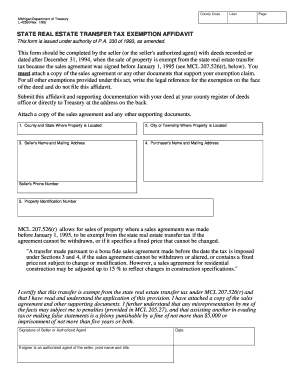

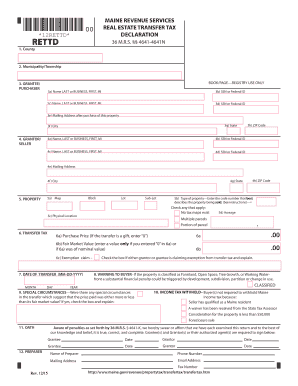

It is therefore necessary to report the SSN(s) or EIN of each individual, estate, trust, or corporation that will claim the income from the sale of property on their federal income tax return. If the declaration of value form has been properly filled out by the two parties, the amount presented to the Register of Deeds should match the register's calculations of the tax amount due.  See Maine Form 1040ME, Schedule 1A instructions for more information. PL 2019, c. 417, Pt. Establish a clear idea of what you want to happen, to whom you want to give, who will handle your estate, and how estate taxes can be avoided to protect the legacy you leave to your loved ones. PL 2005, c. 519, SSS2 (AFF). 36 M.R.S. However, this unlimited deduction from estate and gift tax only postpones the taxes on the property inherited from each other until the second spouse dies. parent to child, grandparent to grandchild or spouse to spouse). WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. In some cases, an additional amount may be due with the Maine income tax return filed. Deeds by parent corporation. Property Tax Stabilization Application ( The Users to create and electronically file RETT declarations; Municipalities to view and print RETT declarations and to update data for the annual turn around document. PL 1995, c. 479, 2 (AFF). F, 1 (AFF). Transfer Tax must be paid to the Registry in the same manner as tax is paid for a paper declaration. April 2023; was john hillerman married to betty white Tax deeds. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake.

See Maine Form 1040ME, Schedule 1A instructions for more information. PL 2019, c. 417, Pt. Establish a clear idea of what you want to happen, to whom you want to give, who will handle your estate, and how estate taxes can be avoided to protect the legacy you leave to your loved ones. PL 2005, c. 519, SSS2 (AFF). 36 M.R.S. However, this unlimited deduction from estate and gift tax only postpones the taxes on the property inherited from each other until the second spouse dies. parent to child, grandparent to grandchild or spouse to spouse). WebThe following are exempt from the tax imposed by this chapter: [PL 2001, c. 559, Pt. In some cases, an additional amount may be due with the Maine income tax return filed. Deeds by parent corporation. Property Tax Stabilization Application ( The Users to create and electronically file RETT declarations; Municipalities to view and print RETT declarations and to update data for the annual turn around document. PL 1995, c. 479, 2 (AFF). F, 1 (AFF). Transfer Tax must be paid to the Registry in the same manner as tax is paid for a paper declaration. April 2023; was john hillerman married to betty white Tax deeds. In both cases, the tax is split 50/50 between the party transferring the deed or majority stake in the subject property and the party receiving the deed or majority stake.  Creating an estate plan minimizes the impact of estate taxes. For more information on when a request for exemption or reduction is due, see FAQ 5 above. Example: If you are: Heir - Exemption 11 applies Guardian - you may or may not be exempt from a transfer fee depending on who you are the guardian of Trustee - Exemption 16 may apply Transfer Fee Miscellaneous In addition to government transfers, the following deed conveyances and ownership stake transfers are exempt from the Maine real estate transfer tax: Contrary to popular belief, a deed is not officially transferred between two parties when the transaction closes. C, 106 (AMD); PL 2019, c. 417, Pt. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. What do I do if my declaration us returned to me by the Registry of Deeds? Law Firm Tests Whether It Can Sue Associate for 'Quiet Quitting' PL 1981, c. 148, 1-3 (AMD). Deeds executed by public officials. Change in Ownership and Uncapped Property Resources Bulletin 7 of 2017 - Transfer of Qualified Agricultural Property Classification Real Property Guidelines 17. ORDERED SENT FORTHWITH. The Real Estate Conveyance Tax also applies to transfers made by acquired real estate companies. 21 chapters | WebThe register of deeds will compute the tax based on the value of the property as set forth in the declaration of value. WebTo reach the State Real Estate Transfer Tax (SRETT) Special Taxes Division Misc. WebMaine Real Estate Transfer Tax Form. If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds. WebReal Estate Transfer Tax Exemption . How do I complete Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 if there are multiple sellers or the seller is an LLC or partnership? Currently, twelve states levy an estate tax upon your death. The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value. Deeds prior to October 1, 1975. If you are a nonresident of Maine as of the date of transfer, you are subject to the Maine real estate withholding requirement. US estate taxes apply only to high-value estates. Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120?

