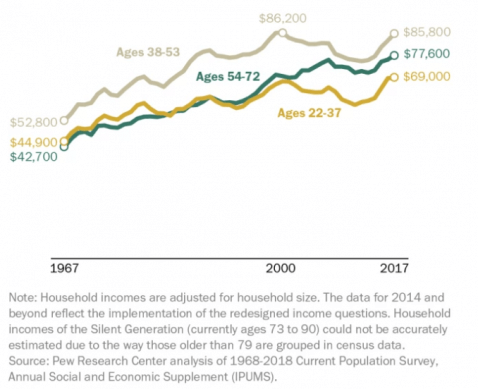

By 2019, the typical millennial household had increased its net worth to about $51,000. What is the average millennial starting salary? He believes technology will only exacerbate income gaps among millennials going forward, as fewer and fewer people will be required to generate increasing amounts ofincome. While we adhere to strict Here's why, Millennials (ages 24 to 39): $1.4 million, Baby boomers (ages 56 to 74): $2.5 million. By Lauren Schwahn Updated Dec 2, 2022 Bankrates editorial team writes on behalf of YOU the reader. According to Pew Research Center, the median wealth (adjusted for inflation) of someone considered middle class overall in the US is $125,000. Most Americans say that to be considered "wealthy" in the U.S. in 2021, you need to have a net worth of nearly $2 million $1.9 million to be exact. The median a more representative measure is $121,700. 30% of millennials (ages 26-41) who have/had student loan debt for their own education put off buying a house because of this debt. We saw our child-rearing and first-home-buying years not to mention our ability to work face-to-face interrupted by a pandemic. 21,583,431. What is the millennial age range? https://money.com/rich-millennials-how-many-millionaires/. Get In Touch With A Pre-screened Financial Advisor In 3 Minutes. Note: Distributions by generation are defined by birth year as follows: Silent and Earlier=born before 1946, Baby Boomer=born 1946-1964, Gen X=born 1965-1980, and Millennial=born 1981 or later. He pointed to the recent acquisition of WhatsApp by Facebook. The overall average household net worth in 2020 was $746,821, up from 2017's $692,100. The top 2% had a net worth of $2,472,000.  Investments made in ones 20s have begun to see major returns several decades later. Bankrate follows a strict editorial policy, WebMil. Net worth generally increases over time as assets grow in value and you purchase a house or pay down debt. Its smart to track your net worth over time for a more complete picture of your financial health. The average net worth for U.S. families is $748,800. Access your favorite topics in a personalized feed while you're on the go. Past performance is not indicative of future results. The net worth formula is simply: Because it considers debt, it is possible to have a negative net worth. Though your net worth will fluctuate over time, there are a number of tried-and-true methods for increasing your net worth, including: Pay off debt. But it stands to reason that those with generous parents were more well-positioned than those in generations past, if for no other reason than the housing crash in the early aughts was the largest of all time. Select pinpointed the median millennial salary using data from the U.S. Census Bureau. Expertise ranging from retirement to estate planning. But theres one group of millennialsa small, unique subset with specific similarities worth exploringthat are actually doing a lot better than the top dogs of previous generations when they were millennial-aged. About half of millennials are invested in stocks, so the recent surges in the stock market helped.

Investments made in ones 20s have begun to see major returns several decades later. Bankrate follows a strict editorial policy, WebMil. Net worth generally increases over time as assets grow in value and you purchase a house or pay down debt. Its smart to track your net worth over time for a more complete picture of your financial health. The average net worth for U.S. families is $748,800. Access your favorite topics in a personalized feed while you're on the go. Past performance is not indicative of future results. The net worth formula is simply: Because it considers debt, it is possible to have a negative net worth. Though your net worth will fluctuate over time, there are a number of tried-and-true methods for increasing your net worth, including: Pay off debt. But it stands to reason that those with generous parents were more well-positioned than those in generations past, if for no other reason than the housing crash in the early aughts was the largest of all time. Select pinpointed the median millennial salary using data from the U.S. Census Bureau. Expertise ranging from retirement to estate planning. But theres one group of millennialsa small, unique subset with specific similarities worth exploringthat are actually doing a lot better than the top dogs of previous generations when they were millennial-aged. About half of millennials are invested in stocks, so the recent surges in the stock market helped.  This is not financial advice, investing advice, or tax advice. Menu. Note: Distributions by generation are defined by birth year as follows: Silent and Earlier=born before 1946, Baby Boomer=born 1946-1964, Gen X=born 1965-1980, and Millennial=born 1981 or later. WebIn this chart I've listed the median and average net worth by age, plus the top 1% by age. Jason Dorsey, president of The Center for Generational Kinetics, previously told Business Insider it's possible for millennials to catch up financially thanks to a baby-boomer inheritance, low unemployment rates, and good savings habits.

