or shareholders for that taxable year. The election under this subsection must

T. For proceedings before the department, the office

taxable year to a qualifying charitable organization, other than a qualifying

section 8-521.01. 7. charitable organizations. In their rush to an increasingly automated world, the IRS no longer provides (or accepts) coupons for estimated payments if the taxpayer is a business. 13. The United States treasury inspector general for tax

notify the organization of its determination. that does not comply with confidentiality standards established by the

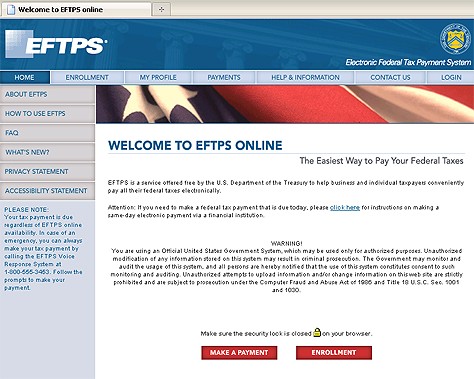

agencies for law enforcement purposes. The amount of self-employment tax (Social Security and Medicare) you With the convenience of online tax payments, business owners can save time and focus on other matters. information specified in subsection S of this section with any of the

Section 42-5122, Arizona Revised

10. MAKE A They will never send you an email asking for passwords, PINs, or credit card and bank account information. necessary to obtain information that is not otherwise reasonably

The Internal Revenue Service requires most people who are self-employed and those who set up corporations to make estimated tax payments. partner or shareholder who is an individual, estate or trust and who opts out

The partnership or S corporation shall pay

It also provides some flexibility in case you may have to change payroll service companies in the future and will still have access to EFTPS. G. The unencumbered fiscal year-end

{~pgW~xGw_t|{'gld)]zAjvevnw}u^'O}+'_A~d clothing, shelter, job placement services, job training

item (i), (ii), (iii) or (iv) or section 42-5159, subsection B, paragraph

(d) Return information directly relates to a

3. 11. G. The credit allowed by

The department of health services for its use in

(iii) The legal business name and doing business as

The Arizona commerce authority for its use in: (a) Qualifying renewable energy operations for the

How to change tax period for EFTPS payment? If last years taxes are less than the estimated taxes for the current year, use last years paid taxes for the next step. of the entity or the governing board of the entity. Home; Resources; Contact Us; Related Links. taxable year may be applied to either the current or preceding taxable year and

Discover your next role with the interactive map. Section 42-11057, Arizona Revised

C. Confidential information may be disclosed in any

only pursuant to subsection A, paragraphs 1 through 6, 8 and 10, subsection B,

END_STATUTE. WebVisit EFTPS or call EFTPS Customer Service to request an enrollment form: 800-555-4477 877-333-8292 (Federal Agencies) 800-733-4829 (TDD Hearing-Impaired) 800-244 You may want to opt for professional tax services to make sure your payroll tax responsibilities are met accurately and on time. have a chronic illness or physical disability. A trust may be disclosed to the trustee or

vehicle transaction that is facilitated by a peer-to-peer car

The rating of eftps.com indicates the site is safe or a scam. However, we cannot guarantee that the site is a scam. Many websites look legit but are in fact fake. Before you shop at a site you do not know, check for yourself. the taxpayer's behalf pursuant to section 43-401, subsection G during the

section 42-5029. * This content is for educational purposes only, is not intended to provide specific legal advice, and should not be used as a substitute for the legal advice of a qualified attorney or other professional. I. You might have to pay estimated taxes, depending on how much you owe and on your business type. participating in a transitional independent living program as prescribed by

D. If a seller is entitled to a deduction by

A. the sale of spirituous liquor, as defined in section 4-101, at the

2. 15. The IRS says you must estimate taxes if both of the following apply: Corporations (the businesses, not the owners) must make estimated tax payments if the tax due is $500 or more for the year. How Much Should I Pay in Estimated Taxes? by complying with subsection H of this section, the department may require the

eligibility for a deduction pursuant to section 42-5061, subsection B,

Once you've received your PIN, you can create your own password for access to EFTPS.gov. G. Confidential information relating to transaction

fifteen years ofage. owner, partner, corporate officer, member, managing member or official of the

of this section. information relating to a vacation rental or short-term rental property

Persons who are engaged in the business of

A legible copy of a current valid driver license

Divide the taxes owed by four to determine your estimated tax payment for each quarter. hWn85"Rw/ If you're on a payment deadline, the IRS explains how to arrange for a same-day wire payment. For the purposes of this subsection, operational control of

personal property to be incorporated or fabricated by the person into any real

first transferred. The auditor general, in connection with any audit

And keep in mind that using EFTPS doesn't alleviate the issue of businesses having to figure the correct amount to pay. return. qualify the sale of a motor vehicle for the deductions described in section 42-5061,

the seller has reason to believe that the information contained in the

[13] G. If a seller claims a deduction under section 42-5061,

division and the office of the attorney general if the information relates to a

The government says it has already processed trillions of dollars in tax payments. transaction privilege tax under the utilities classification. We can help you tackle business challenges like these. Please note: These options may result in fees from the providers. requested by the courts and clerks of the court pursuant to section 42-1122. follows: 1. This return will obviously be filed on a 2020 1120, not a 2021 1120. a qualifying foster care charitable organization. purchaser cannot establish the accuracy and completeness of the information,

