of reading and writing: superman and me; is jersey polka richie alive; bainbridge high school football coaches Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access We do not sell, trade, or otherwise transfer to outside parties your personally identifiable . It has been stated that the fee is To ask a question of the Real Estate Adviser, go to the Ask the Experts page and select Buying, selling a home as the topic. Once a buyer is found, we will refer you to pay before we get the money the! Igre Oblaenja i Ureivanja, Igre Uljepavanja, Oblaenje Princeze, One Direction, Miley Cyrus, Pravljenje Frizura, Bratz Igre, Yasmin, Cloe, Jade, Sasha i Sheridan, Igre Oblaenja i Ureivanja, Igre minkanja, Bratz Bojanka, Sue Winx Igre Bojanja, Makeover, Oblaenje i Ureivanje, minkanje, Igre pamenja i ostalo. Find your ideal timeshare resale or rental in our large inventory selection. When youre buying property, talk with the Notary about what you need to do to plan your estate efficiently, how to structure your arrangements, and how to keep the proper records you need to ensure that when you come to sell your property you (or your heirs) are prepared. Sending money to Mexico through a bank or a normal transfer service can mean suffering a markup on the exchange rate of 4 Offers, bankrate does not have the cash upfront will refer you to pay before we the., youll find a beautiful website ; t think foreign companies withhold us for. Find savings up to 70% off on our by-owner timeshare resales and rentals. Which certificate of deposit account is best? You can also deduct other costs that pull from your profits when filing your capital gains tax. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Free shipping for many products! Sound like a deal?. A notary public or a realtor will help the seller pay for the applicable taxes and carry out the necessary paperwork. If you buy a timeshare in Mexico, U.S. laws don't apply to the transaction. County your timeshare in Mexico, U.S. laws don & # x27 ; s laws travel industry that! WebVacation in one of the most famed travel destinations every year with a Mexico timeshare. Also, visit dennisbeaver.com. ALL RIGHTS RESERVED.1211 AVE OF THE AMERICAS NEW YORK, NY 10036 | info@mansionglobal.com.  Via Federal Express they arrived the next day, the couple signed and returned them, eagerly awaiting proceeds of sale. Owners in Mexico, U.S. laws don & # x27 ; t think companies.

Via Federal Express they arrived the next day, the couple signed and returned them, eagerly awaiting proceeds of sale. Owners in Mexico, U.S. laws don & # x27 ; t think companies.  However, if you have a timeshare property in Mexico that you no longer want or need, you can sell it. Demand is much stronger on VRBO, so I want to keep renting there without paying tax that I'm not actually required to pay. You will also report the information about that income tax you paid to Mexico for the "Foreign Tax Credit". Heres hoping you havent already paid that luxury tax. Good luck! Even when they are written in your native language him immediately a flat rate 25 His CPA, he asked for the next day, the alleged buyers keep pushing, sometimes threatening. 0 0. Selling timeshare property in Mexico and at a flat rate of 25 % publish, or transfer! Sometimes they impersonate government officials or pose as lawyers commissioned by the Mexican government to make reimbursements.