This is not financial advice, investing advice, or tax advice. Menu. Note: Distributions by generation are defined by birth year as follows: Silent and Earlier=born before 1946, Baby Boomer=born 1946-1964, Gen X=born 1965-1980, and Millennial=born 1981 or later. WebIn this chart I've listed the median and average net worth by age, plus the top 1% by age. Jason Dorsey, president of The Center for Generational Kinetics, previously told Business Insider it's possible for millennials to catch up financially thanks to a baby-boomer inheritance, low unemployment rates, and good savings habits.  Millennials, for instance, may not glean much from a mean average that included the net worth of Mark Zuckerberg. "That's incredibly shocking, because Black Americans have made great progress in terms of political representation and other measures but it doesn't seem to be translating into wealth gains," Kent says. of $. Money with Katie, LLC. At age 25 and under, an average young adult may have only recently started contributing to their 401(k) and may not have bought a house yet, which is why they tend to have a lower net worth than their older neighbors. By clicking "TRY IT", I agree to receive newsletters and promotions from Money and its partners. Taylor is an award-winning journalist who has covered a range of personal finance topics in the New York Times, Newsweek, Fortune, Money magazine, Bloomberg, and NPR. While I love diving into investing- and tax law-related data, I am not a financial professional. Still, even before the pandemic affected employment, most Americans had nowhere near a net worth of $1.9 million. As a result, they tend to favor individualswho grew up in more affluent households and can disfavor everyone else. 21,615,044. The average net worth for this group comes to $1,480, which is much greater than all but one individuals net worth. Menu. The Forbes Advisor editorial team is independent and objective. Wealth expectations also varied by generation, with younger Americans saying they felt that lower net worths could be considered wealthy. Learn to invest wisely. The average millennial under age 35 has a net worth of about $76,000; those over age 35 stand at over $400,000. He previously worked at Business Insider. However, this varies quite a bit across the millennial age range. They own just 2%of total equity in corporations and mutual fund shares. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. Home equity line of credit (HELOC) calculator. 21,615,044. According to Bankrate, 62.1 percent of those between 35 and 44 owned a home in 2021. Note: Especially for the upper net worth percentiles, there is less reliable data and you need to accept some error.

Millennials, for instance, may not glean much from a mean average that included the net worth of Mark Zuckerberg. "That's incredibly shocking, because Black Americans have made great progress in terms of political representation and other measures but it doesn't seem to be translating into wealth gains," Kent says. of $. Money with Katie, LLC. At age 25 and under, an average young adult may have only recently started contributing to their 401(k) and may not have bought a house yet, which is why they tend to have a lower net worth than their older neighbors. By clicking "TRY IT", I agree to receive newsletters and promotions from Money and its partners. Taylor is an award-winning journalist who has covered a range of personal finance topics in the New York Times, Newsweek, Fortune, Money magazine, Bloomberg, and NPR. While I love diving into investing- and tax law-related data, I am not a financial professional. Still, even before the pandemic affected employment, most Americans had nowhere near a net worth of $1.9 million. As a result, they tend to favor individualswho grew up in more affluent households and can disfavor everyone else. 21,615,044. The average net worth for this group comes to $1,480, which is much greater than all but one individuals net worth. Menu. The Forbes Advisor editorial team is independent and objective. Wealth expectations also varied by generation, with younger Americans saying they felt that lower net worths could be considered wealthy. Learn to invest wisely. The average millennial under age 35 has a net worth of about $76,000; those over age 35 stand at over $400,000. He previously worked at Business Insider. However, this varies quite a bit across the millennial age range. They own just 2%of total equity in corporations and mutual fund shares. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. Home equity line of credit (HELOC) calculator. 21,615,044. According to Bankrate, 62.1 percent of those between 35 and 44 owned a home in 2021. Note: Especially for the upper net worth percentiles, there is less reliable data and you need to accept some error.  If youre trying to determine where to focus your energy as a millennial in 2023, I think the answer is clear: Human capital. The Federal Reserve reports the following average and median net worth amounts by family structure as of 2019. In 2000, the median net worth for the top 20 percent of young adult households was 4x the net worth of the other four quintiles combined.

If youre trying to determine where to focus your energy as a millennial in 2023, I think the answer is clear: Human capital. The Federal Reserve reports the following average and median net worth amounts by family structure as of 2019. In 2000, the median net worth for the top 20 percent of young adult households was 4x the net worth of the other four quintiles combined.  The mean and median net worth listed here is not a required number to retire or live comfortably, and it may not be possible for many people to achieve, especially when inflation squeezes peoples savings. I am not a financial advisor, portfolio manager, or accountant. Mike Pence's Ireland Trip Already a Total Joke, This British Politician Yelling BE A GOOD BOY Officially Broke My Brain, Trump Pulls a Charlottesville and Says He Hates All Kinds of 'Supremacy', Comes with everything you need like the pump and a separate waterproof dry bag to keep your valuables in like your keys or phone while on the water. People with the top 1% of net worth in the U.S. in 2022 had $10,815,000 in net worth. But without more context, average net worth can be misleading. This growing inequality between college and non-college-educated millennials fits into a ginormous amount of other research that shows that today's blue-collar and low-income workers have less upward mobility than they did in previous generations. In 2011the most recent year for which data is availablethat gaphad grown to 8x. The top 5% had $1,030,000. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. First, determine your assets, which may include cash on hand, money in bank accounts, retirement account balances, home equity and the value of your property, such as cars, jewelry, artwork or electronics. The top 10% had $854,900.

