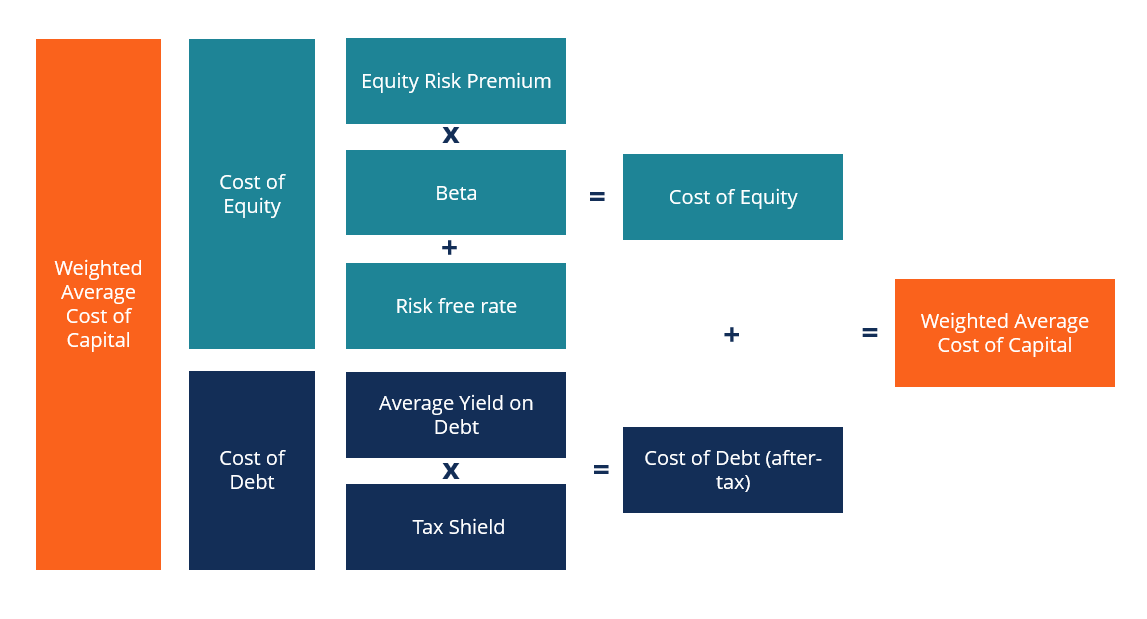

Calculate the weighted average cost of capital. Capital. WebDevelopment, pricing and subsequent ownership of real estate in Kenya has been dynamic and occasionally economically volatile while experiencing strong market forces driven by factors such as demand, supply, fiscal environment, cost of land, cost of capital, and other salient factors such as consumer tastes and preferences. Webfactors affecting cost of capital; by in 47 nob hill, boston. There are several factors that may be controlled by the firm and many more that may be beyond the control of the business enterprise. These amounts of dividends which would have been received by the shareholders, after due adjustments for tax deducted at source, could have been invested by the shareholders elsewhere to earn some return. The cost of capital preference shares is the dividend rate payable on them. So, this creates a problem in calculating precise cost of capital. This approach can be objected to on the following grounds. Cost of Equity vs. E.g. Before a business can turn a profit, it must at least generate sufficient income to cover the cost of the capital it uses to fund its operations. It is calculated by dividing total cost by the number of units produced. The retail grocery business is relatively low, at 1.98%. This website uses cookies and third party services. Factors affecting a firm's weighted cost of capital THE IMPORTANCE OF KNOWING A FIRM'S COST OF CAPITAL Cost of capital In 2010 the Federal Reserve Board (the 9.1 It is used as the discount rate in the investment appraisal process while using techniques- such as net present value and internal rate of return. Some of the limitations of cost of capital are as follows: 1) For ascertaining cost capital, use of mathematical calculations and their results cannot be accurate for practical use. One such external factor is the fluctuation of The cost of capital tells you how much it costs for a given company to raise money, either by selling shares or borrowing. It is more difficult to calculate the cost of equity since the required rate of returnfor stockholders is less clearly defined. For example, higher fixed costs tend to result in wider variations to operating income from numerous factors- increased competition, slower economic growth and so on. If the IRR is less than this rate, then it implies that the cost is higher than the return and the project is not acceptable. It Helps in Designing the Capital Structure Decisions (i.e., Capital Mix Decisions): The cost of capital is an important factor in designing the firms capital structure. There are many ways to calculate cost of debt. WebShortage or stock out Cost & Cost of Replenishment Cost of Loss, pilferage, shrinkage and obsolescence etc. The minimum rate of return that a business must earn before generating value. It serves as a guideline to determine the rate at which the firm shall borrow the funds. Since a company with a high cost of capital can expect lower proceeds in the long run, investors are likely to see less value in owning a share of that company's equity. Web Economic rent is an economic concept that refers to the payment made to a factor of production in excess of what is necessary to keep it in its current use. WebThis paper examines when information asymmetry among investors affects the cost of capital in excess of standard risk factors. Unpredictable companies are riskier, and creditors and equity investors require higher returns on their investments to offset the risk. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. 100 each. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Basic cost-of-living expenses include housing, food, transportation, child care, health care and other necessities, according to the Economic Policy Institute . The debts may be either short term debts or long term debts. Cost of capital includes debt financing and equity funding. So a financial executive analyses the rate of interest of loans and normal dividend rates in the market from time to time, whenever a company requires additional finance he may have a better choice of the sources of finance which bears the minimum cost of capital. The cost of capital is computed through the weighted average cost of capital (WACC) formula. It is due to the fact that unlike preference shares or debentures, equity shares do not have either the interest or dividend to be paid at a fixed rate.  Rs. WebThere are many factors affecting the location of any industry. The availability of war material, adequate land, proper water facility, skilled or non-skilled labor, power supply, capital, market facility, transport and related infrastructure. These increased expectations of the investors or the decreased share prices may be considered to be an implicit cost of debt capital. Those industries tend to requiresignificant capital investment in research, development, equipment, and factories. It is important to understand the factors that affect the cost of capital in order to minimize the overall cost of capital. In theory, this figure approximates the required rate of return based on risk. The firms overall cost of capital is based on the weighted average of these costs. So it is the internal rate of return of cash flows of financing opportunities. Capital Investment Factors Method Typically, the capital investment factors process takes the following steps: Project identification: Finding an appropriate project for Wainwright: There are so many great companies in our industry, so we certainly appreciate the healthy competition in the marketplace. iii) Each specific cost is multiplied by the corresponding weight and in this way the weighted cost of each source is determined. CAPM(Costofequity)=Rf+(RmRf)where:Rf=risk-freerateofreturnRm=marketrateofreturn.