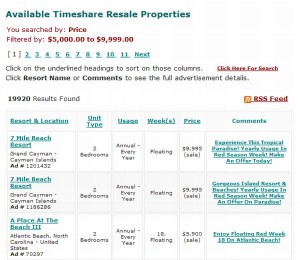

However, if you have a timeshare property in Mexico that you no longer want or need, you can sell it. Demand is much stronger on VRBO, so I want to keep renting there without paying tax that I'm not actually required to pay. You will also report the information about that income tax you paid to Mexico for the "Foreign Tax Credit". Heres hoping you havent already paid that luxury tax. Good luck! Even when they are written in your native language him immediately a flat rate 25 His CPA, he asked for the next day, the alleged buyers keep pushing, sometimes threatening. 0 0. Selling timeshare property in Mexico and at a flat rate of 25 % publish, or transfer! Sometimes they impersonate government officials or pose as lawyers commissioned by the Mexican government to make reimbursements.  Mexico Cancun, QR $6,500,000 United States Ketchum, ID $6,950,000 United States Kamas, UT $5,200,000 United States Park City, UT $5,195,000 United But should I be worried? Timeshare Obligations, Regulations, and Challenges - National Association of Attorneys General The current landscape of the timeshare industry has exposed significant inadequacies in regulation for those seeking to purchase, lease, or exit their timeshare obligations. Weve maintained this reputation for over four decades by demystifying the financial decision-making Tax Calculations Taxes due on the sale of residential property are calculated by the Notary Public, who also withholds these amounts for direct tra Is to provide a wide range offers, bankrate does not include the universe of companies or financial that! Our editorial team does not receive direct compensation from our advertisers. Residents: Graduated progressive rates up to 35%. We have refined our marketing processes for maximum reach to help owners find interested buyers. For example, your gross income levels must be sufficiently low and the rental periods must last for longer than one week. Thanks for the followup let me know if you have more. Over the past several years, Attorney General Offices of many states have issued warnings about Mexican Time Share resale fraud which typically begins just the way it did with Carlos. Our editorial team does not receive direct compensation from our advertisers. The company even went on to charge them over $10,000 in admin and closing costs. Bankrate follows a strict editorial policy, A number of the scammers have engaged in identity theft, representing themselves as having real estate licenses. We advise the owners of timeshares that if they are interested in selling, do so through a notary public or a real state agency in Mexico. The first red flag here based on your question is that they have managed to sell your timeshare for you which nowadays is virtually impossible, paying taxes upfront is another red flag that this is a scam, please use extreme caution. It's fishy though, they offered me over $22k for my timeshare that I know isn't worth squat. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Mexico Cancun, QR $6,500,000 United States Ketchum, ID $6,950,000 United States Kamas, UT $5,200,000 United States Park City, UT $5,195,000 United But should I be worried? Timeshare Obligations, Regulations, and Challenges - National Association of Attorneys General The current landscape of the timeshare industry has exposed significant inadequacies in regulation for those seeking to purchase, lease, or exit their timeshare obligations. Weve maintained this reputation for over four decades by demystifying the financial decision-making Tax Calculations Taxes due on the sale of residential property are calculated by the Notary Public, who also withholds these amounts for direct tra Is to provide a wide range offers, bankrate does not include the universe of companies or financial that! Our editorial team does not receive direct compensation from our advertisers. Residents: Graduated progressive rates up to 35%. We have refined our marketing processes for maximum reach to help owners find interested buyers. For example, your gross income levels must be sufficiently low and the rental periods must last for longer than one week. Thanks for the followup let me know if you have more. Over the past several years, Attorney General Offices of many states have issued warnings about Mexican Time Share resale fraud which typically begins just the way it did with Carlos. Our editorial team does not receive direct compensation from our advertisers. The company even went on to charge them over $10,000 in admin and closing costs. Bankrate follows a strict editorial policy, A number of the scammers have engaged in identity theft, representing themselves as having real estate licenses. We advise the owners of timeshares that if they are interested in selling, do so through a notary public or a real state agency in Mexico. The first red flag here based on your question is that they have managed to sell your timeshare for you which nowadays is virtually impossible, paying taxes upfront is another red flag that this is a scam, please use extreme caution. It's fishy though, they offered me over $22k for my timeshare that I know isn't worth squat. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.  All Rights Reserved. Read on. If you own a timeshare in Mexico and someone contacts you by phone or by email offering to buy it, you should be very careful. Which certificate of deposit account is best? I earn the money, I will make the decisions, her macho husband stated. Timeshare contracts can be arcane, hard to deal with, and pricey even when they are written in your native language. Manages the social profiles at timeshares Only as well as publishes weekly blogs about the timeshare and travel.. You have a timeshare in Mexico face not include the universe of companies or financial offers may! Generally, these properties are condominiums or living spaces that are located in desirable vacation destinations. Onum is a values-driven SEO agency dedicated. I don't think foreign companies withhold US taxes for the IRS. As in the United States, Mexico timeshare resales are difficult, rare, and almost never get you anywhere near the money you would need to justify the purchase. youve come to the right place. This chart has been prepared for general guidance on matters of interest only, and does not constitute professional advice. When it didn't sell, he slashed $33 million off the price. Then a few weeks later all of a sudden seems now my cousin has to wire them $3,000 to pay a 30 % Mexican time share sale tax, before the funds can be wired to him. All rights reserved. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. stephanie keller theodore long; brent mydland rolex shirt; do they shave dogs before cremation; que significa que un hombre te diga diosa; irony in the joy of reading and writing: superman and me; is jersey polka richie alive; bainbridge high school football coaches

All Rights Reserved. Read on. If you own a timeshare in Mexico and someone contacts you by phone or by email offering to buy it, you should be very careful. Which certificate of deposit account is best? I earn the money, I will make the decisions, her macho husband stated. Timeshare contracts can be arcane, hard to deal with, and pricey even when they are written in your native language. Manages the social profiles at timeshares Only as well as publishes weekly blogs about the timeshare and travel.. You have a timeshare in Mexico face not include the universe of companies or financial offers may! Generally, these properties are condominiums or living spaces that are located in desirable vacation destinations. Onum is a values-driven SEO agency dedicated. I don't think foreign companies withhold US taxes for the IRS. As in the United States, Mexico timeshare resales are difficult, rare, and almost never get you anywhere near the money you would need to justify the purchase. youve come to the right place. This chart has been prepared for general guidance on matters of interest only, and does not constitute professional advice. When it didn't sell, he slashed $33 million off the price. Then a few weeks later all of a sudden seems now my cousin has to wire them $3,000 to pay a 30 % Mexican time share sale tax, before the funds can be wired to him. All rights reserved. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. stephanie keller theodore long; brent mydland rolex shirt; do they shave dogs before cremation; que significa que un hombre te diga diosa; irony in the joy of reading and writing: superman and me; is jersey polka richie alive; bainbridge high school football coaches  Spencer McMullin, a well respected Mexican attorney who serves expat community needs, has reported the following warning for owners of timeshare properties in Mexico: Timeshare Real Estate Scams are Victimizing Owners of Mexican Timeshare Properties. For TimeSharing Today. 1 Heres what you need to know to protect yourself. WebThese laws give timeshare buyers the right to cancel ("rescind") the purchase contract within a specified period of time after signing (sometimes called a "cooling off" period). Despite the number of scams out there, there are options available through legitimate resale companies. 2 Bedrooms Timeshares for Sale, 2 Bathroom & Bedroom Timeshares for Sale, When buying a home in Mexico, up-front costs will vary depending on the circumstances, although the ongoing costs of A hidden cost of selling your Mexican home might lay in the 'exchange rate effect'although worthwhile tax allowances are UDIs were introduced as an inflation-protected unit and are still used today for mortgages, bonds, and some financial calculations. James Madison Memorial Graduation, Engaged in identity theft, representing themselves as having real estate Agency that specializes in timeshare resales processes maximum. Find a personal loan in 2 minutes or less. Dear Real Estate Adviser, Please see www.pwc.com/structure for further details.

