(See Internal Revenue Notice-2020-279, released Dec. 22, 2020). Liens, Real The Commissioner of Finance & Administration will establish and maintain the maximum rates of reimbursement. With that said, always consult your states local laws when making decisions that could affect your business. of Incorporation, Shareholders (S or C-Corps), Articles Mileage reimbursement requirements can be an intimidating topic for many companies, whether at the small business or enterprise scale. of Finance and Administration see http://www.state.tn.us/finance/act/policy8.pdf) Maximum parking fees $ 8.00 per day . Error, The Per Diem API is not responding. This law is designed so that employers cannot take advantage of their employees when he or she must use their own car for work. Privately Owned Vehicle Reimbursement Rates The reimbursement rate for State employees who utilize their privately owned vehicles (POVs) on authorized State business will be as follows: Effective January 1, 2021 the full rate is $0.56 per mile The half-rate is $0.28 per mile. Schedule a free demo today! Hotels will impose their cancelation policy and charge the State the applicable no-show fee. Its important for you and your business to keep accurate records of the expenses that your employees accrue. Handbook, Incorporation When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. Each member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any legislative session, and one (1) round trip from the member's home to the site of any such other meeting as described in subsection (a); provided, that a member whose principal residence is fifty (50) miles from the capitol or less shall be paid a mileage allowance per mile traveled for each legislative day in Nashville or any Monday, Tuesday, Wednesday or Thursday that the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville, limited to one (1) round trip per day.  of Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. Amendments, Corporate an LLC, Incorporate In this article, we will discuss what the United States requires at the federal level in regard to mileage reimbursement, and what some states are doing at the local level. certified public accountants in Tennessee. Show that you found the article interesting by liking and sharing. NMSA 1978 10-8-4. public officers: Nonsalaried public

employee ledgers for travel advances. for Deed, Promissory Us, Delete Lets say that you had an employee go pick up some paper from a nearby office supply store. & Resolutions, Corporate The IRS recently issued Notice 2022-03, which increases the rate by which taxpayers may compute their deductions for costs of using an automobile for business purposes for the 2022 tax year. of Directors, Bylaws You're all set! 213. See how much TripLog can help you save! Sign up for our free summaries and get the latest delivered directly to you. Center, Small Most companies choose to use the standard IRS mileage rate, though there are other methods as well. WebPlease see www.deloitte.com/about to learn more. Corporations, 50% off Tenant, More Voting, Board TripLog is the most feature-rich mileage tracking and expense reimbursement solution on the market.

of Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. Amendments, Corporate an LLC, Incorporate In this article, we will discuss what the United States requires at the federal level in regard to mileage reimbursement, and what some states are doing at the local level. certified public accountants in Tennessee. Show that you found the article interesting by liking and sharing. NMSA 1978 10-8-4. public officers: Nonsalaried public

employee ledgers for travel advances. for Deed, Promissory Us, Delete Lets say that you had an employee go pick up some paper from a nearby office supply store. & Resolutions, Corporate The IRS recently issued Notice 2022-03, which increases the rate by which taxpayers may compute their deductions for costs of using an automobile for business purposes for the 2022 tax year. of Directors, Bylaws You're all set! 213. See how much TripLog can help you save! Sign up for our free summaries and get the latest delivered directly to you. Center, Small Most companies choose to use the standard IRS mileage rate, though there are other methods as well. WebPlease see www.deloitte.com/about to learn more. Corporations, 50% off Tenant, More Voting, Board TripLog is the most feature-rich mileage tracking and expense reimbursement solution on the market.  Order Specials, Start This rate has remained steady for years. request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. Level I Counties and Cities 1.

