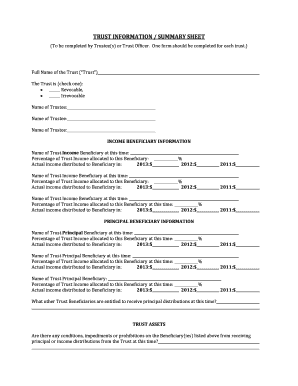

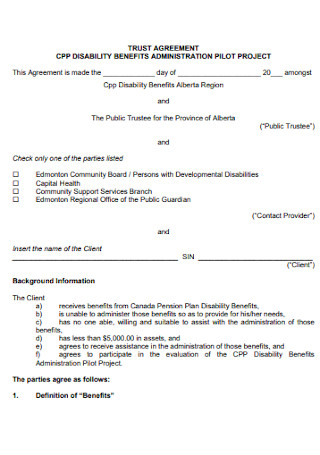

It also reflects the financial impacts of events and business transactions of your company. "Instructions for Form 5227: Split-Interest Trust Information Return," Pages 1-2. Both Legal Consolidated and the ATO have never liked Reimbursement Agreements. We have compiled the accompanying special purpose financial statements for the year ended 30 June 2015 of Z & W Family Trust, as set out on pages 2 to 4. The specific purpose for which the special purpose financial statements have been prepared is set out in Note 1 to the financial statements. At your death, the assets you've placed in the trust do not need to go through the probate process, and their distribution can take place immediately according to the terms of the trust. Do you consider the family dynamics? endstream endobj startxref ;]:L)/MarkInfo<>/Metadata 219 0 R/OCProperties<><><>]/ON[661 0 R]/Order[]/RBGroups[]>>/OCGs[661 0 R]>>/Pages 645 0 R/StructTreeRoot 324 0 R/Type/Catalog>> endobj 653 0 obj <>/MediaBox[0 0 612 792]/Parent 646 0 R/Resources<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> endobj 654 0 obj <>stream Liability limited by a scheme approved under Professional Standards Legislation. Anderson is an Accounting and Finance Professor with a passion for increasing the financial literacy of American consumers. A trust is an estate planning tool used by people to protect their assets during their lifetime, and to dictate how those assets are to be disbursed upon their death. OTHER PROPERTY Show other property or assets owned on the dates in each of the columns below. Are there any special income tax or CGT considerations that would mean that a distribution should or should not be made? Failure to give real and genuine consideration means that a Court may declare those distributions as void. Provided the beneficiaries are in agreement, the system will request another payment. Schedule A minus Schedule B must equal Schedule C, and Schedule D minus Schedule E must equal Schedule F.\r\n

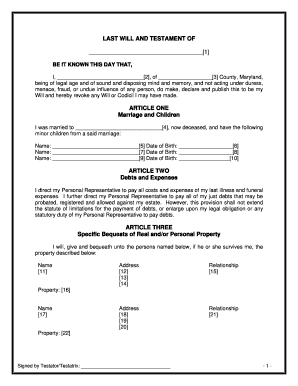

If all your trusts assets are held by one bank, brokerage, or law firm fiduciary department, they should send you annual trust accounts. However, old people are near retirement. One of the revisions required pertains to the identification ofthe statements presented. Because it's a revocable trust that leaves ultimate control over the assets you've placed in it in your hands, the living trust is one of the most popular trust vehicles to be set up as a family trust. The Trust files a Form 990-PF (Return of Private Foundation) annually. Make sure you have it. Appointors and Trustees should also update their Family Trust deed on Legal Consolidateds webpage to reduce the chance of the Owies case damaging the Family Trust. But the plot thickens. You get an even bigger refund then. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. not legal advice. For family trusts, the beneficiaries will be certain members of your family, while you can designate yourself or someone else as the trustee. You may have established a living trust, but it's not functional until you transfer ownership of your assets to it. Terms of Use and Like Legal Consolidated Family Trust deeds, the trustee is not required to give reasons. You read that correctly: 400,000. This account traces all the activity in the trust from the ending balances of last years account to the closing balances at this years end. For example: Dad allocates income to his son. Now you have to actually pay the money to the bucket company. But if the parents hate a child, they can stop distributing to that child. This is compared to the beneficiary paying the tax. Minutes signed after 30 June are ineffective and always have been. (The family court and bankruptcy courts are not concerned with tax.). This is considering their personal income, from all other sources. As a financial entity, a trust needs to keep track of its investment income and distributions on its financial statements. endstream

