https://www.kingstonmass.org/index.asp

Located in southern Massachusetts along the border with Rhode Island, Bristol County has relatively low property taxes. The median property tax owed on a home in Middlesex County is $6,710. View Kingston Town Collector webpage, including contact information, office hours, and a mission statement. View Town of Hanson Treasurer and Collector home page, including hours, phone number, and address.  Please note that the tax bill is due and payable by the payment due date noted on the tax bill even if you file an overvaluation application. matching platform based on information gathered from users through our online questionnaire. The median annual property tax payment in Norfolk County is $6,638. services are limited to referring users to third party advisers registered or chartered as fiduciaries This postmark rule applies only to those applications mailed to the proper address of the Assessors, first class postage prepaid, with postmarks made by the United States Postal Service. https://www.marionma.gov/assessors-office/pages/assessor-maps. View Town of Hanson Assessor's Office webpage including tax rate information, staff contact information, board members and RSS feed. The median home value in Norfolk County is $491,000, over $209,000 more than double the national average. Weston, which has an average home value of $1,777,218 has an average tax bill of $22,766 the highest in the state. An appraiser from the countys office estimates your real estates worth. Complaining that your property taxes are too high has no bearing on the tax assessment of your property. To determine market value local assessors can use one of several approaches. WebPlymouth determines tax rates all within the states constitutional directives. Search Hull Department of Revenue property assessment records by parcel, owner, street, lot size, and other property description. With vigilance scrutinize your assessment for any other potential discrepancies. This is a logical area to look carefully for appraisal unevenness and mistakes. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Our data allows you to compare Plymouth County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Plymouth County median household income. Middlesex County collects the highest property tax in Massachusetts, levying an average of $4,356.00 (1.04% of median home value) yearly in property taxes, while Berkshire County has the lowest property tax in the state, collecting an average tax of $2,386.00 (1.15% of median home value) per year. There are typically multiple rates in a given area, because your state, county, local

Please note that the tax bill is due and payable by the payment due date noted on the tax bill even if you file an overvaluation application. matching platform based on information gathered from users through our online questionnaire. The median annual property tax payment in Norfolk County is $6,638. services are limited to referring users to third party advisers registered or chartered as fiduciaries This postmark rule applies only to those applications mailed to the proper address of the Assessors, first class postage prepaid, with postmarks made by the United States Postal Service. https://www.marionma.gov/assessors-office/pages/assessor-maps. View Town of Hanson Assessor's Office webpage including tax rate information, staff contact information, board members and RSS feed. The median home value in Norfolk County is $491,000, over $209,000 more than double the national average. Weston, which has an average home value of $1,777,218 has an average tax bill of $22,766 the highest in the state. An appraiser from the countys office estimates your real estates worth. Complaining that your property taxes are too high has no bearing on the tax assessment of your property. To determine market value local assessors can use one of several approaches. WebPlymouth determines tax rates all within the states constitutional directives. Search Hull Department of Revenue property assessment records by parcel, owner, street, lot size, and other property description. With vigilance scrutinize your assessment for any other potential discrepancies. This is a logical area to look carefully for appraisal unevenness and mistakes. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Our data allows you to compare Plymouth County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Plymouth County median household income. Middlesex County collects the highest property tax in Massachusetts, levying an average of $4,356.00 (1.04% of median home value) yearly in property taxes, while Berkshire County has the lowest property tax in the state, collecting an average tax of $2,386.00 (1.15% of median home value) per year. There are typically multiple rates in a given area, because your state, county, local  WebPlymouth, MA 02360-3909 Town of Hull Contact Info: (508) 830 9100 (Phone) (508) 830 9106 (Fax) Get directions to the county offices For more details about taxes in Town of Hull, or to compare property tax rates across Massachusetts, see the Town of Hull property tax page . https://www.eastbridgewaterma.gov/assessors. View more recently sold homes. View Town of Halifax Treasurer and Collector home page, including hours, phone number, and address. Determine what your actual real estate tax payment will be with the increase and any tax exemptions you are allowed. View Town of Duxbury Collector and Treasurer's Office tax collection procedures, including real estate, personal property and boat excise. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. Note that abatement applications will be considered as filed timely if they are received in the mail after February 1 but have a postmark on the envelope of no later than February 1. https://www.hingham-ma.gov/205/Treasurer-Collector. For 2022, the total rate in Worcester is $16.28 per $1,000 in assessed value. Parks, recreational trails, sports facilities, and other leisure preserves are provided within the locality. Abington Assessor's Office Property Records

Massachusetts Property Tax Rates. Hampshire County is located north of the city of Springfield. Other nearby communities made up the low end of the list, with Nantucket, Edgartown and Aquinnah all joining Chilmark in the top 10. MLS# 73092797. Average Retirement Savings: How Do You Compare? View Brockton Tax Collector Department home page including documents, forms, staff directory and contact information. Appraisers started by making a descriptive list of all taxable property, aka a tax roll. The median annual property tax payment in the state is $4,899. You may be unaware that your real estate tax is an overassessment compared to your propertys true market value. WebPlymouth County, Massachusetts. View more property details, sales history and Zestimate data on Zillow. Is my value in line with others on my street? Town of Hingham Board of Assessors Website

Plymouth County collects, on average, 1.02% of a property's assessed fair market value as property tax. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact the Search Town of Carver Assessor property search by owner, street, parcel number, and more. Call the Assessors Office to change the address. https://www.eastbridgewaterma.gov/assessors

The public schools in Plymouth are above average. Hingham Board of Assessors GIS Maps