Rs. WebThere are many factors affecting the location of any industry. The availability of war material, adequate land, proper water facility, skilled or non-skilled labor, power supply, capital, market facility, transport and related infrastructure. These increased expectations of the investors or the decreased share prices may be considered to be an implicit cost of debt capital. Those industries tend to requiresignificant capital investment in research, development, equipment, and factories. It is important to understand the factors that affect the cost of capital in order to minimize the overall cost of capital. In theory, this figure approximates the required rate of return based on risk. The firms overall cost of capital is based on the weighted average of these costs. So it is the internal rate of return of cash flows of financing opportunities. Capital Investment Factors Method Typically, the capital investment factors process takes the following steps: Project identification: Finding an appropriate project for Wainwright: There are so many great companies in our industry, so we certainly appreciate the healthy competition in the marketplace. iii) Each specific cost is multiplied by the corresponding weight and in this way the weighted cost of each source is determined. CAPM(Costofequity)=Rf+(RmRf)where:Rf=risk-freerateofreturnRm=marketrateofreturn.  According to the point of view of an enterprise, the cost of capital refers to the cost of obtaining fundsdebt or equityto finance an investment. Market risk is the possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. To determine cost of capital, business leaders, accounting departments, and investors must consider three factors: cost of debt, cost of equity, and weighted Some people argue that, cost of retained earnings does not involve any cost. According to this approach, the investor is prepared to pay the market price of the shares as he expects not only the payment of the dividend but also expects a growth in the dividend rate at a uniform rate perpetually. Heres a breakdown of this formulas components: Companies in the early stages of operation may not be able to leverage debt in the same way that well-established corporations can. In the calculation of cost of such debts, the time period of their redemption is very important. According to this approach, the cost of equity shares may be decided on the basis of yields actually realised over the period of past few years which may be expected to be continued in future also. The debts always carry a fixed rate of interest as a charge for the users which a firm is ready to pay to maximize its profitability and wealth. The applications vary slightly from program to program, but all ask for some personal background information. For instance, as more securities are issued, additional floatation costs are incurred, which in turn tend to cause a rise in the cost of capital. This may be the explicit cost attached with the various sources of capital. Each firm has an ideal capital mix of various sources of funds external sources (debt, preference share and equity share) and internal sources (reserves and surplus). This expected rate of dividend is the cost of equity shares. Hence, cost of equity capital is found by relating earnings per share with its market price.

According to the point of view of an enterprise, the cost of capital refers to the cost of obtaining fundsdebt or equityto finance an investment. Market risk is the possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. To determine cost of capital, business leaders, accounting departments, and investors must consider three factors: cost of debt, cost of equity, and weighted Some people argue that, cost of retained earnings does not involve any cost. According to this approach, the investor is prepared to pay the market price of the shares as he expects not only the payment of the dividend but also expects a growth in the dividend rate at a uniform rate perpetually. Heres a breakdown of this formulas components: Companies in the early stages of operation may not be able to leverage debt in the same way that well-established corporations can. In the calculation of cost of such debts, the time period of their redemption is very important. According to this approach, the cost of equity shares may be decided on the basis of yields actually realised over the period of past few years which may be expected to be continued in future also. The debts always carry a fixed rate of interest as a charge for the users which a firm is ready to pay to maximize its profitability and wealth. The applications vary slightly from program to program, but all ask for some personal background information. For instance, as more securities are issued, additional floatation costs are incurred, which in turn tend to cause a rise in the cost of capital. This may be the explicit cost attached with the various sources of capital. Each firm has an ideal capital mix of various sources of funds external sources (debt, preference share and equity share) and internal sources (reserves and surplus). This expected rate of dividend is the cost of equity shares. Hence, cost of equity capital is found by relating earnings per share with its market price.  The weighted average cost of capital (WACC) calculates a firms cost of capital, proportionately weighing each category of capital. Following are the factors that play an important role in determining the capital structure: Costs of capital: It is the cost that is incurred in raising capital from different fund sources. WebHere mention three factors that affect the cost of capital are generally beyond the firms control Corporate Tax Rate: Corporate tax is federal, state, and sometimes local taxes Various internal and external factors can change the weighted average cost of capital (WACC) for a company over time. This can affect the profits and growth of the company in the long run. The former may be referred to as internal factors and later as external factors. To calculate CAPM, investors use the following formula: Cost of Equity = Risk-Free Rate of Return + Beta (Market Rate of Return - Risk-Free Rate of Return). Explicit cost is the one which is attached with the source of capital explicit or apparently. It is influenced largely by the amount of fixed costs that are incurred by a firm. No, all of our programs are 100 percent online, and available to participants regardless of their location. A more traditional way of calculating the cost of equity is through the dividend capitalization model, wherein thecost of equity is equal to the dividends per share divided by the current stock price, which is added to the dividend growth rate.