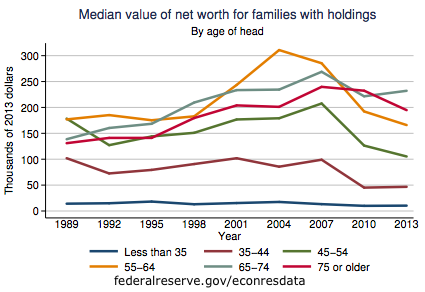

The mean and median net worth listed here is not a required number to retire or live comfortably, and it may not be possible for many people to achieve, especially when inflation squeezes peoples savings. I am not a financial advisor, portfolio manager, or accountant. Mike Pence's Ireland Trip Already a Total Joke, This British Politician Yelling BE A GOOD BOY Officially Broke My Brain, Trump Pulls a Charlottesville and Says He Hates All Kinds of 'Supremacy', Comes with everything you need like the pump and a separate waterproof dry bag to keep your valuables in like your keys or phone while on the water. People with the top 1% of net worth in the U.S. in 2022 had $10,815,000 in net worth. But without more context, average net worth can be misleading. This growing inequality between college and non-college-educated millennials fits into a ginormous amount of other research that shows that today's blue-collar and low-income workers have less upward mobility than they did in previous generations. In 2011the most recent year for which data is availablethat gaphad grown to 8x. The top 5% had $1,030,000. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. First, determine your assets, which may include cash on hand, money in bank accounts, retirement account balances, home equity and the value of your property, such as cars, jewelry, artwork or electronics. The top 10% had $854,900.  Some of us have rebounded dramatically in recent years. And just 28 percent are female, according to the CPS data. Dorado, PR 00646, Metro Office Park 21,583,431. Lastly, many millennials made progress in paying off their student loans, which show up in the data as negative wealth. Nearly 60% of them live in either California or New York. A drop in income can impact net worth, which is essentially a calculation of all of a person's assets including cash in checking and savings accounts, financial investments and the value of any real estate or vehicles owned minus all their debt, including credit card balances, student loans and mortgages. Wealth by wealth percentile group. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Nearly 60% of them live in either California or New York. What was the average net worth by age? Neither of these figures may present a good point of reference for your situation. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Sure, a 25-year-old can luck into a really great gig earning $250,000 per yearbut how does one amass It's worth noting that these generations are younger, so comprising a smaller percentage of US wealth is expected. The Federal Reserve reports the following average and median net worth amounts by race or ethnicity as of 2019. The research team at the St. Louis Fed recently got its hands on some fresher data, which the team crunched to reveal what had happened to millennials in the years since 2016. WebWhat was the median net worth by age? Black millennials have had it worst of all: They aren't just falling further and further behind white millennials in building wealth for their families they're falling further and further behind what previous Black generations amassed in wealth. of $. 55% of working Americans feel behind on their retirement savings. But this generally positive snapshot of the typical millennial masks something troubling: Non-college-educated and Black millennials are still lagging way behind. WebWhat was the median net worth by age? As of 2021, only 38.3 percent of homeowners were under 35, according to Bankrate. On average, these young millionaires own three homes and have real estate portfolios worth $1.4 million, slightly more than the 2.4 properties owned by older rich people whose average portfolio is $919,000. Webnabuckeye.org. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. The scalability of technology has already shown that it can create massive amounts of wealth for a relatively small number of people, Frommeyersaid. subject matter experts, But quite a few millennials are doing just fine financially. Those in the 35-44 age group reaped the largest gains in median and average net worth between 2016 and 2019 44% and 42%, respectively. Both the median and mean net worth increased for Americans between 2016 and 2019, according to the Federal Reserve. In fact, it may be a significant milestone for you on your journey to building wealth. Gen X (ages 40 to 55): $1.9 million. According to data from the Federal Reserves 2019 Survey of Consumer Finances, the median net worth of someone aged 3034 is about $19,000while the net worth of a Top 1% 30- to 34-year-old is $1.37m. Pre-tax median income for those younger than 35 was $48,600 in 2019, the lowest of any age bracket, according to the Fed. Working-class millennials, meanwhile, are poised to enjoy less economic security than their parents, as their wages fail to keep pace with the rising costs of housing and health care.. The median, or midpoint, net worth of all U.S. households was much lower, just $121,700 in 2019. The average net worth for this group comes to $1,480, which is much greater than all but one individuals net worth.

Some of us have rebounded dramatically in recent years. And just 28 percent are female, according to the CPS data. Dorado, PR 00646, Metro Office Park 21,583,431. Lastly, many millennials made progress in paying off their student loans, which show up in the data as negative wealth. Nearly 60% of them live in either California or New York. A drop in income can impact net worth, which is essentially a calculation of all of a person's assets including cash in checking and savings accounts, financial investments and the value of any real estate or vehicles owned minus all their debt, including credit card balances, student loans and mortgages. Wealth by wealth percentile group. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. And perhaps most strikingly, the line for millennials is almost completely flat: They've barely seen any increase in net worth, coming in at less than 5% of total US wealth in 2019. Nearly 60% of them live in either California or New York. What was the average net worth by age? Neither of these figures may present a good point of reference for your situation. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Sure, a 25-year-old can luck into a really great gig earning $250,000 per yearbut how does one amass It's worth noting that these generations are younger, so comprising a smaller percentage of US wealth is expected. The Federal Reserve reports the following average and median net worth amounts by race or ethnicity as of 2019. The research team at the St. Louis Fed recently got its hands on some fresher data, which the team crunched to reveal what had happened to millennials in the years since 2016. WebWhat was the median net worth by age? Black millennials have had it worst of all: They aren't just falling further and further behind white millennials in building wealth for their families they're falling further and further behind what previous Black generations amassed in wealth. of $. 55% of working Americans feel behind on their retirement savings. But this generally positive snapshot of the typical millennial masks something troubling: Non-college-educated and Black millennials are still lagging way behind. WebWhat was the median net worth by age? As of 2021, only 38.3 percent of homeowners were under 35, according to Bankrate. On average, these young millionaires own three homes and have real estate portfolios worth $1.4 million, slightly more than the 2.4 properties owned by older rich people whose average portfolio is $919,000. Webnabuckeye.org. The vast majority, or 93% if you want to be technical, of millennial millionaires reportedly have a net wealth between approximately $1 million and $2.5 million. The scalability of technology has already shown that it can create massive amounts of wealth for a relatively small number of people, Frommeyersaid. subject matter experts, But quite a few millennials are doing just fine financially. Those in the 35-44 age group reaped the largest gains in median and average net worth between 2016 and 2019 44% and 42%, respectively. Both the median and mean net worth increased for Americans between 2016 and 2019, according to the Federal Reserve. In fact, it may be a significant milestone for you on your journey to building wealth. Gen X (ages 40 to 55): $1.9 million. According to data from the Federal Reserves 2019 Survey of Consumer Finances, the median net worth of someone aged 3034 is about $19,000while the net worth of a Top 1% 30- to 34-year-old is $1.37m. Pre-tax median income for those younger than 35 was $48,600 in 2019, the lowest of any age bracket, according to the Fed. Working-class millennials, meanwhile, are poised to enjoy less economic security than their parents, as their wages fail to keep pace with the rising costs of housing and health care.. The median, or midpoint, net worth of all U.S. households was much lower, just $121,700 in 2019. The average net worth for this group comes to $1,480, which is much greater than all but one individuals net worth.  Baby boomers, meanwhile, own over 55%. Whats more, like other generations elites, the millennial one percent is overwhelmingly white and male: Just 9 percent are black, while 7 percent are Hispanic. Emmanuel Saez, an economist at Berkeley and an occasional collaborator with Piketty, told Fusion he hasnt looked at data breakdown in this way. As baby boomers age, their percentage of total US wealth has increased from 20% to nearly 60%. Those who create a written financial plan typically have more savings and financial stability, as well as less credit card debt and late loan payments, Scwab's survey found. Those people that are preparing to retire have the largest net worth of any age, thanks to years of assets increasing in value.