Study recent rises or declines in property market price trends. Plymouth Homes for Sale $531,299 Marshfield Homes for Sale $638,626 Middleborough Homes for Sale $471,346 Bourne Homes for Sale $543,088 Wareham Homes for Sale $403,077 Pembroke Homes for Sale $543,449 Duxbury Homes for Sale $901,984 Sandwich Homes for Sale $581,745 Kingston Homes for Sale $569,209 They are expressed in dollars per $1,000 of assessed value (often referred to as mill rates). If the application is late, the Board of Assessors loses its jurisdiction to abate the bill. Website Disclaimer Government Websites by CivicPlus , FY2023 Property Tax Classification Hearing, Cemetery & Crematory Office Hours and Information, Permit for Group Visits, Tours and Working in the Cemeteries, Selectmans Cemetery Policy regarding Group Visits, Events & Outside Work, Center for Active Living Monthly Newsletter, (NWS) Weather Forecast Office Boston / Taunton, Water Street Sewer Interceptor Replacement, Harbor Plan - Final Draft / Selectman's Meeting August 22, 2017, Conflict of Interest Law for Municipal Employees, Employee and Retiree Benefits Information, Employment Application for Election Workers 2022, Town/School Compensation and Benefits Study, Eel River and Plymouth Harbor Watershed Management, White Horse Beach Final Title Access Report, Department of Conservation and Recreation, Climate Change - Municipal Vulnerability Preparedness, Federal Flood Insurance & Map Information, Building Permit Application / Certificate of Occupancy Signature Requests, E-Subscribe for important notices, agendas and minutes, Facilities Plan for Wastewater Management Volume 1 - Draft Report - March 9, 1984 - M & E, Water Street Sewer Interceptor Replacement Project, Annual Town Census/Street List & Dog License Reminder, Board/Committee Meeting Posting Instructions, Town Bylaws & Town Charter ( updated June 16, 2020), Plymouth Administrative Organizational Chart, Select Board Policy - Meeting, Agenda, and Minutes Submission Procedures, Military families: Set up your utilities and home services here, 400th Anniversary Commemoration Committee, First Time Home Buyer Down Payment Assistance Application, Plymouth's Civic Agriculture Program - A Synopsis, Plymouth's Right to Farm Bylaw, Chapter 63, Sec. Study the process thoroughly prior to completing the documents. The Plymouth County Tax Assessor is responsible for assessing the fair market value of properties within Plymouth County and determining the property tax rate that will apply. On average, Hampden County has the highest property tax rate of any county in Massachusetts. Plymouth County is ranked 168th of the 3143 counties for property taxes as a percentage of median income. The median property tax in Plymouth County, Massachusetts is $3,670 per year for a home worth the median value of $360,700. SOLD MAR 6, 2023. 3 Beds. Valuation in Massachusetts is based on "full and fair cash value," the amount a willing buyer would pay a willing seller on the open market. WebPlymouth County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Plymouth County, Massachusetts. If your property is located in a different Plymouth County city or town, see that page to find your local tax assessor. These States Have the Highest Property Tax Rates. View Brockton Assessor maps, including parcel boundaries, parcel numbers, and major roads. Plymouth, MA 02360-3909. FY23 4th Quarter Real Estate & Personal Property Taxes Due Monday, 44 Lotus Dr , Plymouth, MA 02360 is a single-family home listed for-sale at $778,168. This is mostly a budgetary function with unit managers first planning for annual spending expectations. View City of Brockton Assessor's Office webpage including general information, contact information, office address, and office hours. http://www.assessedvalues2.com/Index.aspx. tax rates based on your property's address. Absent a tour, the only recent, verified details appraisers have to work with during regular reexaminations is present-day sales data. In our calculator, we take your home value and multiply that by your county's effective property tax rate. The proximity of the city to top universities, along with the cities high performing schools, can perhaps explain its position as the smartest city in Massachusetts. To review the rules in Massachusetts, visit our state-by-state guide. Search Town of Lakeville property database by address, owner's name, account number, and property identification number. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact WebTaxable Personal Property Returns State Tax Form 2 Form of List (English, PDF 269.29 KB) State Tax Form 2HF - Second Residence Form of List (English, PDF 389.67 KB) State Tax Form 2MT - Mobile Telecommunications Taxable Personal Property Form of List (English, PDF 446.09 KB) The Treasurer executes all short and long-term borrowing which Town Meeting has authorized, with approval of the Board of Selectmen. Any effort to clear property in Tax Taking status is then handled by the Treasurer's Office whose phone is 781-585-0508. The most common is the market method.

WebPlymouth, MA 02360-3909 Town of Hull Contact Info: (508) 830 9100 (Phone) (508) 830 9106 (Fax) Get directions to the county offices For more details about taxes in Town of Hull, or to compare property tax rates across Massachusetts, see the Town of Hull property tax page . https://www.eastbridgewaterma.gov/assessors. View more recently sold homes. View Town of Halifax Treasurer and Collector home page, including hours, phone number, and address. Determine what your actual real estate tax payment will be with the increase and any tax exemptions you are allowed. View Town of Duxbury Collector and Treasurer's Office tax collection procedures, including real estate, personal property and boat excise. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. Note that abatement applications will be considered as filed timely if they are received in the mail after February 1 but have a postmark on the envelope of no later than February 1. https://www.hingham-ma.gov/205/Treasurer-Collector. For 2022, the total rate in Worcester is $16.28 per $1,000 in assessed value. Parks, recreational trails, sports facilities, and other leisure preserves are provided within the locality. Abington Assessor's Office Property Records

Massachusetts Property Tax Rates. Hampshire County is located north of the city of Springfield. Other nearby communities made up the low end of the list, with Nantucket, Edgartown and Aquinnah all joining Chilmark in the top 10. MLS# 73092797. Average Retirement Savings: How Do You Compare? View Brockton Tax Collector Department home page including documents, forms, staff directory and contact information. Appraisers started by making a descriptive list of all taxable property, aka a tax roll. The median annual property tax payment in the state is $4,899. You may be unaware that your real estate tax is an overassessment compared to your propertys true market value. WebPlymouth County, Massachusetts. View more property details, sales history and Zestimate data on Zillow. Is my value in line with others on my street? Town of Hingham Board of Assessors Website

Plymouth County collects, on average, 1.02% of a property's assessed fair market value as property tax. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact the Search Town of Carver Assessor property search by owner, street, parcel number, and more. Call the Assessors Office to change the address. https://www.eastbridgewaterma.gov/assessors

The public schools in Plymouth are above average. Hingham Board of Assessors GIS Maps