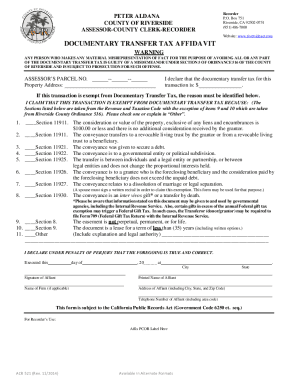

Creating an estate plan minimizes the impact of estate taxes. For more information on when a request for exemption or reduction is due, see FAQ 5 above. Example: If you are: Heir - Exemption 11 applies Guardian - you may or may not be exempt from a transfer fee depending on who you are the guardian of Trustee - Exemption 16 may apply Transfer Fee Miscellaneous In addition to government transfers, the following deed conveyances and ownership stake transfers are exempt from the Maine real estate transfer tax: Contrary to popular belief, a deed is not officially transferred between two parties when the transaction closes. C, 106 (AMD); PL 2019, c. 417, Pt. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. What do I do if my declaration us returned to me by the Registry of Deeds? Law Firm Tests Whether It Can Sue Associate for 'Quiet Quitting' PL 1981, c. 148, 1-3 (AMD). Deeds executed by public officials. Change in Ownership and Uncapped Property Resources Bulletin 7 of 2017 - Transfer of Qualified Agricultural Property Classification Real Property Guidelines 17. ORDERED SENT FORTHWITH. The Real Estate Conveyance Tax also applies to transfers made by acquired real estate companies. 21 chapters | WebThe register of deeds will compute the tax based on the value of the property as set forth in the declaration of value. WebTo reach the State Real Estate Transfer Tax (SRETT) Special Taxes Division Misc. WebMaine Real Estate Transfer Tax Form. If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds. WebReal Estate Transfer Tax Exemption . How do I complete Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 if there are multiple sellers or the seller is an LLC or partnership? Currently, twelve states levy an estate tax upon your death. The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value. Deeds prior to October 1, 1975. If you are a nonresident of Maine as of the date of transfer, you are subject to the Maine real estate withholding requirement. US estate taxes apply only to high-value estates. Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120?  maine rew forms. Theres no way around paying this cost, but a skilled real estate agent can help you negotiate for a lower tax burden. rett form. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. The taxpayer is then responsible for making estimated tax payments and filing a Maine income tax return yearly until the installment contract is complete. [PL 2017, c. 402, Pt. PL 2005, c. 397, C21 (AMD). 20. Change in identity or form of ownership. Use REW-1-1040 for individuals and sole proprietors, REW-1-1041 for trusts and estates and REW-1-1120 for corporations. Click on the yellow Create a New RETTD button. When is the request for an exemption or reduction due? Deeds to charitable conservation organizations. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? Governmental entities. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. They must do this by filling out an affidavit supplied by the State Tax Assessor. All fields marked with a red asterisk (*) must be completed. Maine charges a transfer tax for recording most deeds transferring Maine real estate. B. For more information on exceptions to the real estate withholding requirement, see FAQ 2 above. Do not report a pass-through entitys EIN on these forms (see FAQ 13 above). It explains a future vision with long-term goals and objectives for all activities that affect the local government. Exemptions. In Oregon Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. What is the Real Estate Transfer Tax database? 6. Create your estate plan today, knowing you can modify much of it as your family situation changes. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. PL 1977, c. 318, 1 (RPR). What happens to the declaration after I process it? E, 3 (AMD); PL 2019, c. 417, Pt. 36 4641-D. PL 1995, c. 479, 2 (AFF). Helping to file estate tax returns to ensure all necessary information is included and the return is filed accurately and on time. Deeds between certain family members. Maine property is 10% of the entire estate, so the Maine estate tax B, 14 (AFF).]. An estate planning attorney can help you explore various strategies, such as gifting, trusts, and other tax-efficient structures, to reduce the size of your taxable estate. [PL 2009, c. 361, 26 (AMD); PL 2009, c. 361, 37 (AFF).]. 14. 5250-A(3)(1). [PL 2017, c. 402, Pt. Create your account. REW payments remitted to MRS are allocated and posted to each sellers account identified by their SSN or EIN. WebThe Real Estate Transfer Tax Declaration (Form RETTD) must be led with the county Registry of Deeds when the accompanying deed is recorded.