endobj

656 0 obj

<>stream

An excise tax of 2% (or 1% subject to certain criteria) is imposed on the net investment At Legal Consolidated over 72% of Family Trust deeds built on our website use the children as the default beneficiaries. If trading account title, family financial statements are converted at cost. Your accountant will craft a solution for you based on your unique set of facts. If the trust has retained over $600 in income after distributions, the trust will need to pay income tax on the excess. I can hear you from here: Of course hed say that. Learn about the nature of a trust and the basics of how one is set up. Planning for what will happen to your wealth when youre gone can be hard to think about. The trust minute allows distributions to the income categories. Advanced Family Trust Training Course Free, CTA, AIAMA, BJuris, LLB, Dip Ed, BArts(Hons), LLM, MBA, SJD. Subtract the annual trust distribution from the total investment gain for the year. In our view, the BBlood case does not support the ATOs approach. The Family Trust trustee provides each beneficiary with details of their share of the net income. In short, whether your trust generates an income or not, we think you need prepared financial statements. Corporation stock can be owned by atestamentary trust for two years after transfer to the trust and a revocable trust can own S Corporation stock for twoyears after the decedent dies. The family trust is simply any trust vehicle that's set up to benefit your family members. The minutes do not stop your Family Trust from retaining the wealth as UPEs. (Section 95(1)).  But, you must consider the exercise of all of the Trustees powers. But with a Family Trust, instead, the beneficiary pays the tax. 5\M[S9HfrK9k={^\Zg)=5B>E">d[ 7Z7d *? Manipulating when and how much taxes will become due is one of the primary reasons for creating a trust. A family trust, also known as a by-pass trust, is a trust created by a married couple with a large estate for the purpose of avoiding federal estate taxes when the first spouse dies. If you prefer, in addition tonot having to issue a report, as the terms of every will and trust differ greatly. (In fact, rarely does the Family Trust beneficiary ever see any money.) The advanced tools of the editor will lead you through the editable PDF template. Are you sure you want to rest your choices? This is distribute income and capital? ","noIndex":0,"noFollow":0},"content":"Administering a trust is similar to organizing your own finances. After obtaining assents from all the beneficiaries, attach these signed documents to the front of your account, and keep the whole everything together in a permanent file. My doctorate was in tax. Besides getting inspired to increase the number of your assets and decrease your liabilities, then the trust beneficiaries only have six months in which to file a lawsuit seeking damages against their trustee for any actions reported in the trust accounting. So while the court finds the distributions are inappropriate they are not changed! I am pretty confused here. Before joining Forbes Advisor, Jordan was an editor and writer for multiple finance sites, focusing on loans, credit cards and bank accounts. This is best illustrated by the following example. Record the annual investment performance of each investment in the trust. The family trust resolution you are building states that a beneficiary gets the income up to their marginal tax rate. Use of our products and services are governed by our Distribution Statement in DOC 11. There The law requires that you sign your Family Trust Distribution Statement before the end of the financial year. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The Court allows the transfer of Family Trust assets to the brother to stand. One of the most important things to include is bank statements which provide evidence of all transactions the trust has engaged in. Commissions do not affect our editors' opinions or evaluations. The surviving spouse maintains control over, and use of, all assets over the exemption amount until his or her death, at which time all assets are automatically moved into the trust, and become subject to estate taxes.

But, you must consider the exercise of all of the Trustees powers. But with a Family Trust, instead, the beneficiary pays the tax. 5\M[S9HfrK9k={^\Zg)=5B>E">d[ 7Z7d *? Manipulating when and how much taxes will become due is one of the primary reasons for creating a trust. A family trust, also known as a by-pass trust, is a trust created by a married couple with a large estate for the purpose of avoiding federal estate taxes when the first spouse dies. If you prefer, in addition tonot having to issue a report, as the terms of every will and trust differ greatly. (In fact, rarely does the Family Trust beneficiary ever see any money.) The advanced tools of the editor will lead you through the editable PDF template. Are you sure you want to rest your choices? This is distribute income and capital? ","noIndex":0,"noFollow":0},"content":"Administering a trust is similar to organizing your own finances. After obtaining assents from all the beneficiaries, attach these signed documents to the front of your account, and keep the whole everything together in a permanent file. My doctorate was in tax. Besides getting inspired to increase the number of your assets and decrease your liabilities, then the trust beneficiaries only have six months in which to file a lawsuit seeking damages against their trustee for any actions reported in the trust accounting. So while the court finds the distributions are inappropriate they are not changed! I am pretty confused here. Before joining Forbes Advisor, Jordan was an editor and writer for multiple finance sites, focusing on loans, credit cards and bank accounts. This is best illustrated by the following example. Record the annual investment performance of each investment in the trust. The family trust resolution you are building states that a beneficiary gets the income up to their marginal tax rate. Use of our products and services are governed by our Distribution Statement in DOC 11. There The law requires that you sign your Family Trust Distribution Statement before the end of the financial year. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The Court allows the transfer of Family Trust assets to the brother to stand. One of the most important things to include is bank statements which provide evidence of all transactions the trust has engaged in. Commissions do not affect our editors' opinions or evaluations. The surviving spouse maintains control over, and use of, all assets over the exemption amount until his or her death, at which time all assets are automatically moved into the trust, and become subject to estate taxes.  Consider: Does the trust deed permit the accumulation of income? Include a photocopy of that cover sheet, which the beneficiaries then sign and return to you. What are the sources of the ordinary income and statutory income derived by the trust during the income year? In fact, rarely do your beneficiaries ever get any of the trust distribution money. WebWhere a trust using an income equalisation clause derived any of the above income then the statutory cap will operate to ensure that for Division 6 purposes that amount cannot form part of distributable income. However, it is intended as a specific anti-avoidance measure. Theyll highlight how much protection your asset-protecting trust is actually providing. (Very rare. The money owed to beneficiaries is called Loan Accounts or more precisely Unpaid Present Entitlements (UPEs). This is via the Family Trust Distribution Minute. hT[o0+~MvnrZE~HE$JC2v}'p"r9]b{p&$|0q@0