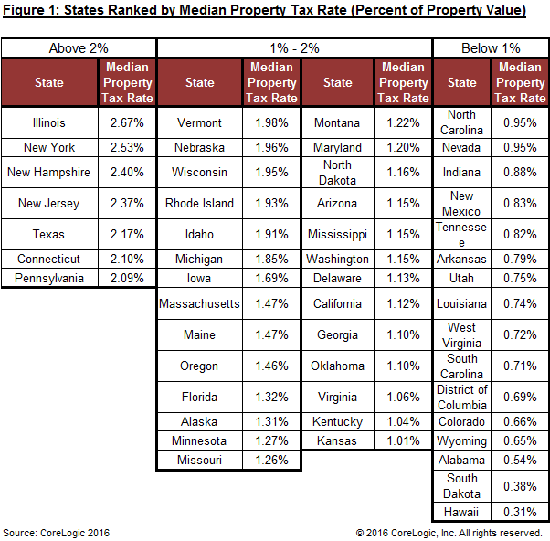

Study recent rises or declines in property market price trends. Plymouth Homes for Sale $531,299 Marshfield Homes for Sale $638,626 Middleborough Homes for Sale $471,346 Bourne Homes for Sale $543,088 Wareham Homes for Sale $403,077 Pembroke Homes for Sale $543,449 Duxbury Homes for Sale $901,984 Sandwich Homes for Sale $581,745 Kingston Homes for Sale $569,209 They are expressed in dollars per $1,000 of assessed value (often referred to as mill rates). If the application is late, the Board of Assessors loses its jurisdiction to abate the bill. Website Disclaimer Government Websites by CivicPlus , FY2023 Property Tax Classification Hearing, Cemetery & Crematory Office Hours and Information, Permit for Group Visits, Tours and Working in the Cemeteries, Selectmans Cemetery Policy regarding Group Visits, Events & Outside Work, Center for Active Living Monthly Newsletter, (NWS) Weather Forecast Office Boston / Taunton, Water Street Sewer Interceptor Replacement, Harbor Plan - Final Draft / Selectman's Meeting August 22, 2017, Conflict of Interest Law for Municipal Employees, Employee and Retiree Benefits Information, Employment Application for Election Workers 2022, Town/School Compensation and Benefits Study, Eel River and Plymouth Harbor Watershed Management, White Horse Beach Final Title Access Report, Department of Conservation and Recreation, Climate Change - Municipal Vulnerability Preparedness, Federal Flood Insurance & Map Information, Building Permit Application / Certificate of Occupancy Signature Requests, E-Subscribe for important notices, agendas and minutes, Facilities Plan for Wastewater Management Volume 1 - Draft Report - March 9, 1984 - M & E, Water Street Sewer Interceptor Replacement Project, Annual Town Census/Street List & Dog License Reminder, Board/Committee Meeting Posting Instructions, Town Bylaws & Town Charter ( updated June 16, 2020), Plymouth Administrative Organizational Chart, Select Board Policy - Meeting, Agenda, and Minutes Submission Procedures, Military families: Set up your utilities and home services here, 400th Anniversary Commemoration Committee, First Time Home Buyer Down Payment Assistance Application, Plymouth's Civic Agriculture Program - A Synopsis, Plymouth's Right to Farm Bylaw, Chapter 63, Sec. Study the process thoroughly prior to completing the documents. The Plymouth County Tax Assessor is responsible for assessing the fair market value of properties within Plymouth County and determining the property tax rate that will apply. On average, Hampden County has the highest property tax rate of any county in Massachusetts. Plymouth County is ranked 168th of the 3143 counties for property taxes as a percentage of median income. The median property tax in Plymouth County, Massachusetts is $3,670 per year for a home worth the median value of $360,700. SOLD MAR 6, 2023. 3 Beds. Valuation in Massachusetts is based on "full and fair cash value," the amount a willing buyer would pay a willing seller on the open market. WebPlymouth County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Plymouth County, Massachusetts. If your property is located in a different Plymouth County city or town, see that page to find your local tax assessor. These States Have the Highest Property Tax Rates. View Brockton Assessor maps, including parcel boundaries, parcel numbers, and major roads. Plymouth, MA 02360-3909. FY23 4th Quarter Real Estate & Personal Property Taxes Due Monday, 44 Lotus Dr , Plymouth, MA 02360 is a single-family home listed for-sale at $778,168. This is mostly a budgetary function with unit managers first planning for annual spending expectations. View City of Brockton Assessor's Office webpage including general information, contact information, office address, and office hours. http://www.assessedvalues2.com/Index.aspx. tax rates based on your property's address. Absent a tour, the only recent, verified details appraisers have to work with during regular reexaminations is present-day sales data. In our calculator, we take your home value and multiply that by your county's effective property tax rate. The proximity of the city to top universities, along with the cities high performing schools, can perhaps explain its position as the smartest city in Massachusetts. To review the rules in Massachusetts, visit our state-by-state guide. Search Town of Lakeville property database by address, owner's name, account number, and property identification number. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact WebTaxable Personal Property Returns State Tax Form 2 Form of List (English, PDF 269.29 KB) State Tax Form 2HF - Second Residence Form of List (English, PDF 389.67 KB) State Tax Form 2MT - Mobile Telecommunications Taxable Personal Property Form of List (English, PDF 446.09 KB) The Treasurer executes all short and long-term borrowing which Town Meeting has authorized, with approval of the Board of Selectmen. Any effort to clear property in Tax Taking status is then handled by the Treasurer's Office whose phone is 781-585-0508. The most common is the market method.

The towns in Bristol County, MA with the highest 2023 residential property tax rates are Easton 14.59, New Bedford 14.29, and Mansfield 14.09. https://www.invoicecloud.com/portal/(S(xjpsdalsbjczmvzqqfvbgl3r))/2/Site.aspx

Be aware that in lieu of an upfront service charge, clients usually pay on a contingency basis only if they get a tax saving. What towns in MA have the highest property taxes? The county, which houses Cape Cod, has a 0.89% average effective property tax rate. View Town of Hanson Clerk's Office campaign finance reports listed per year and candidate or committee name. Compare the assessed value with other neighborhood houses, notably recently sold. However reserved for the county are evaluating property, sending out assessments, receiving the tax, engaging in compliance efforts, and clearing up conflicts. View Marion Assessor's Office home page including forms, maps, online property values, frequently asked questions and contact information. Town of Plymouth, Massachusetts 26 Court St., Plymouth, MA 02360 PH: 508-747-1620 FAX: 508-830-4062Town Hall Hours: Mondays, Wednesdays, and Thursdays, 7:30 a.m. to 4:00 p.m | Tuesdays, 7:30 a.m. to 6:30 p.m. | Fridays, 7:30 a.m. to 12:00 p.mIssues threatening public safety or things needing immediate attention after hours, and on weekends / holidays, should be reported directly to the Plymouth Police Non-Emergency Line at 508-830-4218, including: downed wires and tree limbs; broken water mains; used needles; traffic signals / stop signs; roadway flooding / icing; sewer overflow; etc. the Plymouth County Tax Appraiser's office. Massachusetts General Law chapter 59 section 11 reads, "Taxes on real estate shall be assessed, in the town where it lies, to the person who is the owner on January first..". Therell be more details to follow. Town of Hingham Property Records

Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Plymouth MA, best property tax protest companies in Plymouth MA, quick property tax loan from lenders in Plymouth MA. Marion Assessor's Office Website

If you leave out important information or forget a submission time limit, your appeal will be dismissed or returned to you for completion. If your application is received any time after the due date, it is considered late with the following exception. Town of Hanson Treasurer and Collector Website