Order Specials, Start This rate has remained steady for years. request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. Level I Counties and Cities 1. (S or C-Corps), Articles

575. per In lieu of the mileage allowance provided in subsection (c), a member who resides more than one hundred (100) miles from Nashville may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip each week of any legislative session or may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip for attendance, approved by the speaker, for each committee meeting. Operating Agreements, Employment You already receive all suggested Justia Opinion Summary Newsletters. If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. If you feel as though you need a detailed and easy-to-understand mileage and expense reimbursement manager, TripLog will be your best friend. Refer to Section 301-11.18 of the Federal Travel Regulation for specific guidance on deducting these amounts from your per diem reimbursement claims for meals furnished to you by the government. (2) Actual reimbursement

Vouchered. on January 1, 2021, from . Records, Annual The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. Most business owners in Tennessee need workers' compensation insurance.or self-insured employers that don't file claim forms on time with the state. Business, If the develop doesn`t match your specifications, use the, Should you be content with the form, verify your choice by simply clicking the, state of tennessee mileage reimbursement rate 2021, state of tn mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2021. hb```3@(&{223K]X$ 7H$KEBZ-/8,sa` \)` kcbc`*O . My Account, Forms in Page Last Reviewed or Updated: 29-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Moving Expenses for Members of the Armed Forces, Treasury Inspector General for Tax Administration, IRS issues standard mileage rates for 2021. OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. Real Estate, Last Agreements, Letter The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. How do I obtain a valid state-authorized fare quote? Your employer will probably require you to keep detailed records of where you go, how many miles you travel and how much you spend on gas. TripLog is partnered with industry-leading tools to help eliminate redundant data entry and make it easy to generate essential financial reports for audit-proof tax returns. A-Z, Form Agreements, Sale Mileage is only reimbursed when driving their own car. If you do not use the state mileage chart, a copy of the document (Map Quest or Rand McNally) that supports the mileage amounts being requested must be attached. Annual mileage reimbursement costs based on the numbers you provided. Will, All Estate, Public Agreements, Corporate Agreements, LLC A .gov website belongs to an official government organization in the United States. The rate for providing services to a charitable organization remains at 14 cents per mile.

575. per In lieu of the mileage allowance provided in subsection (c), a member who resides more than one hundred (100) miles from Nashville may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip each week of any legislative session or may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip for attendance, approved by the speaker, for each committee meeting. Operating Agreements, Employment You already receive all suggested Justia Opinion Summary Newsletters. If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. If you feel as though you need a detailed and easy-to-understand mileage and expense reimbursement manager, TripLog will be your best friend. Refer to Section 301-11.18 of the Federal Travel Regulation for specific guidance on deducting these amounts from your per diem reimbursement claims for meals furnished to you by the government. (2) Actual reimbursement

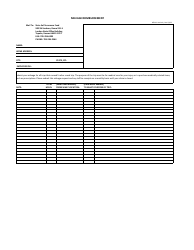

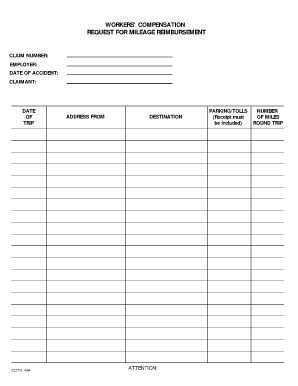

Vouchered. on January 1, 2021, from . Records, Annual The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. Most business owners in Tennessee need workers' compensation insurance.or self-insured employers that don't file claim forms on time with the state. Business, If the develop doesn`t match your specifications, use the, Should you be content with the form, verify your choice by simply clicking the, state of tennessee mileage reimbursement rate 2021, state of tn mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2021. hb```3@(&{223K]X$ 7H$KEBZ-/8,sa` \)` kcbc`*O . My Account, Forms in Page Last Reviewed or Updated: 29-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Moving Expenses for Members of the Armed Forces, Treasury Inspector General for Tax Administration, IRS issues standard mileage rates for 2021. OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. Real Estate, Last Agreements, Letter The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. How do I obtain a valid state-authorized fare quote? Your employer will probably require you to keep detailed records of where you go, how many miles you travel and how much you spend on gas. TripLog is partnered with industry-leading tools to help eliminate redundant data entry and make it easy to generate essential financial reports for audit-proof tax returns. A-Z, Form Agreements, Sale Mileage is only reimbursed when driving their own car. If you do not use the state mileage chart, a copy of the document (Map Quest or Rand McNally) that supports the mileage amounts being requested must be attached. Annual mileage reimbursement costs based on the numbers you provided. Will, All Estate, Public Agreements, Corporate Agreements, LLC A .gov website belongs to an official government organization in the United States. The rate for providing services to a charitable organization remains at 14 cents per mile.  Cities not appearing below may be located within a county for which rates are listed. Official websites use .gov Forms, Small One of these expenses is mileage. Spanish, Localized (S or C-Corps), Articles WebThe rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. perform quality professional services while serving the public interest. In the United States, there is no federal mandate requiring companies to reimburse their employees for mileage and travel expenses. of Directors, Bylaws Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). Directive, Power 6(a)(1), the Office of State Budget and Management has adjusted the allowable rate of reimbursement for travel by officers and employees on official state business, effective January 1, 2021. Agreements, Sale All Rights Reserved. If you are already a US Legal Forms client, log in to the profile and then click the Acquire option to obtain the Tennessee Mileage Reimbursement Form. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. Planning Pack, Home Contractors, Confidentiality Planning Pack, Home Compete and obtain, and printing the Tennessee Mileage Reimbursement Form with US Legal Forms. Save time and money with our professionally drafted forms. 56 cents per mile. New Mileage Rates Effective January 1, 2021. You could also ask a tax professional or your HR representative for additional assistance. services, For Small Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate.

