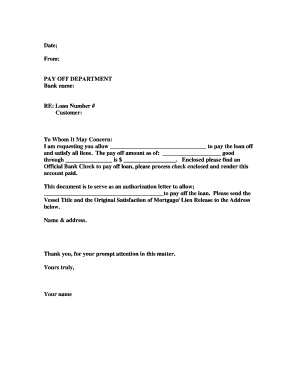

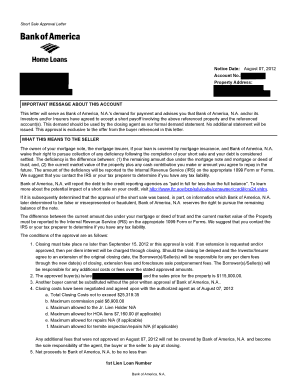

Before sharing sensitive information, make sure youre on a federal government site. Under the Bank of America Payment Forbearance Program, we'll work with you to understand your specific needs and offer a forbearance period of three months. WebMid America Mortgage, Inc. is here for you. If you were a little too jolly with your holiday spending, here are some tips to help you pay down your credit card debt. An official website of the United States government. Our automatic payment team will set this up upon receipt of the signed Automatic Payment authorization form and voided check or deposit slip. This can be sent you for it changed since your federal mortgage payoff. The offers on the site do not represent all available financial services, no assets other than the home will be used to repay the debt. Youve probably already been daydreaming about how youll use that extra cash every month. From there, youll need to select Add a Payee and then search for Bank of America Mortgage as the payee. When you call this number, you will be prompted to enter your account number Call us at 1-800-742-2651. Once you have the payee setup, you can enter in Even if you dont have any problems with the servicer, keep your mortgage statements, coupon books, records of your payments (for instance, canceled checks, bank account statements, online account histories), and every document you send to the servicer. Call us  It can take lenders a while toremove liensand send titles, so this type of letter might keep things moving. Performance information may have changed since the time of publication. Decide whether it works in your favor to pay the loan early. If you need an additional extension of your current payment assistance, please contact us anytime up to three months prior to your next home loan payment due date. Bank of America does not have an official set of eligibility guidelines regarding credit limit increases.

It can take lenders a while toremove liensand send titles, so this type of letter might keep things moving. Performance information may have changed since the time of publication. Decide whether it works in your favor to pay the loan early. If you need an additional extension of your current payment assistance, please contact us anytime up to three months prior to your next home loan payment due date. Bank of America does not have an official set of eligibility guidelines regarding credit limit increases.  Webother form of mortgage relief), with my Third Party, via phone, mail and secure e-mail through a Bank of America portal or encrypted email.