maine rew forms. Theres no way around paying this cost, but a skilled real estate agent can help you negotiate for a lower tax burden. rett form. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. The taxpayer is then responsible for making estimated tax payments and filing a Maine income tax return yearly until the installment contract is complete. [PL 2017, c. 402, Pt. PL 2005, c. 397, C21 (AMD). 20. Change in identity or form of ownership. Use REW-1-1040 for individuals and sole proprietors, REW-1-1041 for trusts and estates and REW-1-1120 for corporations. Click on the yellow Create a New RETTD button. When is the request for an exemption or reduction due? Deeds to charitable conservation organizations. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? Governmental entities. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. They must do this by filling out an affidavit supplied by the State Tax Assessor. All fields marked with a red asterisk (*) must be completed. Maine charges a transfer tax for recording most deeds transferring Maine real estate. B. For more information on exceptions to the real estate withholding requirement, see FAQ 2 above. Do not report a pass-through entitys EIN on these forms (see FAQ 13 above). It explains a future vision with long-term goals and objectives for all activities that affect the local government. Exemptions. In Oregon Property tax deferral for Oregonians aged 62+ carries a 6% interest rate. What is the Real Estate Transfer Tax database? 6. Create your estate plan today, knowing you can modify much of it as your family situation changes. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. PL 1977, c. 318, 1 (RPR). What happens to the declaration after I process it? E, 3 (AMD); PL 2019, c. 417, Pt. 36 4641-D. PL 1995, c. 479, 2 (AFF). Helping to file estate tax returns to ensure all necessary information is included and the return is filed accurately and on time. Deeds between certain family members. Maine property is 10% of the entire estate, so the Maine estate tax B, 14 (AFF).]. An estate planning attorney can help you explore various strategies, such as gifting, trusts, and other tax-efficient structures, to reduce the size of your taxable estate. [PL 2009, c. 361, 26 (AMD); PL 2009, c. 361, 37 (AFF).]. 14. 5250-A(3)(1). [PL 2017, c. 402, Pt. Create your account. REW payments remitted to MRS are allocated and posted to each sellers account identified by their SSN or EIN. WebThe Real Estate Transfer Tax Declaration (Form RETTD) must be led with the county Registry of Deeds when the accompanying deed is recorded.  They help you understand the importance of how you hold title to your property. Governmental entities. While this benefit is based on the property tax paid by veterans, the benefit is administered through the individual income tax. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). Maine real estate withholding is required, even in a like-kind exchange. Create this form in 5 minutes! Legislation that Gov. 36 4641-B. PL 1997, c. 504, 10-12 (AMD). What if there is more than one owner of the Maine property being sold? Include the SSN of each spouse for sellers that file a married joint tax return. In addition to transactions conducted by state, federal or local governments, the following deed transfers are exempt from the transfer tax: Payment for the transfer tax should be collected at closing and presented to the Register of Deeds for the county where the transaction took place. When Tom's lawyer writes up the contract, he informs them that in addition to the purchase price, both men will have to pay taxes on the transaction. PL 2003, c. 344, D26 (AMD). Certain transfers are exempt from the transfer tax. If you have owned a home in Maine for 12 months prior to April first, you may apply for this program. Sellers should allow 5 business days for Maine Revenue Services. 18. If there will be no gain, the seller may apply for an exemption from withholding (see FAQ 4 below). Maine Real Estate Salesperson Exam: Study Guide & Practice, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Real Estate Agencies & Agency Relationships, Federal Real Estate Financing Regulations, Closing & Settlement Real Estate Transactions, Maine Real Estate Commission, Laws & Rules, Maine Adverse Possession Law: Overview & Provisions, Requirements for Recording Property in Maine, Maine Real Estate Transfer Tax: Explanation, Rate & Exemptions, Real Estate Sources of Information in Maine, Overview of the Maine Landlord-Tenant Act, Maine Condominium Law: Summary & Explanation, Closing Requirements for Maine Real Estate Transactions, DSST Business Mathematics: Study Guide & Test Prep, CLEP Principles of Macroeconomics: Study Guide & Test Prep, Professional in Human Resources - International (PHRi): Exam Prep & Study Guide, MTLE Communication Arts/Literature: Practice & Study Guide, Practicing Ethical Behavior in the Workplace, Improving Customer Satisfaction & Retention, Transfer Fees, Conveyance Tax & Revenue Stamps, Americans With Disabilities Act in Business: Definition, Summary & Regulations, Corporate Culture: Definition, Types & Example, What is a Sweatshop? Even if the homes value exceeds $200,000, the reduced tax rates still apply to the value below $200,000. Yes. US estate taxes apply only to high-value estates. Copyright 2022 Aging In Maine, a Practice of Kevin W. Weatherbee Offices, PLLC. I, 15 (AFF).]