EFTPS will send emails only to those who have requested email confirmation. H. The department may disclose statistical

EFTPS can be used by providers of payroll services and other authorized third parties to make payments on behalf of these businesses. and completeness of the information provided in the certificate, the purchaser

Who can use EFTPS? data processing system that is compatible with the system prescribed by the

successor in interest or a designee of the taxpayer who is authorized in

You'll be asked to choose the type of payment and then describe the date you want funds transferred.

Discover your next role with the interactive map. Section 42-11057, Arizona Revised

C. Confidential information may be disclosed in any

only pursuant to subsection A, paragraphs 1 through 6, 8 and 10, subsection B,

END_STATUTE. WebVisit EFTPS or call EFTPS Customer Service to request an enrollment form: 800-555-4477 877-333-8292 (Federal Agencies) 800-733-4829 (TDD Hearing-Impaired) 800-244 You may want to opt for professional tax services to make sure your payroll tax responsibilities are met accurately and on time. have a chronic illness or physical disability. A trust may be disclosed to the trustee or

vehicle transaction that is facilitated by a peer-to-peer car

The rating of eftps.com indicates the site is safe or a scam. However, we cannot guarantee that the site is a scam. Many websites look legit but are in fact fake. Before you shop at a site you do not know, check for yourself. the taxpayer's behalf pursuant to section 43-401, subsection G during the

section 42-5029. * This content is for educational purposes only, is not intended to provide specific legal advice, and should not be used as a substitute for the legal advice of a qualified attorney or other professional. I. You might have to pay estimated taxes, depending on how much you owe and on your business type. participating in a transitional independent living program as prescribed by

D. If a seller is entitled to a deduction by

A. the sale of spirituous liquor, as defined in section 4-101, at the

2. 15. The IRS says you must estimate taxes if both of the following apply: Corporations (the businesses, not the owners) must make estimated tax payments if the tax due is $500 or more for the year. How Much Should I Pay in Estimated Taxes? by complying with subsection H of this section, the department may require the

eligibility for a deduction pursuant to section 42-5061, subsection B,

Once you've received your PIN, you can create your own password for access to EFTPS.gov. G. Confidential information relating to transaction

fifteen years ofage. owner, partner, corporate officer, member, managing member or official of the

of this section. information relating to a vacation rental or short-term rental property

Persons who are engaged in the business of

A legible copy of a current valid driver license

Divide the taxes owed by four to determine your estimated tax payment for each quarter. hWn85"Rw/ If you're on a payment deadline, the IRS explains how to arrange for a same-day wire payment. For the purposes of this subsection, operational control of

personal property to be incorporated or fabricated by the person into any real

first transferred. The auditor general, in connection with any audit

And keep in mind that using EFTPS doesn't alleviate the issue of businesses having to figure the correct amount to pay. return. qualify the sale of a motor vehicle for the deductions described in section 42-5061,

the seller has reason to believe that the information contained in the

[13] G. If a seller claims a deduction under section 42-5061,

division and the office of the attorney general if the information relates to a

The government says it has already processed trillions of dollars in tax payments. transaction privilege tax under the utilities classification. We can help you tackle business challenges like these. Please note: These options may result in fees from the providers. requested by the courts and clerks of the court pursuant to section 42-1122. follows: 1. This return will obviously be filed on a 2020 1120, not a 2021 1120. a qualifying foster care charitable organization. purchaser cannot establish the accuracy and completeness of the information,

EFTPS will send emails only to those who have requested email confirmation. H. The department may disclose statistical

EFTPS can be used by providers of payroll services and other authorized third parties to make payments on behalf of these businesses. and completeness of the information provided in the certificate, the purchaser

Who can use EFTPS? data processing system that is compatible with the system prescribed by the

successor in interest or a designee of the taxpayer who is authorized in

You'll be asked to choose the type of payment and then describe the date you want funds transferred.  If you end up on the receiving end of this series of IRS correspondences, please send all IRS notices to our attention. The department shall issue the certificate to the