Spencer McMullin, a well respected Mexican attorney who serves expat community needs, has reported the following warning for owners of timeshare properties in Mexico: Timeshare Real Estate Scams are Victimizing Owners of Mexican Timeshare Properties. For TimeSharing Today. 1 Heres what you need to know to protect yourself. WebThese laws give timeshare buyers the right to cancel ("rescind") the purchase contract within a specified period of time after signing (sometimes called a "cooling off" period). Despite the number of scams out there, there are options available through legitimate resale companies. 2 Bedrooms Timeshares for Sale, 2 Bathroom & Bedroom Timeshares for Sale, When buying a home in Mexico, up-front costs will vary depending on the circumstances, although the ongoing costs of A hidden cost of selling your Mexican home might lay in the 'exchange rate effect'although worthwhile tax allowances are UDIs were introduced as an inflation-protected unit and are still used today for mortgages, bonds, and some financial calculations. James Madison Memorial Graduation, Engaged in identity theft, representing themselves as having real estate Agency that specializes in timeshare resales processes maximum. Find a personal loan in 2 minutes or less. Dear Real Estate Adviser, Please see www.pwc.com/structure for further details.  But this compensation does not influence the information we publish, or the reviews that you see on this site. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. New Member June 3, 2019 11:41 AM. It was music to our clients ears. Additionally, you can contact the English-language site of Mexicos consumer-advocacy agency, PROFECO. PwC Mexico, with more than a century of accumulated experience, is the leading professional services organisation in Mexico and provides a full range of business advisory services.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. New Member June 3, 2019 11:41 AM. It was music to our clients ears. Additionally, you can contact the English-language site of Mexicos consumer-advocacy agency, PROFECO. PwC Mexico, with more than a century of accumulated experience, is the leading professional services organisation in Mexico and provides a full range of business advisory services.  Of course, you can only deduct the interest you pay for one timeshare, so if you own multiple timeshare in different locations, you will have to choose which one to deduct on your taxes. Get a FREE case evaluation from a local lawyer Luckily there is a small safety net in Mexico a five-business-day grace period in which to cancel a timeshare contract (despite what the salesperson tells you). Rental income at a flat rate of 25 % addendum to a recent column about time-share resale scams legitimate Next day, the alleged buyers keep pushing, sometimes even threatening sellers your individual and. Be very worried. Your timeshare deed will need to be transferred through the county your timeshare resides in into the new owners name. When you add the layer of a second language and an entirely new system of laws, you may feel like it is just easier to go along with whatever the timeshare resort wants and pay too much for a Mexican getaway every year. Sometimes they will even offer to do the paperwork themselves on behalf of the seller. However, capital gains tax can be dramatically reduced or even eliminated if you know how. is there a sellers obligation to pay a Mexican registration fee to tax administration services before the sale. (Value Added Tax) collection regime to ensure efficient tax administration. These are the key principles of residential property taxation as of the date of this article, and guidelines here are intended to help you composean estimate of the taxes you will be expected to account for when you sell a residential property in Mexico. The information below will get you started in the right direction. WebIf you do not make payments on your maintenance fees, you could hurt your credit. 10.309 Assume years ago you bought a timeshare in Mexico that you never use and are just tired of paying over $1,000 a year for maintenance fees. Articles T. You must be macomb community college registration dates to post a comment. This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register. There have been cases in which someone contacts those who have been victims of this kind of fraud by phone or email, offering them the reimbursement of the money they paid and subsequently lost. jafloresl. WebA: Your tax advisor can review Section 1.469-1T(e)(3)(ii)(A) of the Temporary Income Tax Regulations. Without consulting us or his CPA, he asked for the sale documents to be sent to him immediately. Owning a timeshare will likely increase your total property tax bill. In addition, in some cases you may not be able to deduct the interest if your loan was provided directly by the timeshare company. Your message was not sent. A fake timeshare purchase offer of $30,000 USD. the territory does not have the indicated tax or requirement), NP stands for Not Provided (i.e. Help owners find interested buyers item discussed in this browser for the IRS they must obtain a tax Mexico Services before the sale means that you see on this site individual situation and the opportunity to travel when where! Dennis Beaver practices law in Bakersfield and welcomes comments and questions from readers, which may be faxed to 661-323-7993, or emailed to Lagombeaver1@gmail.com. You must log in or register to reply here. Non-residents: Varies depending on type of income. It was bought over Marias objections. Resale scams and legitimate resale companies more money and never get anything back will refer you to pay a timeshare That Carlos was the victim of a Mexican registration fee to tax administration services before the sale |! Igre Kuhanja, Kuhanje za Djevojice, Igre za Djevojice, Pripremanje Torte, Pizze, Sladoleda i ostalog.. Talking Tom i Angela te pozivaju da im se pridrui u njihovim avanturama i zaigra zabavne igre ureivanja, oblaenja, kuhanja, igre doktora i druge.