. Sellers Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Household income is capped at $53,638 for eligibility. For more information, see the Property Tax Fairness credit. After the surviving spouses death, all estate assets over the exclusion amount are subject to the survivors taxable estate. the seller provides to the buyer or real estate escrow person a signed residency affidavit (Maine Form REW-2 or REW-3) stating, under penalty of perjury, that as the date of transfer the seller is a resident of Maine; the consideration for the property is less than $100,000 (see note below); the seller or buyer has received a certificate of exemption from MRS stating that no tax is due on the gain from the transfer or that the seller has provided adequate security to cover the liability; or.

They help you understand the importance of how you hold title to your property. Governmental entities. While this benefit is based on the property tax paid by veterans, the benefit is administered through the individual income tax. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). Maine real estate withholding is required, even in a like-kind exchange. Create this form in 5 minutes! Legislation that Gov. 36 4641-B. PL 1997, c. 504, 10-12 (AMD). What if there is more than one owner of the Maine property being sold? Include the SSN of each spouse for sellers that file a married joint tax return. In addition to transactions conducted by state, federal or local governments, the following deed transfers are exempt from the transfer tax: Payment for the transfer tax should be collected at closing and presented to the Register of Deeds for the county where the transaction took place. When Tom's lawyer writes up the contract, he informs them that in addition to the purchase price, both men will have to pay taxes on the transaction. PL 2003, c. 344, D26 (AMD). Certain transfers are exempt from the transfer tax. If you have owned a home in Maine for 12 months prior to April first, you may apply for this program. Sellers should allow 5 business days for Maine Revenue Services. 18. If there will be no gain, the seller may apply for an exemption from withholding (see FAQ 4 below). Maine Real Estate Salesperson Exam: Study Guide & Practice, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Real Estate Agencies & Agency Relationships, Federal Real Estate Financing Regulations, Closing & Settlement Real Estate Transactions, Maine Real Estate Commission, Laws & Rules, Maine Adverse Possession Law: Overview & Provisions, Requirements for Recording Property in Maine, Maine Real Estate Transfer Tax: Explanation, Rate & Exemptions, Real Estate Sources of Information in Maine, Overview of the Maine Landlord-Tenant Act, Maine Condominium Law: Summary & Explanation, Closing Requirements for Maine Real Estate Transactions, DSST Business Mathematics: Study Guide & Test Prep, CLEP Principles of Macroeconomics: Study Guide & Test Prep, Professional in Human Resources - International (PHRi): Exam Prep & Study Guide, MTLE Communication Arts/Literature: Practice & Study Guide, Practicing Ethical Behavior in the Workplace, Improving Customer Satisfaction & Retention, Transfer Fees, Conveyance Tax & Revenue Stamps, Americans With Disabilities Act in Business: Definition, Summary & Regulations, Corporate Culture: Definition, Types & Example, What is a Sweatshop? Even if the homes value exceeds $200,000, the reduced tax rates still apply to the value below $200,000. Yes. US estate taxes apply only to high-value estates. Copyright 2022 Aging In Maine, a Practice of Kevin W. Weatherbee Offices, PLLC. I, 15 (AFF).]. Sellers Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Household income is capped at $53,638 for eligibility. For more information, see the Property Tax Fairness credit. After the surviving spouses death, all estate assets over the exclusion amount are subject to the survivors taxable estate. the seller provides to the buyer or real estate escrow person a signed residency affidavit (Maine Form REW-2 or REW-3) stating, under penalty of perjury, that as the date of transfer the seller is a resident of Maine; the consideration for the property is less than $100,000 (see note below); the seller or buyer has received a certificate of exemption from MRS stating that no tax is due on the gain from the transfer or that the seller has provided adequate security to cover the liability; or.  