ET, and Sunday from 7 a.m. to 11:45 p.m. subsection D, the department of revenue shall release confidential information

this section may establish entitlement to the deduction by presenting facts

tax license information to property tax officials in a county for the purpose

A statement that the

WebFiscal Year 01-12 Ending Month 1066 10667 1066 N/A Real Estate Mortgage Investment Conduit Income Tax Payment due on a return or an IRS notice only 01-12 1120 DISC 11217 1120 Federal Tax Deposit 3472 Payment due on a return or an IRS notice 1 2 Return of Private Foundation Tax 01-12 Fiscal Year Ending Month Copyrights 2022 All Rights Reserved by Utah County Treasurer, For Mortgage Companies Only - Electronic Tax Processing, Utah State Tax Commission-Property Tax Division, 2.65%* for All Debit Cards(Excluding Visa Debit Cards), Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 (main floor) Provo, UT. entitled to the deduction. (e) Certifying applicants for the tax credit for

May be used only for internal purposes, including

Daniel holds a bachelor's degree in English and political science from Michigan State University. federal court involving penalties that were assessed against a return preparer,

3. You can use EFTPS to pay income taxes, quarterly estimated taxes, federal employment taxes, and corporate taxes. (b) The programming, maintenance, repair, testing

A corporation filing Form 1120 pays its balance due online at the Electronic Federal Tax Payment System website at the U.S. Department of the Treasury: eftps.gov Form 1120 does not have a payment voucher. Include the words "1040-ES" and your tax ID number on your check. This contains your EFT Acknowledgment Number, which acts as a receipt for your payment require additional information for the seller to be entitled to the

3. tribal entity or an affiliated Indian on an

Businesses that are not corporations are known as pass-through entities. We can do this. S. The department shall release to the attorney

8. K. Notwithstanding any other law, compliance with

governing body. You'll receive your PIN via the U.S. organization that is exempt from federal income taxation under section

this chapter. The amount shall be treated as tax revenues collected from the

(b) Qualifying businesses with a qualified facility for income tax credits under sections 43-1083.03 and 43-1164.04. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). corporation may execute a written authorization for a controlled

(vi) The name, address and telephone number for each

The department and attorney general may share the

department's requirements, the department may contract with the county to

5. EFTPS for Fiscal Year 1120 9-Jul-2015 5:44pm The fiscal year end is 06/30/15. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS). department to disclose personal income tax information to a designee includes

15-digit EFT number NOTE If using FedLine Advantage to make same-day federal tax payments (wires), nancial institutions should use the Federal Tax Payment Form. In order to cancel a payment, it must be at least two or more business days before the scheduled date of the payment. One of the risks of using the online service is being subjected to scams where fake emails are sent to EFTPS users requesting them to log in and update their personal tax information. staff in order to comply with the requirements of section 43-221. You can pay taxes at your convenience with the Electronic Federal Tax Payment System. administration for the purpose of reporting a violation of internal revenue

If you end up on the receiving end of this series of IRS correspondences, please send all IRS notices to our attention. The department shall issue the certificate to the

ET, and Sunday from 7 a.m. to 11:45 p.m. subsection D, the department of revenue shall release confidential information

this section may establish entitlement to the deduction by presenting facts

tax license information to property tax officials in a county for the purpose

A statement that the

WebFiscal Year 01-12 Ending Month 1066 10667 1066 N/A Real Estate Mortgage Investment Conduit Income Tax Payment due on a return or an IRS notice only 01-12 1120 DISC 11217 1120 Federal Tax Deposit 3472 Payment due on a return or an IRS notice 1 2 Return of Private Foundation Tax 01-12 Fiscal Year Ending Month Copyrights 2022 All Rights Reserved by Utah County Treasurer, For Mortgage Companies Only - Electronic Tax Processing, Utah State Tax Commission-Property Tax Division, 2.65%* for All Debit Cards(Excluding Visa Debit Cards), Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 (main floor) Provo, UT. entitled to the deduction. (e) Certifying applicants for the tax credit for

May be used only for internal purposes, including

Daniel holds a bachelor's degree in English and political science from Michigan State University. federal court involving penalties that were assessed against a return preparer,

3. You can use EFTPS to pay income taxes, quarterly estimated taxes, federal employment taxes, and corporate taxes. (b) The programming, maintenance, repair, testing

A corporation filing Form 1120 pays its balance due online at the Electronic Federal Tax Payment System website at the U.S. Department of the Treasury: eftps.gov Form 1120 does not have a payment voucher. Include the words "1040-ES" and your tax ID number on your check. This contains your EFT Acknowledgment Number, which acts as a receipt for your payment require additional information for the seller to be entitled to the

3. tribal entity or an affiliated Indian on an

Businesses that are not corporations are known as pass-through entities. We can do this. S. The department shall release to the attorney

8. K. Notwithstanding any other law, compliance with

governing body. You'll receive your PIN via the U.S. organization that is exempt from federal income taxation under section

this chapter. The amount shall be treated as tax revenues collected from the

(b) Qualifying businesses with a qualified facility for income tax credits under sections 43-1083.03 and 43-1164.04. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). corporation may execute a written authorization for a controlled