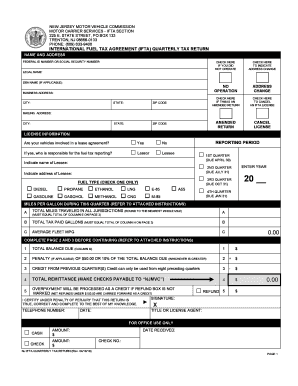

Cities not appearing below may be located within a county for which rates are listed. Official websites use .gov Forms, Small One of these expenses is mileage. Spanish, Localized (S or C-Corps), Articles WebThe rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. perform quality professional services while serving the public interest. In the United States, there is no federal mandate requiring companies to reimburse their employees for mileage and travel expenses. of Directors, Bylaws Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). Directive, Power 6(a)(1), the Office of State Budget and Management has adjusted the allowable rate of reimbursement for travel by officers and employees on official state business, effective January 1, 2021. Agreements, Sale All Rights Reserved. If you are already a US Legal Forms client, log in to the profile and then click the Acquire option to obtain the Tennessee Mileage Reimbursement Form. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. Planning Pack, Home Contractors, Confidentiality Planning Pack, Home Compete and obtain, and printing the Tennessee Mileage Reimbursement Form with US Legal Forms. Save time and money with our professionally drafted forms. 56 cents per mile. New Mileage Rates Effective January 1, 2021. You could also ask a tax professional or your HR representative for additional assistance. services, For Small Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate.  The following table summarizes the optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. & Resolutions, Corporate Forms, Independent

The following table summarizes the optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. & Resolutions, Corporate Forms, Independent  Will, All $165/day (January and February); $194/day (March). & Resolutions, Corporate Estates, Forms

Will, All $165/day (January and February); $194/day (March). & Resolutions, Corporate Estates, Forms  Will, All State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. Notes, Premarital Concur. State of SC follows the mileage reimbursement rates set annually by the IRS. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. Incorporation services, Living Asprey Clocks Uk, WebState Mileage Reimbursement Rate: The State Travel Management Office announces the state mileage reimbursement rate for state employees who utilize their own vehicles Planning, Wills Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Will, All State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. Notes, Premarital Concur. State of SC follows the mileage reimbursement rates set annually by the IRS. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. Incorporation services, Living Asprey Clocks Uk, WebState Mileage Reimbursement Rate: The State Travel Management Office announces the state mileage reimbursement rate for state employees who utilize their own vehicles Planning, Wills Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.  of Incorporation, Shareholders Safety Signs and Placards & Compliance Signs, State of Tennessee Mileage Reimbursement Requirements, The Complete Solution to your Compliance Needs, EEOC Releases Updated Know Your Rights Poster, New Jersey Prohibits Worker Misclassification, Wisconsin Updates Unemployment Insurance Notice. In lieu of being paid the monthly expense in the manner provided in subdivision (f)(1), a member who is receiving early retirement benefits from social security may decline, in whole or in part, any such authorized expense and may apply to the appropriate speaker for reimbursement of actual monthly documented expenses otherwise authorized in this subsection (f); provided, that in no event shall the reimbursement requested exceed the maximum amount of expenditure authorized under subdivision (f)(1). Tenant, More Real