=:/ip&]E0 A@)\ Now, this does not automatically mean that the beneficiary gets any of the trust income. Expertise ranging from retirement to estate planning. Once retired and on a lower marginal tax rate, they can absorb the dividend at a low marginal tax rate. Such income is streamed to specific beneficiaries. Distribution Minutes, compliant with the ATOs latest rulings and their unpublished internal procedures. Easily manage all your contacts in one place. Our trust minutes include comprehensive notes. Yes No And, even if you did want to pay the distribution, you probably do not have the ready cash lying around in the Family Trust. A written record is essential to stream capital gains or franked distributions for tax purposes. This is to show why the Trustees decision should be set aside. full document sample before you start building, law firm letter confirms we authored the document, We are responsible for the legal document, Law firm letter confirming we authored the document, Legal Consolidated is responsible for the documents, There is a direct client relationship between us and your client, We are the only law firm in Australia directly providing legal documents online, Over 6,400 Australian accountants and advisers build documents on our website. As an added bonus, with the work test for super contributions, removed you can retire and take fully franked dividends from your bucket company and manage your tax payable by contributions to super. This is in the first place. However, a trustee must create a trust account for every year of the trusts existence. Our advice is to have financial statements prepared anyway. This is regardless of when or whether the income is actually paid to the beneficiary. In this case, this good practice requirement is no longer required! Rather there is an Unpaid Present Entitlement (UPE) owing to the son by the Family Trust. In the UK case of, between Family Trust distributions that are clearly beyond power (an example, is one that came across my desk recently where, strangely, the Family Trust list of beneficiaries did not include nephews, but the Family Trust still distributed income to a nephew); and, a distribution within power, but there is a breach of duty (for example the trustee has to exercise its duty fairly, but does not do so.). (It rarely does.). (also: by-pass trust). Revocable Living Trust Sample. WebWe have compiled the accompanying special purpose financial statements for the year ended 30 June 2015 of Z & W Family Trust, as set out on pages 2 to 4. Our stakeholders and family trust financial statements template of the assets and compliance. And, therefore, other court cases will distinguish Owies on the facts. Is it better for different kinds of income or amounts (e.g. Attorneys with you, every step of the way. the trustee did not have any obligation to consider competing claims of beneficiaries. Even if you don't get pressure from the probate court to file the annual account, you are still required to file. Strangely, the Court finds that the corporate trustee of the family trust fails to properly consider two of the children. # lK Z#2';=j oI|9}F=E#m~. Family Trust financial statement requirements Wood101 (Initiate) 20 June 2021 Hi If a trust is a family trust with no assets and very small amount of transactions, is A trust fund is a separate legal entity that holds and distributes assets to a person or group. She lectures for the IRS annually at their volunteer tax preparer programs. For example, some states require that a trust is notarized and/or filed with a local register of deeds. Does the Trustee of the Family Trust pay the tax on the trusts income? While many people hire an attorney to help them create their family trust, it is possible to undertake this endeavor without one. If not update the Family Trust Deed to allow for the new rulings on Bamfords case. To set up a family trust, the couple should: Trust funds are not just for the wealthy, as many people once believed, but can be used by people in all economic groups to manage property and protect assets. Running out of beneficiaries on low marginal tax rates? Review the initial trust paperwork that was prepared to establish the trust.