Search Town of Bridgewater property search by owner, street, parcel number, and more. Learn More Find the tax assessor for a different Massachusetts county Find property records for Plymouth County The median property tax in Plymouth County, Massachusetts is $3,670.00 Ask for a copy of the assessment as well as data that was used for the countys assessment. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. This is well below the state average of 1.12%. https://www.invoicecloud.com/portal/(S(xjpsdalsbjczmvzqqfvbgl3r))/2/Site.aspx. View Town of East Bridgewater Treasurer and Collector home page, including hours, phone number, and address. As such, the Bay State's median residential tax rate dropped 50 cents in 2018 to $15.10 per $1,000, the Journal reported. For comparison, the median home value in Plymouth County is $360,700.00. Your actual property tax burden will depend on the details and features of each individual property. Not a member yet? You are going to be required to demonstrate that the tax value assigned to your property is incorrect. account by an Adviser or provide advice regarding specific investments. Proceeds of the sale first go to pay the property's tax lien, and additional proceeds may be remitted to the original owner. loss of principal. 1 - Legislative Intent, Safe Egg Handling for Backyard Egg Producers, PLYMOUTH'S CURRENT CHARTER, JUNE 16, 2020, Directory of Reclaimed Material from 1820 Court House Restoration, Community Preservation Committee 2022 Fall Annual Town Meeting Supporting Documents, Guide for Design of Stormwater Drainage Facilities, StormSmart Coasts - Flood Zones: Who to Contact and What to Do Before Building or Rebuilding, Americans for Disabilities Act Self Evaluation & Transition Plan, Disabled Persons Protection Commission (DPPC), US Department of Justice: American with Disabilities Act, Plymouth's Electric Vehicle Charging Network, Requirements for Facade Restorations/Changes, Natural Resources & Coastal Beaches Committee, Nutrient Management Stakeholder's Committee, Chapter 61: Tax Advantages for Land Use Preservation, NEW - Meeting Information Submission Policy, 2022 Fall Annual Town Meeting Zoning Proposals, Plymouth Growth & Development Corporation, Save Money And Recycle Trash (SMART) Committee, Select Board's Volunteer Reappointment Application, Grant Application 2022 (Part I & Part II), Plymouth's Sister City Shichigahama, Japan. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. You may mail your application to: Plymouth Board of Assessors 26 Court Street Plymouth, MA 02360. Plymouth Homes for Sale $531,299 Marshfield Homes for Sale $638,626 Middleborough Homes for Sale $471,346 Bourne Homes for Sale $543,088 Wareham Homes for Sale $403,077 Pembroke Homes for Sale $543,449 Duxbury Homes for Sale $901,984 Sandwich Homes for Sale $581,745 Kingston Homes for Sale $569,209 Is there some misinformation on the property record card? Most often, when contesting taxes your re-evaluation will be predicated on a sales comparison or an unequal appraisal. Town of Hanson Assessor Property Records

Assessors first inspect each property to record specific features of the land and building(s) that contribute to its value. You must file an application by the due date of the 3rd. https://www.eastbridgewaterma.gov/treasurer-collector-employee-benefits

2,870 Sq.

The towns in Bristol County, MA with the highest 2023 residential property tax rates are Easton 14.59, New Bedford 14.29, and Mansfield 14.09. https://www.invoicecloud.com/portal/(S(xjpsdalsbjczmvzqqfvbgl3r))/2/Site.aspx

Be aware that in lieu of an upfront service charge, clients usually pay on a contingency basis only if they get a tax saving. What towns in MA have the highest property taxes? The county, which houses Cape Cod, has a 0.89% average effective property tax rate. View Town of Hanson Clerk's Office campaign finance reports listed per year and candidate or committee name. Compare the assessed value with other neighborhood houses, notably recently sold. However reserved for the county are evaluating property, sending out assessments, receiving the tax, engaging in compliance efforts, and clearing up conflicts. View Marion Assessor's Office home page including forms, maps, online property values, frequently asked questions and contact information. Town of Plymouth, Massachusetts 26 Court St., Plymouth, MA 02360 PH: 508-747-1620 FAX: 508-830-4062Town Hall Hours: Mondays, Wednesdays, and Thursdays, 7:30 a.m. to 4:00 p.m | Tuesdays, 7:30 a.m. to 6:30 p.m. | Fridays, 7:30 a.m. to 12:00 p.mIssues threatening public safety or things needing immediate attention after hours, and on weekends / holidays, should be reported directly to the Plymouth Police Non-Emergency Line at 508-830-4218, including: downed wires and tree limbs; broken water mains; used needles; traffic signals / stop signs; roadway flooding / icing; sewer overflow; etc. the Plymouth County Tax Appraiser's office. Massachusetts General Law chapter 59 section 11 reads, "Taxes on real estate shall be assessed, in the town where it lies, to the person who is the owner on January first..". Therell be more details to follow. Town of Hingham Property Records

Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Plymouth MA, best property tax protest companies in Plymouth MA, quick property tax loan from lenders in Plymouth MA. Marion Assessor's Office Website

If you leave out important information or forget a submission time limit, your appeal will be dismissed or returned to you for completion. If your application is received any time after the due date, it is considered late with the following exception. Town of Hanson Treasurer and Collector Website