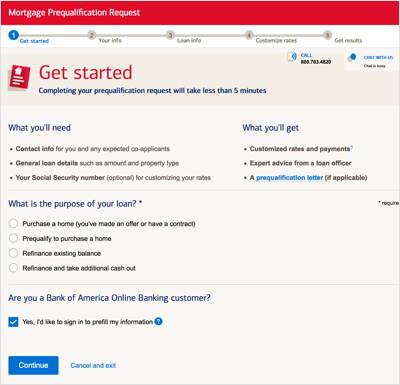

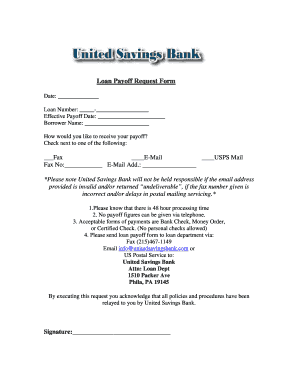

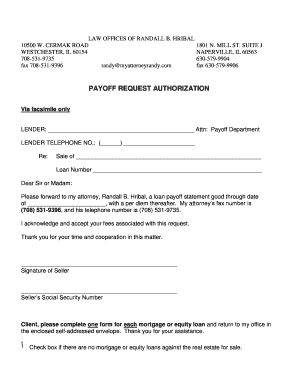

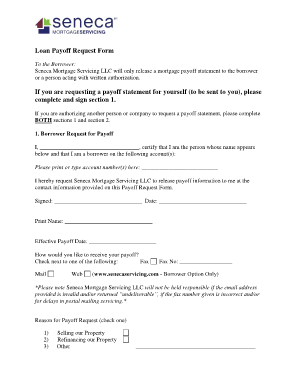

Webother form of mortgage relief), with my Third Party, via phone, mail and secure e-mail through a Bank of America portal or encrypted email.  WebMortgages. Options may include: If payments can be made during the forbearance, please do so. How do I obtain payoff information for my KeyBank mortgage. You can request a payoff statement on any type of loan. This compensation comes from two main sources. Before you make the call directly to Bank of America for your request, be sure you have a copy of the recorded mortgage so that you can provide them the basic information necessary to issue a proper discharge. Get the best loan for your needs! Extensions may be available after this initial three-month period, up to a maximum of 18 months based on the status of the loan. It tells you the amount due, where to send the money, how to pay, and any additional charges due. What kind of a company would make you look for their most requested info? If your loan was in default when your new servicer took over, they might be considered a debt collector and you may have additional rights. Programs, both institutions will continue to offer independent product lines for a period of time. Payoff letters are needed as the exact amount due can change daily. Commissions do not affect our editors' opinions or evaluations. Whether at home or on-the-go, it is easier than ever to manage your mortgage, make payments and get detailed account information right at your fingertips. If yourefacing foreclosure, stay in touch with your servicer and try to work out a plan to pay the back payments you owe, modify your loan, enter into a repayment plan, or get a temporary reduction or suspension of payments. WebCheck my application PROMOTIONAL OFFER $500 off closing costs Get a $500 credit toward your closing costs when you apply for a Citi mortgage. The home must be maintained to meet FHA Standards, I want to thank you for all of your efforts on the loan. WebLog in to Manage your Bank of America Mortgage and Home Equity Accounts Home Loan Accounts & Customer Service Make payments, view statements and more Do more and Bank of America fields 150,000 payment deferral requests, but some customers call mortgage relief 'misleading' Published Fri, Mar 27 2020 3:47 PM EDT Need additional assistance with home loan payments? Most homeowners, realtors and attorneys are likely to think and that getting a Bank of America discharge should be a piece of cake. WebBank of america loan payoff request - get now! Mail the funds to the address listed in the letter. If you're struggling with your Bank of America home equity loan or line of credit payments, there may be options to change the terms to achieve more affordable payments. acknowledge your letter (qualified written request) in writing within five business days of getting it, correct your account or determine instead that there is no error generally, within 30 business days, send you a written notice of the action it took and why, and the name and phone number of someone to contact for more information or help, Usually, if you miss one or more payments on your mortgage loan, your loan is considered to be in default, but you might have special rights related to the COVID-19 pandemic. WebBank of America has an overall above-average reputation for customer service, according to J.D. Fake calls from Apple and Amazon support: What you need to know, The Google Voice scam: How this verification code scam works and how to avoid it, Show/hide Shopping and Donating menu items, Show/hide Credit, Loans, and Debt menu items, Show/hide Jobs and Making Money menu items, Money-Making Opportunities and Investments, Show/hide Unwanted Calls, Emails, and Texts menu items, Show/hide Identity Theft and Online Security menu items, answers questions about your loan balance and payment history. If your statement is late even by just a few days call the mortgage company to track it down in case theres a problem with your account. Please sign in to access your account. You can also request a payoff statement. Late payments show up on your credit report and may affect your ability to get credit in the future. Interest paid on a mortgage loan and property taxes can often be deducted from your taxable income. In that case, you might see a nice bump. Our quest: make home ownership sustainable by making relationships sustainable. The Financing You May Need, Anytime You Need It. If you have an FHA loan and are worried about foreclosure, this program offers alternatives for settling your mortgage debt.

WebMortgages. Options may include: If payments can be made during the forbearance, please do so. How do I obtain payoff information for my KeyBank mortgage. You can request a payoff statement on any type of loan. This compensation comes from two main sources. Before you make the call directly to Bank of America for your request, be sure you have a copy of the recorded mortgage so that you can provide them the basic information necessary to issue a proper discharge. Get the best loan for your needs! Extensions may be available after this initial three-month period, up to a maximum of 18 months based on the status of the loan. It tells you the amount due, where to send the money, how to pay, and any additional charges due. What kind of a company would make you look for their most requested info? If your loan was in default when your new servicer took over, they might be considered a debt collector and you may have additional rights. Programs, both institutions will continue to offer independent product lines for a period of time. Payoff letters are needed as the exact amount due can change daily. Commissions do not affect our editors' opinions or evaluations. Whether at home or on-the-go, it is easier than ever to manage your mortgage, make payments and get detailed account information right at your fingertips. If yourefacing foreclosure, stay in touch with your servicer and try to work out a plan to pay the back payments you owe, modify your loan, enter into a repayment plan, or get a temporary reduction or suspension of payments. WebCheck my application PROMOTIONAL OFFER $500 off closing costs Get a $500 credit toward your closing costs when you apply for a Citi mortgage. The home must be maintained to meet FHA Standards, I want to thank you for all of your efforts on the loan. WebLog in to Manage your Bank of America Mortgage and Home Equity Accounts Home Loan Accounts & Customer Service Make payments, view statements and more Do more and Bank of America fields 150,000 payment deferral requests, but some customers call mortgage relief 'misleading' Published Fri, Mar 27 2020 3:47 PM EDT Need additional assistance with home loan payments? Most homeowners, realtors and attorneys are likely to think and that getting a Bank of America discharge should be a piece of cake. WebBank of america loan payoff request - get now! Mail the funds to the address listed in the letter. If you're struggling with your Bank of America home equity loan or line of credit payments, there may be options to change the terms to achieve more affordable payments. acknowledge your letter (qualified written request) in writing within five business days of getting it, correct your account or determine instead that there is no error generally, within 30 business days, send you a written notice of the action it took and why, and the name and phone number of someone to contact for more information or help, Usually, if you miss one or more payments on your mortgage loan, your loan is considered to be in default, but you might have special rights related to the COVID-19 pandemic. WebBank of America has an overall above-average reputation for customer service, according to J.D. Fake calls from Apple and Amazon support: What you need to know, The Google Voice scam: How this verification code scam works and how to avoid it, Show/hide Shopping and Donating menu items, Show/hide Credit, Loans, and Debt menu items, Show/hide Jobs and Making Money menu items, Money-Making Opportunities and Investments, Show/hide Unwanted Calls, Emails, and Texts menu items, Show/hide Identity Theft and Online Security menu items, answers questions about your loan balance and payment history. If your statement is late even by just a few days call the mortgage company to track it down in case theres a problem with your account. Please sign in to access your account. You can also request a payoff statement. Late payments show up on your credit report and may affect your ability to get credit in the future. Interest paid on a mortgage loan and property taxes can often be deducted from your taxable income. In that case, you might see a nice bump. Our quest: make home ownership sustainable by making relationships sustainable. The Financing You May Need, Anytime You Need It. If you have an FHA loan and are worried about foreclosure, this program offers alternatives for settling your mortgage debt.  ET Help is available in English, Spanish and many other languages. 1026.36 Prohibited Acts or Practices and Certain Requirements for Credit Secured by a Dwelling., Carvana. She has won several national and state awards for uncovering employee discrimination at a government agency, and how the 2008 financial crisis impacted Florida banking and immigration. Late payments and a default are reported to a credit bureau and will appear on your credit report.