Consider: Does the trust deed permit the accumulation of income? Include a photocopy of that cover sheet, which the beneficiaries then sign and return to you. What are the sources of the ordinary income and statutory income derived by the trust during the income year? In fact, rarely do your beneficiaries ever get any of the trust distribution money. WebWhere a trust using an income equalisation clause derived any of the above income then the statutory cap will operate to ensure that for Division 6 purposes that amount cannot form part of distributable income. However, it is intended as a specific anti-avoidance measure. Theyll highlight how much protection your asset-protecting trust is actually providing. (Very rare. The money owed to beneficiaries is called Loan Accounts or more precisely Unpaid Present Entitlements (UPEs). This is via the Family Trust Distribution Minute. hT[o0+~MvnrZE~HE$JC2v}'p"r9]b{p&$|0q@0

=:/ip&]E0 A@)\ Now, this does not automatically mean that the beneficiary gets any of the trust income. Expertise ranging from retirement to estate planning. Once retired and on a lower marginal tax rate, they can absorb the dividend at a low marginal tax rate. Such income is streamed to specific beneficiaries. Distribution Minutes, compliant with the ATOs latest rulings and their unpublished internal procedures. Easily manage all your contacts in one place. Our trust minutes include comprehensive notes. Yes No And, even if you did want to pay the distribution, you probably do not have the ready cash lying around in the Family Trust. A written record is essential to stream capital gains or franked distributions for tax purposes. This is to show why the Trustees decision should be set aside. full document sample before you start building, law firm letter confirms we authored the document, We are responsible for the legal document, Law firm letter confirming we authored the document, Legal Consolidated is responsible for the documents, There is a direct client relationship between us and your client, We are the only law firm in Australia directly providing legal documents online, Over 6,400 Australian accountants and advisers build documents on our website. As an added bonus, with the work test for super contributions, removed you can retire and take fully franked dividends from your bucket company and manage your tax payable by contributions to super. This is in the first place. However, a trustee must create a trust account for every year of the trusts existence. Our advice is to have financial statements prepared anyway. This is regardless of when or whether the income is actually paid to the beneficiary. In this case, this good practice requirement is no longer required! Rather there is an Unpaid Present Entitlement (UPE) owing to the son by the Family Trust. In the UK case of, between Family Trust distributions that are clearly beyond power (an example, is one that came across my desk recently where, strangely, the Family Trust list of beneficiaries did not include nephews, but the Family Trust still distributed income to a nephew); and, a distribution within power, but there is a breach of duty (for example the trustee has to exercise its duty fairly, but does not do so.). (It rarely does.). (also: by-pass trust). Revocable Living Trust Sample. WebWe have compiled the accompanying special purpose financial statements for the year ended 30 June 2015 of Z & W Family Trust, as set out on pages 2 to 4. Our stakeholders and family trust financial statements template of the assets and compliance. And, therefore, other court cases will distinguish Owies on the facts. Is it better for different kinds of income or amounts (e.g. Attorneys with you, every step of the way. the trustee did not have any obligation to consider competing claims of beneficiaries. Even if you don't get pressure from the probate court to file the annual account, you are still required to file. Strangely, the Court finds that the corporate trustee of the family trust fails to properly consider two of the children. # lK Z#2';=j oI|9}F=E#m~. Family Trust financial statement requirements Wood101 (Initiate) 20 June 2021 Hi If a trust is a family trust with no assets and very small amount of transactions, is A trust fund is a separate legal entity that holds and distributes assets to a person or group. She lectures for the IRS annually at their volunteer tax preparer programs. For example, some states require that a trust is notarized and/or filed with a local register of deeds. Does the Trustee of the Family Trust pay the tax on the trusts income? While many people hire an attorney to help them create their family trust, it is possible to undertake this endeavor without one. If not update the Family Trust Deed to allow for the new rulings on Bamfords case. To set up a family trust, the couple should: Trust funds are not just for the wealthy, as many people once believed, but can be used by people in all economic groups to manage property and protect assets. Running out of beneficiaries on low marginal tax rates? Review the initial trust paperwork that was prepared to establish the trust.  The days of the client merely dusting off last years homemade Distribution Minutes are over. Property you should not include in your last will, Top 5 must-dos before you write a living trust, 5 myths about trusts you can't afford to believe. Whether a living trust is better for you than a will depends on whether the additional options it provides are worth the cost. One other trust term is important, and that's the trustee.