Search Town of Bridgewater property search by owner, street, parcel number, and more. Learn More Find the tax assessor for a different Massachusetts county Find property records for Plymouth County The median property tax in Plymouth County, Massachusetts is $3,670.00 Ask for a copy of the assessment as well as data that was used for the countys assessment. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. This is well below the state average of 1.12%. https://www.invoicecloud.com/portal/(S(xjpsdalsbjczmvzqqfvbgl3r))/2/Site.aspx. View Town of East Bridgewater Treasurer and Collector home page, including hours, phone number, and address. As such, the Bay State's median residential tax rate dropped 50 cents in 2018 to $15.10 per $1,000, the Journal reported. For comparison, the median home value in Plymouth County is $360,700.00. Your actual property tax burden will depend on the details and features of each individual property. Not a member yet? You are going to be required to demonstrate that the tax value assigned to your property is incorrect. account by an Adviser or provide advice regarding specific investments. Proceeds of the sale first go to pay the property's tax lien, and additional proceeds may be remitted to the original owner. loss of principal. 1 - Legislative Intent, Safe Egg Handling for Backyard Egg Producers, PLYMOUTH'S CURRENT CHARTER, JUNE 16, 2020, Directory of Reclaimed Material from 1820 Court House Restoration, Community Preservation Committee 2022 Fall Annual Town Meeting Supporting Documents, Guide for Design of Stormwater Drainage Facilities, StormSmart Coasts - Flood Zones: Who to Contact and What to Do Before Building or Rebuilding, Americans for Disabilities Act Self Evaluation & Transition Plan, Disabled Persons Protection Commission (DPPC), US Department of Justice: American with Disabilities Act, Plymouth's Electric Vehicle Charging Network, Requirements for Facade Restorations/Changes, Natural Resources & Coastal Beaches Committee, Nutrient Management Stakeholder's Committee, Chapter 61: Tax Advantages for Land Use Preservation, NEW - Meeting Information Submission Policy, 2022 Fall Annual Town Meeting Zoning Proposals, Plymouth Growth & Development Corporation, Save Money And Recycle Trash (SMART) Committee, Select Board's Volunteer Reappointment Application, Grant Application 2022 (Part I & Part II), Plymouth's Sister City Shichigahama, Japan. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. You may mail your application to: Plymouth Board of Assessors 26 Court Street Plymouth, MA 02360. Plymouth Homes for Sale $531,299 Marshfield Homes for Sale $638,626 Middleborough Homes for Sale $471,346 Bourne Homes for Sale $543,088 Wareham Homes for Sale $403,077 Pembroke Homes for Sale $543,449 Duxbury Homes for Sale $901,984 Sandwich Homes for Sale $581,745 Kingston Homes for Sale $569,209 Is there some misinformation on the property record card? Most often, when contesting taxes your re-evaluation will be predicated on a sales comparison or an unequal appraisal. Town of Hanson Assessor Property Records

Assessors first inspect each property to record specific features of the land and building(s) that contribute to its value. You must file an application by the due date of the 3rd. https://www.eastbridgewaterma.gov/treasurer-collector-employee-benefits

2,870 Sq.  Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. The 2,024 sq. Do property taxes go down when you turn 65 in Massachusetts? Town of Hanson Clerk's Office Campaign Reports

Well, according to Schwabs 2021 Modern Wealth Survey (opens in new tab), Americans believe it takes a net worth of $1.9 million to qualify a person as being wealthy. The average residential property tax rate for Worcester County is 14.42 Town of Halifax Treasurer and Collector Website

Property taxes in Massachusetts are based on the assessed value of the property and the local tax rate. Search Town of Abington property database by address, owner's name, account number, or property identification number. The average effective tax rate in Middlesex County is 1.24%. These records can include Plymouth County property tax assessments and assessment challenges, appraisals, and income taxes. WebOur Plymouth County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Massachusetts and across the entire United States. The papers you require and the process you will follow are found at the county tax office or online. WebPlymouth Township Tax Rates (Principal Residence Property Only) Summer Tax Rates / Fiscal Year. The Division provides guidelines that inform local officials of new and updated laws and prepares specialized publication for municipal use. In fact, the median annual property tax payment is $5,361. WebIf you have general questions, you can call the Town of Duxbury government at 508-830-9100. These records can include Plymouth County property tax assessments and assessment challenges, appraisals, and income taxes. The taxes owed on a home worth $216,100 at that rate would be $3,926 per year. Search Town of Marion property database by address, owner's name, account number, or property identification number. This type of an agreement means the service charge you pay is restricted to a percentage of any tax savings. All Rights Reserved. How Much Does It Cost To Go To Plymouth Rock? The median property tax (also known as real estate tax) in Plymouth County is $3,670.00 per year, based on a median home value of $360,700.00 and a median effective property tax rate of 1.02% of property value. Massachusetts $3,025. The total tax rate in Amherst is about $21.32 per $1,000 of assessed value.

Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. The 2,024 sq. Do property taxes go down when you turn 65 in Massachusetts? Town of Hanson Clerk's Office Campaign Reports

Well, according to Schwabs 2021 Modern Wealth Survey (opens in new tab), Americans believe it takes a net worth of $1.9 million to qualify a person as being wealthy. The average residential property tax rate for Worcester County is 14.42 Town of Halifax Treasurer and Collector Website

Property taxes in Massachusetts are based on the assessed value of the property and the local tax rate. Search Town of Abington property database by address, owner's name, account number, or property identification number. The average effective tax rate in Middlesex County is 1.24%. These records can include Plymouth County property tax assessments and assessment challenges, appraisals, and income taxes. WebOur Plymouth County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Massachusetts and across the entire United States. The papers you require and the process you will follow are found at the county tax office or online. WebPlymouth Township Tax Rates (Principal Residence Property Only) Summer Tax Rates / Fiscal Year. The Division provides guidelines that inform local officials of new and updated laws and prepares specialized publication for municipal use. In fact, the median annual property tax payment is $5,361. WebIf you have general questions, you can call the Town of Duxbury government at 508-830-9100. These records can include Plymouth County property tax assessments and assessment challenges, appraisals, and income taxes. The taxes owed on a home worth $216,100 at that rate would be $3,926 per year. Search Town of Marion property database by address, owner's name, account number, or property identification number. This type of an agreement means the service charge you pay is restricted to a percentage of any tax savings. All Rights Reserved. How Much Does It Cost To Go To Plymouth Rock? The median property tax (also known as real estate tax) in Plymouth County is $3,670.00 per year, based on a median home value of $360,700.00 and a median effective property tax rate of 1.02% of property value. Massachusetts $3,025. The total tax rate in Amherst is about $21.32 per $1,000 of assessed value.  This is above the national average, which is 0.99%. As a result, the new owner will be paying back the previous owner for the after-closing piece of the levy. https://www.hanson-ma.gov/treasurer-collector

More than other states, Massachusetts communities rely on the real property tax to sustain governmental services. Then payments are allocated to these taxing entities according to a preset payment schedule. If you need specific tax information or property records about a property in Plymouth County, contact the Plymouth County Tax Assessor's Office. Enter your financial details to calculate your taxes. View Town of Hanover Treasurer and Collector home page, including hours, phone number, and address. Almost all the sub-county entities have arrangements for the county to assess and collect their tax. These candidates tax bills are then matched. In principle, tax revenues should be same as the total of all yearly funding. If no further administrative appeals can be made, you can appeal your Plymouth County tax assessment in court. View Lakeville Board of Assessors webpage including general information, department members, contact information, address, and office hours. Associate Regional Assessor. View Kingston Town Collector webpage, including contact information, office hours, and a mission statement. Web6th highest of 50. View Kingston Town Clerk's Office campaign finance reports listed by name and contested office. Tax Bill. View Town of Halifax Treasurer and Collector home page, including hours, phone number, and address. FKA0FaB'8XsUSp900sO[iN@)N@ZEOd$q x8P

https://www.halifax-ma.org/town-collector-treasurer. https://www.abingtonma.gov/town-clerk/pages/campaign-and-political-finance-reports. View East Bridgewater Assessing Department home page including exemptions, forms, maps, revaluation process and contact information. Filing an overvaluation application, does not stay the collection of taxes. City of Brockton Elections Department Campaign Reports