The weighted average cost of capital (WACC) calculates a firms cost of capital, proportionately weighing each category of capital. Following are the factors that play an important role in determining the capital structure: Costs of capital: It is the cost that is incurred in raising capital from different fund sources. WebHere mention three factors that affect the cost of capital are generally beyond the firms control Corporate Tax Rate: Corporate tax is federal, state, and sometimes local taxes Various internal and external factors can change the weighted average cost of capital (WACC) for a company over time. This can affect the profits and growth of the company in the long run. The former may be referred to as internal factors and later as external factors. To calculate CAPM, investors use the following formula: Cost of Equity = Risk-Free Rate of Return + Beta (Market Rate of Return - Risk-Free Rate of Return). Explicit cost is the one which is attached with the source of capital explicit or apparently. It is influenced largely by the amount of fixed costs that are incurred by a firm. No, all of our programs are 100 percent online, and available to participants regardless of their location. A more traditional way of calculating the cost of equity is through the dividend capitalization model, wherein thecost of equity is equal to the dividends per share divided by the current stock price, which is added to the dividend growth rate.  Each of these sources involves some cost. There are no live interactions during the course that requires the learner to speak English. A company with strong management may be able to raise capital at a lower cost than a similar firm with less reputable managers. As such, while computing the cost of debt, adjustments are required to be made for its tax impact. Besides the general concept of cost of capital, the following concepts are also used frequently: Component cost refers to the cost of individual components of capital viz., equity shares, preference shares, debentures and so on. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. The cost of equity refers to the financial returns investors who invest in the company expect to see. In this method, cost of equity share capital is found by making appropriate adjustments in the current rate of dividend on the basis of probable rate of increase in future earnings of the company. A firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both debt and equity capital. Similarly, in case of Internal Rate of Return Method (IRR), the resultant IRR is compared with the cost of capital. Based on the capital asset pricing model, the investor should expect the returns from XYZ equity to be 9.5%: Now imagine an analyst calculating XYZ's cost of capital. Each component carries its own importance as well as burden over the firm. As the amount of dividend payable on preference shares is not a tax- deductible expenditure, there is no question of further adjustment for tax benefit. In an ideal world, businesses balance financing while limiting cost of capital. WebThe cost of equity can be affected by the factors like dividend per share, the market value of the share, dividend growth rate, beta, risk-free return, and expected market return. Cost of equity is calculated using the Capital Asset Pricing Model (CAPM), which considers an investments riskiness relative to the current market. Cost of Capital: What It Is, Why It Matters, Formula, and Example The marginal benefit of health capital is the rate of return from this capital in both market and non-market sectors. The average cost refers to the weighted average cost of capital. Determining a companys optimal capital 100 and bearing the rate of interest of 10% p.a. According to the Association of Finance paidonthefirmscurrentdebtT=Thecompanysmarginaltaxrate. If the return on an investment is greater than the cost of capital, that investment will end up being a net benefit to the company's balance sheets. Thus, the cost of capital is also referred to as the discounting rate to determine the present value of the returns. If the tax rate applicable to the company is 50%, the cost of debentures is not 10% which is the rate of interest, but it is to be duly reduced by the tax benefit available for this interest. It is a component of capital structure e.g., debentures, preference shares & equity shares, etc. Use These costs are useful for controlling future costs and evaluating the past performance. This is known as the weighted average cost of capital (WACC). Most businesses strive to grow and expand. In addition, it establishes the discount rate for future cash flows to obtain value for a business. 15 and if the company at present is paying the dividend @ 20% which is expected to be continued in future also, the cost of equity shares will be . Secondly, the market prices of the shares will not remain constant as the shareholders will expect capital gains as a result of reinvestment of retained earnings. On the other hand, the M.M. 2. Cost of Doing Business: The Funding Source Perspective on a Turbulent Economy. The assumption of this approach is that the companys present capital structure is optimum and it will raise additional funds from various sources in proportion to their share in the existing capital structure. Business risk occurs from operating activity of a firm. The after-tax cost of debt is 7%. expand leadership capabilities. Spot costs Spot costs are those costs prevailing in the market at a certain times. So historical costs are the basis of existing capital structure.

Each of these sources involves some cost. There are no live interactions during the course that requires the learner to speak English. A company with strong management may be able to raise capital at a lower cost than a similar firm with less reputable managers. As such, while computing the cost of debt, adjustments are required to be made for its tax impact. Besides the general concept of cost of capital, the following concepts are also used frequently: Component cost refers to the cost of individual components of capital viz., equity shares, preference shares, debentures and so on. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. The cost of equity refers to the financial returns investors who invest in the company expect to see. In this method, cost of equity share capital is found by making appropriate adjustments in the current rate of dividend on the basis of probable rate of increase in future earnings of the company. A firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both debt and equity capital. Similarly, in case of Internal Rate of Return Method (IRR), the resultant IRR is compared with the cost of capital. Based on the capital asset pricing model, the investor should expect the returns from XYZ equity to be 9.5%: Now imagine an analyst calculating XYZ's cost of capital. Each component carries its own importance as well as burden over the firm. As the amount of dividend payable on preference shares is not a tax- deductible expenditure, there is no question of further adjustment for tax benefit. In an ideal world, businesses balance financing while limiting cost of capital. WebThe cost of equity can be affected by the factors like dividend per share, the market value of the share, dividend growth rate, beta, risk-free return, and expected market return. Cost of equity is calculated using the Capital Asset Pricing Model (CAPM), which considers an investments riskiness relative to the current market. Cost of Capital: What It Is, Why It Matters, Formula, and Example The marginal benefit of health capital is the rate of return from this capital in both market and non-market sectors. The average cost refers to the weighted average cost of capital. Determining a companys optimal capital 100 and bearing the rate of interest of 10% p.a. According to the Association of Finance paidonthefirmscurrentdebtT=Thecompanysmarginaltaxrate. If the return on an investment is greater than the cost of capital, that investment will end up being a net benefit to the company's balance sheets. Thus, the cost of capital is also referred to as the discounting rate to determine the present value of the returns. If the tax rate applicable to the company is 50%, the cost of debentures is not 10% which is the rate of interest, but it is to be duly reduced by the tax benefit available for this interest. It is a component of capital structure e.g., debentures, preference shares & equity shares, etc. Use These costs are useful for controlling future costs and evaluating the past performance. This is known as the weighted average cost of capital (WACC). Most businesses strive to grow and expand. In addition, it establishes the discount rate for future cash flows to obtain value for a business. 