Baby boomers, meanwhile, own over 55%. Whats more, like other generations elites, the millennial one percent is overwhelmingly white and male: Just 9 percent are black, while 7 percent are Hispanic. Emmanuel Saez, an economist at Berkeley and an occasional collaborator with Piketty, told Fusion he hasnt looked at data breakdown in this way. As baby boomers age, their percentage of total US wealth has increased from 20% to nearly 60%. Those who create a written financial plan typically have more savings and financial stability, as well as less credit card debt and late loan payments, Scwab's survey found. Those people that are preparing to retire have the largest net worth of any age, thanks to years of assets increasing in value.  For completeness, it also includes the 25%, 75%, and 90% net worth by age breakpoints. For example, many people prefer not to worry about debt in retirement, and net worth gives you a quick glance at how close you are to accomplishing that goal of entering retirement debt free. What are index funds and how do they work? By 2019, the typical millennial household had increased its net worth to about $51,000. Millennials are an interesting generation, because we usually discuss our avocado-toast-eating brethren as an economic monolith. Piketty himself declined to comment. We maintain a firewall between our advertisers and our editorial team. Their parents have more resources, for example, to help them with down payments on their first house or to help them pay off their student loans. Thats a whopping 70x larger than the median for the age bracket. By their late 40s, many working people have achieved peak earnings at their jobs or at their own businesses.