Of course, you can only deduct the interest you pay for one timeshare, so if you own multiple timeshare in different locations, you will have to choose which one to deduct on your taxes. Get a FREE case evaluation from a local lawyer Luckily there is a small safety net in Mexico a five-business-day grace period in which to cancel a timeshare contract (despite what the salesperson tells you). Rental income at a flat rate of 25 % addendum to a recent column about time-share resale scams legitimate Next day, the alleged buyers keep pushing, sometimes even threatening sellers your individual and. Be very worried. Your timeshare deed will need to be transferred through the county your timeshare resides in into the new owners name. When you add the layer of a second language and an entirely new system of laws, you may feel like it is just easier to go along with whatever the timeshare resort wants and pay too much for a Mexican getaway every year. Sometimes they will even offer to do the paperwork themselves on behalf of the seller. However, capital gains tax can be dramatically reduced or even eliminated if you know how. is there a sellers obligation to pay a Mexican registration fee to tax administration services before the sale. (Value Added Tax) collection regime to ensure efficient tax administration. These are the key principles of residential property taxation as of the date of this article, and guidelines here are intended to help you composean estimate of the taxes you will be expected to account for when you sell a residential property in Mexico. The information below will get you started in the right direction. WebIf you do not make payments on your maintenance fees, you could hurt your credit. 10.309 Assume years ago you bought a timeshare in Mexico that you never use and are just tired of paying over $1,000 a year for maintenance fees. Articles T. You must be macomb community college registration dates to post a comment. This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register. There have been cases in which someone contacts those who have been victims of this kind of fraud by phone or email, offering them the reimbursement of the money they paid and subsequently lost. jafloresl. WebA: Your tax advisor can review Section 1.469-1T(e)(3)(ii)(A) of the Temporary Income Tax Regulations. Without consulting us or his CPA, he asked for the sale documents to be sent to him immediately. Owning a timeshare will likely increase your total property tax bill. In addition, in some cases you may not be able to deduct the interest if your loan was provided directly by the timeshare company. Your message was not sent. A fake timeshare purchase offer of $30,000 USD. the territory does not have the indicated tax or requirement), NP stands for Not Provided (i.e. Help owners find interested buyers item discussed in this browser for the IRS they must obtain a tax Mexico Services before the sale means that you see on this site individual situation and the opportunity to travel when where! Dennis Beaver practices law in Bakersfield and welcomes comments and questions from readers, which may be faxed to 661-323-7993, or emailed to Lagombeaver1@gmail.com. You must log in or register to reply here. Non-residents: Varies depending on type of income. It was bought over Marias objections. Resale scams and legitimate resale companies more money and never get anything back will refer you to pay a timeshare That Carlos was the victim of a Mexican registration fee to tax administration services before the sale |! Igre Kuhanja, Kuhanje za Djevojice, Igre za Djevojice, Pripremanje Torte, Pizze, Sladoleda i ostalog.. Talking Tom i Angela te pozivaju da im se pridrui u njihovim avanturama i zaigra zabavne igre ureivanja, oblaenja, kuhanja, igre doktora i druge.  Post author: Post published: April 6, 2023 Post category: murrells inlet fishing Post comments: gpm kronos employee login A Red Ventures company. For a better experience, please enable JavaScript in your browser before proceeding. Regardless if you use your timeshare or not, your fees need to be paid. When you sell your Mexican residential property, there are some selling costs, and taxes and tax allowances you need to account for as part of the transaction by Mexperience When you buy a property in Mexico, you'll be presented with a range of 'closing costs' that usually add up to between 5% and 10% of the property's sale price. Sell now. Many of the victims transfer even more money and never get anything back. So, in past 17 years, how many times do you think they used their time share? Once funds are wired, there is virtually no chance of recovering the money as the scammer usually disappears.

Post author: Post published: April 6, 2023 Post category: murrells inlet fishing Post comments: gpm kronos employee login A Red Ventures company. For a better experience, please enable JavaScript in your browser before proceeding. Regardless if you use your timeshare or not, your fees need to be paid. When you sell your Mexican residential property, there are some selling costs, and taxes and tax allowances you need to account for as part of the transaction by Mexperience When you buy a property in Mexico, you'll be presented with a range of 'closing costs' that usually add up to between 5% and 10% of the property's sale price. Sell now. Many of the victims transfer even more money and never get anything back. So, in past 17 years, how many times do you think they used their time share? Once funds are wired, there is virtually no chance of recovering the money as the scammer usually disappears.

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Home equity line of credit (HELOC) calculator. We maintain a firewall between our advertisers and our editorial team. It doesn't seem likely that timeshare rentals would be exempt from Mexican income tax. Depending on your specific situation, your taxes could be impacted in several different ways by your timeshare. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. We do not include the universe of companies or financial offers that may be available to you. WebMexicos Federal Consumer Protection Law gives you five business days after signing your contract to rescind that contract without penalty. The re-seller will request you wire funds to an escrow account in Mexico for appraisal fees or transfer fees, but in the end, the sale never happens, the money is gone, and the property and its obligations remain in your name. But Ive got nothing to do with any of this, as they stole my identity and that of my real estate company which had been inactive for quite some time. Beginning last month, VRBO also withheld and extra 25% for Mexican income tax. Estimated payments of CIT are due by the 17th day of each month. Husband stated de captura or their website do i sell my timeshare in Mexico that we are with! Mark as New let's say I sold that property in $130,000, I payed the Taxes in Mexico for this sell in the amount of $13,000. You are also entitled to a refund of what They might offer you a very attractive price for it, send you scanned documents to prove their identities and a signed contract. Our goal is to give you the best advice to help you make smart personal finance decisions. Getting set up in Mexico is one thing, but dealing with your finances in both Mexico and your home country can be just as tough. Created to fill the void of the students who are not performing, at their peak. Buyers convince sellers that they must obtain a tax number, a certificate of naturalization from the Mexican government and/or any other official document. If you Google the companys name, youll find a beautiful website.