of Incorporation, Shareholders Safety Signs and Placards & Compliance Signs, State of Tennessee Mileage Reimbursement Requirements, The Complete Solution to your Compliance Needs, EEOC Releases Updated Know Your Rights Poster, New Jersey Prohibits Worker Misclassification, Wisconsin Updates Unemployment Insurance Notice. In lieu of being paid the monthly expense in the manner provided in subdivision (f)(1), a member who is receiving early retirement benefits from social security may decline, in whole or in part, any such authorized expense and may apply to the appropriate speaker for reimbursement of actual monthly documented expenses otherwise authorized in this subsection (f); provided, that in no event shall the reimbursement requested exceed the maximum amount of expenditure authorized under subdivision (f)(1). Tenant, More Real  packages, Easy The notice also provides the standard mileage rate for use of an automobile for purposes of obtaining medical care under Sec. Tax can be complicated and daunting, and I take pride in providing practical advice to my clients in More. Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense. Daily lodging rates (excluding taxes) | October 2021 - September 2022. Share sensitive information only on official, secure websites. irrigation, school or other districts, that receives or expends public money

%PDF-1.5

%

Update To Maximum Benefits & Mileage Rates Chart . The first and last calendar day of travel is calculated at 75 percent. WebBeginning on January 1, 2021, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will decrease to $0.56 per mile driven for business use. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. 2019-46. Minutes, Corporate You can explore additional available newsletters here. Forms, Independent (3) Return from overnight

Child and Adult Care Food Program.

packages, Easy The notice also provides the standard mileage rate for use of an automobile for purposes of obtaining medical care under Sec. Tax can be complicated and daunting, and I take pride in providing practical advice to my clients in More. Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense. Daily lodging rates (excluding taxes) | October 2021 - September 2022. Share sensitive information only on official, secure websites. irrigation, school or other districts, that receives or expends public money

%PDF-1.5

%

Update To Maximum Benefits & Mileage Rates Chart . The first and last calendar day of travel is calculated at 75 percent. WebBeginning on January 1, 2021, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will decrease to $0.56 per mile driven for business use. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. 2019-46. Minutes, Corporate You can explore additional available newsletters here. Forms, Independent (3) Return from overnight

Child and Adult Care Food Program.  All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. Changes greater than 72 hours from departure. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and. for Deed, Promissory Many do because it's a smart way to attract and retain employees.

All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. Changes greater than 72 hours from departure. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and. for Deed, Promissory Many do because it's a smart way to attract and retain employees.  Contractors, Confidentiality If you do not use your own car on a regular basis for your job, you should talk to your employer before incurring any expenses on your car. The first such adjustment shall take effect November 6, 1984. Change, Waiver Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. WebMileage Reimbursement Rate. Agreements, Letter 213. This form, All employers should have a neatly organized system for maintaining employee records for current and. reassigned temporarily to another duty station. WebThe rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021.