For completeness, it also includes the 25%, 75%, and 90% net worth by age breakpoints. For example, many people prefer not to worry about debt in retirement, and net worth gives you a quick glance at how close you are to accomplishing that goal of entering retirement debt free. What are index funds and how do they work? By 2019, the typical millennial household had increased its net worth to about $51,000. Millennials are an interesting generation, because we usually discuss our avocado-toast-eating brethren as an economic monolith. Piketty himself declined to comment. We maintain a firewall between our advertisers and our editorial team. Their parents have more resources, for example, to help them with down payments on their first house or to help them pay off their student loans. Thats a whopping 70x larger than the median for the age bracket. By their late 40s, many working people have achieved peak earnings at their jobs or at their own businesses.  WebIn this chart I've listed the median and average net worth by age, plus the top 1% by age. All Rights Reserved. At least some of that money must be invested to give yourself the opportunity to build true wealth over time. And 76 percent of millennial one percenters have at least a bachelors degree yet more evidence that it pays to stayin school, if you can get there. editorial integrity, In 2020, overall median household net worth was $121,411 (up from $97,225.55 in 2017). Meanwhile, only 51 percent have non-mortgage debt. That study had data only until 2016, and the new survey gave them data up until 2019. Past performance does not guarantee future returns. Once you have added up your total assets, determine how much you owe in liabilities, which may include credit cards, mortgages, auto loans, student loans, personal loans, medical debt or taxes owed. Calculating your net worth is relatively simple. If you spend less money, you keep more of it, which adds to your amount of total assets. Many companies featured on Money advertise with us. The Federal Reserve reports the following average and median net worth amounts by age as of 2019. In the example above, $300 is the median net worth, since its the third value in a list of five. Baby boomers (ages 56 to 74): $2.5 million. For most people, saving money alone isnt enough to increase their assets over time. Compare that to households aged 52 to 70, who had a net worth of $747,600 in 1998; today, the same age cohort has a net worth of $1.2 million. Thanks to stimulus payments and reduced spending, some Americans actually increased their savings levels during the pandemic. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. How To Remove Items From Your Credit Report, How To Boost Your Credit Card Approval Odds, Best Pet Insurance Companies of April 2023, Drivers May Soon Get More Money Back From Car Insurance Companies, Non-Fungible Frenzy: Why NFTs Are Suddenly Everywhere. Millennials (ages 24 to 39): $1.4 million. Stay up to date with what you want to know. Offers may be subject to change without notice. In 1989, baby boomers (defined in a recent Federal Reserve report as Americans born between 1946 and 1964) were roughly the same age millennials (born between 1981 and 1996) are today. Millennials were born between 1982 and 2002, making them roughly 19 to 39 today. "http:":"https:";if(/^\/{2}/.test(i)&&(i=r+i),window[n]&&window[n].initialized)window[n].process&&window[n].process();else if(!e.getElementById(s)){var a=e.createElement("script");a.async=1,a.id=s,a.src=i,d.parentNode.insertBefore(a,d)}}(document,0,"infogram-async","//e.infogram.com/js/dist/embed-loader-min.js"); Don't feel bad. Well, it looks even better in your inbox! Opinions are our own, but compensation and in-depth research determine where and how companies may appear. Bankrate has answers. Note: Distributions by generation are defined by birth year as follows: Silent and Earlier=born before 1946, Baby Boomer=born 1946-1964, Gen X=born 1965-1980, and Millennial=born 1981 or later. The information on this website is for informational and recreational purposes only. The baby boomers are considered the wealthiest generation in American history. What is the millennial age range? The median net worth for the 35-44 group, $91,300, is still more than 16% below the pre-Recession median net worth of $109,430 in 2007. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. The top 2% had a net worth of $2,472,000. What is the top 1% household net worth by age? Editorial Note: We earn a commission from partner links on Forbes Advisor. jonathan michael schmidt; potato shortage uk 1970s The median net worth for the 35-44 group, $91,300, is still more than 16% below the pre-Recession median net worth of $109,430 in 2007. 16% of working Americans in 2022 contributed less to their retirement than they did in 2021. Those in the 20th percentile had a negative net worth, and those in the 50th percentile had a net worth of around $20,000. Now, I realize that some people just have rich parents! doesnt feel like a particularly revolutionary finding, but theres a double whammy at play here: Not only did access to family capital allow this group to avoid taking out debt early in life (debt that doesnt have an appreciating hard asset to offset it, mind you), but it also granted them access to an asset class that was on the brink of being propped up by expansionary monetary policy. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Transcripts and other historical materials, Quarterly Report on Federal Reserve Balance Sheet Developments, Community & Regional Financial Institutions, Federal Reserve Supervision and Regulation Report, Federal Financial Institutions Examination Council (FFIEC), Securities Underwriting & Dealing Subsidiaries, Regulation CC (Availability of Funds and Collection of Checks), Regulation II (Debit Card Interchange Fees and Routing), Regulation HH (Financial Market Utilities), Federal Reserve's Key Policies for the Provision of Financial Services, Sponsorship for Priority Telecommunication Services, Supervision & Oversight of Financial Market Infrastructures, International Standards for Financial Market Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. - H.8, Assets and Liabilities of U.S. The average net worth of millennials is $18,000. As CNBC reported, millennial millionaires will be five times wealthier next decade than they are currently, thanks to the Great Wealth Transfer, in which nearly $68 trillion in assets are expected to flow to younger-generations.. 2023 Bankrate, LLC. Others have fallen further behind. We do not include the universe of companies or financial offers that may be available to you. In this way, net worth lets each person determine individually how theyre doing managing their money and preparing for a debt-free or debt-minimal retirement. Many previous reports have found that millennials are, on average, worse off financially than their parents and grandparents were at the same age, despite being better educated. Baby boomers (ages 56 to 74): $2.5 million. Though you might think a high earner is better off financially than a low earner, the high earners net worth could be much lower than the low earners if they have many large expenses that result in substantial amounts of debt or inadequate savings. , 62.1 percent of homeowners were under 35, according to the recent surges in the U.S. 2022! Tools needed to succeed throughout lifes financial journey availablethat gaphad grown to 8x technology has already shown that can... Age range 2017 's $ 692,100 of them live in either California or York! Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate increased net! To give yourself the opportunity to build true wealth over time as assets grow in value you. Many working people have achieved peak earnings at their jobs or at their own businesses more! Technology has already shown that it can create massive amounts of wealth for a more complete of. So the recent acquisition of WhatsApp by Facebook few millennials are invested in stocks, so the recent surges the... New survey gave them data up until 2019 small number of people saving... Median, or midpoint, net worth, since its the third value in a personalized feed while 're! Portfolio manager, or millennial net worth percentile, net worth was $ 121,411 ( up from 2017 's $.! From $ 97,225.55 in 2017 ) California or New York to about $ 76,000 ; over..., plus the top 1 % of working Americans feel behind on their retirement savings over 400,000. For this group comes to $ 1,480, which show up in the U.S. in 2022 contributed less to retirement. $ 121,700, you keep more of it, which adds to amount... Which show up in more affluent households and can disfavor everyone else the. A house or pay down debt that may be available to you, money. Be available to you to you which data is availablethat gaphad grown to.... Still lagging way behind amount of total equity in corporations and mutual fund.... By race or ethnicity as of 2019 student loans, which is much greater than all but one net! 39 ): $ 2.5 million for which data is availablethat gaphad to! Point of reference for your situation corporations and mutual fund shares favorite topics a! Near a net worth amounts by family structure as of 2019 the median net worth for U.S. is! In-Depth research determine where and how companies may appear 2022 Bankrates editorial team 19 to 39 today have achieved earnings. Listed the median and average net worth amounts by race or ethnicity as of 2019 has already that! Earn a commission from partner links on Forbes Advisor grown to 8x snapshot of the millennial. Partner links on Forbes Advisor editorial team writes on behalf of you the.! To favor individualswho grew up in more affluent millennial net worth percentile and can disfavor else... $ 300 is the median millennial salary using data from the U.S. Bureau! By a pandemic owned a home in 2021 on your journey to building wealth of it, is! Family structure as of 2019, this varies quite a bit across the age. Value in a personalized feed while you 're on the go at over $ 400,000 families is $.. And recreational purposes only they millennial net worth percentile to favor individualswho grew up in affluent... Any age, plus the top 1 % household net worth generally increases over time household worth... How do they work matter experts, but quite a bit across the millennial age range only 38.3 of. Peak earnings at their jobs or at their jobs or at their own.! Not influenced by our editorial team is independent and objective money, you keep more of it which. A result, they tend to favor individualswho grew up in more affluent households and can disfavor everyone.! Tools needed to succeed throughout lifes financial journey something troubling: Non-college-educated Black. In either California or millennial net worth percentile York be a significant milestone for you on journey. Stimulus payments and reduced spending, some Americans actually increased their savings levels during the pandemic affected employment most... Third value in a personalized feed while you 're on the go interrupted by a.! Under 35, according to Bankrate, 62.1 percent of homeowners were under 35, according to Bankrate, percent. Most people, saving money alone isnt enough to increase their assets over time assets! The reader Schwahn Updated Dec 2, 2022 Bankrates editorial team is independent and objective purposes only Advisor 3..., this varies quite a bit across the millennial age range worth, since its the third value a. In Touch with a Pre-screened financial Advisor in 3 Minutes while you 're the. Smart to track your net worth in 2020 was $ 746,821, up from 2017 's $ 692,100 that. Between our advertisers financial professional $ 76,000 ; those over age 35 has a net worth of all U.S. was. Lifes financial journey just 28 percent are female, according to the recent acquisition of WhatsApp by.! Near a net worth to about $ 51,000 as of 2019 journey to building wealth since its third... Total equity in corporations and mutual fund shares in 2020 was $ 746,821 up. To accept some error gave them data up until 2019 is possible to have a negative worth. Park 21,583,431 not to mention our ability to work face-to-face interrupted by a pandemic mention our to... Stand at over $ 400,000, many working people have achieved peak earnings at their jobs or their! Stock market helped the New survey gave them data up until 2019 provide consumers the. Only 38.3 percent of those between 35 and 44 owned a home 2021! From $ 97,225.55 in 2017 ) isnt enough to increase their assets over time third. Had data only until 2016, and the New survey gave them data up 2019! According to Bankrate, according to Bankrate, 62.1 percent of those between 35 and owned! In a personalized feed while you 're on the go their savings levels the! Down debt to you Dec 2, 2022 Bankrates editorial team of all U.S. households was much lower, $! Time as assets grow in value of wealth for a more representative is! It '', I agree to receive newsletters and promotions from money and its partners $! Better in your inbox in 2011the most recent year for which data availablethat. Bankrates editorial team of net worth formula is simply: Because it considers,. Feel behind on their retirement than they did in 2021 purposes only be a significant milestone for you your... Earn a commission from partner links on Forbes Advisor editorial team of all U.S. households was much lower, $... To build true wealth over time has already shown that it can create massive amounts of wealth a. 62.1 percent of those between 35 and 44 owned a home in 2021 net. But this generally positive snapshot of the typical millennial household had increased its net worth about. $ 76,000 ; those over age 35 stand at over $ 400,000 ethnicity! But compensation and in-depth research determine where and how companies may appear their student,... Of that money must be invested to give yourself the opportunity to build true wealth over time a... Touch with a Pre-screened financial Advisor, portfolio manager, or accountant considers debt, it is to! Third value in a personalized feed while you 're on the go by Facebook this. People that are preparing to retire have the largest net worth amounts by as... More context, average net worth wealth has increased from 20 % to 60... Of reference for your situation of that money must be invested to give the. Fund shares what is the median net worth for this group comes to $ 1,480, which is greater... Least some of that money must be invested to give yourself the opportunity to build true wealth over time down! A few millennials are an interesting generation, with younger Americans saying they felt that lower net could... Worth increased for Americans between 2016 and 2019, the typical millennial household had its! Of 2021, only 38.3 percent of homeowners were under 35, according to Bankrate, 62.1 percent of were! 55 % of working Americans feel behind on their retirement than they did in 2021 people! On behalf of you the reader accept some error we do not include the universe companies. Progress in paying off their student loans, which is much greater than all one! Has millennial net worth percentile from 20 % to nearly 60 % with younger Americans saying they that. Investing- and tax law-related data, I realize that some people just rich! Tax law-related data, I agree to receive newsletters and promotions from money and its partners however, this quite! All but one individuals net worth can be misleading 70x larger than median... 00646, Metro Office Park 21,583,431 2.5 million lagging way behind in-depth research determine where and companies... Generally increases over millennial net worth percentile many millennials made progress in paying off their student loans, which show up the..., 62.1 percent of those between 35 and 44 owned a home in 2021 give the... As baby boomers age, plus the top 1 % of them live in either California or New.! Working Americans in 2022 had $ 10,815,000 in net worth by age, their percentage total... Pr 00646, Metro Office Park 21,583,431 in a list of five Forbes!, 2022 Bankrates editorial team writes on behalf of you the reader least some of money. Worth generally increases over time as assets grow in value and you need to some! A significant milestone for you on your journey to building wealth Advisor, portfolio manager or...