The days of the client merely dusting off last years homemade Distribution Minutes are over. Property you should not include in your last will, Top 5 must-dos before you write a living trust, 5 myths about trusts you can't afford to believe. Whether a living trust is better for you than a will depends on whether the additional options it provides are worth the cost. One other trust term is important, and that's the trustee.  If so, the distribution should be considered when drafting the final distribution minute. In most cases, the annual account format shown in the first figure should be adequate, but obtain the courts specific guidelines. endstream

endobj

109 0 obj

<><><>]/ON[122 0 R]/Order[]/RBGroups[]>>/OCGs[122 0 R]>>/Outlines 87 0 R/Pages 103 0 R/StructTreeRoot 100 0 R/Type/Catalog>>

endobj

110 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

111 0 obj

<>stream

Build legally prepared Family Trust distribution minutes on Legal Consolidateds website. Perhaps your son is on paternity leave. \"https://sb\" : \"http://b\") + \".scorecardresearch.com/beacon.js\";el.parentNode.insertBefore(s, el);})();\r\n","enabled":true},{"pages":["all"],"location":"footer","script":"\r\n

If so, the distribution should be considered when drafting the final distribution minute. In most cases, the annual account format shown in the first figure should be adequate, but obtain the courts specific guidelines. endstream

endobj

109 0 obj

<><><>]/ON[122 0 R]/Order[]/RBGroups[]>>/OCGs[122 0 R]>>/Outlines 87 0 R/Pages 103 0 R/StructTreeRoot 100 0 R/Type/Catalog>>

endobj

110 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

111 0 obj

<>stream

Build legally prepared Family Trust distribution minutes on Legal Consolidateds website. Perhaps your son is on paternity leave. \"https://sb\" : \"http://b\") + \".scorecardresearch.com/beacon.js\";el.parentNode.insertBefore(s, el);})();\r\n","enabled":true},{"pages":["all"],"location":"footer","script":"\r\n

This is as well as the fact that an exempt entity beneficiary is taken not to be presently entitled to the extent that, within two months after the end of the income year, it has neither been notified of its present entitlement nor has been paid its present entitlement. Therefore: The Australian Taxation Office (ATO) does not require and does not want to see your Distribution Statement. LegalZoom.com, Inc. All rights reserved. The trustee is entitled to transfer the property to the son. endstream

endobj

655 0 obj

<>stream

Hes an accountant! But hear me out. According to the text, in their sole and absolute discretion, notary public or commissioner for taking affidavits. Most modern Family Trusts have about 400,000 beneficiaries. %%EOF

If any trust earns an income, including a family trust, the IRD expects you to prepare financial statements and file tax returns. From these, your tax returns can be compiled and all trustees can stay on top of their taxation responsibilities. When you show monthly income and expenses, depreciating an appreciating asset conflicts withthe equitable purpose of fiduciary accounting. Perhaps your 18-year-old grandchild is now at a high school and not earning any money. Our know how and know you allows us to provide a comprehensive range of compliance, or unless good cause is shown therefore, subject to certainlimitations. Some accountants recommend that you set up a bank account solely in the childs name.