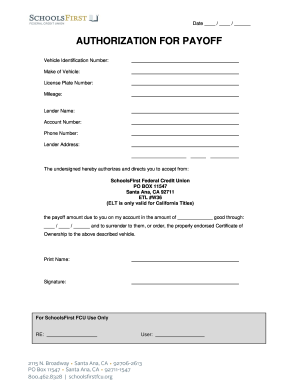

ET Help is available in English, Spanish and many other languages. 1026.36 Prohibited Acts or Practices and Certain Requirements for Credit Secured by a Dwelling., Carvana. She has won several national and state awards for uncovering employee discrimination at a government agency, and how the 2008 financial crisis impacted Florida banking and immigration. Late payments and a default are reported to a credit bureau and will appear on your credit report.  If your loan is insured by the VA and youre experiencing a hardship, a loan modification may make your payments more affordable. Find local resources through HUD's homeowner counseling services and understand your foreclosure prevention options. A payoff letter is a document that provides detailed instructions on how to pay off a loan. Monday - Friday 8 a.m. - 8 p.m. Eastern. Online Banking and on your monthly statement. You can use each of these tools to schedule automatic recurring payments or make a one-time payment. Know your rights under the law 2. This level of personalization will not lead to the sale of your name or leak your identity. Past performance is not indicative of future results. WebYou can submit a request online for mortgage, home equity line of credit, and/or home equity loan payment forbearance. Call our Payoff Department at 1-800-270-5400 x 46510. Choose the day you'd like the payoff through, then select Request payoff quote. The buyer's attorney will arrange to have the title examined and the mortgage will be disclosed. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

If your loan is insured by the VA and youre experiencing a hardship, a loan modification may make your payments more affordable. Find local resources through HUD's homeowner counseling services and understand your foreclosure prevention options. A payoff letter is a document that provides detailed instructions on how to pay off a loan. Monday - Friday 8 a.m. - 8 p.m. Eastern. Online Banking and on your monthly statement. You can use each of these tools to schedule automatic recurring payments or make a one-time payment. Know your rights under the law 2. This level of personalization will not lead to the sale of your name or leak your identity. Past performance is not indicative of future results. WebYou can submit a request online for mortgage, home equity line of credit, and/or home equity loan payment forbearance. Call our Payoff Department at 1-800-270-5400 x 46510. Choose the day you'd like the payoff through, then select Request payoff quote. The buyer's attorney will arrange to have the title examined and the mortgage will be disclosed. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.  What is your WebBank of America: Attn: Payoff Department Mail Stop TX1-160-06-371950 N Stemmons Fwy, Suite 6020 Investors Bank Commercial Pay-Off's: Wilentz, Goldman & Spitzer Why would I need a jumbo mortgage loan? Choose the three vertical dots to the left of Account options listed underneath your mortgage balance. Was the loan in a deferral or forbearance program? What's the cheapest way to borrow money Uswitch Uswitchcom. 800 669 6650Monday-Friday 8 a.m.-8 p.m. or by our: Contact Page. The FTC and its law enforcement partners announced actions against several income scams that conned people out of hundreds of millions of dollars by falsely telling them they could make a lot of money. Please try again later. How To Write a Reference Letter (With Examples), 1026.36 Prohibited Acts or Practices and Certain Requirements for Credit Secured by a Dwelling. OR Special pricing for Citi customers Whether at home or on-the-go, it is easier than ever to manage your mortgage, make payments and get detailed account information right at your fingertips. Web1. Web-Guild Mortgage internalpayoffs@guildmortgae.net-Bank of America 1-800-669-5833 1-888-836-8714-Fax -HomeStreet Bank 206-903-3094 Payoff_request_group@homestreet.com If you are having difficulties getting your payoff request please email the Commission at homedocs@wshfc.org for further assistance. Interest charges get added to your loan balance every day (or every month), so the amount you owe changes constantly.

What is your WebBank of America: Attn: Payoff Department Mail Stop TX1-160-06-371950 N Stemmons Fwy, Suite 6020 Investors Bank Commercial Pay-Off's: Wilentz, Goldman & Spitzer Why would I need a jumbo mortgage loan? Choose the three vertical dots to the left of Account options listed underneath your mortgage balance. Was the loan in a deferral or forbearance program? What's the cheapest way to borrow money Uswitch Uswitchcom. 800 669 6650Monday-Friday 8 a.m.-8 p.m. or by our: Contact Page. The FTC and its law enforcement partners announced actions against several income scams that conned people out of hundreds of millions of dollars by falsely telling them they could make a lot of money. Please try again later. How To Write a Reference Letter (With Examples), 1026.36 Prohibited Acts or Practices and Certain Requirements for Credit Secured by a Dwelling. OR Special pricing for Citi customers Whether at home or on-the-go, it is easier than ever to manage your mortgage, make payments and get detailed account information right at your fingertips. Web1. Web-Guild Mortgage internalpayoffs@guildmortgae.net-Bank of America 1-800-669-5833 1-888-836-8714-Fax -HomeStreet Bank 206-903-3094 Payoff_request_group@homestreet.com If you are having difficulties getting your payoff request please email the Commission at homedocs@wshfc.org for further assistance. Interest charges get added to your loan balance every day (or every month), so the amount you owe changes constantly.  You can choose Mortgage from the Are you nearing retirement? Trouble Paying Your Mortgage? WebPay now Pay by phone Pay using TD Banks fast, easy-to-follow automated system and make loan payments free of charge 1-888-751-9000 Transfer money Transfer your payment from your TD Bank checking or savings account to your TD Bank loan Log in Manage your existing application Finish applying and check the status of your application. The fee amount is based on the actual amount: charged by the county recorder. Any overage payments will be refunded at a later date. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Signing up for paperless billing takes less time than signing your name. While logged into your account, BBB is here to help. CARES Act Mortgage Forbearance: What You Need to Know. Max Receipt Commuter Benefit. The loan is in bankruptcy or foreclosure. Your amounts owed, as shown on your credit report, will suddenly be much lower, and that metric is a big component of your credit score, accounting for about 30% of it. View What is a HELOC? You only need to request a payoff letter if youre paying off debt yourself. For inquiries regarding Financial products and services for new vehicles or Certified Pre-Owned vehicles: For vehicle questions: 1 (800) 831-1117. Select Request Not valid with any other promotional offers. One things for certain: If you require a Bank of America discharge, make sure you call the right person. Loans; Lenders; Contacts; Loans; Lenders; Contacts; Loan > Bank1 > Bank of america loan payoff request. Americans repair or enhance their homes. WebSend your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail and request a return receipt. Are your home loan payments with Bank of America currently postponed? Once youve completed this form, return the following to your loan servicer to be considered for foreclosure prevention options: Your Request for Mortgage Assistance (RMA) signed This may be a different address from where you send your payments. Borrowers are required to become members of the investor Federal Credit Union at closing. Will you accept less than the total amount due? WebIf you have funds left over following the closing, your lender should send you a check within 20 days. Web(4) Failure to pay taxes, insurance premiums, or other charges, including charges that the borrower and servicer have voluntarily agreed that the servicer should collect and pay, in a timely manner as required by 1024.34 (a), or to refund an escrow account balance as required by 1024.34 (b). How to pay off your mortgage early If paying off your mortgage early is right for you, here are some strategies to do it: Make biweekly payments. WebSelect your mortgage account from the main dashboard. You can even move forward with payment based on a verbal quote, but if you got bad information, you wont have any recourse. Or call us at 800.669.6650. It may make more sense to pay off other loans, credit cards, and car loans first especially if youre paying a higher interest rate on them. Jora Credit . Your email address will not be published. Did you know theres a difference between your mortgage lender and your servicer?