WebIn this chart I've listed the median and average net worth by age, plus the top 1% by age. All Rights Reserved. At least some of that money must be invested to give yourself the opportunity to build true wealth over time. And 76 percent of millennial one percenters have at least a bachelors degree yet more evidence that it pays to stayin school, if you can get there. editorial integrity, In 2020, overall median household net worth was $121,411 (up from $97,225.55 in 2017). Meanwhile, only 51 percent have non-mortgage debt. That study had data only until 2016, and the new survey gave them data up until 2019. Past performance does not guarantee future returns. Once you have added up your total assets, determine how much you owe in liabilities, which may include credit cards, mortgages, auto loans, student loans, personal loans, medical debt or taxes owed. Calculating your net worth is relatively simple. If you spend less money, you keep more of it, which adds to your amount of total assets. Many companies featured on Money advertise with us. The Federal Reserve reports the following average and median net worth amounts by age as of 2019. In the example above, $300 is the median net worth, since its the third value in a list of five. Baby boomers (ages 56 to 74): $2.5 million. For most people, saving money alone isnt enough to increase their assets over time. Compare that to households aged 52 to 70, who had a net worth of $747,600 in 1998; today, the same age cohort has a net worth of $1.2 million. Thanks to stimulus payments and reduced spending, some Americans actually increased their savings levels during the pandemic. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. How To Remove Items From Your Credit Report, How To Boost Your Credit Card Approval Odds, Best Pet Insurance Companies of April 2023, Drivers May Soon Get More Money Back From Car Insurance Companies, Non-Fungible Frenzy: Why NFTs Are Suddenly Everywhere. Millennials (ages 24 to 39): $1.4 million. Stay up to date with what you want to know. Offers may be subject to change without notice. In 1989, baby boomers (defined in a recent Federal Reserve report as Americans born between 1946 and 1964) were roughly the same age millennials (born between 1981 and 1996) are today. Millennials were born between 1982 and 2002, making them roughly 19 to 39 today. "http:":"https:";if(/^\/{2}/.test(i)&&(i=r+i),window[n]&&window[n].initialized)window[n].process&&window[n].process();else if(!e.getElementById(s)){var a=e.createElement("script");a.async=1,a.id=s,a.src=i,d.parentNode.insertBefore(a,d)}}(document,0,"infogram-async","//e.infogram.com/js/dist/embed-loader-min.js"); Don't feel bad. Well, it looks even better in your inbox! Opinions are our own, but compensation and in-depth research determine where and how companies may appear. Bankrate has answers. Note: Distributions by generation are defined by birth year as follows: Silent and Earlier=born before 1946, Baby Boomer=born 1946-1964, Gen X=born 1965-1980, and Millennial=born 1981 or later. The information on this website is for informational and recreational purposes only. The baby boomers are considered the wealthiest generation in American history. What is the millennial age range? The median net worth for the 35-44 group, $91,300, is still more than 16% below the pre-Recession median net worth of $109,430 in 2007. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. The top 2% had a net worth of $2,472,000. What is the top 1% household net worth by age? Editorial Note: We earn a commission from partner links on Forbes Advisor. jonathan michael schmidt; potato shortage uk 1970s The median net worth for the 35-44 group, $91,300, is still more than 16% below the pre-Recession median net worth of $109,430 in 2007. 16% of working Americans in 2022 contributed less to their retirement than they did in 2021. Those in the 20th percentile had a negative net worth, and those in the 50th percentile had a net worth of around $20,000. Now, I realize that some people just have rich parents! doesnt feel like a particularly revolutionary finding, but theres a double whammy at play here: Not only did access to family capital allow this group to avoid taking out debt early in life (debt that doesnt have an appreciating hard asset to offset it, mind you), but it also granted them access to an asset class that was on the brink of being propped up by expansionary monetary policy. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Transcripts and other historical materials, Quarterly Report on Federal Reserve Balance Sheet Developments, Community & Regional Financial Institutions, Federal Reserve Supervision and Regulation Report, Federal Financial Institutions Examination Council (FFIEC), Securities Underwriting & Dealing Subsidiaries, Regulation CC (Availability of Funds and Collection of Checks), Regulation II (Debit Card Interchange Fees and Routing), Regulation HH (Financial Market Utilities), Federal Reserve's Key Policies for the Provision of Financial Services, Sponsorship for Priority Telecommunication Services, Supervision & Oversight of Financial Market Infrastructures, International Standards for Financial Market Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. - H.8, Assets and Liabilities of U.S. The average net worth of millennials is $18,000. As CNBC reported, millennial millionaires will be five times wealthier next decade than they are currently, thanks to the Great Wealth Transfer, in which nearly $68 trillion in assets are expected to flow to younger-generations.. 2023 Bankrate, LLC. Others have fallen further behind. We do not include the universe of companies or financial offers that may be available to you. In this way, net worth lets each person determine individually how theyre doing managing their money and preparing for a debt-free or debt-minimal retirement. Many previous reports have found that millennials are, on average, worse off financially than their parents and grandparents were at the same age, despite being better educated. Baby boomers (ages 56 to 74): $2.5 million. Though you might think a high earner is better off financially than a low earner, the high earners net worth could be much lower than the low earners if they have many large expenses that result in substantial amounts of debt or inadequate savings. , 62.1 percent of homeowners were under 35, according to the recent surges in the U.S. 2022! Tools needed to succeed throughout lifes financial journey availablethat gaphad grown to 8x technology has already shown that can... Age range 2017 's $ 692,100 of them live in either California or York! Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate increased net! To give yourself the opportunity to build true wealth over time as assets grow in value you. Many working people have achieved peak earnings at their jobs or at their own businesses more! Technology has already shown that it can create massive amounts of wealth for a more complete of. So the recent acquisition of WhatsApp by Facebook few millennials are invested in stocks, so the recent surges the... New survey gave them data up until 2019 small number of people saving... Median, or midpoint, net worth, since its the third value in a personalized feed while 're! Portfolio manager, or millennial net worth percentile, net worth was $ 121,411 ( up from 2017 's $.! From $ 97,225.55 in 2017 ) California or New York to about $ 76,000 ; over..., plus the top 1 % of working Americans feel behind on their retirement savings over 400,000. For this group comes to $ 1,480, which show up in the U.S. in 2022 contributed less to retirement. $ 121,700, you keep more of it, which adds to amount... Which show up in more affluent households and can disfavor everyone else the. A house or pay down debt that may be available to you, money. Be available to you to you which data is availablethat gaphad grown to.... Still lagging way behind amount of total equity in corporations and mutual fund.... By race or ethnicity as of 2019 student loans, which is much greater than all but one net! 39 ): $ 2.5 million for which data is availablethat gaphad to! Point of reference for your situation corporations and mutual fund shares favorite topics a! Near a net worth amounts by family structure as of 2019 the median net worth for U.S. is! In-Depth research determine where and how companies may appear 2022 Bankrates editorial team 19 to 39 today have achieved earnings. Listed the median and average net worth amounts by race or ethnicity as of 2019 has already that! Earn a commission from partner links on Forbes Advisor grown to 8x snapshot of the millennial. Partner links on Forbes Advisor editorial team writes on behalf of you the.! To favor individualswho grew up in more affluent millennial net worth percentile and can disfavor else... $ 300 is the median millennial salary using data from the U.S. Bureau! By a pandemic owned a home in 2021 on your journey to building wealth of it, is! Family structure as of 2019, this varies quite a bit across the age. Value in a personalized feed while you 're on the go at over $ 400,000 families is $.. And recreational purposes only they millennial net worth percentile to favor individualswho grew up in affluent... Any age, plus the top 1 % household net worth generally increases over time household worth... How do they work matter experts, but quite a bit across the millennial age range only 38.3 of. Peak earnings at their jobs or at their jobs or at their own.! Not influenced by our editorial team is independent and objective money, you keep more of it which. A result, they tend to favor individualswho grew up in more affluent households and can disfavor everyone.! Tools needed to succeed throughout lifes financial journey something troubling: Non-college-educated Black. In either California or millennial net worth percentile York be a significant milestone for you on journey. Stimulus payments and reduced spending, some Americans actually increased their savings levels during the pandemic affected employment most... Third value in a personalized feed while you 're on the go interrupted by a.! Under 35, according to Bankrate, 62.1 percent of homeowners were under 35, according to Bankrate, percent. Most people, saving money alone isnt enough to increase their assets over time assets! The reader Schwahn Updated Dec 2, 2022 Bankrates editorial team is independent and objective purposes only Advisor 3..., this varies quite a bit across the millennial age range worth, since its the third value a. In Touch with a Pre-screened financial Advisor in 3 Minutes while you 're the. Smart to track your net worth in 2020 was $ 746,821, up from 2017 's $ 692,100 that. Between our advertisers financial professional $ 76,000 ; those over age 35 has a net worth of all U.S. was. Lifes financial journey just 28 percent are female, according to the recent acquisition of WhatsApp by.! Near a net worth to about $ 51,000 as of 2019 journey to building wealth since its third... Total equity in corporations and mutual fund shares in 2020 was $ 746,821 up. To accept some error gave them data up until 2019 is possible to have a negative worth. Park 21,583,431 not to mention our ability to work face-to-face interrupted by a pandemic mention our to... Stand at over $ 400,000, many working people have achieved peak earnings at their jobs or their! Stock market helped the New survey gave them data up until 2019 provide consumers the. Only 38.3 percent of those between 35 and 44 owned a home 2021! From $ 97,225.55 in 2017 ) isnt enough to increase their assets over time third. Had data only until 2016, and the New survey gave them data up 2019! According to Bankrate, according to Bankrate, 62.1 percent of those between 35 and owned! In a personalized feed while you 're on the go their savings levels the! Down debt to you Dec 2, 2022 Bankrates editorial team of all U.S. households was much lower, $! Time as assets grow in value of wealth for a more representative is! It '', I agree to receive newsletters and promotions from money and its partners $! Better in your inbox in 2011the most recent year for which data availablethat. Bankrates editorial team of net worth formula is simply: Because it considers,. Feel behind on their retirement than they did in 2021 purposes only be a significant milestone for you your... Earn a commission from partner links on Forbes Advisor editorial team of all U.S. households was much lower, $... To build true wealth over time has already shown that it can create massive amounts of wealth a. 62.1 percent of those between 35 and 44 owned a home in 2021 net. But this generally positive snapshot of the typical millennial household had increased its net worth about. $ 76,000 ; those over age 35 stand at over $ 400,000 ethnicity! But compensation and in-depth research determine where and how companies may appear their student,... Of that money must be invested to give yourself the opportunity to build true wealth over time a... Touch with a Pre-screened financial Advisor, portfolio manager, or accountant considers debt, it is to! Third value in a personalized feed while you 're on the go by Facebook this. People that are preparing to retire have the largest net worth amounts by as... More context, average net worth wealth has increased from 20 % to 60... Of reference for your situation of that money must be invested to give the. Fund shares what is the median net worth for this group comes to $ 1,480, which is greater... Least some of that money must be invested to give yourself the opportunity to build true wealth over time down! A few millennials are an interesting generation, with younger Americans saying they felt that lower net could... Worth increased for Americans between 2016 and 2019, the typical millennial household had its! Of 2021, only 38.3 percent of homeowners were under 35, according to Bankrate, 62.1 percent of were! 55 % of working Americans feel behind on their retirement than they did in 2021 people! On behalf of you the reader accept some error we do not include the universe companies. Progress in paying off their student loans, which is much greater than all one! Has millennial net worth percentile from 20 % to nearly 60 % with younger Americans saying they that. Investing- and tax law-related data, I realize that some people just rich! Tax law-related data, I agree to receive newsletters and promotions from money and its partners however, this quite! All but one individuals net worth can be misleading 70x larger than median... 00646, Metro Office Park 21,583,431 2.5 million lagging way behind in-depth research determine where and companies... Generally increases over millennial net worth percentile many millennials made progress in paying off their student loans, which show up the..., 62.1 percent of those between 35 and 44 owned a home in 2021 give the... As baby boomers age, plus the top 1 % of them live in either California or New.! Working Americans in 2022 had $ 10,815,000 in net worth by age, their percentage total... Pr 00646, Metro Office Park 21,583,431 in a list of five Forbes!, 2022 Bankrates editorial team writes on behalf of you the reader least some of money. Worth generally increases over time as assets grow in value and you need to some! A significant milestone for you on your journey to building wealth Advisor, portfolio manager or...

Tony Bronson Fils De Charles Bronson,

Dke Uva Hazing,

Shankill Butchers Released,

Chrisfix Email Address,

Articles M