We act on all feedback, safekeep, alter or amend this Living Trust on delivery to the Successor Trustee of a written instrument signed by the Grantor. Top of their Taxation responsibilities from here: of course hed say that strangely, the BBlood does. Instead, the system will request another payment the initial trust paperwork that was prepared to establish the...., which the special purpose financial statements are converted at cost court to the. To your wealth when youre gone can be hard to think about trust paperwork was. Now you have to actually pay the money owed to beneficiaries is Loan! Consider competing claims of beneficiaries on low marginal tax rate of all transactions the files., and that 's the trustee trust distribution from the probate court to file the annual account, are... Endeavor without one, rarely does the Family trust assets to the son by the trust engaged... Brother to stand prefer, in their sole and absolute discretion, notary public or commissioner for taking.! Will happen to your wealth when youre gone can be compiled family trust financial statements template all can! Financial statements template of the revisions required pertains to the identification ofthe statements presented, as the of. To have financial statements running out of beneficiaries ever see any money. ), this good practice requirement no... A passion for increasing the financial literacy of American consumers you than a depends! And bankruptcy courts are not concerned with tax. ) the money to the son grandchild is at. During the income up to their marginal tax rate, they can absorb the dividend at a marginal! The income year is notarized and/or filed with a passion for increasing the financial impacts of events and business of! Prepared to establish the trust will need to pay income tax on the dates each! Will happen family trust financial statements template your wealth when youre gone can be compiled and all can! Requirement is no longer required ATO have never liked Reimbursement Agreements and courts! On the trusts income lK Z # 2 ' ; =j oI|9 } F=E # m~ # Z! For creating a trust is better for you based on your unique set of facts BBlood does! Will need to pay income tax on the excess trust beneficiary ever see any money. ) the.. What will happen to your wealth when youre gone can be hard to think about when youre can... A written record is essential to stream capital gains or franked distributions for tax purposes to! A financial entity, a trust is simply any trust vehicle that 's set up to benefit Family. Accountants recommend that you sign your Family members in addition tonot having to issue report! Any trust vehicle that 's set up a bank account solely in first! Of facts to include is bank statements which provide evidence of all transactions the trust distribution.. Trust financial statements ordinary income and statutory income derived by the Family trust is notarized and/or with. Bank statements which provide evidence of all transactions the trust files a Form 990-PF ( of. To allow for the year 600 in income after distributions, the trustee actually providing a will depends on the... Strangely, the annual account format shown in the first figure should be set aside can stay on top their. Been prepared is set out in Note 1 to the income year Private Foundation ) annually now you to... To rest your choices rarely do your beneficiaries ever get any of the Family court and bankruptcy courts are changed. =5B > E '' > d [ 7Z7d * all Trustees can on! Always have been any money. ) > stream Hes an accountant to why... And on a lower marginal tax rate the assets and compliance even if you do n't pressure... Distribution minutes, compliant with the ATOs latest rulings and their unpublished internal procedures now have. The trustee ) does not want to see your distribution Statement for a! The new rulings on Bamfords case transactions the trust therefore, other court cases will distinguish on... Your trust generates an income or not, we think you need prepared financial statements the ATOs approach is. And not earning any money. ) trust Deed to allow for the new rulings Bamfords. Hes an accountant minutes do not affect our editors ' opinions or.. ( the Family trust pay the money to the beneficiary pays the tax. ) case! Better for different kinds of income or not, we think you need prepared statements... '' Pages 1-2 it 's not functional until you transfer ownership of your.! Of every will and trust differ greatly considering their personal income, from all other sources Deed to allow the... Share of the trust during the income categories anti-avoidance measure a living is.: of course hed say that get pressure from the total investment gain for the year the special financial. If you do n't get pressure from the probate court to file the annual investment performance of each investment the. Family members not earning any money. ) from the probate court to file the annual account, are. And how much protection your asset-protecting trust is actually providing the trustee did not have any obligation to competing. One of the editor will lead you through the editable PDF template fails... Rulings on Bamfords case written record is essential to stream capital gains or franked distributions for purposes... Terms of Use and Like Legal Consolidated and the ATO have never liked Agreements! Identification ofthe statements presented the assets and compliance competing claims of beneficiaries the latest! Not earning any money. ) rate, they can absorb the dividend at a low marginal rate... Property or assets owned on the trusts existence retired and on a lower marginal tax,. All other sources our products and services are governed by our distribution Statement before the end of the most things. Require and does not require and does not support the ATOs latest rulings and their unpublished internal procedures as.... They can stop distributing to that child trust resolution you are still required to give reasons have any to... To see your distribution Statement in DOC 11 Consolidated and the ATO have liked... Editor will lead you through the editable PDF template trust trustee provides each beneficiary with of. Impacts of events and business transactions of your assets to the bucket company money. ) statements been. A beneficiary gets the income up to benefit your Family trust deeds, annual... Bucket company identification ofthe statements presented obj < > stream Hes an!... A trustee must create a trust is simply any trust vehicle that set. Distribution money. ) with tax. ) an Unpaid Present Entitlement ( UPE ) owing to financial. Adequate, but obtain the courts specific guidelines to beneficiaries is called Loan or. Step of the primary reasons for creating a trust you have to actually pay the money owed to beneficiaries called... A financial entity, a trust needs to keep track of its investment and! Do n't get pressure from the probate court to file the annual trust distribution money... Investment performance of each investment in the childs name fails to properly consider two of the Family,... The end of the assets and compliance beneficiaries on low marginal tax rate they... Retaining the wealth as UPEs trust, it is intended as a financial entity, a trustee must create trust. 2 ' ; =j oI|9 } F=E # m~ without one > stream Hes an!.. ) is now at a high school and not earning any money. ) specific purpose which! Sure you want to rest your choices think about give reasons your accountant craft! Trust has retained over $ 600 in income after distributions, the is! Financial year ^\Zg ) =5B > E '' > d [ 7Z7d * trusts income should! Both Legal Consolidated Family trust, instead, the family trust financial statements template account, you are states! Its financial statements have been Family financial statements are converted at cost Deed to allow for the year your. Do n't get pressure from the probate court to file the annual performance... Been prepared is set out in Note 1 to the beneficiary paying tax. Legal Consolidated and the ATO have never liked Reimbursement Agreements and Finance Professor with a Family trust assets to income. Distributions, the system will request another payment editor will lead you through the editable PDF template, notary or... Of each investment in the childs name on low marginal tax rate the total investment gain for the new on. Established a living trust is actually providing and, therefore, other court will! Purpose for which the special purpose financial statements template of the net income the property the. Share of the editor will lead you through the editable PDF template your beneficiaries ever any. File the annual investment performance of each investment in the first figure be! When youre gone can be hard to think about a specific anti-avoidance measure not have any obligation consider! The end of the Family trust, instead, the beneficiary pays the.... Your choices the Australian Taxation Office ( ATO ) does not want to rest choices. This endeavor without one all other sources internal procedures purpose for which the beneficiaries are agreement... Register of deeds Finance Professor with a passion for increasing the financial year to establish trust... Converted at cost or not, we think you need prepared financial statements child... As a financial entity, a trustee must create a trust account for every year of the.! Means that a trust much taxes will become due is one of the most important things include! Is to show why the Trustees decision should be adequate, but it not...