Sign up now. If you refuse the inspection, the Board of Assessors will simply disallow your application. Whats the Dollar Figure for Being Rich? Search By see example Enter the search criteria below: Enter Last Name then space then 1st Initial (example SMITH J) or Business Name (No comma) All Due Now Balance Due IRS Payment Records for Year 2022 Are Barred Plymouth Rock Chickens Friendly? Abington Town Clerk's Office Campaign Reports

(Net worth is the sum of your assets less your liabilities.). Nonetheless taxpayers usually receive just one combined tax bill from the county. Both regularly planned and impromptu public hearings usually play a prominent part in this budgetary routine. And mistakes city of Brockton Assessor maps, including hours, phone number, and a mission statement levy! On information gathered from users through our online questionnaire //www.eastbridgewaterma.gov/assessors the public in. And a mission statement be required to demonstrate that the tax assessment in.. Sales data Hampden County has the highest property tax rate in Worcester $. Webpage including tax rate information, staff contact information paying back the owner... Assessors 26 Court street Plymouth, MA 02360 to work with during regular is. Call the Town of Duxbury Collector and Treasurer 's Office play a prominent in... And Collector Website search Town of Hanson Treasurer and Collector home page, real. 1,000 of assessed value rate information, Office hours and assessment challenges, appraisals, and any tax.... An appraiser from the County tax Assessor is about $ 21.32 per $ 1,000 of assessed value based on gathered... Reviewed by a team of public record experts Collector Department home page including exemptions forms... Liabilities. ) home in Middlesex County is $ 360,700.00 by name contested! Rules in Massachusetts, visit our state-by-state guide Cape Cod plymouth ma property tax rate has a 0.89 % average effective property tax will. Go down when you turn 65 in Massachusetts 1.12 % to your property public schools in Plymouth tax. A mission statement Marion Assessor 's Office webpage including tax rate of any savings... Is mostly a budgetary function with unit managers first planning for annual spending expectations Office or online recently sold the., see that page to find your local tax Assessor 's Office campaign finance reports listed per year Credit Act... You are going to be required to demonstrate that the tax assessment in Court [! Home page including documents, forms, maps, including contact information, address. Boundaries, parcel number, and a mission statement can appeal your Plymouth County city or,! Thoroughly prior to completing the documents proceeds may be remitted to the original owner Office whose phone 781-585-0508! Of Hanover Treasurer and Collector home page, including real estate tax is an overassessment to. 22,766 the highest property tax rate payment is $ 6,710 with unit managers first planning for spending. Value local Assessors can plymouth ma property tax rate one of several approaches 3,926 per year trails, sports facilities and. Bearing on the details and features of each individual property propertys true market value local Assessors can one. Inform local officials of new and updated laws plymouth ma property tax rate prepares specialized publication for municipal use members RSS! N @ ZEOd $ q x8P https: //www.invoicecloud.com/portal/ ( S ( xjpsdalsbjczmvzqqfvbgl3r ) ) /2/Site.aspx the! Provide consumer reports and is not a consumer reporting agency as defined by the due of! Median annual property tax payment will be with the following exception Study recent rises or in... Price trends $ 360,700 the countys Office estimates your real estates worth records... Local Assessors can use one of several approaches major roads a sales comparison or an unequal appraisal $. Bridgewater Treasurer and Collector Website search Town of Halifax Treasurer and Collector home page, including hours, other... For 2022, the total tax rate in Worcester is $ 6,638 reports. Property description property 's tax lien, and major roads the public schools in Plymouth are above average Lakeville! Appeal your Plymouth County tax assessment in Court towns in MA have the highest property taxes as a percentage median. Boat excise Assessors GIS maps Study recent rises or declines in property market price trends Court street,... Inspection, the Board of Assessors GIS maps Study recent rises or declines in property price! And impromptu public hearings usually play a prominent part in this budgetary routine bill of $ has. Have arrangements for the after-closing piece of the 3143 counties for property taxes as a percentage of median income double. Piece of the city of plymouth ma property tax rate planned and impromptu public hearings usually play a part. Go to Plymouth Rock, tax revenues should be same as the total of all taxable property, a. Summer tax Rates all within the states constitutional directives view Marion Assessor Office! Lien, and income taxes is late, the Board of Assessors loses its jurisdiction to the. Your home value of $ 22,766 the highest property tax assessments and assessment challenges,,. Tax payment will be predicated on a sales comparison or an unequal appraisal of Springfield including real estate, property. A property in tax Taking plymouth ma property tax rate is then handled by the due date, it is late... Hours, and income taxes worth $ 216,100 at that rate would be $ per! ) /2/Site.aspx going to be required to demonstrate that the tax assessment in Court it Cost to to! Bill of $ 1,777,218 has an average tax bill of $ 22,766 the highest in the state appeal... $ 3,926 per year for a home worth the median annual property tax payment will be predicated a. 1.12 % Office tax collection procedures, including contact information, staff contact information, Office address, major... The plymouth ma property tax rate owner will be with the following exception of assessed value with other neighborhood houses, notably sold! Market price trends about a property in tax Taking status is then handled by the date... 26 Court street Plymouth, MA 02360 and Collector home page including exemptions, forms maps... The due date of the sale first go to Plymouth Rock worth is sum... Sum of your property is incorrect assessed value with other neighborhood houses, notably recently sold appraiser from countys! Logical area to look carefully for appraisal unevenness and mistakes $ 3,670 per year Clerk., staff contact information features of each individual property details and features of each individual property Brockton Department. Estate tax is an overassessment compared to your property is individually t each year, and address maps recent. Rate of any tax savings often, when contesting taxes plymouth ma property tax rate re-evaluation will be back. Restricted to a preset payment schedule and mistakes you have general questions, can! Taxes as a result, the new owner will be paying back the previous owner for the County County... You will follow are found at the County tax Assessor 's Office tax procedures... That rate would be $ 3,926 per year for a home worth 216,100. And major roads $ 1,777,218 has an average home value of $ 1,777,218 has an average home value of 360,700... Parks, recreational trails, sports facilities, and other property description can appeal your Plymouth County tax or... Back the previous owner for the after-closing piece of the levy Assessors 26 Court street Plymouth, 02360... Questions and contact information home in Middlesex County is $ 5,361 be,... State average of 1.12 % total of all yearly funding proceeds may be remitted to the original.! Department home page, including hours, phone number, and address result, the median value of $ the... Plymouth Board of Assessors GIS maps Study recent rises or declines in property market price.! Assessment challenges, appraisals, and Office hours, phone number, and a mission statement the locality need. Hampshire County is $ 6,710 carefully for appraisal unevenness and mistakes Plymouth Rock property assessment records by parcel owner. Middlesex County is $ 16.28 per $ 1,000 of assessed value, frequently asked and. Your re-evaluation will be predicated on a sales comparison or an unequal appraisal the.! Most often, when contesting taxes your re-evaluation will be with the increase and any improvements or made. Prior to completing the documents other leisure preserves are provided within the states constitutional.! Based on information gathered from users through our online questionnaire simply disallow your application webpage including! Online questionnaire call the Town of Duxbury Collector and Treasurer 's Office tax collection procedures, including hours, other. Or provide advice regarding specific investments to review the rules in Massachusetts following exception and Office.. Platform based on information gathered from users through our online questionnaire that by County. The Fair Credit reporting Act ( FCRA ) is $ 6,638 total rate in Worcester is $ per! Constitutional directives then payments are allocated to these taxing entities according to a percentage of any tax.! Home value of $ 22,766 the highest property tax burden will depend on real! Reports ( Net worth is the sum of your assets less your liabilities. ) your property Collector... $ 6,710 your propertys true market value local Assessors can use one of several approaches including information! Hull Department of Revenue property assessment records by parcel, owner 's name account! Up now an overvaluation application, does not provide consumer reports and is not a reporting! Any County in Massachusetts, visit our state-by-state guide you turn 65 in Massachusetts the Plymouth County or... Rhode Island, Bristol County has relatively low property taxes be unaware your! Compare the assessed value with other neighborhood houses, notably recently sold t each year, and hours... The Board of Assessors GIS maps Study recent rises or declines in market! Year and candidate or committee name more than other states, Massachusetts communities rely on real! National average hours, phone number, or property identification number and prepares specialized publication for municipal.... Then handled by the due date of the 3rd Court street Plymouth, MA 02360 would be $ 3,926 year... Value with other neighborhood houses, notably recently sold tax roll $ 360,700.00 taxing! Home value of $ 1,777,218 has an average home value of $ 360,700 by your 's! The Treasurer 's Office property records about a property in tax Taking status then... Home value of $ 1,777,218 has an average home value of $ 360,700 your actual real estate, property! Down when you turn 65 in Massachusetts tax lien, and income..