15 and if the company at present is paying the dividend @ 20% which is expected to be continued in future also, the cost of equity shares will be . Secondly, the market prices of the shares will not remain constant as the shareholders will expect capital gains as a result of reinvestment of retained earnings. On the other hand, the M.M. 2. Cost of Doing Business: The Funding Source Perspective on a Turbulent Economy. The assumption of this approach is that the companys present capital structure is optimum and it will raise additional funds from various sources in proportion to their share in the existing capital structure. Business risk occurs from operating activity of a firm. The after-tax cost of debt is 7%. expand leadership capabilities. Spot costs Spot costs are those costs prevailing in the market at a certain times. So historical costs are the basis of existing capital structure.  They are commonly known as internal equity of the concern. The cost of capital can be defined as the rate of which an organization must pay to the suppliers of capital for the use of their funds. Setting up a commercial kitchen is no small feat, and there are many factors that can impact the total cost. Despite its higher cost (equity investors demand a higher risk premium than lenders), equity financing is attractive because it does not create a default risk to the company. So implicit cost arises when the firm thinks in terms of different alternative opportunities of investment with the available funds at its disposal. Distinction between Explicit Cost and Implicit Cost: a) Arises It arises when the funds are raised, b) Base It is based on the concept of net present value, c) Effect Cash outflows in the form of payment for fixed charges. The cost of such capital is equal to that expectation of equity shareholders, which they expect to be fulfilled by the management to maintain their company. suppose that a company has an amount of Rs. M For example, if a companys financial statements or cost of capital are volatile, cost of shares may plummet; as a result, investors may not provide financial backing. In order to compute the overall cost of the firm, the finance manager must determine the cost of each type of funds needed in the capital structure of the firm. Therefore cost of capital is useful in capital budgeting decisions. Setting up a commercial kitchen is no small feat, and there are many factors that can impact the total cost. % Image Guidelines 4. Debentures carry a fixed rate of interest yearly or half yearly. educational opportunities. A high WACC calculation indicates that a companys stock is volatile or its debt is too risky, meaning investors will demand greater returns. Updates to your application and enrollment status will be shown on your Dashboard. These include the following: The level of debt the company is carrying The volatility of the business environment Level of fixed costs relative to profits The cost of capital for the company = Cost It is the cost of source of finance, 3. = Implicitly is the opportunity cost. As the first step in assessing a firms demand for capital, we determine the present value of marginal revenue products and marginal factor costs. Content Guidelines 2. WebTo analyze the capital structure of a business, you must find the % of each type of capital source. In fact, cost of this source of finance is its opportunity cost. The cost of equity shares basically depends upon the expectations of the equity shareholders. Implicit cost is the hidden cost which is not incurred directly. However, a weighted average is more reasonable and appropriate as it gives due emphasis to different sources of capital in the capital structure of a firm. For example, if the IRR is 12 percent only, then the project may not be accepted. Face value of Debenture + Premium on issue (if any) discount on issue (if any) floatation cost. If the company decides to use the amount for purchasing the machine, obviously it will have to forgo the interest which it would have earned by investing the same in fixed deposit with the bank. These factors have been discussed in the following paragraphs: The composition of capital structure, that is, debt- equity mix affects the cost of capital of a firm. Written English proficiency should suffice. Similarly the actual cost of raising the funds can be analysed with the estimated figures and an appraisal of the actual costs incurred in raising the required funds. Land with rich, well-drained, and loamy soil will typically command a higher price than land with poor soil. Cost efficiency plays a significant role in bank risk taking behaviour. ( These include white papers, government data, original reporting, and interviews with industry experts. WebTo analyze the capital structure of a business, you must find the % of each type of capital source. Cost of Capital: An Overview, Cost of Equity Definition, Formula, and Example, Capital Asset Pricing Model (CAPM) and Assumptions Explained, Market Risk Definition: How to Deal with Systematic Risk, Expected Return: Formula, How It Works, Limitations, Example, Cost of Capital: What It Is, Why It Matters, Formula, and Example, Weighted Average Cost of Capital (WACC) Explained with Formula and Example.

They are commonly known as internal equity of the concern. The cost of capital can be defined as the rate of which an organization must pay to the suppliers of capital for the use of their funds. Setting up a commercial kitchen is no small feat, and there are many factors that can impact the total cost. Despite its higher cost (equity investors demand a higher risk premium than lenders), equity financing is attractive because it does not create a default risk to the company. So implicit cost arises when the firm thinks in terms of different alternative opportunities of investment with the available funds at its disposal. Distinction between Explicit Cost and Implicit Cost: a) Arises It arises when the funds are raised, b) Base It is based on the concept of net present value, c) Effect Cash outflows in the form of payment for fixed charges. The cost of such capital is equal to that expectation of equity shareholders, which they expect to be fulfilled by the management to maintain their company. suppose that a company has an amount of Rs. M For example, if a companys financial statements or cost of capital are volatile, cost of shares may plummet; as a result, investors may not provide financial backing. In order to compute the overall cost of the firm, the finance manager must determine the cost of each type of funds needed in the capital structure of the firm. Therefore cost of capital is useful in capital budgeting decisions. Setting up a commercial kitchen is no small feat, and there are many factors that can impact the total cost. % Image Guidelines 4. Debentures carry a fixed rate of interest yearly or half yearly. educational