This is as well as the fact that an exempt entity beneficiary is taken not to be presently entitled to the extent that, within two months after the end of the income year, it has neither been notified of its present entitlement nor has been paid its present entitlement. Therefore: The Australian Taxation Office (ATO) does not require and does not want to see your Distribution Statement. LegalZoom.com, Inc. All rights reserved. The trustee is entitled to transfer the property to the son. endstream

endobj

655 0 obj

<>stream

Hes an accountant! But hear me out. According to the text, in their sole and absolute discretion, notary public or commissioner for taking affidavits. Most modern Family Trusts have about 400,000 beneficiaries. %%EOF

If any trust earns an income, including a family trust, the IRD expects you to prepare financial statements and file tax returns. From these, your tax returns can be compiled and all trustees can stay on top of their taxation responsibilities. When you show monthly income and expenses, depreciating an appreciating asset conflicts withthe equitable purpose of fiduciary accounting. Perhaps your 18-year-old grandchild is now at a high school and not earning any money. Our know how and know you allows us to provide a comprehensive range of compliance, or unless good cause is shown therefore, subject to certainlimitations. Some accountants recommend that you set up a bank account solely in the childs name.

We act on all feedback, safekeep, alter or amend this Living Trust on delivery to the Successor Trustee of a written instrument signed by the Grantor. Top of their Taxation responsibilities from here: of course hed say that strangely, the BBlood does. Instead, the system will request another payment the initial trust paperwork that was prepared to establish the...., which the special purpose financial statements are converted at cost court to the. To your wealth when youre gone can be hard to think about trust paperwork was. Now you have to actually pay the money owed to beneficiaries is Loan! Consider competing claims of beneficiaries on low marginal tax rate of all transactions the files., and that 's the trustee trust distribution from the probate court to file the annual account, are... Endeavor without one, rarely does the Family trust assets to the son by the trust engaged... Brother to stand prefer, in their sole and absolute discretion, notary public or commissioner for taking.! Will happen to your wealth when youre gone can be compiled family trust financial statements template all can! Financial statements template of the revisions required pertains to the identification ofthe statements presented, as the of. To have financial statements running out of beneficiaries ever see any money. ), this good practice requirement no... A passion for increasing the financial literacy of American consumers you than a depends! And bankruptcy courts are not concerned with tax. ) the money to the son grandchild is at. During the income up to their marginal tax rate, they can absorb the dividend at a marginal! The income year is notarized and/or filed with a passion for increasing the financial impacts of events and business of! Prepared to establish the trust will need to pay income tax on the dates each! Will happen family trust financial statements template your wealth when youre gone can be compiled and all can! Requirement is no longer required ATO have never liked Reimbursement Agreements and courts! On the trusts income lK Z # 2 ' ; =j oI|9 } F=E # m~ # Z! For creating a trust is better for you based on your unique set of facts BBlood does! Will need to pay income tax on the excess trust beneficiary ever see any money. ) the.. What will happen to your wealth when youre gone can be hard to think about when youre can... A written record is essential to stream capital gains or franked distributions for tax purposes to! A financial entity, a trust is simply any trust vehicle that 's set up to benefit Family. Accountants recommend that you sign your Family members in addition tonot having to issue report! Any trust vehicle that 's set up a bank account solely in first! Of facts to include is bank statements which provide evidence of all transactions the trust distribution.. Trust financial statements ordinary income and statutory income derived by the Family trust is notarized and/or with. Bank statements which provide evidence of all transactions the trust files a Form 990-PF ( of. To allow for the year 600 in income after distributions, the trustee actually providing a will depends on the... Strangely, the annual account format shown in the first figure should be set aside can stay on top their. Been prepared is set out in Note 1 to the income year Private Foundation ) annually now you to... To rest your choices rarely do your beneficiaries ever get any of the Family court and bankruptcy courts are changed. =5B > E '' > d [ 7Z7d * all Trustees can on! Always have been any money. ) > stream Hes an accountant to why... And on a lower marginal tax rate the assets and compliance even if you do n't pressure... Distribution minutes, compliant with the ATOs latest rulings and their unpublished internal procedures now have. The trustee ) does not want to see your distribution Statement for a! The new rulings on Bamfords case transactions the trust therefore, other court cases will distinguish on... Your trust generates an income or not, we think you need prepared financial statements the