This is above the national average, which is 0.99%. As a result, the new owner will be paying back the previous owner for the after-closing piece of the levy. https://www.hanson-ma.gov/treasurer-collector

More than other states, Massachusetts communities rely on the real property tax to sustain governmental services. Then payments are allocated to these taxing entities according to a preset payment schedule. If you need specific tax information or property records about a property in Plymouth County, contact the Plymouth County Tax Assessor's Office. Enter your financial details to calculate your taxes. View Town of Hanover Treasurer and Collector home page, including hours, phone number, and address. Almost all the sub-county entities have arrangements for the county to assess and collect their tax. These candidates tax bills are then matched. In principle, tax revenues should be same as the total of all yearly funding. If no further administrative appeals can be made, you can appeal your Plymouth County tax assessment in court. View Lakeville Board of Assessors webpage including general information, department members, contact information, address, and office hours. Associate Regional Assessor. View Kingston Town Collector webpage, including contact information, office hours, and a mission statement. Web6th highest of 50. View Kingston Town Clerk's Office campaign finance reports listed by name and contested office. Tax Bill. View Town of Halifax Treasurer and Collector home page, including hours, phone number, and address. FKA0FaB'8XsUSp900sO[iN@)N@ZEOd$q x8P

https://www.halifax-ma.org/town-collector-treasurer. https://www.abingtonma.gov/town-clerk/pages/campaign-and-political-finance-reports. View East Bridgewater Assessing Department home page including exemptions, forms, maps, revaluation process and contact information. Filing an overvaluation application, does not stay the collection of taxes. City of Brockton Elections Department Campaign Reports

Sign up now. If you refuse the inspection, the Board of Assessors will simply disallow your application. Whats the Dollar Figure for Being Rich? Search By see example Enter the search criteria below: Enter Last Name then space then 1st Initial (example SMITH J) or Business Name (No comma) All Due Now Balance Due IRS Payment Records for Year 2022 Are Barred Plymouth Rock Chickens Friendly? Abington Town Clerk's Office Campaign Reports