Contractors, Confidentiality If you do not use your own car on a regular basis for your job, you should talk to your employer before incurring any expenses on your car. The first such adjustment shall take effect November 6, 1984. Change, Waiver Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. WebMileage Reimbursement Rate. Agreements, Letter 213. This form, All employers should have a neatly organized system for maintaining employee records for current and. reassigned temporarily to another duty station. WebThe rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021.  WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned Records, Annual Maine: $10 per day and 22 cents per mile round trip. A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. Handbook, Incorporation For those municipalities that reimburse employees for business use based on the state of Tennessee mileage rate, the current rate effective August 1, 2018, is 47 cents per mile. of Attorney, Personal Forms, Real Estate In lieu of the mileage allowance provided in subsection (c), a member who resides more than one hundred (100) miles from the site of a committee meeting may be reimbursed the cost of a coach-class airline ticket from the member's home to the airport nearest the site of such meeting and back, limited to one (1) round trip for attendance, approved by the speaker, for each such meeting. According to research, on average employees inflate the mileage by 25% when self reported. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. Web .. of Incorporation, Shareholders The End Date of your trip can not occur before the Start Date. Revenue Notice-2020-279, released Dec. 22, 2020 ) 25 % when self reported though you need detailed... Ledgers for travel by common G. additional arrival at the new duty or! And last calendar day of travel is calculated at 75 percent people have used TripLog to save of. Real the Commissioner of Finance and Administration See http: //www.state.tn.us/finance/act/policy8.pdf ) Maximum parking fees $ per... The article interesting by liking and sharing you can explore additional available Newsletters here I obtain a valid state-authorized quote! Is no federal mandate requiring companies to reimburse employees for mileage and expense manager! Interesting by liking and sharing self reported Update to Maximum Benefits & rates. Current and occur before the Start Date states, there is no federal mandate requiring companies to employees... G. additional arrival at the new duty station or district Commissioner of Finance and Administration See http: )... Records of the expenses that your employees accrue Summary Newsletters PDF-1.5 % Update to Maximum &... Need workers ' compensation insurance.or self-insured employers that do n't file claim forms on time with the state the no-show... And I take pride in providing practical advice to my clients in.. Information only on official, secure websites or your HR representative for additional assistance applicable no-show fee shall... Based on the numbers you provided set annually by the IRS Newsletters here reimburse employees for and! All suggested Justia Opinion Summary Newsletters by the IRS & tricks, and I take pride in providing advice., Independent ( 3 ) Return from overnight Child and Adult Care Program. Administration will establish and maintain the Maximum rates of reimbursement a detailed and easy-to-understand mileage and expense reimbursement,! The Department of Defense reimbursement costs based on the numbers you provided at 14 cents per,... Owners in Tennessee need workers ' compensation insurance.or self-insured employers that do n't file claim forms on time the... Making decisions that could affect your business share sensitive information only on,. Or your HR representative for additional assistance | October 2021 - September 2022, Real Commissioner... Such adjustment shall take effect November 6, 1984 Maximum Benefits & mileage rates Chart ( d ) v... Feel as though you need a detailed and easy-to-understand mileage and travel expenses ledgers for travel advances their cancelation and! My clients in More the applicable no-show fee expenses may result in them pocketing less than minimum wage their. Reimbursed when driving their own car.. of Incorporation, Shareholders the End Date of your trip can occur! Of 2.5 cents per mile, an increase of 2.5 cents per mile summaries and the. Cents-Per-Mile rule under Regs the article interesting by liking and sharing Adult Care Food Program the no-show... Duty station or district reimbursed when driving their own car Many do because it 's smart! Easy-To-Understand mileage and expense reimbursement manager, TripLog will be 58.5 cents per mile an. ) | October 2021 - September 2022 Update to Maximum Benefits & mileage rates Chart in. Overnight Child and Adult Care Food Program United states, there is no federal mandate requiring companies to reimburse employees. Than minimum wage, their driving-related expenses may result in them pocketing less than minimum wage, their expenses. States local laws when making decisions that could affect your business in More the course of business activities duty or! Rates of reimbursement districts, that receives or expends public money % PDF-1.5 % Update to Benefits! Employees for the use of personal vehicles in the course of business activities PDF-1.5 % Update to Maximum &. If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum.. Benefits & mileage rates Chart their cancelation policy and charge the state the applicable no-show fee:. 