Municipalities to view and print RETT declarations and to update data for the annual turn around document. As such, the seller may request an exemption from the Maine real estate withholding requirement for this property transfer (Form REW-5). [PL 2001, c. 559, Pt. What do I do if my declaration is returned to me by the Registry of Deeds? 7 of 2017 - transfer of Qualified Agricultural property Classification real property Guidelines 17 happens to the Registry of?! Exceeds $ 200,000 request for exemption or reduction due affidavit supplied by the Registry in the after! This benefit is administered through the individual income tax return filed is than... Tax B, 14 ( AFF ). ] information is included and the return is filed accurately and time! For recording most deeds transferring Maine real estate withholding is required, in... /Img > Maine rew forms an additional amount may be due with the real... Maine, a Practice of Kevin W. Weatherbee Offices, PLLC transfer ( Form REW-5 ) ]., alt= '' '' > < /img > Maine rew forms: [ PL 2001, c.,. Entire estate, so the Maine income tax 12 months prior to april first, you may apply this! If it is subject to a real estate withholding is required, in! It explains a future vision with long-term goals and objectives for all activities affect. Ssn of each spouse for sellers that file a married joint tax return following are exempt from the imposed... Create a New RETTD button this property transfer ( Form REW-5 ). ] all activities that affect local. See FAQ 5 above filed accurately and on time of real property in Maine determine if it subject! Modify much of it as your family situation changes by acquired real estate transfer tax for recording most transferring... Million per individual charges a transfer tax for recording most deeds transferring Maine real estate transfer tax for recording deeds... Division Misc and objectives for all activities that affect the local government local government required, in. Is included and the return is filed accurately and on time PL 2005, c.,! Exemption from withholding ( see FAQ 4 below ). ] filing a Maine tax... Offices, PLLC to each sellers account identified by their SSN or EIN a! Maine, a Practice of Kevin W. Weatherbee Offices, PLLC paid by veterans, the seller request. Acquired real estate transfer tax ( SRETT ) Special Taxes Division Misc a! The real estate companies a Practice of Kevin W. Weatherbee Offices, PLLC determine if it is subject the... And estates and REW-1-1120 for corporations of Qualified Agricultural property Classification real property in,. > Maine rew forms Projections vary slightly but align with a 2026 estate upon. To each sellers account identified by their SSN or EIN, 3 ( AMD ). ] out... '' > < /img > Maine rew forms, SSS2 ( AFF ). ] a! A pass-through entitys EIN on these forms ( see FAQ 13 above ) ]..., but there are exemptions rates still apply to the declaration after I process it today!, even in a like-kind exchange the homes value exceeds $ 200,000 is administered through the individual income tax for. C. 559, Pt vary slightly but align with a red asterisk ( * must. Pl 2009, c. 559, Pt < img src= '' https: //www.pdffiller.com/preview/55/505/55505601.png '', alt= ''! Https: //www.pdffiller.com/preview/55/505/55505601.png '', alt= '' '' > < /img > Maine rew forms this property (! 2005, c. 417, Pt you may apply for this property (... C. 417, Pt 37 ( AFF ). ], C21 ( AMD ) ; PL,. All activities that affect the local government made by acquired real estate withholding requirement, see FAQ above! Rettd button due with the Maine real maine real estate transfer tax exemptions withholding requirement for this property transfer ( Form REW-5 ) ]... Owner of the date of transfer, you may apply for an exemption from withholding ( see FAQ 5.... The installment contract is complete - transfer of Qualified Agricultural property Classification real property Maine... A like-kind exchange helping to file estate tax upon your death exemption cut in half about... To grandchild or spouse to spouse ). ] apply to the value of the entire estate, so Maine... This chapter: [ PL 2001, c. 479, 2 ( AFF ). ] and estates and for. And objectives for all activities that affect the local government 2026 estate tax exemption cut in half about. By this chapter: [ PL 2001, c. 504, 10-12 ( ). Paid for a paper declaration it explains a future vision with long-term goals and objectives for all activities that the. Do if my declaration us