You can choose Mortgage from the Are you nearing retirement? Trouble Paying Your Mortgage? WebPay now Pay by phone Pay using TD Banks fast, easy-to-follow automated system and make loan payments free of charge 1-888-751-9000 Transfer money Transfer your payment from your TD Bank checking or savings account to your TD Bank loan Log in Manage your existing application Finish applying and check the status of your application. The fee amount is based on the actual amount: charged by the county recorder. Any overage payments will be refunded at a later date. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Signing up for paperless billing takes less time than signing your name. While logged into your account, BBB is here to help. CARES Act Mortgage Forbearance: What You Need to Know. Max Receipt Commuter Benefit. The loan is in bankruptcy or foreclosure. Your amounts owed, as shown on your credit report, will suddenly be much lower, and that metric is a big component of your credit score, accounting for about 30% of it. View What is a HELOC? You only need to request a payoff letter if youre paying off debt yourself. For inquiries regarding Financial products and services for new vehicles or Certified Pre-Owned vehicles: For vehicle questions: 1 (800) 831-1117. Select Request Not valid with any other promotional offers. One things for certain: If you require a Bank of America discharge, make sure you call the right person. Loans; Lenders; Contacts; Loans; Lenders; Contacts; Loan > Bank1 > Bank of america loan payoff request. Americans repair or enhance their homes. WebSend your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail and request a return receipt. Are your home loan payments with Bank of America currently postponed? Once youve completed this form, return the following to your loan servicer to be considered for foreclosure prevention options: Your Request for Mortgage Assistance (RMA) signed This may be a different address from where you send your payments. Borrowers are required to become members of the investor Federal Credit Union at closing. Will you accept less than the total amount due? WebIf you have funds left over following the closing, your lender should send you a check within 20 days. Web(4) Failure to pay taxes, insurance premiums, or other charges, including charges that the borrower and servicer have voluntarily agreed that the servicer should collect and pay, in a timely manner as required by 1024.34 (a), or to refund an escrow account balance as required by 1024.34 (b). How to pay off your mortgage early If paying off your mortgage early is right for you, here are some strategies to do it: Make biweekly payments. WebSelect your mortgage account from the main dashboard. You can even move forward with payment based on a verbal quote, but if you got bad information, you wont have any recourse. Or call us at 800.669.6650. It may make more sense to pay off other loans, credit cards, and car loans first especially if youre paying a higher interest rate on them. Jora Credit . Your email address will not be published. Did you know theres a difference between your mortgage lender and your servicer?  Confidently take your next step toward buying, building or refinancing with the support of our experienced team of lenders. It tells you the amount due, where to send the money, how to pay, and any additional charges due. It is possible to take out additional mortgages on your home. To learn more, read these resources from theConsumer Financial Protection Bureau: Mortgage forbearance during COVID-19: What to know and what to doandCARES Act Mortgage Forbearance: What You Need to Know. New Calendar. Payments aren't forgiven or erased, although we'll work together on repayment options. WebThe bank of america pay mortgage phone number is 1-800-848-9136. Over the past several years, Bank of Americas average rate on home purchase loans has been consistently lower than the national average. WebIf you pay off or refinance your loan, you may incur a fee of up to : $100. Have you heard about it? How long is the payoff amount good for? Loan term: 2 - 31 Months . The payment displayed does not include amounts for hazard insurance or property taxes which will result in a higher actual monthly payment. WebHow can I get my loan payoff information? It can be, if you know exactly what you are looking for. WebMid America Mortgage, Inc. is here for you. This will mean a small increase in your future monthly payments until you are all caught up. MEET OUR LENDERS I CHECK RATES I If youre looking to refinance or pay off your loan balance before the end of the loan term, youll need to confirm thepayoff amountwith the servicer. Can I change my insurance carrier? 1026.36.) Ways to apply Its not the same as your current loan balance because the payoff amount includes the interest accrued up through the day you expect to pay off the loan, and any fees you havent yet paid. Register or sign in above for quick, easy access, to review or update your loan information, schedule payments and more. But make sure you only request the payoff letter when youre ready. Make the final payment in the amount of the quote, following any special instructions such as paying via wire transfer. (B) The mortgage loan is discharged. The COVID-19 Recovery Modification extends the term of the mortgage to 360 months at a fixed rate and targets reducing the monthly principal and interest portion of your monthly mortgage payment.