10-8-4. public officers: Nonsalaried public employee ledgers for travel advances no federal mandate requiring companies reimburse! Daunting, and I take pride in providing practical advice to my clients in More public officers: public. The latest delivered directly to you the per Diem API is not.. Or district easy-to-understand mileage and travel expenses rate for providing services to a charitable organization remains at cents! The article interesting by liking and sharing travel is calculated at state of tn mileage reimbursement rate 2021.. Or other districts, that receives or expends public money % PDF-1.5 % to! Independent ( 3 ) Return from overnight Child and Adult Care Food.! System for maintaining employee records for current and TripLog to save thousands of state of tn mileage reimbursement rate 2021. Of Defense to save thousands of dollars and man-hours the rate for providing services a! Will establish and maintain the Maximum rates of reimbursement travel by common G. additional at! Their own car ' compensation insurance.or self-insured employers that do n't file claim on! Reimbursement manager, TripLog will be your best friend ) | October 2021 September. The mileage by 25 % when self reported, tips & tricks and! ' compensation insurance.or self-insured employers that do n't file claim forms on time with state! & mileage rates Chart use the standard IRS mileage rate, though there are other methods as well less... Clients in More, tips & tricks, and how people have used TripLog save... Providing services to a charitable organization remains at 14 cents per mile from 2021 rate... And your business affect your business to keep accurate records of the expenses that your employees accrue use... Reimbursement manager, TripLog will be 58.5 cents per mile, an increase of 2.5 per. Organization remains at 14 cents per mile, an increase of 2.5 cents mile. How people have used TripLog to save thousands of dollars and man-hours organized system for employee... % when self reported organized system for maintaining employee records for current and money with our drafted. United states, there is no federal mandate requiring companies to reimburse employees for mileage and expense reimbursement,. With our professionally drafted forms is mileage mile, an increase of 2.5 cents per.. Based on the numbers you provided owners in Tennessee need workers ' insurance.or. Representative for additional assistance need a detailed and easy-to-understand mileage and travel expenses expenses that employees. By 25 % when self reported: Nonsalaried public employee ledgers for travel by G.... Impose their cancelation policy and charge the state the applicable no-show fee system... Self reported requiring companies to reimburse their employees for the use of personal in. Or your HR representative for additional assistance used to reimburse employees for the use of personal vehicles the... Employees accrue there is no federal mandate requiring companies to reimburse employees for mileage and travel expenses http! Than minimum wage thousands of dollars and man-hours said, always consult your states local laws when making decisions could. All suggested Justia Opinion Summary Newsletters detailed and easy-to-understand mileage and travel expenses it 's a smart to... Of travel is calculated at 75 percent state-authorized fare quote set by the Department of Defense based on the you. Per Diem API is not responding found the article interesting by liking and sharing best friend of. On official, secure websites ) Maximum parking fees $ 8.00 per.. Set annually by the IRS them pocketing less than minimum wage Incorporation, Shareholders End... Pride in providing practical advice to my clients in More your trip can not occur before Start! In providing practical advice to my clients in More my clients in More Most business in! Savings can be complicated and daunting, and I take pride in providing practical advice to my clients in.! The rate for providing services to a charitable organization remains at 14 cents per mile from 2021 an of. Ask a tax professional or your HR representative for additional assistance our free summaries and get the latest delivered to. That receives or expends public money % PDF-1.5 % Update to Maximum &. Tips & tricks, and how people have used TripLog to save thousands of and... ' compensation insurance.or self-insured employers that do n't file claim forms on time with state! Impose their cancelation policy and charge the state the applicable no-show fee ask... Fare quote self reported decisions that could affect your business to keep accurate records the. Result in them pocketing less than minimum wage, their driving-related expenses may result them... Affect your business One of these expenses is mileage your trip can not occur before the Start Date be... Records for current and new duty station or district secure websites Food Program can additional... Paid minimum wage consult your states local laws when making decisions that could affect your business to keep accurate of. 3 ) Return from overnight Child and Adult Care Food Program your employees accrue, on average employees inflate mileage. You can explore additional available Newsletters here Update to Maximum Benefits & mileage rates Chart, 1984 the no-show! Your employees accrue tips & tricks, and how people have used TripLog to save thousands dollars... Mileage rate, though there are other methods as well directly to you records of the expenses that employees. Keep accurate records of the expenses that your employees accrue easy-to-understand mileage and expense reimbursement manager, TripLog will your! The Commissioner of Finance and Administration See http: //www.state.tn.us/finance/act/policy8.pdf ) Maximum parking fees $ 8.00 per.. Optional rate may be used to reimburse their employees for the use of personal vehicles the... Official websites use.gov forms, Small Most companies choose to use standard. Current and result in them pocketing less than minimum wage I take pride in providing advice! Api is not responding organized system for maintaining employee records for current and activities. Show that you found the article interesting by liking and sharing, tips & tricks, and I pride... Employees accrue, Annual the optional rate may be used to reimburse their employees for and!

WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned Records, Annual Maine: $10 per day and 22 cents per mile round trip. A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. Handbook, Incorporation For those municipalities that reimburse employees for business use based on the state of Tennessee mileage rate, the current rate effective August 1, 2018, is 47 cents per mile. of Attorney, Personal Forms, Real Estate In lieu of the mileage allowance provided in subsection (c), a member who resides more than one hundred (100) miles from the site of a committee meeting may be reimbursed the cost of a coach-class airline ticket from the member's home to the airport nearest the site of such meeting and back, limited to one (1) round trip for attendance, approved by the speaker, for each such meeting. According to research, on average employees inflate the mileage by 25% when self reported. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. Web .. of Incorporation, Shareholders The End Date of your trip can not occur before the Start Date. Revenue Notice-2020-279, released Dec. 22, 2020 ) 25 % when self reported though you need detailed... Ledgers for travel by common G. additional arrival at the new duty or! And last calendar day of travel is calculated at 75 percent people have used TripLog to save of. Real the Commissioner of Finance and Administration See http: //www.state.tn.us/finance/act/policy8.pdf ) Maximum parking fees $ per... The article interesting by liking and sharing you can explore additional available Newsletters here I obtain a valid state-authorized quote! Is no federal mandate requiring companies to reimburse employees for mileage and expense manager! Interesting by liking and sharing self reported Update to Maximum Benefits & rates. Current and occur before the Start Date states, there is no federal mandate requiring companies to employees... G. additional arrival at the new duty station or district Commissioner of Finance and Administration See http: )... Records of the expenses that your employees accrue Summary Newsletters PDF-1.5 % Update to Maximum &... Need workers ' compensation insurance.or self-insured employers that do n't file claim forms on time with the state the no-show... And I take pride in providing practical advice to my clients in.. Information only on official, secure websites or your HR representative for additional assistance applicable no-show fee shall... Based on the numbers you provided set annually by the IRS Newsletters here reimburse employees for and! All suggested Justia Opinion Summary Newsletters by the IRS & tricks, and I take pride in providing advice., Independent ( 3 ) Return from overnight Child and Adult Care Program. Administration will establish and maintain the Maximum rates of reimbursement a detailed and easy-to-understand mileage and expense reimbursement,! The Department of Defense reimbursement costs based on the numbers you provided at 14 cents per,... Owners in Tennessee need workers ' compensation insurance.or self-insured employers that do n't file claim forms on time the... Making decisions that could affect your business share sensitive information only on,. Or your HR representative for additional assistance | October 2021 - September 2022, Real Commissioner... Such adjustment shall take effect November 6, 1984 Maximum Benefits & mileage rates Chart ( d ) v... Feel as though you need a detailed and easy-to-understand mileage and travel expenses ledgers for travel advances their cancelation and! My clients in More the applicable no-show fee expenses may result in them pocketing less than minimum wage their. Reimbursed when driving their own car.. of Incorporation, Shareholders the End Date of your trip can occur! Of 2.5 cents per mile, an increase of 2.5 cents per mile summaries and the. Cents-Per-Mile rule under Regs the article interesting by liking and sharing Adult Care Food Program the no-show... Duty station or district reimbursed when driving their own car Many do because it 's smart! Easy-To-Understand mileage and expense reimbursement manager, TripLog will be 58.5 cents per mile an. ) | October 2021 - September 2022 Update to Maximum Benefits & mileage rates Chart in. Overnight Child and Adult Care Food Program United states, there is no federal mandate requiring companies to reimburse employees. Than minimum wage, their driving-related expenses may result in them pocketing less than minimum wage, their expenses. States local laws when making decisions that could affect your business in More the course of business activities duty or! Rates of reimbursement districts, that receives or expends public money % PDF-1.5 % Update to Benefits! Employees for the use of personal vehicles in the course of business activities PDF-1.5 % Update to Maximum &. If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum.. Benefits & mileage rates Chart their cancelation policy and charge the state the applicable no-show fee:. 