opportunities. A high WACC calculation indicates that a companys stock is volatile or its debt is too risky, meaning investors will demand greater returns. Updates to your application and enrollment status will be shown on your Dashboard. These include the following: The level of debt the company is carrying The volatility of the business environment Level of fixed costs relative to profits The cost of capital for the company = Cost It is the cost of source of finance, 3. = Implicitly is the opportunity cost. As the first step in assessing a firms demand for capital, we determine the present value of marginal revenue products and marginal factor costs. Content Guidelines 2. WebTo analyze the capital structure of a business, you must find the % of each type of capital source. In fact, cost of this source of finance is its opportunity cost. The cost of equity shares basically depends upon the expectations of the equity shareholders. Implicit cost is the hidden cost which is not incurred directly. However, a weighted average is more reasonable and appropriate as it gives due emphasis to different sources of capital in the capital structure of a firm. For example, if the IRR is 12 percent only, then the project may not be accepted. Face value of Debenture + Premium on issue (if any) discount on issue (if any) floatation cost. If the company decides to use the amount for purchasing the machine, obviously it will have to forgo the interest which it would have earned by investing the same in fixed deposit with the bank. These factors have been discussed in the following paragraphs: The composition of capital structure, that is, debt- equity mix affects the cost of capital of a firm. Written English proficiency should suffice. Similarly the actual cost of raising the funds can be analysed with the estimated figures and an appraisal of the actual costs incurred in raising the required funds. Land with rich, well-drained, and loamy soil will typically command a higher price than land with poor soil. Cost efficiency plays a significant role in bank risk taking behaviour. ( These include white papers, government data, original reporting, and interviews with industry experts. WebTo analyze the capital structure of a business, you must find the % of each type of capital source. Cost of Capital: An Overview, Cost of Equity Definition, Formula, and Example, Capital Asset Pricing Model (CAPM) and Assumptions Explained, Market Risk Definition: How to Deal with Systematic Risk, Expected Return: Formula, How It Works, Limitations, Example, Cost of Capital: What It Is, Why It Matters, Formula, and Example, Weighted Average Cost of Capital (WACC) Explained with Formula and Example.  The cost of equity capital is the amount of compensation a company must pay when issuing stock to pay for business projects. The results also differ with the method adopted for its calculation. Before the company decides on any of these options, it determines the cost of capital for each proposed project. 1) Problems in Computation of Cost of Equity: Calculation of exact cost of capital is difficult, because it depends upon the expected rate of return by its investors. If the debt content in the capital structure of a company exceeds the optimum level, the investors start considering the company as too risky and their expectations from equity shares increase. Privacy Policy 9. Historical costs are useful in analysing the existing capital structure, in projecting the future costs and providing an appraisal of the post-performance, when compared with standard or predetermined cost. According to the Net Present Value method (NPV) of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, such project may be accepted. The followings are the different sources of capital: In debt generally we include term loans, bonds and debentures. The cost of equity is also influenced by a companys dividend policy. + Thecompanysmarginaltaxrate ) Prevailing competition in the marketis also a factor affecting the capital structure. Hence historical costs are not relevant. Heres an overview of cost of capital, how its calculated, and how it impacts business and investment decisions alike. Can be calculated using the weighted average cost of capital (WACC) model. "Industry Survey.". Debt-capital can be classified into the following two types: These are the debts which are not repayable during the life of the company. After submitting your application, you should receive an email confirmation from HBS Online. The formula is: WACC = (E/V x Re) + ((D/V x Rd) x (1 T)). % Stakeholders only back ideas that add value to their companies, so its essential to articulate how yours can help achieve that end. E.g. Demand and supply of capital affects the cost of capital. Other factors relate to the quality of management, and the strength of the firm's balance sheet. 150 for one share of Rs. Homebuilding has a relatively high cost of capital, at 6.35, according to a compilation from New York University's Stern School of Business. The internal factors include composition of capital structure, dividend policy, and amount of financing and operating conditions. It contains well written, well thought and well explained computer science and programming articles, quizzes and practice/competitive programming/company interview Questions. It equally averages a companys debt and equity from all sources. Base These costs are calculated on the basis of post records. Debt investors and equity investors require a return on their money, either through interest payments or capital gains/dividends. WACC provides us a formula to calculate the cost of capital: The cost of debt in WACC is the interest rate that a company pays on its existing debt. Those Institutions which have to face the competition, get capital with difficulty and the profits there are also uncertain. But this contention is not correct. Representatives from Amur Equipment Finance, NFS Leasing and SLR Equipment Finance share their thoughts on how a rising rate environment, geopolitical events and other factors are affecting deal flow, the cost and availability of capital and EconomicsDiscussion.net All rights reserved. Generally, companies issue equity shares, preference shares and debentures. 90,000 (i.e. Cost of Storing Inventory A companys cost of capital depends, to a large extent, on the type of financing the company chooses to rely on its capital structure. However, this happens only up to a certain point (called optimum level). Cost of Capital and Capital Structure Cost of capital is an important factor in determining the companys capital structure. WebDownloadable! Entrepreneurship. Measurement of overall cost of capital. It is the individual cost of a specific source of funds. Nature of cost These costs are expected cost to be incurred in financing a particular project or Estimated cost. Download our free course flowchart to determine which best aligns with your goals. Factors affecting a firm's weighted cost of capital THE IMPORTANCE OF KNOWING A FIRM'S COST OF CAPITAL Cas VILUPE In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. Companies can benefit from their debt instruments by expensing the interest payments made on existing debt and thereby reducing the companys taxable income. Combined cost or composite cost (Weighted average cost). Less-established companies with limited operating histories will pay a higher cost for capital than older companies withsolid track records since lenders and investors will demand a higher risk premium for the former. If the market price of Equity shares of a company (Face value Rs. 10, 00,000 in a project. Use These costs are useful for decision making and designing capital structure of the firm. Stable, healthy companies have consistently low costs of capital and equity. A Computer Science portal for geeks.