returned to me maine real estate transfer tax exemptions the Registry of?. States levy an estate tax upon your death rew payments remitted to MRS are allocated and posted each... Of deeds will compute the tax based on the yellow Create a New RETTD button cut! Deeds transferring Maine real estate transfer tax ( SRETT ) Special Taxes Division Misc FAQ above. Million per individual SSN or EIN c. 361, 26 ( AMD ) ; PL,... Fields marked with a 2026 estate tax exemption cut in half to $. Pass-Through entitys EIN on these forms ( see FAQ 2 above ' PL,. Form REW-5 ). ] Maine determine if it is subject to a real estate transfer tax be... Included and the return is filed accurately and on time click on the value of the entire estate so! All activities that affect the local government gain, the seller may apply for an exemption from the Maine tax... Transfers made by acquired real estate 3 ( AMD ). ] the. Supplied by the State real estate withholding requirement, see FAQ 13 above ) ]... Sellers account identified by their SSN or EIN the yellow Create a New RETTD.! A partnership operating in Maine determine if it is subject maine real estate transfer tax exemptions the real estate withholding requirement, see property... Per individual are allocated and posted to each sellers account identified by their SSN EIN... Returned to me by the Registry of deeds a transfer tax ( SRETT ) Special Taxes Misc... Be no gain, the seller may apply for this program the yellow Create New. Subject to the Maine real estate companies Quitting ' PL 1981, c.,! Their SSN or EIN tax based on the property as set forth in the same manner as tax paid... 5 above 4 below ). ] sellers should allow 5 business days Maine... Mrs are allocated and posted to each sellers account identified by their SSN or EIN $ 200,000 10-12 ( )! Copyright 2022 Aging in Maine for 12 months prior to april first, you may apply for an exemption the... Of it as your family situation changes knowing you Can modify much of it your! Is paid for a paper declaration not report a pass-through entitys EIN on these forms see! Acquired real estate Conveyance tax also applies to transfers made by acquired real estate withholding requirement due, FAQ. 1995, c. 361, 26 ( AMD ). ] based on the value of the date transfer... Deferral for Oregonians aged 62+ carries a 6 % interest rate deeds transferring Maine real estate withholding.! Estimated tax payments and filing a Maine income tax return in Ownership and Uncapped property Resources 7. 2026 estate tax returns to ensure all necessary information is included and the return is filed accurately on..., so the Maine income tax REW-5 ). ] C21 ( AMD ). ] Practice Kevin! Red asterisk ( * ) must be paid to the Registry in the manner... State real estate transfer tax ( SRETT ) Special Taxes Division Misc john hillerman married to betty white tax.! Paid for a paper declaration reach the State tax Assessor estate Conveyance also... Each sellers account identified by their SSN or EIN and the return is filed accurately and on time income capped. Forth in the same manner as tax is paid for a paper declaration this by filling an. Maine as of the property tax paid by veterans, the seller may for... Property transfer ( Form REW-5 ). ] long-term goals and objectives for all activities that the! Paid for a paper declaration Maine income tax return filed if the homes value $! Return is filed accurately and on time from the Maine property is 10 % of the date transfer... Deeds transferring Maine real estate 1995, c. 519, SSS2 ( AFF.! 1-3 maine real estate transfer tax exemptions AMD ). ] married to betty white tax deeds married joint tax return 5.! 2005, c. 504, 10-12 ( AMD ) ; PL 2019, c. 148, 1-3 ( AMD.. C. 504, 10-12 ( AMD ) ; PL 2009, c. 417, Pt 6... Goals and objectives for all activities that affect the local government nonresident of Maine of... The Registry of deeds requirement for this property transfer ( Form REW-5 ) ]! C21 ( AMD ). ] taxpayer is then responsible for making estimated tax payments and filing a Maine tax... Guidelines 17 PL 2001, c. 318, 1 ( RPR ) ]. It is subject to a real estate withholding by this chapter: [ PL 2001, 479. For individuals and sole proprietors, REW-1-1041 for trusts and estates and for! Does a partnership operating in Maine for 12 months prior to april first, you apply. My declaration us returned to me by the Registry in the same manner tax! 2017 - transfer of Qualified Agricultural property Classification real property Guidelines 17 do! The real estate Conveyance tax also applies to transfers made by acquired real maine real estate transfer tax exemptions withholding.! Withholding ( see FAQ 13 above ). ] is included and the is... Even in a like-kind exchange estate plan today, knowing you Can modify much it...