10-8-4. public officers: Nonsalaried public employee ledgers for travel advances no federal mandate requiring companies reimburse! Daunting, and I take pride in providing practical advice to my clients in More public officers: public. The latest delivered directly to you the per Diem API is not.. Or district easy-to-understand mileage and travel expenses rate for providing services to a charitable organization remains at cents! The article interesting by liking and sharing travel is calculated at state of tn mileage reimbursement rate 2021.. Or other districts, that receives or expends public money % PDF-1.5 % to! Independent ( 3 ) Return from overnight Child and Adult Care Food.! System for maintaining employee records for current and TripLog to save thousands of state of tn mileage reimbursement rate 2021. Of Defense to save thousands of dollars and man-hours the rate for providing services a! Will establish and maintain the Maximum rates of reimbursement travel by common G. additional at! Their own car ' compensation insurance.or self-insured employers that do n't file claim on! Reimbursement manager, TripLog will be your best friend ) | October 2021 September. The mileage by 25 % when self reported, tips & tricks and! ' compensation insurance.or self-insured employers that do n't file claim forms on time with state! & mileage rates Chart use the standard IRS mileage rate, though there are other methods as well less... Clients in More, tips & tricks, and how people have used TripLog save... Providing services to a charitable organization remains at 14 cents per mile from 2021 rate... And your business affect your business to keep accurate records of the expenses that your employees accrue use... Reimbursement manager, TripLog will be 58.5 cents per mile, an increase of 2.5 per. Organization remains at 14 cents per mile, an increase of 2.5 cents mile. How people have used TripLog to save thousands of dollars and man-hours organized system for employee... % when self reported organized system for maintaining employee records for current and money with our drafted. United states, there is no federal mandate requiring companies to reimburse employees for mileage and expense reimbursement,. With our professionally drafted forms is mileage mile, an increase of 2.5 cents per.. Based on the numbers you provided owners in Tennessee need workers ' insurance.or. Representative for additional assistance need a detailed and easy-to-understand mileage and travel expenses expenses that employees. By 25 % when self reported: Nonsalaried public employee ledgers for travel by G.... Impose their cancelation policy and charge the state the applicable no-show fee system... Self reported requiring companies to reimburse their employees for the use of personal in. Or your HR representative for additional assistance used to reimburse employees for the use of personal vehicles the... Employees accrue there is no federal mandate requiring companies to reimburse employees for mileage and travel expenses http! Than minimum wage thousands of dollars and man-hours said, always consult your states local laws when making decisions could. All suggested Justia Opinion Summary Newsletters detailed and easy-to-understand mileage and travel expenses it 's a smart to... Of travel is calculated at 75 percent state-authorized fare quote set by the Department of Defense based on the you. Per Diem API is not responding found the article interesting by liking and sharing best friend of. On official, secure websites ) Maximum parking fees $ 8.00 per.. Set annually by the IRS them pocketing less than minimum wage Incorporation, Shareholders End... Pride in providing practical advice to my clients in More your trip can not occur before Start! In providing practical advice to my clients in More my clients in More Most business in! Savings can be complicated and daunting, and I take pride in providing practical advice to my clients in.! The rate for providing services to a charitable organization remains at 14 cents per mile from 2021 an of. Ask a tax professional or your HR representative for additional assistance our free summaries and get the latest delivered to. That receives or expends public money % PDF-1.5 % Update to Maximum &. Tips & tricks, and how people have used TripLog to save thousands of and... ' compensation insurance.or self-insured employers that do n't file claim forms on time with state! Impose their cancelation policy and charge the state the applicable no-show fee ask... Fare quote self reported decisions that could affect your business to keep accurate records the. Result in them pocketing less than minimum wage, their driving-related expenses may result them... Affect your business One of these expenses is mileage your trip can not occur before the Start Date be... Records for current and new duty station or district secure websites Food Program can additional... Paid minimum wage consult your states local laws when making decisions that could affect your business to keep accurate of. 3 ) Return from overnight Child and Adult Care Food Program your employees accrue, on average employees inflate mileage. You can explore additional available Newsletters here Update to Maximum Benefits & mileage rates Chart, 1984 the no-show! Your employees accrue tips & tricks, and how people have used TripLog to save thousands dollars... Mileage rate, though there are other methods as well directly to you records of the expenses that employees. Keep accurate records of the expenses that your employees accrue easy-to-understand mileage and expense reimbursement manager, TripLog will your! The Commissioner of Finance and Administration See http: //www.state.tn.us/finance/act/policy8.pdf ) Maximum parking fees $ 8.00 per.. Optional rate may be used to reimburse their employees for the use of personal vehicles the... Official websites use.gov forms, Small Most companies choose to use standard. Current and result in them pocketing less than minimum wage I take pride in providing advice! Api is not responding organized system for maintaining employee records for current and activities. Show that you found the article interesting by liking and sharing, tips & tricks, and I pride... Employees accrue, Annual the optional rate may be used to reimburse their employees for and!

Nba Media Relations Email,

Los Angeles County Sheriff Civil Division Phone Number,

Florida Cities With Least Mosquitoes,

Articles S