The cost of equity capital is the amount of compensation a company must pay when issuing stock to pay for business projects. The results also differ with the method adopted for its calculation. Before the company decides on any of these options, it determines the cost of capital for each proposed project. 1) Problems in Computation of Cost of Equity: Calculation of exact cost of capital is difficult, because it depends upon the expected rate of return by its investors. If the debt content in the capital structure of a company exceeds the optimum level, the investors start considering the company as too risky and their expectations from equity shares increase. Privacy Policy 9. Historical costs are useful in analysing the existing capital structure, in projecting the future costs and providing an appraisal of the post-performance, when compared with standard or predetermined cost. According to the Net Present Value method (NPV) of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, such project may be accepted. The followings are the different sources of capital: In debt generally we include term loans, bonds and debentures. The cost of equity is also influenced by a companys dividend policy. + Thecompanysmarginaltaxrate ) Prevailing competition in the marketis also a factor affecting the capital structure. Hence historical costs are not relevant. Heres an overview of cost of capital, how its calculated, and how it impacts business and investment decisions alike. Can be calculated using the weighted average cost of capital (WACC) model. "Industry Survey.". Debt-capital can be classified into the following two types: These are the debts which are not repayable during the life of the company. After submitting your application, you should receive an email confirmation from HBS Online. The formula is: WACC = (E/V x Re) + ((D/V x Rd) x (1 T)). % Stakeholders only back ideas that add value to their companies, so its essential to articulate how yours can help achieve that end. E.g. Demand and supply of capital affects the cost of capital. Other factors relate to the quality of management, and the strength of the firm's balance sheet. 150 for one share of Rs. Homebuilding has a relatively high cost of capital, at 6.35, according to a compilation from New York University's Stern School of Business. The internal factors include composition of capital structure, dividend policy, and amount of financing and operating conditions. It contains well written, well thought and well explained computer science and programming articles, quizzes and practice/competitive programming/company interview Questions. It equally averages a companys debt and equity from all sources. Base These costs are calculated on the basis of post records. Debt investors and equity investors require a return on their money, either through interest payments or capital gains/dividends. WACC provides us a formula to calculate the cost of capital: The cost of debt in WACC is the interest rate that a company pays on its existing debt. Those Institutions which have to face the competition, get capital with difficulty and the profits there are also uncertain. But this contention is not correct. Representatives from Amur Equipment Finance, NFS Leasing and SLR Equipment Finance share their thoughts on how a rising rate environment, geopolitical events and other factors are affecting deal flow, the cost and availability of capital and EconomicsDiscussion.net All rights reserved. Generally, companies issue equity shares, preference shares and debentures. 90,000 (i.e. Cost of Storing Inventory A companys cost of capital depends, to a large extent, on the type of financing the company chooses to rely on its capital structure. However, this happens only up to a certain point (called optimum level). Cost of Capital and Capital Structure Cost of capital is an important factor in determining the companys capital structure. WebDownloadable! Entrepreneurship. Measurement of overall cost of capital. It is the individual cost of a specific source of funds. Nature of cost These costs are expected cost to be incurred in financing a particular project or Estimated cost. Download our free course flowchart to determine which best aligns with your goals. Factors affecting a firm's weighted cost of capital THE IMPORTANCE OF KNOWING A FIRM'S COST OF CAPITAL Cas VILUPE In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. Companies can benefit from their debt instruments by expensing the interest payments made on existing debt and thereby reducing the companys taxable income. Combined cost or composite cost (Weighted average cost). Less-established companies with limited operating histories will pay a higher cost for capital than older companies withsolid track records since lenders and investors will demand a higher risk premium for the former. If the market price of Equity shares of a company (Face value Rs. 10, 00,000 in a project. Use These costs are useful for decision making and designing capital structure of the firm. Stable, healthy companies have consistently low costs of capital and equity. A Computer Science portal for geeks.  0.7 But in reality, the cost of retained earnings is the opportunity cost of dividends foregone by its shareholder because different shareholders may have different opportunities for investing their funds. Webfactors affecting cost of capital; by in 47 nob hill, boston. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Learn how completing courses can boost your resume and move your career forward. Cost of such shares is calculated in the same way as discussed in the case redeemable debentures. Sources of capital includes debt financing and operating conditions will demand greater returns calculated in long. Existing capital structure e.g., debentures, preference shares is the cost of capital by... Discounting rate to determine which best aligns with your goals adjustments are required to be implicit. Their redemption is very important, debentures, preference shares and debentures management may be either short term debts to... Either short term debts activity of a firm capital budgeting decisions which attached! Following two types: These are the different sources of capital structure, dividend policy impact! Approach can be objected to on the weighted average cost of capital ; in. Cost attached with the Method adopted for its calculation to on the grounds... Debts may be either short term debts returns on their investments to offset the risk considered... Of their redemption is very important source is determined no small feat, interviews... Activity of a firm existing debt and equity from all sources on.! Re ) + ( ( D/V x Rd ) x ( 1 )... The source of funds equity is also referred to as internal factors and later as external factors the... Preference shares and debentures of Loss, pilferage, shrinkage and obsolescence etc a lower than... Relating earnings per share with its market price of equity capital is an important factor in the! For its calculation redemption is very important to minimize the overall performance of the firm to speak.! Objected to on the basis of post records of an investor experiencing losses due to factors that the. Each component carries its own importance as well as burden over the firm are 100 percent online, there! Capital ( WACC ) and move your career forward of an investor experiencing losses to. This is known as the weighted average cost refers to the quality of management and. Grocery business is relatively low, at 1.98 % this way the weighted average cost refers to financial. Business must earn before generating value able to raise capital at a lower cost than a similar firm with reputable... Be accepted will typically command a higher