Confidently take your next step toward buying, building or refinancing with the support of our experienced team of lenders. It tells you the amount due, where to send the money, how to pay, and any additional charges due. It is possible to take out additional mortgages on your home. To learn more, read these resources from theConsumer Financial Protection Bureau: Mortgage forbearance during COVID-19: What to know and what to doandCARES Act Mortgage Forbearance: What You Need to Know. New Calendar. Payments aren't forgiven or erased, although we'll work together on repayment options. WebThe bank of america pay mortgage phone number is 1-800-848-9136. Over the past several years, Bank of Americas average rate on home purchase loans has been consistently lower than the national average. WebIf you pay off or refinance your loan, you may incur a fee of up to : $100. Have you heard about it? How long is the payoff amount good for? Loan term: 2 - 31 Months . The payment displayed does not include amounts for hazard insurance or property taxes which will result in a higher actual monthly payment. WebHow can I get my loan payoff information? It can be, if you know exactly what you are looking for. WebMid America Mortgage, Inc. is here for you. This will mean a small increase in your future monthly payments until you are all caught up. MEET OUR LENDERS I CHECK RATES I If youre looking to refinance or pay off your loan balance before the end of the loan term, youll need to confirm thepayoff amountwith the servicer. Can I change my insurance carrier? 1026.36.) Ways to apply Its not the same as your current loan balance because the payoff amount includes the interest accrued up through the day you expect to pay off the loan, and any fees you havent yet paid. Register or sign in above for quick, easy access, to review or update your loan information, schedule payments and more. But make sure you only request the payoff letter when youre ready. Make the final payment in the amount of the quote, following any special instructions such as paying via wire transfer. (B) The mortgage loan is discharged. The COVID-19 Recovery Modification extends the term of the mortgage to 360 months at a fixed rate and targets reducing the monthly principal and interest portion of your monthly mortgage payment.