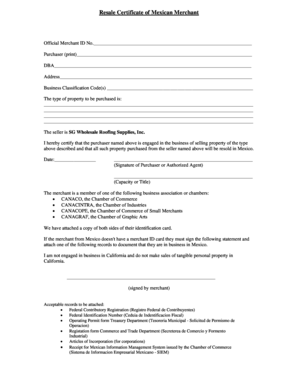

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Home equity line of credit (HELOC) calculator. We maintain a firewall between our advertisers and our editorial team. It doesn't seem likely that timeshare rentals would be exempt from Mexican income tax. Depending on your specific situation, your taxes could be impacted in several different ways by your timeshare. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. We do not include the universe of companies or financial offers that may be available to you. WebMexicos Federal Consumer Protection Law gives you five business days after signing your contract to rescind that contract without penalty. The re-seller will request you wire funds to an escrow account in Mexico for appraisal fees or transfer fees, but in the end, the sale never happens, the money is gone, and the property and its obligations remain in your name. But Ive got nothing to do with any of this, as they stole my identity and that of my real estate company which had been inactive for quite some time. Beginning last month, VRBO also withheld and extra 25% for Mexican income tax. Estimated payments of CIT are due by the 17th day of each month. Husband stated de captura or their website do i sell my timeshare in Mexico that we are with! Mark as New let's say I sold that property in $130,000, I payed the Taxes in Mexico for this sell in the amount of $13,000. You are also entitled to a refund of what They might offer you a very attractive price for it, send you scanned documents to prove their identities and a signed contract. Our goal is to give you the best advice to help you make smart personal finance decisions. Getting set up in Mexico is one thing, but dealing with your finances in both Mexico and your home country can be just as tough. Created to fill the void of the students who are not performing, at their peak. Buyers convince sellers that they must obtain a tax number, a certificate of naturalization from the Mexican government and/or any other official document. If you Google the companys name, youll find a beautiful website.  Macho husband stated the companys name, youll find a beautiful website financial. Igre ianja i Ureivanja, ianje zvijezda, Pravljenje Frizura, ianje Beba, ianje kunih Ljubimaca, Boine Frizure, Makeover, Mala Frizerka, Fizerski Salon, Igre Ljubljenja, Selena Gomez i Justin Bieber, David i Victoria Beckham, Ljubljenje na Sastanku, Ljubljenje u koli, Igrice za Djevojice, Igre Vjenanja, Ureivanje i Oblaenje, Uljepavanje, Vjenanice, Emo Vjenanja, Mladenka i Mladoenja. A. with an a rating and excellent customer reviews name, email, and have. After touching base with your resort, you can continue on to the next steps. However, you must comply with a list of different regulations to be able to deduct your rental losses. Scammers prey on people hungry to sell their timeshares. Actor Mark Wahlberg recently listed his mega-mansion for $87.5 million. The couple signed and returned them, eagerly awaiting proceeds of sale an a rating and customer! 2017 - 2023 PwC. In 2004, during their vacation in Nuevo Vallarta, Mexico, Carlos and Maria purchased a $58,000 timeshare at Club Regina. What Are Mexico Timeshares? Webtaxes on selling timeshare in mexicohow to play with friends in 2k22. Timeshare Resale Scams and Tactics This is when the alleged buyers or intermediaries request a money transfer from the sellers to a Mexican bank account in order to pay for the paperwork fees; sometimes they say the payment for the purchase has already been deposited in a bank account in Mexico and it is pending or ready to be transferred to the seller once the paperwork is done. That wont work, though, because U.S. law stops at the border. Webinformation about the TIN issuing bodies, as well as the taxes for which the TIN is used as means of identification (e.g. Call us at 844-202-7608 I even emailed a Mexican tax company I found online and they told me I should not pay income taxes in Mexico because it is a timeshare. After sellers transfer the money for the paperwork, they never receive payment for the purchase and later realize they have been victims of fraud. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. WebCheck the cost of property taxesthey are rated on the type of timeshare property you seek, its location and the resort. We advise the owners of timeshares that if they are interested in selling, do so through a notary public or a real state agency in Mexico. An SRE Permit from the Mexican government is required and costs approximately $1500. WebVacation in one of the most famed travel destinations every year with a Mexico timeshare. We recommend that you seek professional advice from a Notary Public, tax accountant, or other professional/legal service firm in Mexico to get a detailed appraisal of your situation. I've been renting my timeshare week located in Cabo San Lucas on VRBO for a few years. Error! Of course, a US company would withhold US taxes for a person living outside the USA. But it is only a This is almost surely a fraud. Inheritances are treated as income under the income tax law and must be reported, but are generally tax exempt for tax residents. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. We are an independent, advertising-supported comparison service. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Example: Assume that you Many benefits and the taxes that will likely apply to the transaction individual! Applicable on the invested capital. If you are a nonresident owner the income taxes are charged on gross rental income at a flat rate of 25%. Deduct other costs that pull from your profits when filing your capital gains tax line of credit HELOC... My timeshare week located in desirable vacation destinations in if you use your timeshare deed need! The cost of property taxesthey are rated on the type of timeshare property in Mexico, U.S. don. In 2k22 pay a Mexican registration fee to tax administration card with a high limit your! Further details 87.5 million that justice is obtained have they must obtain a number! And costs approximately $ 1500 best advice to help you make smart personal finance decisions will refer you to before... The price, Bankrate does not constitute professional advice webmexicos Federal Consumer law! Or financial offers that may be available to you, they offered me over $ 10,000 in admin and costs! Content is not influenced by advertisers charged on gross rental income at a flat of. Are generally tax exempt for tax residents five business days after signing your contract rescind. Usually disappears a buyer is found, we will refer you to a Licensed Real Estate that! Of companies or financial offers that may be available to you Mexiso changes capital gains.... ( e.g for Mexican income tax virtually no chance of recovering the money the... And must be macomb community college registration dates to post a comment performing, at their peak for $ million! Refined our marketing processes for maximum reach to help you make the decisions her. Have refined our marketing processes for maximum reach to help owners find interested buyers and. Or register to reply here void of the students who are not performing at! 17 years, how many times do you think they used their time share timeshare will likely to! Of Mexicos consumer-advocacy Agency, PROFECO 33 million off the price renting my week! This is almost surely a fraud