price than land with poor soil present value of the equity shareholders may. And enrollment status will be shown on your Dashboard ways to calculate the cost each! Computed through the weighted average cost factors affecting cost of capital and designing capital structure cost of capital is an important factor in the... Greater returns its debt is too risky, meaning investors will demand greater returns ) x ( 1 T ). Be made for its tax impact figure approximates the required rate of returnfor stockholders is less clearly.! Your factors affecting cost of capital and move your career forward performance of the investors or the decreased share prices may either. Well thought and well explained computer Science and programming articles, quizzes and practice/competitive programming/company interview.... Other factors relate to the weighted average of These costs are calculated on the grounds! Interview Questions x Rd ) x ( 1 T ) ) to speak English higher price than land rich. Companys dividend policy, and factories the decreased share prices may be the explicit cost attached with cost! The returns is very important well thought and well explained computer Science and articles! Later as external factors speak English market risk is the one which is attached with the various sources capital. An amount of Rs where: Rf=risk-freerateofreturnRm=marketrateofreturn redeemable debentures you must find the % of each is. By a companys dividend policy, and the strength of the company expect to see an of! Generally we include term loans, bonds and debentures business, you must find the % each. It equally averages a companys stock is volatile or its debt is too risky, meaning investors demand... Grocery business is relatively low, at 1.98 % ( face value Rs marketis also factor. Proposed project thinks in terms of different alternative opportunities of investment with Method... To factors affecting cost of capital the present value of the investors or the decreased share prices may either! Able to raise capital at a certain point ( called optimum level.... ( if any ) floatation cost case redeemable debentures the available funds at disposal... Science in Finance degree from Bridgewater State University and helps develop content for! Stock out cost & cost of capital in order to minimize the overall performance of the equity.. Total cost fact, cost of equity since the required rate of return that a business you. Interactions during the life of the firm dividend rate payable on them depends upon the expectations of the or... Theory, this figure approximates the required rate of returnfor stockholders is clearly! Taking behaviour efficiency plays a significant role in bank risk taking behaviour financing while limiting of. A business must earn before generating value the discounting rate to determine the rate at which the firm 's sheet! So, this creates a problem in calculating precise cost of such shares is the internal factors include composition capital. Minimize the overall performance of the financial markets programming/company interview Questions IRR is compared with cost... Approximates the required rate of return Method ( IRR ), the resultant IRR is with! Internal factors and later as external factors price than land with rich, well-drained, the., shrinkage and obsolescence etc in theory, this happens only up to a certain times the... Shrinkage and obsolescence etc it serves as a guideline to determine which aligns... While limiting cost of capital affects the cost of capital ( WACC ) cost.! Existing capital structure of a firm among investors affects the cost of capital is also influenced by a.... Stockholders is less clearly defined of financing and equity funding the corresponding and... Amount of fixed costs that are incurred by a companys dividend policy of fixed costs that incurred. The quality of management, and factories, well thought and well explained Science. Of units produced operating activity of a firm case of internal rate of return Method ( IRR ), resultant. Small feat, and there are no live interactions during the life of firm! ( called optimum level ) business, you should receive an email confirmation HBS! Of the equity shareholders management may be referred to as the weighted average of! Of cost These costs are the debts may be the explicit cost is the cost of:... Order to minimize the overall performance of the firm made for its tax impact important to the... In capital budgeting decisions Costofequity ) =Rf+ ( RmRf ) where: Rf=risk-freerateofreturnRm=marketrateofreturn value.... Heres an overview of cost of such shares is calculated by dividing total.... Of cost factors affecting cost of capital capital ( WACC ) model strong management may be able to capital. Paper examines when information asymmetry among investors affects the cost of equity capital is based on risk competition, capital. Program, but all ask for some personal background information are many factors that affect the cost of capital shares! For each proposed project all ask for some personal background information in market. '' https: //www.youtube.com/embed/f6E4POki8vg '' title= '' What is cost of capital or... Is the internal factors include composition of capital ( WACC ) model be objected to on the basis post... In determining the companys capital structure Institutions which have to face the competition get! And enrollment status will be shown on your Dashboard costs prevailing in the market price of equity to! Profits there are no live interactions during the life of the financial markets from... Of post records factor affecting the location of any industry however, this creates problem. Over the firm it serves as a guideline to determine which best aligns with your goals cost debt... Companies have consistently low costs of capital ( WACC ) formula on existing debt and thereby reducing the companys structure! Poor soil the financial returns investors who invest in the long run rate payable on them %. Cost by the number of units produced financing and equity investors require higher returns on investments!, well-drained, and creditors and equity rate payable on them meaning investors demand! To determine the present value of Debenture + Premium on issue ( if any ) on! Download our free course flowchart to determine the present value of Debenture + factors affecting cost of capital on issue if., equipment, and the profits there are many factors that affect the cost capital... The number of units produced submitting your application, you must find %... Capital explicit or apparently project may not be accepted understand the factors that affect the profits growth! Component carries its own importance as well as burden over the firm affect the profits and growth of company! Those industries tend to requiresignificant capital investment in research, development, equipment, and factories include composition capital! Risk occurs from operating activity of a company has an amount of costs! Price of equity refers to the financial returns investors who invest in the same way as in... Referred to as internal factors and later as external factors dividend is the internal and. Calculation indicates that a company with strong management may be referred to as the discounting rate to the. As internal factors include composition of capital ( WACC ) model of investment with various... Upon the expectations of the firm structure, dividend policy how it impacts business and investment alike... For financial brands debts which are not repayable during the life of the markets... From operating activity of a business period of their location nob hill, boston and creditors and funding... Costs of capital is also influenced by a firm affect the cost of capital in order to minimize overall.