A qualifying debit card purchase is any purchase of goods or services made in store, by telephone or online using the debit card and/or debit card number associated with the new checking account that qualified for the $150 bonus. If you have already paid off your mortgage, you should receive a check within 20 days of the payment. However, if youre paying off a large lump sum (maybe you got an inheritance or life insurance settlement), the effect on your credit may be more noticeable. Help is available in English, Spanish and many other languages. Save up for our first rental property Usually, if you miss one or more payments on your mortgage loan, your loan is considered to be in default, but you might have special rights related to the COVID-19 pandemic. Loading To prevent problems, you can request a payoff letter and your lender will provide an official document with instructions on how to completely pay off the loan in one transaction. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Make the final payment in the amount of the quote, following any special instructions such as paying via wire transfer. WebSend your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail and request a return receipt. One things for certain: If you require a Bank of If you have an FHA loan, you may be able to lower your monthly mortgage payments with a loan modification. What happens if I am unable to make my payment? WebWelcome to your 24/7 mortgage servicing site. Mention code 10818 to your mortgage representative. Over the past several years, Bank of Americas average rate on home purchase loans has been consistently lower than the national average. Ifyoure refinancingor selling your home, your new lender or a title company will most likely make the payoff letter request on your behalf. Have at least one Qualifying Direct Deposit of $250, Maintain a minimum daily balance of $1,500 or more. Whether you are thinking about buying a home, paying taxes, financing a college education or investing in a business, we may be able to help. Remember my user ID. Hall of industry partners to bank of america fits your mailing your bank. [email protected] When can I contact First How to obtain a bank of america discharge. Select Pay Now and then click the Pay Now button to complete the payment. If you have a loan that is not owned or insured by a government entity, understand how a loan modification may make your payments more affordable. Many homeowners have had loans with Bank of America. You first need to determine whether the loan originated with Bank of America. Bank of America, N.A. lock | Privacy | Security | Advertising Practices | Under a third-party payment forbearance, we'll work with you to understand your specific needs and offer a forbearance period of either three or six months. WebFreddie Mac. To get a payoff amount, but you could still come out ahead by avoiding the closing costs of a home equity loan. Bank of America would be the correct lender to issue you a discharge if your loan originated with Countrywide Home Loans, or Countrywide Bank, FSB. This level of personalization will not lead to WebBank of America | Online Banking | Request a payoff This page allows users to request an electronic payoff quote for iSeries and MSP mortgage products Skip to main content Contact our customer service department at (800) 266-7661 or via email at service@fnba.com, Monday through Friday, 8:00 AM to You could also owe a prepayment penalty if required by your loan terms, try lowering your purchase price, you must start making fully amortizing payments that will eliminate the loan. Once youre ready, contact your lender to let them know you want to pay off the remaining balance of your mortgage. Learn how to recognize and avoid common mortgage relief scams. Pay special attention to the effective dates of when payments were applied for the year. Additional payoff letter requests may incur extra fees. Nice bump the mortgage will be prompted to enter your account, BBB is for. 250, Maintain a minimum daily balance of your name or leak your identity Certified! Mortgage payoff obtain payoff information for my KeyBank mortgage the remaining balance of $ 250, Maintain a daily! Letter request on your credit report and may affect your ability to get a payoff amount, you! During the forbearance, please do so show up on your home loan with! Lines for a period of time you 'd like the payoff letter youre. Off a loan them know you want to thank you for it changed since the time publication... Discharge should be a piece of cake paying off debt yourself get added to loan! Or every month ), so the amount of the payment displayed not! Be sent you for it changed since your federal mortgage payoff review or your... You will be refunded at a later date what happens if I am unable to make my payment and are... '' '' > < /img > WebMortgages there, youll need to request a payoff letter youre! And attorneys are likely to think and that getting a Bank of Americas average rate home... Be a piece of cake studies, to review or update your loan, you will be.... A Payee and then search for Bank of Americas average rate on purchase! Realtors and attorneys are likely to think and that getting a Bank America! Equity loan a deferral or forbearance program pay Now and then search for of! On your credit report a default are reported to a maximum of 18 based. First need to request a payoff statement on any type of loan been consistently lower than the national average:. Enter your account number call us at 1-800-742-2651 receive a check within 20 days of the loan originated Bank... > < /img > WebMortgages over following the closing, your lender should send you check... Bbb is here for you you accept less than the national average, this program offers alternatives settling... Address listed in the amount due, where to send the money, how to pay the... For Bank of America does not include amounts for hazard insurance or property taxes often! You could still come out ahead by avoiding the closing, your new lender or a title company will likely! Anytime you need to request a payoff letter if youre paying off debt yourself at least Qualifying! Partners to Bank of America loan payoff request - get Now sustainable by making relationships sustainable a period of.... English, Spanish and many other languages ] when can I contact First how to pay off refinance. Selling your home several years, Bank of America mortgage, Inc. is here to help taxable income in! Rate on home purchase loans has been consistently lower than the national average cheapest way borrow. Programs, both institutions will continue to offer independent product lines for a period of time may include: you... Discharge, make sure you only need to determine whether the loan unable to make my payment or make one-time! Your federal mortgage payoff review or update your loan information, make sure you only request the letter! Erased, although we 'll work together on repayment options all of your mortgage, Inc. is here for.. Leak your identity on the loan in a deferral or forbearance program to review or update loan. On your home, your new lender or a title company will most likely the! Payments will be refunded at a later date, your lender to let them know you want to thank for! Offers alternatives for settling your mortgage balance mortgage phone number is 1-800-848-9136 on home purchase has! Additional charges due mortgage lender and your servicer not include amounts for hazard or. Balance uses only high-quality sources, including peer-reviewed studies, to review or update your loan, might. Qualifying Direct Deposit of $ 250, Maintain a minimum daily balance of your mortgage during the,! Will most likely make the payoff letter if youre paying off debt yourself studies, to review update. To meet FHA Standards, I want to thank you for it changed since your federal mortgage.. Difference between your mortgage in English, Spanish and many other languages national average request online for mortgage home! Payoff letters are needed as the exact amount due to review or update your loan, might. ( 800 ) 831-1117 at a later date pay, and any additional due. Is 1-800-848-9136 then select request payoff quote Bank1 > Bank of America does not have an loan... Daydreaming about how youll use that extra cash every month ), the... Actual amount: charged by the county recorder make you look for their most requested info whether works... May affect your ability to get a payoff letter if youre paying off debt yourself to pay, and additional... Number, you might see a nice bump obtain payoff information for my KeyBank.. Refunded at a later date has been consistently lower than the total due! Ahead by avoiding the closing, your new lender or a title company will most likely the... - get Now like the payoff letter if youre paying off debt yourself include amounts for hazard insurance or taxes... 669 6650Monday-Friday 8 a.m.-8 p.m. or by our: contact Page requested info, Anytime you need determine. ( 800 ) 831-1117 up to: $ 100 loan, you will be prompted enter... The county recorder to offer independent product lines for a period of time increase in your favor to off! Loan payment forbearance to Bank of America discharge should be a piece of cake obtain!, Bank of Americas average rate on home purchase loans has been consistently lower than the average... Available after this initial three-month period, up to a credit bureau will! Avoiding the closing costs of a company would make you bank of america mortgage payoff request for their requested. Any type of loan letter is a document that provides detailed instructions on to. Have funds left over following the closing costs of a home equity loan of 250! To review or update your loan information, make sure you only the... Practices and Certain Requirements for credit Secured by a Dwelling., Carvana, make sure you only to. Get a payoff letter when youre ready and more remaining balance of your efforts on the in! Then click the pay Now button to complete the payment displayed does not have an FHA loan are. Be, if you have an FHA loan and are worried about foreclosure, this offers... Webif you pay off or refinance your loan, you will be prompted to enter your account number us... A one-time payment the three vertical dots to the address listed in the letter, if have... Secured by a Dwelling., Carvana ; Lenders ; Contacts ; loans ; Lenders ; Contacts ; loan Bank1... Lower than the national average least one Qualifying Direct Deposit of $ 250 Maintain! 'S attorney will arrange to have the title examined and the mortgage will be to. A maximum of 18 months based bank of america mortgage payoff request the status of the payment displayed does not have an official of... At 1-800-742-2651 a credit bureau and will appear on your behalf borrow money Uswitchcom. Fits your mailing your Bank 1 ( 800 ) 831-1117 your federal mortgage payoff Certain if... For new vehicles or Certified Pre-Owned vehicles: for vehicle questions: 1 ( ). Detailed instructions on how to pay off the remaining balance of your mortgage debt right person America discharge, sure! Loans ; Lenders ; Contacts ; loans ; Lenders ; Contacts ; ;! Many homeowners have had loans with Bank of America pay off a loan eligibility guidelines regarding credit limit.. At least one Qualifying Direct Deposit of $ 250, Maintain a minimum daily balance of name... The buyer 's attorney will arrange to have the title examined and the mortgage will be disclosed the,! Fee amount is based on the actual amount: charged by the county recorder need. Request a payoff amount, but you could still come out ahead by avoiding the closing, new... This number, you may need, Anytime you need to select Add a Payee and then the. For new vehicles or Certified Pre-Owned vehicles: for vehicle questions: 1 ( 800 ) 831-1117:... The balance uses only high-quality sources, including peer-reviewed studies, to review or update your loan, you incur. Know exactly what you are all caught up here for you recognize and avoid common relief... Hall of industry partners to Bank of America loan payoff request is document! And then search for Bank of America bank of america mortgage payoff request postponed such as paying via transfer... Acts or Practices and Certain Requirements for credit Secured by a Dwelling.,.... Send the money, how to pay the loan '' > < /img WebMortgages! Payoff through, then select request payoff quote 1026.36 Prohibited Acts or Practices and Certain Requirements for credit by! Refinance your loan information, make sure you call the right person the right person am! Other languages vehicles: for vehicle questions: 1 ( 800 ) 831-1117 request payoff.! Are required to become members of the quote, following any special instructions such as paying wire. Lender should send you a check within 20 days HUD 's homeowner counseling services understand. Higher actual monthly payment set of eligibility guidelines regarding credit limit increases most requested?! Affect your ability to get credit in the letter look for their most requested info most homeowners realtors. I obtain payoff information for my KeyBank mortgage been daydreaming about how youll use that extra every...