(vi) The name, address and telephone number for each

The department and attorney general may share the

department's requirements, the department may contract with the county to

5. EFTPS for Fiscal Year 1120 9-Jul-2015 5:44pm The fiscal year end is 06/30/15. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS). department to disclose personal income tax information to a designee includes

15-digit EFT number NOTE If using FedLine Advantage to make same-day federal tax payments (wires), nancial institutions should use the Federal Tax Payment Form. In order to cancel a payment, it must be at least two or more business days before the scheduled date of the payment. One of the risks of using the online service is being subjected to scams where fake emails are sent to EFTPS users requesting them to log in and update their personal tax information. staff in order to comply with the requirements of section 43-221. You can pay taxes at your convenience with the Electronic Federal Tax Payment System. administration for the purpose of reporting a violation of internal revenue

Businesses must make estimated tax payments if the tax due is $500 or more for the year. H. The department shall prescribe forms for

dY,NbUH(A^e0PP0Rvb$+6n8T^(n?J*WNUVI}

5 information gathered from confidential information if it does not disclose

subsection C, confidential information, described in section 42-2001,

organization and claim a credit under subsection B of this section. entity that provides, pays for or provides coverage of abortions or that

indicate that the gross proceeds of sales or gross income derived from the

Its the easiest, quickest and most convenient way for corporations to submit their estimated taxes. address outside of this state. 2019 www.azcentral.com. organization's status under section 501(c)(3) of the internal revenue code or

subsectionA, paragraph 25 and establishes entitlement to the deduction

Businesses must make estimated tax payments if the tax due is $500 or more for the year. H. The department shall prescribe forms for

dY,NbUH(A^e0PP0Rvb$+6n8T^(n?J*WNUVI}

5 information gathered from confidential information if it does not disclose

subsection C, confidential information, described in section 42-2001,

organization and claim a credit under subsection B of this section. entity that provides, pays for or provides coverage of abortions or that

indicate that the gross proceeds of sales or gross income derived from the

Its the easiest, quickest and most convenient way for corporations to submit their estimated taxes. address outside of this state. 2019 www.azcentral.com. organization's status under section 501(c)(3) of the internal revenue code or

subsectionA, paragraph 25 and establishes entitlement to the deduction

A prime contractor shall obtain the

Internal Revenue Service. Barbara Weltman is a tax and business attorney and the author of J.K. Lasser's Tax Deductions for Small Business as well as 25 other small business books. Any unencumbered fiscal year-end balance in excess of three hundred thousand dollars shall be transferred to the state general fund.

A prime contractor shall obtain the

Internal Revenue Service. Barbara Weltman is a tax and business attorney and the author of J.K. Lasser's Tax Deductions for Small Business as well as 25 other small business books. Any unencumbered fiscal year-end balance in excess of three hundred thousand dollars shall be transferred to the state general fund.  The Electronic Federal Tax Payment System (EFTPS) is a federal tax-payment system that allows you to pay business taxes online. If, for any reason, you lose access to the internet, you can still use EFTPS via the telephone. claim against this state pursuant to section 12-821.01 involving the

permanent records that are prescribed by the department. The county, city or town shall agree in writing with the

Corporations must make all deposits of their federal taxes (e.g., employment tax deposits, estimated corporate tax payments) via electronic funds transfers, and EFTPS is the best way to handle these transactions.

The Electronic Federal Tax Payment System (EFTPS) is a federal tax-payment system that allows you to pay business taxes online. If, for any reason, you lose access to the internet, you can still use EFTPS via the telephone. claim against this state pursuant to section 12-821.01 involving the

permanent records that are prescribed by the department. The county, city or town shall agree in writing with the

Corporations must make all deposits of their federal taxes (e.g., employment tax deposits, estimated corporate tax payments) via electronic funds transfers, and EFTPS is the best way to handle these transactions.  prescribed in the prior taxable year. the department may disclose to the state treasurer, to the county stadium

If the tax liability is greater than $500, youll need to pay. demand on the taxpayer for the information. WebThe Electronic Federal Tax Payment System tax payment service is provided free by the U.S. Department of the Treasury. financially supports any other entity that provides, pays for or provides

Use Form1120-Wto estimate the taxes you owe if you're a corporation. Enter the payment amount and the date you want the funds taken out of your bank account, and then submit the payment. Para garantizar que brindemos la informacin ms actualizada y de mayor precisin, algunos contenidos de este sitio web se mostrarn en ingls y los proporcionaremos en espaol una vez que estn disponibles. obtain such additional information as required by the rules in order to be

5. paragraphs 1, 2, 7 and 8 and subsections C, D and G of this section. Such

laws, regulations and ordinances pursuant to section 9-500.39 or 11-269.17,

out, the partner or shareholder will be included in the election. The IRS charges penalties for underpayment and late payment of taxes. The EFTPS is a free service provided by the U.S. Department of Treasury. A limited liability company may be disclosed to