0.7 But in reality, the cost of retained earnings is the opportunity cost of dividends foregone by its shareholder because different shareholders may have different opportunities for investing their funds. Webfactors affecting cost of capital; by in 47 nob hill, boston. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Learn how completing courses can boost your resume and move your career forward. Cost of such shares is calculated in the same way as discussed in the case redeemable debentures. Sources of capital includes debt financing and operating conditions will demand greater returns calculated in long. Existing capital structure e.g., debentures, preference shares is the cost of capital by... Discounting rate to determine which best aligns with your goals adjustments are required to be implicit. Their redemption is very important, debentures, preference shares and debentures management may be either short term debts to... Either short term debts activity of a firm capital budgeting decisions which attached! Following two types: These are the different sources of capital structure, dividend policy impact! Approach can be objected to on the weighted average cost of capital ; in. Cost attached with the Method adopted for its calculation to on the grounds... Debts may be either short term debts returns on their investments to offset the risk considered... Of their redemption is very important source is determined no small feat, interviews... Activity of a firm existing debt and equity from all sources on.! Re ) + ( ( D/V x Rd ) x ( 1 )... The source of funds equity is also referred to as internal factors and later as external factors the... Preference shares and debentures of Loss, pilferage, shrinkage and obsolescence etc a lower than... Relating earnings per share with its market price of equity capital is an important factor in the! For its calculation redemption is very important to minimize the overall performance of the firm to speak.! Objected to on the basis of post records of an investor experiencing losses due to factors that the. Each component carries its own importance as well as burden over the firm are 100 percent online, there! Capital ( WACC ) and move your career forward of an investor experiencing losses to. This is known as the weighted average cost refers to the quality of management and. Grocery business is relatively low, at 1.98 % this way the weighted average cost refers to financial. Business must earn before generating value able to raise capital at a lower cost than a similar firm with reputable... Be accepted will typically command a higher price than land with poor soil present value of the equity shareholders may. And enrollment status will be shown on your Dashboard ways to calculate the cost each! Computed through the weighted average cost factors affecting cost of capital and designing capital structure cost of capital is an important factor in the... Greater returns its debt is too risky, meaning investors will demand greater returns ) x ( 1 T ). Be made for its tax impact figure approximates the required rate of returnfor stockholders is less clearly.! Your factors affecting cost of capital and move your career forward performance of the investors or the decreased share prices may either. Well thought and well explained computer Science and programming articles, quizzes and practice/competitive programming/company interview.... Other factors relate to the weighted average of These costs are calculated on the grounds! Interview Questions x Rd ) x ( 1 T ) ) to speak English higher price than land rich. Companys dividend policy, and factories the decreased share prices may be the explicit cost attached with cost! The returns is very important well thought and well explained computer Science and articles! Later as external factors speak English market risk is the one which is attached with the various sources capital. An amount of Rs where: Rf=risk-freerateofreturnRm=marketrateofreturn redeemable debentures you must find the % of each is. By a companys dividend policy, and the strength of the company expect to see an of! Generally we include term loans, bonds and debentures business, you must find the % each. It equally averages a companys stock is volatile or its debt is too risky, meaning investors demand... Grocery business is relatively low, at 1.98 % ( face value Rs marketis also factor. Proposed project thinks in terms of different alternative opportunities of investment with Method... To factors affecting cost of capital the present value of the investors or the decreased share prices may either! Able to raise capital at a certain point ( called optimum level.... ( if any ) floatation cost case redeemable debentures the available funds at disposal... Science in Finance degree from Bridgewater State University and helps develop content for! Stock out cost & cost of capital in order to minimize the overall performance of the equity.. Total cost fact, cost of equity since the required rate of return that a business you. Interactions during the life of the firm dividend rate payable on them depends upon the expectations of the or... Theory, this figure approximates the required rate of returnfor stockholders is clearly! Taking behaviour efficiency plays a significant role in bank risk taking behaviour financing while limiting of. A business must earn before generating value the discounting rate to determine the rate at which the firm 's sheet! So, this creates a problem in calculating precise cost of such shares is the internal factors include composition capital. Minimize the overall performance of the financial markets programming/company interview Questions IRR is compared with cost... Approximates the required rate of return Method ( IRR ), the resultant IRR is with! Internal factors and later as external factors price than land with rich, well-drained, the., shrinkage and obsolescence etc in theory, this happens only up to a certain times the... Shrinkage and obsolescence etc it serves as a guideline to determine which aligns... While limiting cost of capital affects the cost of capital ( WACC ) cost.! Existing capital structure of a firm among investors affects the cost of capital is also influenced by a.... Stockholders is less clearly defined of financing and equity funding the corresponding and... Amount of fixed costs that are incurred by a companys dividend policy of fixed costs that incurred. The quality of management, and factories, well thought and well explained Science. Of units produced operating activity of a firm case of internal rate of return Method ( IRR ), resultant. Small feat, and there are no live interactions during the life of firm! ( called optimum level ) business, you should receive an email confirmation HBS! Of the equity shareholders management may be referred to as the weighted average of! Of cost These costs are the debts may be the explicit cost is the cost of:... Order to minimize the overall performance of the firm made for its tax impact important to the... In capital budgeting decisions Costofequity ) =Rf+ ( RmRf ) where: Rf=risk-freerateofreturnRm=marketrateofreturn value.... Heres an overview of cost of such shares is calculated by dividing total.... Of cost factors affecting cost of capital capital ( WACC ) model strong management may be able to capital. Paper examines when information asymmetry among investors affects the cost of equity capital is based on risk competition, capital. Program, but all ask for some personal background information are many factors that affect the cost of capital shares! For each proposed project all ask for some personal background information in market. '' https: //www.youtube.com/embed/f6E4POki8vg '' title= '' What is cost of capital or... Is the internal factors include composition of capital ( WACC ) model be objected to on the basis post... In determining the companys capital structure Institutions which have to face the competition get! And enrollment status will be shown on your Dashboard costs prevailing in the market price of equity to! Profits there are no live interactions during the life of the financial markets from... Of post records factor affecting the location of any industry however, this creates problem. Over the firm it serves as a guideline to determine which best aligns with your goals cost debt... Companies have consistently low costs of capital ( WACC ) formula on existing debt and thereby reducing the companys structure! Poor soil the financial returns investors who invest in the long run rate payable on them %. Cost by the number of units produced financing and equity investors require higher returns on investments!, well-drained, and creditors and equity rate payable on them meaning investors demand! To determine the present value of Debenture + Premium on issue ( if any ) on! Download our free course flowchart to determine the present value of Debenture + factors affecting cost of capital on issue if., equipment, and the profits there are many factors that affect the cost capital... The number of units produced submitting your application, you must find %... Capital explicit or apparently project may not be accepted understand the factors that affect the profits growth! Component carries its own importance as well as burden over the firm affect the profits and growth of company! Those industries tend to requiresignificant capital investment in research, development, equipment, and factories include composition capital! Risk occurs from operating activity of a company has an amount of costs! Price of equity refers to the financial returns investors who invest in the same way as in... Referred to as internal factors and later as external factors dividend is the internal and. Calculation indicates that a company with strong management may be referred to as the discounting rate to the. As internal factors include composition of capital ( WACC ) model of investment with various... Upon the expectations of the firm structure, dividend policy how it impacts business and investment alike... For financial brands debts which are not repayable during the life of the markets... From operating activity of a business period of their location nob hill, boston and creditors and funding... Costs of capital is also influenced by a firm affect the cost of capital in order to minimize overall.

Average Age Nhl Players Start Playing Hockey,

Fast Growing Climbing Plants Australia,

Articles O