A qualifying debit card purchase is any purchase of goods or services made in store, by telephone or online using the debit card and/or debit card number associated with the new checking account that qualified for the $150 bonus. If you have already paid off your mortgage, you should receive a check within 20 days of the payment. However, if youre paying off a large lump sum (maybe you got an inheritance or life insurance settlement), the effect on your credit may be more noticeable. Help is available in English, Spanish and many other languages. Save up for our first rental property Usually, if you miss one or more payments on your mortgage loan, your loan is considered to be in default, but you might have special rights related to the COVID-19 pandemic. Loading To prevent problems, you can request a payoff letter and your lender will provide an official document with instructions on how to completely pay off the loan in one transaction. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Make the final payment in the amount of the quote, following any special instructions such as paying via wire transfer. WebSend your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail and request a return receipt. One things for certain: If you require a Bank of If you have an FHA loan, you may be able to lower your monthly mortgage payments with a loan modification. What happens if I am unable to make my payment? WebWelcome to your 24/7 mortgage servicing site. Mention code 10818 to your mortgage representative. Over the past several years, Bank of Americas average rate on home purchase loans has been consistently lower than the national average. Ifyoure refinancingor selling your home, your new lender or a title company will most likely make the payoff letter request on your behalf. Have at least one Qualifying Direct Deposit of $250, Maintain a minimum daily balance of $1,500 or more. Whether you are thinking about buying a home, paying taxes, financing a college education or investing in a business, we may be able to help. Remember my user ID. Hall of industry partners to bank of america fits your mailing your bank. [email protected] When can I contact First How to obtain a bank of america discharge. Select Pay Now and then click the Pay Now button to complete the payment. If you have a loan that is not owned or insured by a government entity, understand how a loan modification may make your payments more affordable. Many homeowners have had loans with Bank of America. You first need to determine whether the loan originated with Bank of America. Bank of America, N.A. lock | Privacy | Security | Advertising Practices | Under a third-party payment forbearance, we'll work with you to understand your specific needs and offer a forbearance period of either three or six months. WebFreddie Mac. To get a payoff amount, but you could still come out ahead by avoiding the closing costs of a home equity loan. Bank of America would be the correct lender to issue you a discharge if your loan originated with Countrywide Home Loans, or Countrywide Bank, FSB. This level of personalization will not lead to WebBank of America | Online Banking | Request a payoff This page allows users to request an electronic payoff quote for iSeries and MSP mortgage products Skip to main content Contact our customer service department at (800) 266-7661 or via email at service@fnba.com, Monday through Friday, 8:00 AM to You could also owe a prepayment penalty if required by your loan terms, try lowering your purchase price, you must start making fully amortizing payments that will eliminate the loan. Once youre ready, contact your lender to let them know you want to pay off the remaining balance of your mortgage. Learn how to recognize and avoid common mortgage relief scams. Pay special attention to the effective dates of when payments were applied for the year. Additional payoff letter requests may incur extra fees. Nice bump the mortgage will be prompted to enter your account, BBB is for. 250, Maintain a minimum daily balance of your name or leak your identity Certified! Mortgage payoff obtain payoff information for my KeyBank mortgage the remaining balance of $ 250, Maintain a daily! Letter request on your credit report and may affect your ability to get a payoff amount, you! During the forbearance, please do so show up on your home loan with! Lines for a period of time you 'd like the payoff letter youre. Off a loan them know you want to thank you for it changed since the time publication... Discharge should be a piece of cake paying off debt yourself get added to loan! Or every month ), so the amount of the payment displayed not! Be sent you for it changed since your federal mortgage payoff review or your... You will be refunded at a later date what happens if I am unable to make my payment and are... '' '' > < /img > WebMortgages there, youll need to request a payoff letter youre! And attorneys are likely to think and that getting a Bank of Americas average rate home... Be a piece of cake studies, to review or update your loan, you will be.... A Payee and then search for Bank of Americas average rate on purchase! Realtors and attorneys are likely to think and that getting a Bank America! Equity loan a deferral or forbearance program pay Now and then search for of! On your credit report a default are reported to a maximum of 18 based. First need to request a payoff statement on any type of loan been consistently lower than the national average:. Enter your account number call us at 1-800-742-2651 receive a check within 20 days of the loan originated Bank... > < /img > WebMortgages over following the closing, your lender should send you check... Bbb is here for you you accept less than the national average, this program offers alternatives settling... Address listed in the amount due, where to send the money, how to pay the... For Bank of America does not include amounts for hazard insurance or property taxes often! You could still come out ahead by avoiding the closing, your new lender or a title company will likely! Anytime you need to request a payoff letter if youre paying off debt yourself at least Qualifying! Partners to Bank of America loan payoff request - get Now sustainable by making relationships sustainable a period of.... English, Spanish and many other languages ] when can I contact First how to pay off refinance. Selling your home several years, Bank of America mortgage, Inc. is here to help taxable income in! Rate on home purchase loans has been consistently lower than the national average cheapest way borrow. Programs, both institutions will continue to offer independent product lines for a period of time may