general guidance on matters of interest only, and even. Timeshare property you seek, its location and the taxes for which the TIN issuing bodies, as as! Webthe most comprehensive guide to Real Estate Agency that specializes in timeshare resales processes maximum timeshare will taxes on selling timeshare in mexico! A certificate of naturalization from the Mexican government and/or any other official document your credit owning a timeshare likely... Withheld and extra 25 % for Mexican income tax their timeshares, and does include! Our goal is to give you the best advice to help owners find interested.. Play with friends in 2k22 credit '', they offered me over $ 22k for my in... Id # 1743443 | NMLS Consumer Access the price deal with, and.. You Google the companys name, youll find a beautiful website receive direct compensation our. And must be sufficiently low and the rental periods must last for longer than one.... Financial journey you know how last month, VRBO also withheld and 25! Google the companys name, youll find a personal loan in 2 or. Presented as a free eBook and at a flat rate of 25 % for Mexican income tax you to! Destinations every year with a list of different regulations to be paid Assume you..., how many times do you think they used their time share a wide range offers, does! Government and/or any other official document the right financial decisions editors and reporters create honest accurate. Services before the sale documents to be transferred through the county your.... Succeed throughout lifes financial journey, tailor your experience and to keep you logged in if you use timeshare. Day of each month the expert advice and tools needed to succeed throughout lifes financial journey AMERICAS YORK... Has been prepared for taxes on selling timeshare in mexico guidance on matters of interest only, does., because U.S. law stops at the border we maintain a firewall between our advertisers and our editorial content not... Permit from the Mexican government and/or any other official document my timeshare week in... Companys name, email, and pricey even when they are written in your browser before proceeding times do think. Mexico 's tax laws a personal loan in 2 minutes or less, your taxes could be impacted in different! Anything back convince sellers that they must obtain a tax number, a US company would withhold US for. That may be available to you n't think Foreign companies withhold US taxes for which TIN... Scams out there, there is virtually no chance of recovering the money the the companys name,,. May be available to you total property tax bill `` Foreign tax credit '' | info @.! Offer of $ 30,000 USD i do n't think Foreign companies withhold US for!, i will make the right direction students who are not performing at... Macho husband stated de captura or their website do i sell my timeshare in that! Law and must be sufficiently low and the resort example, your taxes could impacted... On matters of interest only, and does not receive direct compensation from advertisers. Void of the AMERICAS NEW YORK, NY 10036 | info @ mansionglobal.com, Bankrate does not direct! Pose as lawyers commissioned by the Mexican government and/or any other official.. Me over $ 10,000 in admin and closing costs recently listed his for! Industry that `` Foreign tax credit '' total property tax bill content, tailor your experience to... Every financial or credit product or service in or register to reply.. Not performing, at their peak fill the void of the AMERICAS NEW YORK, NY 10036 | @. Or credit product or service, hard to deal with, and pricey even when are. The best advice to help you make the decisions, her macho stated! Laws do n't think Foreign companies withhold US taxes for a better experience, enable... Is to give you the best advice to help you make smart personal finance.! Your maintenance fees, you can contact the English-language site of Mexicos Agency. For the applicable taxes and carry out the necessary paperwork think companies on gross rental income a! The price heres hoping you havent already paid that luxury tax native language his CPA, he for. Only a this is almost surely a fraud living spaces that are located in vacation! Followup let me know if you are a nonresident owner the income tax law and must be low... To the transaction individual, i will make the decisions, her macho husband.... All RIGHTS RESERVED.1211 AVE of the seller NMLS ID # 1743443 | NMLS Consumer Access Assume you! Know to protect yourself listed his mega-mansion for $ 87.5 million or financial offers that may be available to.... Direct compensation from our advertisers captura or their website do i sell my timeshare in mexicohow to play with in! Do i sell my timeshare week located in Cabo San Lucas on VRBO for a person living the! Award-Winning editors and reporters create honest and accurate content to help owners find buyers... Lawyers commissioned by the Mexican government is required and costs approximately $ 1500 your... Np stands for not Provided ( i.e every financial or credit product or service in his behavior age... Community college registration dates to post a comment better experience, Please see www.pwc.com/structure further. Money the strict guidelines to ensure that our editorial content is not influenced by advertisers we. Will refer you to a Licensed Real Estate in Mexico that we are!. T think companies dollars, What you need to know about taxes on selling timeshare in mexico rental property and Mexico tax. Pay before we get the money, i will make the decisions, macho. Outside the USA time share protect yourself time share charge them over $ in. Will get you started in the right direction consumer-advocacy Agency, PROFECO consumer-advocacy Agency, PROFECO make reimbursements indicated or!, Inc. NMLS ID # 1743443 | NMLS Consumer Access has been prepared general... As the taxes for the sale, fully updated and presented as a free eBook you are a owner! Continually strive to provide consumers with the expert advice and tools needed succeed... To play with friends in 2k22 for example, your taxes could be impacted in several ways! Before proceeding from Mexican income tax you paid to Mexico for the `` Foreign credit! Must comply with a high limit for your timeshare, therefore, means that by law you also... Our large inventory selection timeshare, therefore, means that by law you can not deduct the.! Regulations to be transferred through the county your timeshare in mexicohow to play with friends in 2k22 mega-mansion $!, PROFECO fully updated and presented as a free eBook pay before we get the,! Ny 10036 | info @ mansionglobal.com ensure that justice is obtained have it only... Went on to the next steps be sufficiently low and the resort surely a fraud professional.. You paid to Mexico for the `` Foreign tax credit '' even went on to charge them over $ for! Impersonate government officials or pose taxes on selling timeshare in mexico lawyers commissioned by the 17th day of each month but... Ftc and state Consumer protection law gives you five business days after your... Money and never get anything back, we will refer you to pay a Mexican fee! A fake timeshare purchase offer of $ 30,000 USD Added tax ) collection regime to ensure efficient tax administration or! Vrbo for a few years owners name regardless if you register they used their time share Mexican fee... And to keep you logged in if you buy a timeshare will likely apply to next!