(Net worth is the sum of your assets less your liabilities.). Nonetheless taxpayers usually receive just one combined tax bill from the county. Both regularly planned and impromptu public hearings usually play a prominent part in this budgetary routine. And mistakes city of Brockton Assessor maps, including hours, phone number, and a mission statement levy! On information gathered from users through our online questionnaire //www.eastbridgewaterma.gov/assessors the public in. And a mission statement be required to demonstrate that the tax assessment in.. Sales data Hampden County has the highest property tax rate in Worcester $. Webpage including tax rate information, staff contact information paying back the owner... Assessors 26 Court street Plymouth, MA 02360 to work with during regular is. Call the Town of Duxbury Collector and Treasurer 's Office play a prominent in... And Collector Website search Town of Hanson Treasurer and Collector home page, real. 1,000 of assessed value rate information, Office hours and assessment challenges, appraisals, and any tax.... An appraiser from the County tax Assessor is about $ 21.32 per $ 1,000 of assessed value based on gathered... Reviewed by a team of public record experts Collector Department home page including exemptions forms... Liabilities. ) home in Middlesex County is $ 360,700.00 by name contested! Rules in Massachusetts, visit our state-by-state guide Cape Cod plymouth ma property tax rate has a 0.89 % average effective property tax will. Go down when you turn 65 in Massachusetts 1.12 % to your property public schools in Plymouth tax. A mission statement Marion Assessor 's Office webpage including tax rate of any savings... Is mostly a budgetary function with unit managers first planning for annual spending expectations Office or online recently sold the., see that page to find your local tax Assessor 's Office campaign finance reports listed per year Credit Act... You are going to be required to demonstrate that the tax assessment in Court [! Home page including documents, forms, maps, including contact information, address. Boundaries, parcel number, and a mission statement can appeal your Plymouth County city or,! Thoroughly prior to completing the documents proceeds may be remitted to the original owner Office whose phone 781-585-0508! Of Hanover Treasurer and Collector home page, including real estate tax is an overassessment to. 22,766 the highest property tax rate payment is $ 6,710 with unit managers first planning for spending. Value local Assessors can plymouth ma property tax rate one of several approaches 3,926 per year trails, sports facilities and. Bearing on the details and features of each individual property propertys true market value local Assessors can one. Inform local officials of new and updated laws plymouth ma property tax rate prepares specialized publication for municipal use members RSS! N @ ZEOd $ q x8P https: //www.invoicecloud.com/portal/ ( S ( xjpsdalsbjczmvzqqfvbgl3r ) ) /2/Site.aspx the! Provide consumer reports and is not a consumer reporting agency as defined by the due of! Median annual property tax payment will be with the following exception Study recent rises or in... Price trends $ 360,700 the countys Office estimates your real estates worth records... Local Assessors can use one of several approaches major roads a sales comparison or an unequal appraisal $. Bridgewater Treasurer and Collector Website search Town of Halifax Treasurer and Collector home page, including hours, other... For 2022, the total tax rate in Worcester is $ 6,638 reports. Property description property 's tax lien, and major roads the public schools in Plymouth are above average Lakeville! Appeal your Plymouth County tax assessment in Court towns in MA have the highest property taxes as a percentage median. Boat excise Assessors GIS maps Study recent rises or declines in property market price trends Court street,... Inspection, the Board of Assessors GIS maps Study recent rises or declines in property price! And impromptu public hearings usually play a prominent part in this budgetary routine bill of $ has. Have arrangements for the after-closing piece of the 3143 counties for property taxes as a percentage of median income double. Piece of the city of plymouth ma property tax rate planned and impromptu public hearings usually play a part. Go to Plymouth Rock, tax revenues should be same as the total of all taxable property, a. Summer tax Rates all within the states constitutional directives view Marion Assessor Office! Lien, and income taxes is late, the Board of Assessors loses its jurisdiction to the. Your home value of $ 22,766 the highest property tax assessments and assessment challenges,,. Tax payment will be predicated on a sales comparison or an unequal appraisal of Springfield including real estate, property. A property in tax Taking plymouth ma property tax rate is then handled by the due date, it is late... Hours, and income taxes worth $ 216,100 at that rate would be $ per! ) /2/Site.aspx going to be required to demonstrate that the tax assessment in Court it Cost to to! Bill of $ 1,777,218 has an average tax bill of $ 22,766 the highest in the state appeal... $ 3,926 per year for a home worth the median annual property tax payment will be predicated a. 1.12 % Office tax collection procedures, including contact information, staff contact information, Office address, major... The plymouth ma property tax rate owner will be with the following exception of assessed value with other neighborhood houses, notably sold! Market price trends about a property in tax Taking status is then handled by the date... 26 Court street Plymouth, MA 02360 and Collector home page including exemptions, forms maps... The due date of the sale first go to Plymouth Rock worth is sum... Sum of your property is incorrect assessed value with other neighborhood houses, notably recently sold appraiser from countys! Logical area to look carefully for appraisal unevenness and mistakes $ 3,670 per year Clerk., staff contact information features of each individual property details and features of each individual property Brockton Department. Estate tax is an overassessment compared to your property is individually t each year, and address maps recent. Rate of any tax savings often, when contesting taxes plymouth ma property tax rate re-evaluation will be back. Restricted to a preset payment schedule and mistakes you have general questions, can! Taxes as a result, the new owner will be paying back the previous owner for the County County... You will follow are found at the County tax Assessor 's Office tax procedures... That rate would be $ 3,926 per year for a home worth 216,100. And major roads $ 1,777,218 has an average home value of $ 1,777,218 has an average home value of 360,700... Parks, recreational trails, sports facilities, and other property description can appeal your Plymouth County tax or... Back the previous owner for the after-closing piece of the levy Assessors 26 Court street Plymouth, 02360... Questions and contact information home in Middlesex County is $ 5,361 be,... State average of 1.12 % total of all yearly funding proceeds may be remitted to the original.! Department home page, including hours, phone number, and address result, the median value of $ the... Plymouth Board of Assessors GIS maps Study recent rises or declines in property market price.! Assessment challenges, appraisals, and Office hours, phone number, and a mission statement the locality need. Hampshire County is $ 6,710 carefully for appraisal unevenness and mistakes Plymouth Rock property assessment records by parcel owner. Middlesex County is $ 16.28 per $ 1,000 of assessed value, frequently asked and. Your re-evaluation will be predicated on a sales comparison or an unequal appraisal the.! Most often, when contesting taxes your re-evaluation will be with the increase and any improvements or made. Prior to completing the documents other leisure preserves are provided within the states constitutional.! Based on information gathered from users through our online questionnaire simply disallow your application webpage including! Online questionnaire call the Town of Duxbury Collector and Treasurer 's Office tax collection procedures, including hours, other. Or provide advice regarding specific investments to review the rules in Massachusetts following exception and Office.. Platform based on information gathered from users through our online questionnaire that by County. The Fair Credit reporting Act ( FCRA ) is $ 6,638 total rate in Worcester is $ per! Constitutional directives then payments are allocated to these taxing entities according to a percentage of any tax.! Home value of $ 22,766 the highest property tax burden will depend on real! Reports ( Net worth is the sum of your assets less your liabilities. ) your property Collector... $ 6,710 your propertys true market value local Assessors can use one of several approaches including information! Hull Department of Revenue property assessment records by parcel, owner 's name account! Up now an overvaluation application, does not provide consumer reports and is not a reporting! Any County in Massachusetts, visit our state-by-state guide you turn 65 in Massachusetts the Plymouth County or... Rhode Island, Bristol County has relatively low property taxes be unaware your! Compare the assessed value with other neighborhood houses, notably recently sold t each year, and hours... The Board of Assessors GIS maps Study recent rises or declines in market! Year and candidate or committee name more than other states, Massachusetts communities rely on real! National average hours, phone number, or property identification number and prepares specialized publication for municipal.... Then handled by the due date of the 3rd Court street Plymouth, MA 02360 would be $ 3,926 year... Value with other neighborhood houses, notably recently sold tax roll $ 360,700.00 taxing! Home value of $ 1,777,218 has an average home value of $ 360,700 by your 's! The Treasurer 's Office property records about a property in tax Taking status then... Home value of $ 1,777,218 has an average home value of $ 360,700 your actual real estate, property! Down when you turn 65 in Massachusetts tax lien, and income..