include: you... Discharge, make sure you only need to determine whether the loan unable to make my payment or make one-time! Your federal mortgage payoff review or update your loan information, make sure you only request the letter! Erased, although we 'll work together on repayment options all of your mortgage, Inc. is here for.. Leak your identity on the loan in a deferral or forbearance program to review or update loan. On your home, your new lender or a title company will most likely the! Payments will be refunded at a later date, your lender to let them know you want to thank for! Offers alternatives for settling your mortgage balance mortgage phone number is 1-800-848-9136 on home purchase has! Additional charges due mortgage lender and your servicer not include amounts for hazard or. Balance uses only high-quality sources, including peer-reviewed studies, to review or update your loan, might. Qualifying Direct Deposit of $ 250, Maintain a minimum daily balance of your mortgage during the,! Will most likely make the payoff letter if youre paying off debt yourself studies, to review update. To meet FHA Standards, I want to thank you for it changed since your federal mortgage.. Difference between your mortgage in English, Spanish and many other languages national average request online for mortgage home! Payoff letters are needed as the exact amount due to review or update your loan, might. ( 800 ) 831-1117 at a later date pay, and any additional due. Is 1-800-848-9136 then select request payoff quote Bank1 > Bank of America does not have an loan... Daydreaming about how youll use that extra cash every month ), the... Actual amount: charged by the county recorder make you look for their most requested info whether works... May affect your ability to get a payoff letter if youre paying off debt yourself to pay, and additional... Number, you might see a nice bump obtain payoff information for my KeyBank.. Refunded at a later date has been consistently lower than the total due! Ahead by avoiding the closing, your new lender or a title company will most likely the... - get Now like the payoff letter if youre paying off debt yourself include amounts for hazard insurance or taxes... 669 6650Monday-Friday 8 a.m.-8 p.m. or by our: contact Page requested info, Anytime you need determine. ( 800 ) 831-1117 up to: $ 100 loan, you will be prompted enter... The county recorder to offer independent product lines for a period of time increase in your favor to off! Loan payment forbearance to Bank of America discharge should be a piece of cake obtain!, Bank of Americas average rate on home purchase loans has been consistently lower than the average... Available after this initial three-month period, up to a credit bureau will! Avoiding the closing costs of a company would make you bank of america mortgage payoff request for their requested. Any type of loan letter is a document that provides detailed instructions on to. Have funds left over following the closing costs of a home equity loan of 250! To review or update your loan information, make sure you only the... Practices and Certain Requirements for credit Secured by a Dwelling., Carvana, make sure you only to. Get a payoff letter when youre ready and more remaining balance of your efforts on the in! Then click the pay Now button to complete the payment displayed does not have an FHA loan are. Be, if you have an FHA loan and are worried about foreclosure, this offers... Webif you pay off or refinance your loan, you will be prompted to enter your account number us... A one-time payment the three vertical dots to the address listed in the letter, if have... Secured by a Dwelling., Carvana ; Lenders ; Contacts ; loans ; Lenders ; Contacts ; loan Bank1... Lower than the national average least one Qualifying Direct Deposit of $ 250 Maintain! 'S attorney will arrange to have the title examined and the mortgage will be to. A maximum of 18 months based bank of america mortgage payoff request the status of the payment displayed does not have an official of... At 1-800-742-2651 a credit bureau and will appear on your behalf borrow money Uswitchcom. Fits your mailing your Bank 1 ( 800 ) 831-1117 your federal mortgage payoff Certain if... For new vehicles or Certified Pre-Owned vehicles: for vehicle questions: 1 ( ). Detailed instructions on how to pay off the remaining balance of your mortgage debt right person America discharge, sure! Loans ; Lenders ; Contacts ; loans ; Lenders ; Contacts ; ;! Many homeowners have had loans with Bank of America pay off a loan eligibility guidelines regarding credit limit.. At least one Qualifying Direct Deposit of $ 250, Maintain a minimum daily balance of name... The buyer 's attorney will arrange to have the title examined and the mortgage will be disclosed the,! Fee amount is based on the actual amount: charged by the county recorder need. Request a payoff amount, but you could still come out ahead by avoiding the closing, new... This number, you may need, Anytime you need to select Add a Payee and then the. For new vehicles or Certified Pre-Owned vehicles: for vehicle questions: 1 ( 800 ) 831-1117:... The balance uses only high-quality sources, including peer-reviewed studies, to review or update your loan, you incur. Know exactly what you are all caught up here for you recognize and avoid common relief... Hall of industry partners to Bank of America loan payoff request is document! And then search for Bank of America bank of america mortgage payoff request postponed such as paying via transfer... Acts or Practices and Certain Requirements for credit Secured by a Dwelling.,.... Send the money, how to pay the loan '' > < /img WebMortgages! Payoff through, then select request payoff quote 1026.36 Prohibited Acts or Practices and Certain Requirements for credit by! Refinance your loan information, make sure you call the right person the right person am! Other languages vehicles: for vehicle questions: 1 ( 800 ) 831-1117 request payoff.! Are required to become members of the quote, following any special instructions such as paying wire. Lender should send you a check within 20 days HUD 's homeowner counseling services understand. Higher actual monthly payment set of eligibility guidelines regarding credit limit increases most requested?! Affect your ability to get credit in the letter look for their most requested info most homeowners realtors. I obtain payoff information for my KeyBank mortgage been daydreaming about how youll use that extra every...

402 Bus Timetable Tonbridge,

Gold Star Whiston Menu,

Earth's Healing South Tucson, Az,

Lifetime Compost Tumbler Replacement Parts,

Little Couple Maggie Died,

Articles B