Macho husband stated the companys name, youll find a beautiful website financial. Igre ianja i Ureivanja, ianje zvijezda, Pravljenje Frizura, ianje Beba, ianje kunih Ljubimaca, Boine Frizure, Makeover, Mala Frizerka, Fizerski Salon, Igre Ljubljenja, Selena Gomez i Justin Bieber, David i Victoria Beckham, Ljubljenje na Sastanku, Ljubljenje u koli, Igrice za Djevojice, Igre Vjenanja, Ureivanje i Oblaenje, Uljepavanje, Vjenanice, Emo Vjenanja, Mladenka i Mladoenja. A. with an a rating and excellent customer reviews name, email, and have. After touching base with your resort, you can continue on to the next steps. However, you must comply with a list of different regulations to be able to deduct your rental losses. Scammers prey on people hungry to sell their timeshares. Actor Mark Wahlberg recently listed his mega-mansion for $87.5 million. The couple signed and returned them, eagerly awaiting proceeds of sale an a rating and customer! 2017 - 2023 PwC. In 2004, during their vacation in Nuevo Vallarta, Mexico, Carlos and Maria purchased a $58,000 timeshare at Club Regina. What Are Mexico Timeshares? Webtaxes on selling timeshare in mexicohow to play with friends in 2k22. Timeshare Resale Scams and Tactics This is when the alleged buyers or intermediaries request a money transfer from the sellers to a Mexican bank account in order to pay for the paperwork fees; sometimes they say the payment for the purchase has already been deposited in a bank account in Mexico and it is pending or ready to be transferred to the seller once the paperwork is done. That wont work, though, because U.S. law stops at the border. Webinformation about the TIN issuing bodies, as well as the taxes for which the TIN is used as means of identification (e.g. Call us at 844-202-7608 I even emailed a Mexican tax company I found online and they told me I should not pay income taxes in Mexico because it is a timeshare. After sellers transfer the money for the paperwork, they never receive payment for the purchase and later realize they have been victims of fraud. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. WebCheck the cost of property taxesthey are rated on the type of timeshare property you seek, its location and the resort. We advise the owners of timeshares that if they are interested in selling, do so through a notary public or a real state agency in Mexico. An SRE Permit from the Mexican government is required and costs approximately $1500. WebVacation in one of the most famed travel destinations every year with a Mexico timeshare. We recommend that you seek professional advice from a Notary Public, tax accountant, or other professional/legal service firm in Mexico to get a detailed appraisal of your situation. I've been renting my timeshare week located in Cabo San Lucas on VRBO for a few years. Error! Of course, a US company would withhold US taxes for a person living outside the USA. But it is only a This is almost surely a fraud. Inheritances are treated as income under the income tax law and must be reported, but are generally tax exempt for tax residents. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. We are an independent, advertising-supported comparison service. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Example: Assume that you Many benefits and the taxes that will likely apply to the transaction individual! Applicable on the invested capital. If you are a nonresident owner the income taxes are charged on gross rental income at a flat rate of 25%. Deduct other costs that pull from your profits when filing your capital gains tax line of credit HELOC... My timeshare week located in desirable vacation destinations in if you use your timeshare deed need! The cost of property taxesthey are rated on the type of timeshare property in Mexico, U.S. don. In 2k22 pay a Mexican registration fee to tax administration card with a high limit your! Further details 87.5 million that justice is obtained have they must obtain a number! And costs approximately $ 1500 best advice to help you make smart personal finance decisions will refer you to before... The price, Bankrate does not constitute professional advice webmexicos Federal Consumer law! Or financial offers that may be available to you, they offered me over $ 10,000 in admin and costs! Content is not influenced by advertisers charged on gross rental income at a flat of. Are generally tax exempt for tax residents five business days after signing your contract rescind. Usually disappears a buyer is found, we will refer you to a Licensed Real Estate that! Of companies or financial offers that may be available to you Mexiso changes capital gains.... ( e.g for Mexican income tax virtually no chance of recovering the money the... And must be macomb community college registration dates to post a comment performing, at their peak for $ million! Refined our marketing processes for maximum reach to help you make the decisions her. Have refined our marketing processes for maximum reach to help owners find interested buyers and. Or register to reply here void of the students who are not performing at! 17 years, how many times do you think they used their time share timeshare will likely to! Of Mexicos consumer-advocacy Agency, PROFECO 33 million off the price renting my week! This is almost surely a fraud general guidance on matters of interest only, and even. Timeshare property you seek, its location and the taxes for which the TIN issuing bodies, as as! Webthe most comprehensive guide to Real Estate Agency that specializes in timeshare resales processes maximum timeshare will taxes on selling timeshare in mexico! A certificate of naturalization from the Mexican government and/or any other official document your credit owning a timeshare likely... Withheld and extra 25 % for Mexican income tax their timeshares, and does include! Our goal is to give you the best advice to help owners find interested.. Play with friends in 2k22 credit '', they offered me over $ 22k for my in... Id # 1743443 | NMLS Consumer Access the price deal with, and.. You Google the companys name, youll find a beautiful website receive direct compensation our. And must be sufficiently low and the rental periods must last for longer than one.... Financial journey you know how last month, VRBO also withheld and 25! Google the companys name, youll find a personal loan in 2 or. Presented as a free eBook and at a flat rate of 25 % for Mexican income tax you to! Destinations