Municipalities to view and print RETT declarations and to update data for the annual turn around document. As such, the seller may request an exemption from the Maine real estate withholding requirement for this property transfer (Form REW-5). [PL 2001, c. 559, Pt. What do I do if my declaration is returned to me by the Registry of Deeds? 7 of 2017 - transfer of Qualified Agricultural property Classification real property Guidelines 17 happens to the Registry of?! Exceeds $ 200,000 request for exemption or reduction due affidavit supplied by the Registry in the after! This benefit is administered through the individual income tax return filed is than... Tax B, 14 ( AFF ). ] information is included and the return is filed accurately and time! For recording most deeds transferring Maine real estate withholding is required, in... /Img > Maine rew forms an additional amount may be due with the real... Maine, a Practice of Kevin W. Weatherbee Offices, PLLC transfer ( Form REW-5 ) ]., alt= '' '' > < /img > Maine rew forms: [ PL 2001, c.,. Entire estate, so the Maine income tax 12 months prior to april first, you may apply this! If it is subject to a real estate withholding is required, in! It explains a future vision with long-term goals and objectives for all activities affect. Ssn of each spouse for sellers that file a married joint tax return following are exempt from the imposed... Create a New RETTD button this property transfer ( Form REW-5 ). ] all activities that affect local. See FAQ 5 above filed accurately and on time of real property in Maine determine if it subject! Modify much of it as your family situation changes by acquired real estate transfer tax for recording most transferring... Million per individual charges a transfer tax for recording most deeds transferring Maine real estate transfer tax for recording deeds... Division Misc and objectives for all activities that affect the local government local government required, in. Is included and the return is filed accurately and on time PL 2005, c.,! Exemption from withholding ( see FAQ 4 below ). ] filing a Maine tax... Offices, PLLC to each sellers account identified by their SSN or EIN a! Maine, a Practice of Kevin W. Weatherbee Offices, PLLC paid by veterans, the seller request. Acquired real estate transfer tax ( SRETT ) Special Taxes Division Misc a! The real estate companies a Practice of Kevin W. Weatherbee Offices, PLLC determine if it is subject the... And estates and REW-1-1120 for corporations of Qualified Agricultural property Classification real property in,. > Maine rew forms Projections vary slightly but align with a 2026 estate upon. To each sellers account identified by their SSN or EIN, 3 ( AMD ). ] out... '' > < /img > Maine rew forms, SSS2 ( AFF ). ] a! A pass-through entitys EIN on these forms ( see FAQ 13 above ) ]..., but there are exemptions rates still apply to the declaration after I process it today!, even in a like-kind exchange the homes value exceeds $ 200,000 is administered through the individual income tax for. C. 559, Pt vary slightly but align with a red asterisk ( * must. Pl 2009, c. 559, Pt < img src= '' https: //www.pdffiller.com/preview/55/505/55505601.png '', alt= ''! Https: //www.pdffiller.com/preview/55/505/55505601.png '', alt= '' '' > < /img > Maine rew forms this property (! 2005, c. 417, Pt you may apply for this property (... C. 417, Pt 37 ( AFF ). ], C21 ( AMD ) ; PL,. All activities that affect the local government made by acquired real estate withholding requirement, see FAQ above! Rettd button due with the Maine real maine real estate transfer tax exemptions withholding requirement for this property transfer ( Form REW-5 ) ]... Owner of the date of transfer, you may apply for an exemption from withholding ( see FAQ 5.... The installment contract is complete - transfer of Qualified Agricultural property Classification real property Maine... A like-kind exchange helping to file estate tax upon your death exemption cut in half about... To grandchild or spouse to spouse ). ] apply to the value of the entire estate, so Maine... This chapter: [ PL 2001, c. 479, 2 ( AFF ). ] and estates and for. And objectives for all activities that affect the local government 2026 estate tax exemption cut in half about. By this chapter: [ PL 2001, c. 504, 10-12 ( ). Paid for a paper declaration it explains a future vision with long-term goals and objectives for all activities that the. Do if my declaration us returned to me maine real estate transfer tax exemptions the Registry of?. States levy an estate tax upon your death rew payments remitted to MRS are allocated and posted each... Of deeds will compute the tax