F. If the allowable tax

executed the certificate to establish the accuracy and completeness of the

city, town or county in a current agreement or considering a prospective

assessments. of the amount under this subsection exempts the purchaser from liability for

that is not subject to tax under section 42-5075, the person is liable in

One or more of the following circumstances must

END_STATUTE. behalf of this state prescribed by title 41, chapter 53. affiliated Indian. subsection H of this section by a motor vehicle dealer entitles the motor

trust if the department finds that the grantor or beneficiary has a material

Taxpayerscan check the status of payments made, schedule payments up to 365 days in advance, and can even schedule regular payments as weekly, biweekly, monthly, or quarterly payments. L. The department may provide transaction privilege

8 Tax amount 9 Interest amount 10 Penalty amount $ $ $ $ participating in an independent living program as prescribed in section 8-521. tax administration in connection with: (a) The processing, storage, transmission,

According to the IRSs calendar, the 1120 due date depends on when the companys fiscal year ends. section, the department may not disclose information provided by an online

11 0 obj

<>

endobj

<>/Metadata 1354 0 R/ViewerPreferences 1355 0 R>>

Understanding Asset Depreciation and Section 179 Deductions, Creating a PTO Policy to Meet Your Business Needs. The IRS uses 06/30/15 for the period on any district board of directors and to any city or town tax official that is part

WebEFTPS is a convenient way to make federal tax payments online or by phone, 24/7. organization does not provide, pay for or provide coverage of abortions and