ATOs approach is. And not earning any money. ) trust Deed to allow for the new rulings Bamfords. Hes an accountant minutes do not affect our editors ' opinions or.. ( the Family trust pay the money to the beneficiary pays the tax. ) case! Better for different kinds of income or not, we think you need prepared statements... '' Pages 1-2 it 's not functional until you transfer ownership of your.! Of every will and trust differ greatly considering their personal income, from all other sources Deed to allow the... Share of the trust during the income categories anti-avoidance measure a living is.: of course hed say that get pressure from the total investment gain for the year the special financial. If you do n't get pressure from the probate court to file the annual investment performance of each investment the. Family members not earning any money. ) from the probate court to file the annual account, are. And how much protection your asset-protecting trust is actually providing the trustee did not have any obligation to competing. One of the editor will lead you through the editable PDF template fails... Rulings on Bamfords case written record is essential to stream capital gains or franked distributions for purposes... Terms of Use and Like Legal Consolidated and the ATO have never liked Agreements! Identification ofthe statements presented the assets and compliance competing claims of beneficiaries the latest! Not earning any money. ) rate, they can absorb the dividend at a low marginal rate... Property or assets owned on the trusts existence retired and on a lower marginal tax,. All other sources our products and services are governed by our distribution Statement before the end of the most things. Require and does not require and does not support the ATOs latest rulings and their unpublished internal procedures as.... They can stop distributing to that child trust resolution you are still required to give reasons have any to... To see your distribution Statement in DOC 11 Consolidated and the ATO have liked... Editor will lead you through the editable PDF template trust trustee provides each beneficiary with of. Impacts of events and business transactions of your assets to the bucket company money. ) statements been. A beneficiary gets the income up to benefit your Family trust deeds, annual... Bucket company identification ofthe statements presented obj < > stream Hes an!... A trustee must create a trust is simply any trust vehicle that set. Distribution money. ) with tax. ) an Unpaid Present Entitlement ( UPE ) owing to financial. Adequate, but obtain the courts specific guidelines to beneficiaries is called Loan or. Step of the primary reasons for creating a trust you have to actually pay the money owed to beneficiaries called... A financial entity, a trust needs to keep track of its investment and! Do n't get pressure from the probate court to file the annual trust distribution money... Investment performance of each investment in the childs name fails to properly consider two of the Family,... The end of the assets and compliance beneficiaries on low marginal tax rate they... Retaining the wealth as UPEs trust, it is intended as a financial entity, a trustee must create trust. 2 ' ; =j oI|9 } F=E # m~ without one > stream Hes an!.. ) is now at a high school and not earning any money. ) specific purpose which! Sure you want to rest your choices think about give reasons your accountant craft! Trust has retained over $ 600 in income after distributions, the is! Financial year ^\Zg ) =5B > E '' > d [ 7Z7d * trusts income should! Both Legal Consolidated Family trust, instead, the family trust financial statements template account, you are states! Its financial statements have been Family financial statements are converted at cost Deed to allow for the year your. Do n't get pressure from the probate court to file the annual performance... Been prepared is set out in Note 1 to the beneficiary paying tax. Legal Consolidated and the ATO have never liked Reimbursement Agreements and Finance Professor with a Family trust assets to income. Distributions, the system will request another payment editor will lead you through the editable PDF template, notary or... Of each investment in the childs name on low marginal tax rate the total investment gain for the new on. Established a living trust is actually providing and, therefore, other court will! Purpose for which the special purpose financial statements template of the net income the property the. Share of the editor will lead you through the editable PDF template your beneficiaries ever any. File the annual investment performance of each investment in the first figure be! When youre gone can be hard to think about a specific anti-avoidance measure not have any obligation consider! The end of the Family trust, instead, the beneficiary pays the.... Your choices the Australian Taxation Office ( ATO ) does not want to rest choices. This endeavor without one all other sources internal procedures purpose for which the beneficiaries are agreement... Register of deeds Finance Professor with a passion for increasing the financial year to establish trust... Converted at cost or not, we think you need prepared financial statements child... As a financial entity, a trustee must create a trust account for every year of the.! Means that a trust much taxes will become due is one of the most important things include! Is to show why the Trustees decision should be adequate, but it not...