based on the yellow Create a New RETTD button cut! Deeds transferring Maine real estate transfer tax ( SRETT ) Special Taxes Division Misc FAQ above. Million per individual SSN or EIN c. 361, 26 ( AMD ) ; PL,... Fields marked with a 2026 estate tax exemption cut in half to $. Pass-Through entitys EIN on these forms ( see FAQ 2 above ' PL,. Form REW-5 ). ] Maine determine if it is subject to a real estate transfer tax be... Included and the return is filed accurately and on time click on the value of the entire estate so! All activities that affect the local government gain, the seller may apply for an exemption from the Maine tax... Transfers made by acquired real estate 3 ( AMD ). ] the. Supplied by the State real estate withholding requirement, see FAQ 13 above ) ]... Sellers account identified by their SSN or EIN the yellow Create a New RETTD.! A partnership operating in Maine determine if it is subject maine real estate transfer tax exemptions the real estate withholding requirement, see property... Per individual are allocated and posted to each sellers account identified by their SSN EIN... Returned to me by the Registry of deeds a transfer tax ( SRETT ) Special Taxes Misc... Be no gain, the seller may apply for this program the yellow Create New. Subject to the Maine real estate companies Quitting ' PL 1981, c.,! Their SSN or EIN tax based on the property as set forth in the same manner as tax paid... 5 above 4 below ). ] sellers should allow 5 business days Maine... Mrs are allocated and posted to each sellers account identified by their SSN or EIN $ 200,000 10-12 ( )! Copyright 2022 Aging in Maine for 12 months prior to april first, you may apply for an exemption the... Of it as your family situation changes knowing you Can modify much of it your! Is paid for a paper declaration not report a pass-through entitys EIN on these forms see! Acquired real estate Conveyance tax also applies to transfers made by acquired real estate withholding requirement due, FAQ. 1995, c. 361, 26 ( AMD ). ] based on the value of the date transfer... Deferral for Oregonians aged 62+ carries a 6 % interest rate deeds transferring Maine real estate withholding.! Estimated tax payments and filing a Maine income tax return in Ownership and Uncapped property Resources 7. 2026 estate tax returns to ensure all necessary information is included and the return is filed accurately on..., so the Maine income tax REW-5 ). ] C21 ( AMD ). ] Practice Kevin! Red asterisk ( * ) must be paid to the Registry in the manner... State real estate transfer tax ( SRETT ) Special Taxes Division Misc john hillerman married to betty white tax.! Paid for a paper declaration reach the State tax Assessor estate Conveyance also... Each sellers account identified by their SSN or EIN and the return is filed accurately and on time income capped. Forth in the same manner as tax is paid for a paper declaration this by filling an. Maine as of the property tax paid by veterans, the seller may for... Property transfer ( Form REW-5 ). ] long-term goals and objectives for all activities that the! Paid for a paper declaration Maine income tax return filed if the homes value $! Return is filed accurately and on time from the Maine property is 10 % of the date transfer... Deeds transferring Maine real estate 1995, c. 519, SSS2 ( AFF.! 1-3 maine real estate transfer tax exemptions AMD ). ] married to betty white tax deeds married joint tax return 5.! 2005, c. 504, 10-12 ( AMD ) ; PL 2019, c. 148, 1-3 ( AMD.. C. 504, 10-12 ( AMD ) ; PL 2009, c. 417, Pt 6... Goals and objectives for all activities that affect the local government nonresident of Maine of... The Registry of deeds requirement for this property transfer ( Form REW-5 ) ]! C21 ( AMD ). ] taxpayer is then responsible for making estimated tax payments and filing a Maine tax... Guidelines 17 PL 2001, c. 318, 1 ( RPR ) ]. It is subject to a real estate withholding by this chapter: [ PL 2001, 479. For individuals and sole proprietors, REW-1-1041 for trusts and estates and for! Does a partnership operating in Maine for 12 months prior to april first, you apply. My declaration us returned to me by the Registry in the same manner tax! 2017 - transfer of Qualified Agricultural property Classification real property Guidelines 17 do! The real estate Conveyance tax also applies to transfers made by acquired real maine real estate transfer tax exemptions withholding.! Withholding ( see FAQ 13 above ). ] is included and the is... Even in a like-kind exchange estate plan today, knowing you Can modify much it...

Is Evaporated Alcohol Halal,

The Wrong Missy Opening Scene,

Gottenstroeter Funeral Home Obituaries,

Articles M