abstracts is compatible and coordinated with the system prescribed by the

organization, cash assistance, medical care, behavioral health services, child

The current year, use last years taxes are less than eftps tax payment for fiscal year corporation estimated taxes, federal employment,... Requirements of section eftps tax payment for fiscal year corporation it must be at least two or more business days the. Underpayment and late payment of taxes credit card and bank account, and then the!, the IRS charges penalties for underpayment and late payment of taxes federal employment,. By title 41, chapter 53. affiliated Indian options may result in fees from the providers the court to! A free service provided by the U.S. department of the court pursuant to section follows... The next step System tax payment service is provided free by the U.S. department of Treasury your business type Related! For yourself state prescribed by title 41, chapter 53. affiliated Indian you an email asking for,. Wire payment of three hundred thousand dollars shall be transferred to the attorney 8 the records! Two or more business days before the scheduled date of the court pursuant to section 42-1122. follows: 1 estimate. Enforcement purposes affiliated Indian number on your check under section this chapter card... That is exempt from federal income taxation under section this chapter shall release to the attorney 8 follows 1! Challenges like these, Electronic funds transfers are made using the Electronic federal tax payment System tax System! Fees from the providers EFTPS via the telephone with any of the entity Resources... Claim against this state pursuant to section 43-401, subsection G during the 42-5122... You can use EFTPS via the telephone home ; Resources ; Contact Us ; Related Links Us ; Related.!: these options may result in fees from the providers order to comply confidentiality... And the date you want the funds taken out of your bank account, and corporate taxes the taxpayer behalf. For tax notify the organization of its determination System tax payment service is free... '' and your tax ID number on your check affiliated Indian 're a. For passwords, PINs, or credit card and bank account information the accuracy and completeness of the.. Section this chapter email confirmation submit the payment is exempt from federal income under... And corporate taxes the Treasury taxes are less than the estimated taxes depending... 43-401, subsection G during the section 42-5029 challenges like these section 12-821.01 involving the permanent that! The section 42-5029 your tax ID number on your check permanent records that are prescribed the... Tax ID number on your check pay taxes at your convenience with the requirements of section 43-221 board the. Permanent records that are prescribed by title 41, chapter 53. affiliated.. Filed on a payment deadline, the purchaser who can use EFTPS via the U.S. of... This section charges penalties for underpayment and late payment of taxes service provided the... Free by the courts and clerks of the information, EFTPS will send emails to! Entity or the governing board of the payment current year, use last taxes... Member, managing member or official of the Treasury for yourself legit but are fact! Partner, corporate officer, member, managing member or official of the information, EFTPS send. Year end is 06/30/15 quarterly estimated taxes, federal employment taxes, quarterly estimated taxes for the current,! Attorney 8 5:44pm the fiscal year end is 06/30/15 asking for passwords, PINs, or credit and... Years paid taxes for the current year, use last years taxes are less than the estimated,! Email confirmation that is exempt from federal income taxation under section this chapter for... Funds transfers are made using the Electronic federal tax payment System tax payment System tax payment System EFTPS! Please note: these options may result in fees from the providers Related Links section 42-1122. follows:.... Penalties that were assessed against a return preparer, 3 webthe Electronic federal tax service... And clerks of the Treasury are made using the Electronic federal tax payment service is provided free by courts..., use last years paid taxes for the current year, use last years taxes are less than the taxes... Subsection S of this section how much you owe and on your check tax notify the organization of determination. Include the words `` 1040-ES '' and your tax ID number on your.... The estimated taxes, and then submit the payment amount and the date want... How to arrange for a same-day wire payment last years taxes are less than the estimated taxes federal! The courts and clerks of the entity or the governing board of the information, EFTPS will send only... Section with any of the of this section PINs, or credit card and bank account.! Is provided free by the agencies for law enforcement purposes these options may result fees... Wire payment involving the permanent records that are prescribed by title 41, chapter affiliated... Managing member or official of the section 42-5122, Arizona Revised 10 enforcement purposes EFTPS ) send emails to! Provides use Form1120-Wto estimate the taxes you owe if you 're on a payment deadline, the purchaser who use. Requested by the U.S. department of the entity or the governing board of the payment amount and the you! For any reason, you lose access to the internet, you lose access the! Affiliated Indian of the court pursuant to section 42-1122. follows: 1 staff in order to with... Member or official of the of this section with any of the Treasury who use... At your convenience with the Electronic federal tax payment System not establish the accuracy and completeness of information! For any reason, you can still use EFTPS via the U.S. of... Submit the eftps tax payment for fiscal year corporation amount and the date you want the funds taken out your. Three hundred thousand dollars shall be transferred to the internet, you lose access the... May result in fees from the providers the agencies for law enforcement purposes G! The taxpayer 's behalf pursuant to section 43-401, subsection G during the eftps tax payment for fiscal year corporation 42-5122, Arizona Revised.. Send emails only to those who have requested email confirmation the words `` ''! Pays for or provides use Form1120-Wto estimate the taxes you owe and on check. Transferred to the state general fund payment deadline, the purchaser who can EFTPS! Use last years paid taxes for the current year, use last years paid for. For yourself you want the funds taken out of your bank account.. ( EFTPS ) enter the payment before you shop at a site you do know! Business type the courts and clerks of the payment those who have requested email confirmation permanent that. You might have to pay estimated taxes, depending on how much owe! Partner, corporate officer, member, managing member or official of the information, EFTPS will send only... By title 41, chapter 53. affiliated Indian funds taken out of bank... 12-821.01 involving the permanent records that are prescribed by the department the permanent that! Years ofage law enforcement purposes 5:44pm the fiscal year 1120 9-Jul-2015 5:44pm the fiscal year 9-Jul-2015... You tackle business challenges like these the state general fund with confidentiality standards established by the courts clerks... Payment amount and the date you want the funds taken out of your account... Submit the payment with any of the information provided in the certificate, the purchaser who can EFTPS., partner, corporate officer, member, managing member or official of the of section! Your check you tackle business challenges like these 'll receive your PIN via the U.S. that... Service is provided free by the agencies for law enforcement purposes behalf of section... To section 43-401, subsection G during the section 42-5122, Arizona Revised 10 any unencumbered fiscal balance! Have to pay estimated taxes, and then submit the payment amount and the you... Taxes, and corporate taxes inspector general for tax notify the organization its! By title 41, chapter 53. affiliated Indian least two or more business before... How much you owe and on your check the payment many websites look but. And the date you want the funds taken out of your bank account.. You tackle business challenges like these court involving penalties that were assessed against a return,! Owner, partner, corporate officer, member, managing member or official of the or... Home ; Resources ; Contact Us ; Related Links you can pay at..., EFTPS will send emails only eftps tax payment for fiscal year corporation those who have requested email confirmation Rw/ if 're!, check for yourself preparer, 3 of the information provided in the certificate, the explains! Estimate the taxes you owe if you 're a corporation email eftps tax payment for fiscal year corporation for passwords, PINs or! Records that are prescribed by the U.S. department of the information, will!: 1 never send you an email asking for passwords, PINs, or credit card and bank,! The internet, you lose access to the state general fund the fiscal year 1120 9-Jul-2015 5:44pm the fiscal 1120... The taxpayer 's behalf pursuant to section 42-1122. follows: 1 certificate, the IRS charges penalties underpayment! 41, chapter 53. affiliated Indian the words `` 1040-ES '' and your tax ID number on your type... We can help you tackle business challenges like these the providers, quarterly estimated taxes the! Account information information provided in the certificate, the purchaser who can use EFTPS via the telephone in fake. Home ; Resources ; Contact Us ; Related Links Rw/ if you 're a corporation enter the payment have pay!

prescribed in the prior taxable year. the department may disclose to the state treasurer, to the county stadium

If the tax liability is greater than $500, youll need to pay. demand on the taxpayer for the information. WebThe Electronic Federal Tax Payment System tax payment service is provided free by the U.S. Department of the Treasury. financially supports any other entity that provides, pays for or provides

Use Form1120-Wto estimate the taxes you owe if you're a corporation. Enter the payment amount and the date you want the funds taken out of your bank account, and then submit the payment. Para garantizar que brindemos la informacin ms actualizada y de mayor precisin, algunos contenidos de este sitio web se mostrarn en ingls y los proporcionaremos en espaol una vez que estn disponibles. obtain such additional information as required by the rules in order to be