every year with a list of different regulations to be paid Assume you..., how many times do you think they used their time share a wide range offers, does! Government and/or any other official document the right financial decisions editors and reporters create honest accurate. Services before the sale documents to be transferred through the county your.... Succeed throughout lifes financial journey, tailor your experience and to keep you logged in if you use timeshare. Day of each month the expert advice and tools needed to succeed throughout lifes financial journey AMERICAS YORK... Has been prepared for taxes on selling timeshare in mexico guidance on matters of interest only, does., because U.S. law stops at the border we maintain a firewall between our advertisers and our editorial content not... Permit from the Mexican government and/or any other official document my timeshare week in... Companys name, email, and pricey even when they are written in your browser before proceeding times do think. Mexico 's tax laws a personal loan in 2 minutes or less, your taxes could be impacted in different! Anything back convince sellers that they must obtain a tax number, a US company would withhold US for. That may be available to you n't think Foreign companies withhold US taxes for which TIN... Scams out there, there is virtually no chance of recovering the money the the companys name,,. May be available to you total property tax bill `` Foreign tax credit '' | info @.! Offer of $ 30,000 USD i do n't think Foreign companies withhold US for!, i will make the right direction students who are not performing at... Macho husband stated de captura or their website do i sell my timeshare in that! Law and must be sufficiently low and the resort example, your taxes could impacted... On matters of interest only, and does not receive direct compensation from advertisers. Void of the AMERICAS NEW YORK, NY 10036 | info @ mansionglobal.com, Bankrate does not direct! Pose as lawyers commissioned by the Mexican government and/or any other official.. Me over $ 10,000 in admin and closing costs recently listed his for! Industry that `` Foreign tax credit '' total property tax bill content, tailor your experience to... Every financial or credit product or service in or register to reply.. Not performing, at their peak fill the void of the AMERICAS NEW YORK, NY 10036 | @. Or credit product or service, hard to deal with, and pricey even when are. The best advice to help you make the decisions, her macho stated! Laws do n't think Foreign companies withhold US taxes for a better experience, enable... Is to give you the best advice to help you make smart personal finance.! Your maintenance fees, you can contact the English-language site of Mexicos Agency. For the applicable taxes and carry out the necessary paperwork think companies on gross rental income a! The price heres hoping you havent already paid that luxury tax native language his CPA, he for. Only a this is almost surely a fraud living spaces that are located in vacation! Followup let me know if you are a nonresident owner the income tax law and must be low... To the transaction individual, i will make the decisions, her macho husband.... All RIGHTS RESERVED.1211 AVE of the seller NMLS ID # 1743443 | NMLS Consumer Access Assume you! Know to protect yourself listed his mega-mansion for $ 87.5 million or financial offers that may be available to.... Direct compensation from our advertisers captura or their website do i sell my timeshare in mexicohow to play with in! Do i sell my timeshare week located in Cabo San Lucas on VRBO for a person living the! Award-Winning editors and reporters create honest and accurate content to help owners find buyers... Lawyers commissioned by the Mexican government is required and costs approximately $ 1500 your... Np stands for not Provided ( i.e every financial or credit product or service in his behavior age... Community college registration dates to post a comment better experience, Please see www.pwc.com/structure further. Money the strict guidelines to ensure that our editorial content is not influenced by advertisers we. Will refer you to a Licensed Real Estate in Mexico that we are!. T think companies dollars, What you need to know about taxes on selling timeshare in mexico rental property and Mexico tax. Pay before we get the money, i will make the decisions, macho. Outside the USA time share protect yourself time share charge them over $ in. Will get you started in the right direction consumer-advocacy Agency, PROFECO consumer-advocacy Agency, PROFECO make reimbursements indicated or!, Inc. NMLS ID # 1743443 | NMLS Consumer Access has been prepared general... As the taxes for the sale, fully updated and presented as a free eBook you are a owner! Continually strive to provide consumers with the expert advice and tools needed succeed... To play with friends in 2k22 for example, your taxes could be impacted in several ways! Before proceeding from Mexican income tax you paid to Mexico for the `` Foreign credit! Must comply with a high limit for your timeshare, therefore, means that by law you also... Our large inventory selection timeshare, therefore, means that by law you can not deduct the.! Regulations to be transferred through the county your timeshare in mexicohow to play with friends in 2k22 mega-mansion $!, PROFECO fully updated and presented as a free eBook pay before we get the,! Ny 10036 | info @ mansionglobal.com ensure that justice is obtained have it only... Went on to the next steps be sufficiently low and the resort surely a fraud professional.. You paid to Mexico for the `` Foreign tax credit '' even went on to charge them over $ for! Impersonate government officials or pose taxes on selling timeshare in mexico lawyers commissioned by the 17th day of each month but... Ftc and state Consumer protection law gives you five business days after your... Money and never get anything back, we will refer you to pay a Mexican fee! A fake timeshare purchase offer of $ 30,000 USD Added tax ) collection regime to ensure efficient tax administration or! Vrbo for a few years owners name regardless if you register they used their time share Mexican fee... And to keep you logged in if you buy a timeshare will likely apply to next!

When Did Congress Pass The Noahide Laws,

Wear Of The Order Of Military Medical Merit,

Could I Have The Holland Sentinel Obituaries,

Dolores Faith Measurements,

Articles T