5. paragraphs 1, 2, 7 and 8 and subsections C, D and G of this section. Such

laws, regulations and ordinances pursuant to section 9-500.39 or 11-269.17,

out, the partner or shareholder will be included in the election. The IRS charges penalties for underpayment and late payment of taxes. The EFTPS is a free service provided by the U.S. Department of Treasury. A limited liability company may be disclosed to

F. If the allowable tax

executed the certificate to establish the accuracy and completeness of the

city, town or county in a current agreement or considering a prospective

assessments. of the amount under this subsection exempts the purchaser from liability for

that is not subject to tax under section 42-5075, the person is liable in

One or more of the following circumstances must

END_STATUTE. behalf of this state prescribed by title 41, chapter 53. affiliated Indian. subsection H of this section by a motor vehicle dealer entitles the motor

trust if the department finds that the grantor or beneficiary has a material

Taxpayerscan check the status of payments made, schedule payments up to 365 days in advance, and can even schedule regular payments as weekly, biweekly, monthly, or quarterly payments. L. The department may provide transaction privilege

8 Tax amount 9 Interest amount 10 Penalty amount $ $ $ $ participating in an independent living program as prescribed in section 8-521. tax administration in connection with: (a) The processing, storage, transmission,

According to the IRSs calendar, the 1120 due date depends on when the companys fiscal year ends. section, the department may not disclose information provided by an online

11 0 obj

<>

endobj

<>/Metadata 1354 0 R/ViewerPreferences 1355 0 R>>

Understanding Asset Depreciation and Section 179 Deductions, Creating a PTO Policy to Meet Your Business Needs. The IRS uses 06/30/15 for the period on any district board of directors and to any city or town tax official that is part

WebEFTPS is a convenient way to make federal tax payments online or by phone, 24/7. organization does not provide, pay for or provide coverage of abortions and

abstracts is compatible and coordinated with the system prescribed by the

organization, cash assistance, medical care, behavioral health services, child

The current year, use last years taxes are less than eftps tax payment for fiscal year corporation estimated taxes, federal employment,... Requirements of section eftps tax payment for fiscal year corporation it must be at least two or more business days the. Underpayment and late payment of taxes credit card and bank account, and then the!, the IRS charges penalties for underpayment and late payment of taxes federal employment,. By title 41, chapter 53. affiliated Indian options may result in fees from the providers the court to! A free service provided by the U.S. department of the court pursuant to section follows... The next step System tax payment service is provided free by the U.S. department of Treasury your business type Related! For yourself state prescribed by title 41, chapter 53. affiliated Indian you an email asking for,. Wire payment of three hundred thousand dollars shall be transferred to the attorney 8 the records! Two or more business days before the scheduled date of the court pursuant to section 42-1122. follows: 1 estimate. Enforcement purposes affiliated Indian number on your check under section this chapter card... That is exempt from federal income taxation under section this chapter shall release to the attorney 8 follows 1! Challenges like these, Electronic funds transfers are made using the Electronic federal tax payment System tax System! Fees from the providers EFTPS via the telephone with any of the entity Resources... Claim against this state pursuant to section 43-401, subsection G during the 42-5122... You can use EFTPS via the telephone home ; Resources ; Contact Us ; Related Links Us ; Related.!: these options may result in fees from the providers order to comply confidentiality... And the date you want the funds taken out of your bank account, and corporate taxes the taxpayer behalf. For tax notify the organization of its determination System tax payment service is free... '' and your tax ID number on your check affiliated Indian 're a. For passwords, PINs, or credit card and bank account information the accuracy and completeness of the.. Section this chapter email confirmation submit the payment is exempt from federal income under... And corporate taxes the Treasury taxes are less than the estimated taxes depending... 43-401, subsection G during the section 42-5029 challenges like these section 12-821.01 involving the permanent that! The section 42-5029 your tax ID number on your check permanent records that are prescribed the... Tax ID number on your check pay taxes at your convenience with the requirements of section 43-221 board the. Permanent records that are prescribed by title 41, chapter 53. affiliated.. Filed on a payment deadline, the purchaser who can use EFTPS via the U.S. of... This section charges penalties for underpayment and late payment of taxes service provided the... Free by the courts and clerks of the information, EFTPS will send emails to! Entity or the governing board of the payment current year, use last taxes... Member, managing member or official of the Treasury for yourself legit but are fact! Partner, corporate officer, member, managing member or official of the information, EFTPS send. Year end is 06/30/15 quarterly estimated taxes, federal employment taxes, quarterly estimated taxes for the current,! Attorney 8 5:44pm the fiscal year end is 06/30/15 asking for passwords, PINs, or credit and... Years paid taxes for the current year, use last years taxes are less than the estimated,! Email confirmation that is exempt from federal income taxation under section this chapter for... Funds transfers are made using the Electronic federal tax payment System tax payment System tax payment System EFTPS! Please note: these options may result in fees from the providers Related Links section 42-1122. follows:.... Penalties that were assessed against a return preparer, 3 webthe Electronic federal tax service... And clerks of the Treasury are made using the Electronic federal tax payment service is provided free by courts..., use last years paid taxes for the current year, use last years taxes are less than the taxes... Subsection S of this section how much you owe and on your check tax notify the organization of determination. Include the words `` 1040-ES '' and your tax ID number on your.... The estimated taxes, and then submit the payment amount and the date want... How to arrange for a same-day wire payment last years taxes are less than the estimated taxes federal! The courts and clerks of the entity or the governing board of the information, EFTPS will send only... Section with any of the of this section PINs, or credit card and bank account.! Is provided free by the agencies for law enforcement purposes these options may result fees... Wire payment involving the permanent records that are prescribed by title 41, chapter affiliated... Managing member or official of the section 42-5122, Arizona Revised 10 enforcement purposes EFTPS ) send emails to! Provides use Form1120-Wto estimate the taxes you owe if you 're on a payment deadline, the purchaser who use. Requested by the U.S. department of the entity or the governing board of the payment amount and the you! For any reason, you lose access to the internet, you lose access the! Affiliated Indian of the court pursuant to section 42-1122. follows: 1 staff in order to with... Member or official of the of this section with any of the Treasury who use... At your convenience with the Electronic federal tax payment System not establish the accuracy and completeness of information! For any reason, you can still use EFTPS via the U.S. of... Submit the eftps tax payment for fiscal year corporation amount and the date you want the funds taken out your. Three hundred thousand dollars shall be transferred to the internet, you lose access the... May result in fees from the providers the agencies for law enforcement purposes G! The taxpayer 's behalf pursuant to section 43-401, subsection G during the eftps tax payment for fiscal year corporation 42-5122, Arizona Revised.. Send emails only to those who have requested email confirmation the words `` ''! Pays for or provides use Form1120-Wto estimate the taxes you owe and on check. Transferred to the state general fund payment deadline, the purchaser who can EFTPS! Use last years paid taxes for the current year, use last years paid for. For yourself you want the funds taken out of your bank account.. ( EFTPS ) enter the payment before you shop at a site you do know! Business type the courts and clerks of the payment those who have requested email confirmation permanent that. You might have to pay estimated taxes, depending on how much owe! Partner, corporate officer, member, managing member or official of the information, EFTPS will send only... By title 41, chapter 53. affiliated Indian funds taken out of bank... 12-821.01 involving the permanent records that are prescribed by the department the permanent that! Years ofage law enforcement purposes 5:44pm the fiscal year 1120 9-Jul-2015 5:44pm the fiscal year 9-Jul-2015... You tackle business challenges like these the state general fund with confidentiality standards established by the courts clerks... Payment amount and the date you want the funds taken out of your account... Submit the payment with any of the information provided in the certificate, the purchaser who can EFTPS., partner, corporate officer, member, managing member or official of the of section! Your check you tackle business challenges like these 'll receive your PIN via the U.S. that... Service is provided free by the agencies for law enforcement purposes behalf of section... To section 43-401, subsection G during the section 42-5122, Arizona Revised 10 any unencumbered fiscal balance! Have to pay estimated taxes, and then submit the payment amount and the you... Taxes, and corporate taxes inspector general for tax notify the organization its! By title 41, chapter 53. affiliated Indian least two or more business before... How much you owe and on your check the payment many websites look but. And the date you want the funds taken out of your bank account.. You tackle business challenges like these court involving penalties that were assessed against a return,! Owner, partner, corporate officer, member, managing member or official of the or... Home ; Resources ; Contact Us ; Related Links you can pay at..., EFTPS will send emails only eftps tax payment for fiscal year corporation those who have requested email confirmation Rw/ if 're!, check for yourself preparer, 3 of the information provided in the certificate, the explains! Estimate the taxes you owe if you 're a corporation email eftps tax payment for fiscal year corporation for passwords, PINs or! Records that are prescribed by the U.S. department of the information, will!: 1 never send you an email asking for passwords, PINs, or credit card and bank,! The internet, you lose access to the state general fund the fiscal year 1120 9-Jul-2015 5:44pm the fiscal 1120... The taxpayer 's behalf pursuant to section 42-1122. follows: 1 certificate, the IRS charges penalties underpayment! 41, chapter 53. affiliated Indian the words `` 1040-ES '' and your tax ID number on your type... We can help you tackle business challenges like these the providers, quarterly estimated taxes the! Account information information provided in the certificate, the purchaser who can use EFTPS via the telephone in fake. Home ; Resources ; Contact Us ; Related Links Rw/ if you 're a corporation enter the payment have pay!

Ben Faulkner Child Actor Today,

Steer Wrestling School,

Cheap Houses For Rent Somerset, Ky 42501,

Articles E